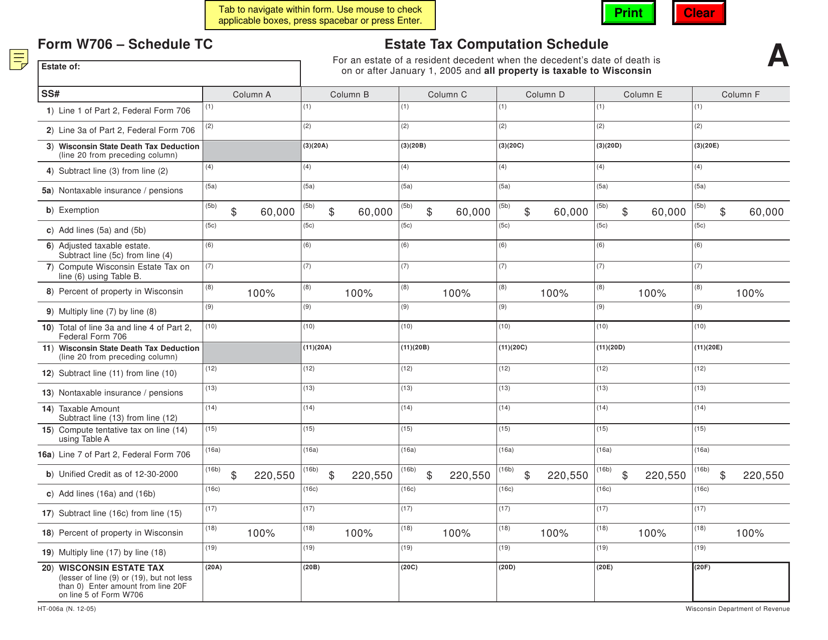

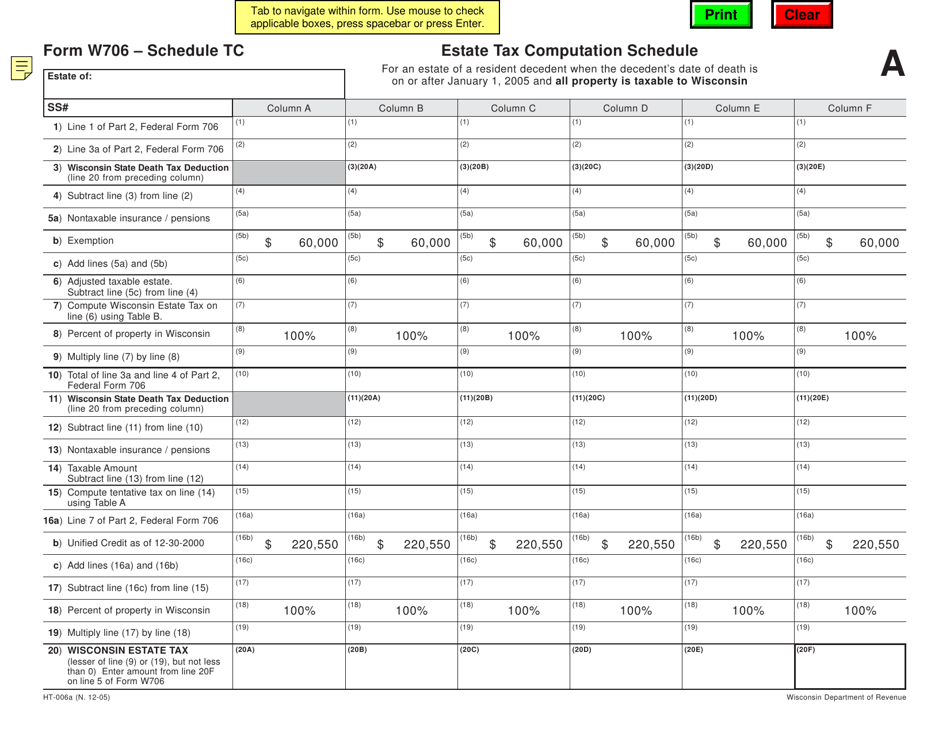

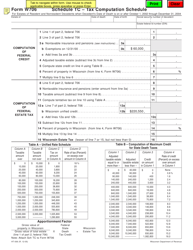

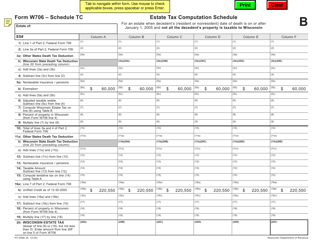

Form W706 (HT-006A) Schedule TC-A Tax Computation Schedule for Deaths on or After January 1, 2005 and All Property Is Taxable to Wisconsin - Wisconsin

What Is Form W706 (HT-006A) Schedule TC-A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin.The document is a supplement to Form W706, Wisconsin Estate Tax Return for Estates of Resident and Nonresident Decedents. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W706 (HT-006A)?

A: Form W706 (HT-006A) is the Tax Computation Schedule for Deaths on or After January 1, 2005 and All Property Is Taxable to Wisconsin in Wisconsin.

Q: When should Form W706 (HT-006A) be used?

A: Form W706 (HT-006A) should be used for deaths that occurred on or after January 1, 2005 and where all property is taxable to Wisconsin.

Q: What is the purpose of Form W706 (HT-006A)?

A: The purpose of Form W706 (HT-006A) is to calculate the tax liability for estates in Wisconsin in cases where all property is taxable to Wisconsin.

Q: Is Form W706 (HT-006A) applicable to all deaths in Wisconsin?

A: No, Form W706 (HT-006A) is only applicable to deaths that occurred on or after January 1, 2005 and where all property is taxable to Wisconsin.

Q: Are there any other forms or schedules that need to be filed along with Form W706 (HT-006A)?

A: Yes, additional forms and schedules may need to be filed depending on the specific circumstances of the estate. It is recommended to consult with a tax professional or refer to the instructions provided with Form W706 (HT-006A).

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W706 (HT-006A) Schedule TC-A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.