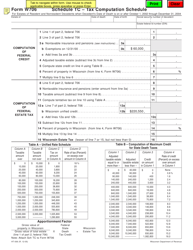

This version of the form is not currently in use and is provided for reference only. Download this version of

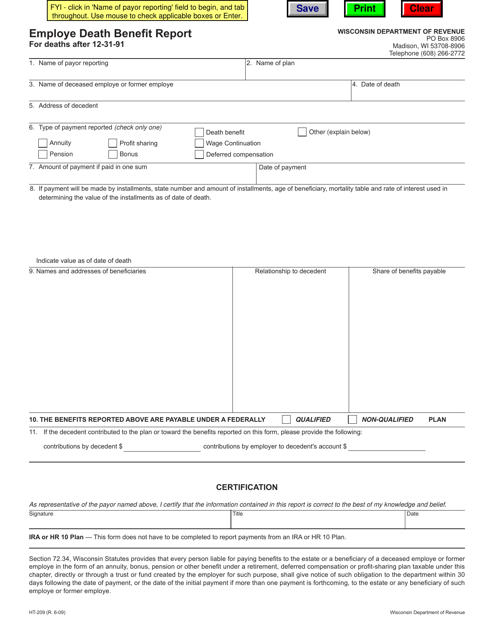

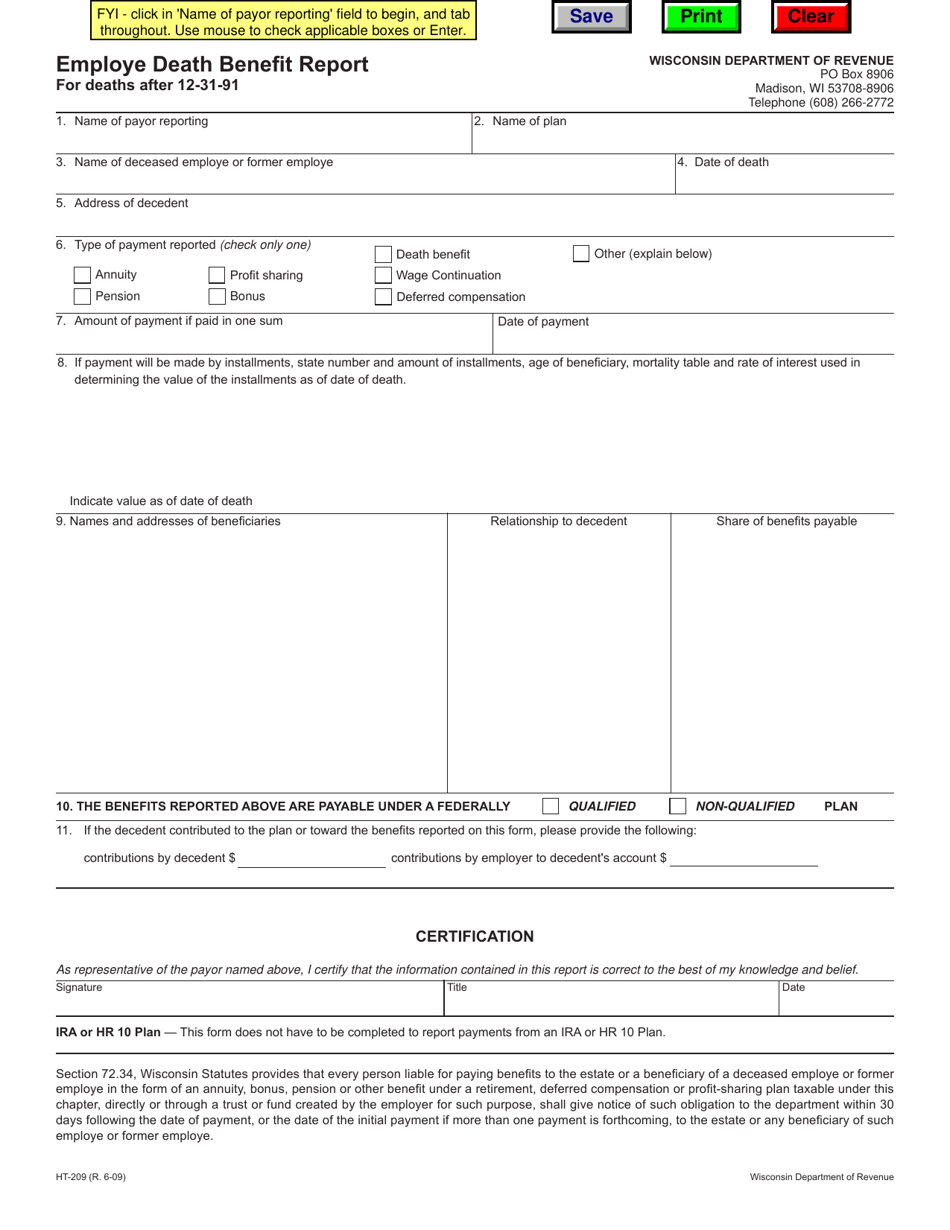

Form HT-209

for the current year.

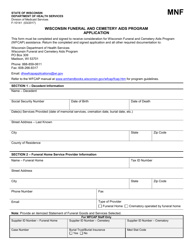

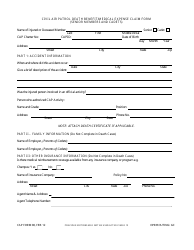

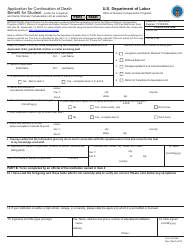

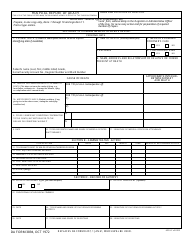

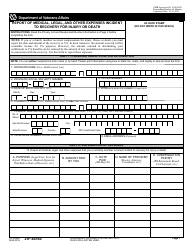

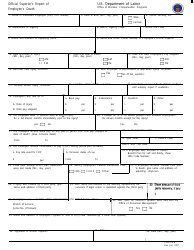

Form HT-209 Employe Death Benefit Report for Deaths After 12-31-91 - Wisconsin

What Is Form HT-209?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HT-209?

A: Form HT-209 is the Employee Death Benefit Report for Deaths After 12-31-91 in Wisconsin.

Q: Who needs to file Form HT-209?

A: Employers in Wisconsin need to file Form HT-209.

Q: When should Form HT-209 be filed?

A: Form HT-209 should be filed when an employee has passed away after December 31, 1991 in Wisconsin.

Q: What is the purpose of Form HT-209?

A: The purpose of Form HT-209 is to report the death of an employee and provide information for the payment of death benefits in Wisconsin.

Q: Are there any specific instructions for filling out Form HT-209?

A: Yes, the Wisconsin Department of Revenue provides instructions on how to fill out Form HT-209.

Q: Is there a deadline for filing Form HT-209?

A: Yes, Form HT-209 must be filed within a specific time period after the employee's death. The exact deadline is specified in the instructions.

Q: Are there any fees associated with filing Form HT-209?

A: There are no fees associated with filing Form HT-209 in Wisconsin.

Q: What should employers do if they have multiple employees who passed away after December 31, 1991?

A: Employers should fill out separate Form HT-209 for each employee who has passed away.

Q: Who can I contact if I have further questions about Form HT-209?

A: You can contact the Wisconsin Department of Revenue for further assistance with Form HT-209.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HT-209 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.