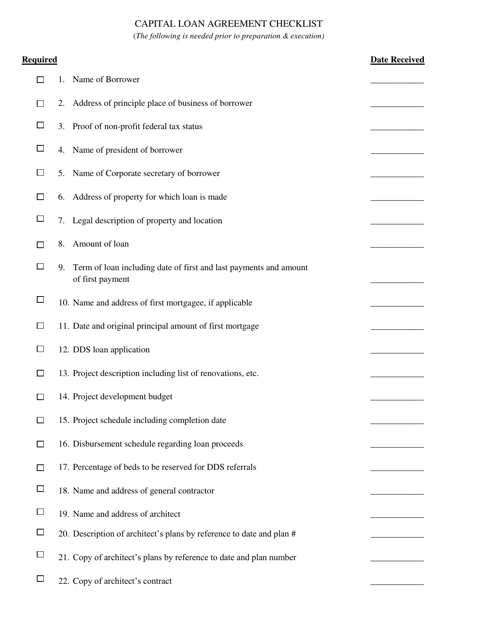

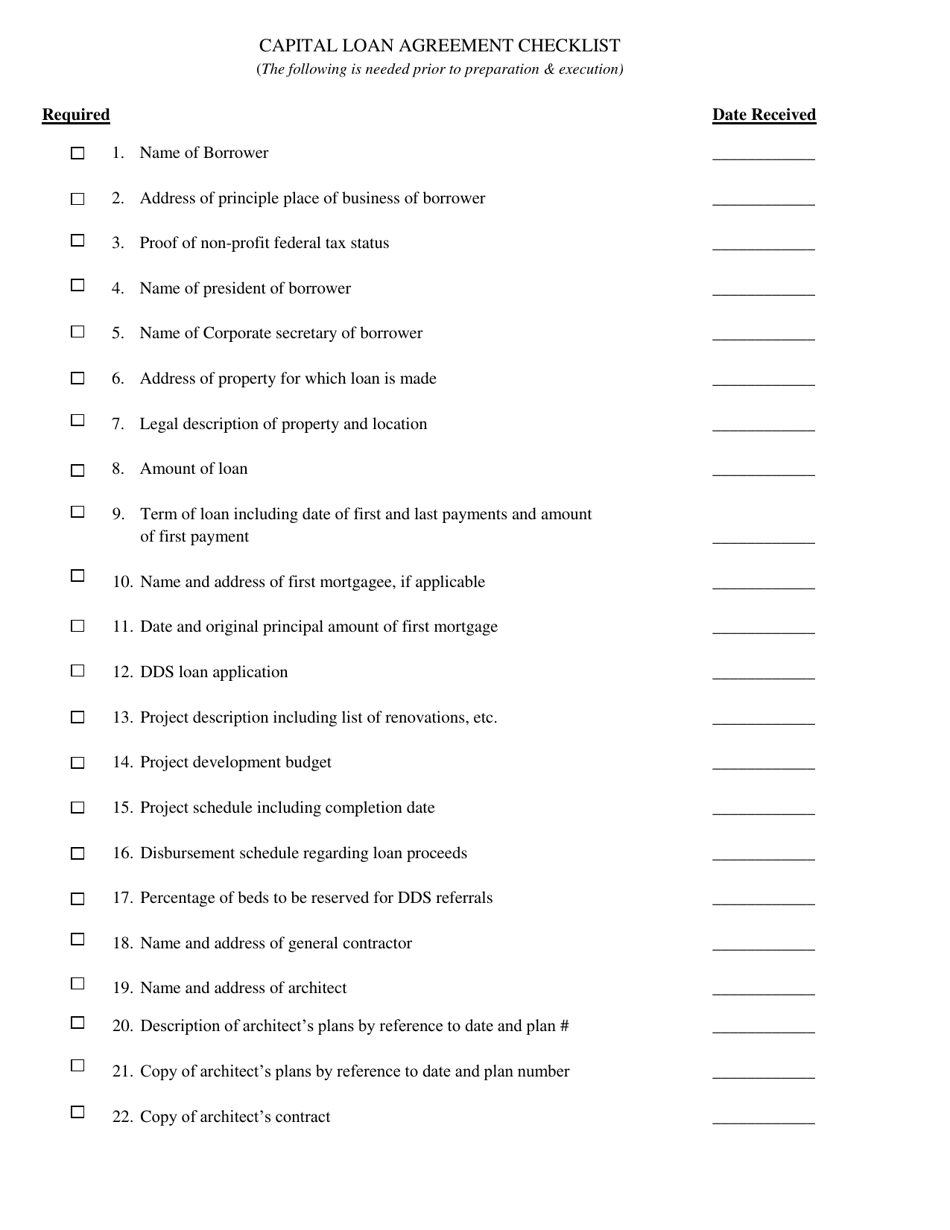

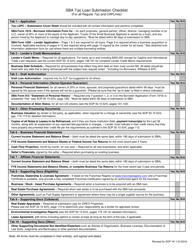

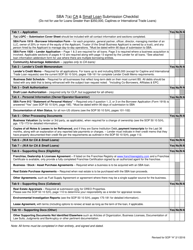

Capital Loan Agreement Checklist - Connecticut

Capital Loan Agreement Checklist is a legal document that was released by the Connecticut Department of Developmental Services - a government authority operating within Connecticut.

FAQ

Q: What is the Capital Loan Agreement Checklist?

A: The Capital Loan Agreement Checklist is a document that outlines the key elements to consider when entering into a capital loan agreement in Connecticut.

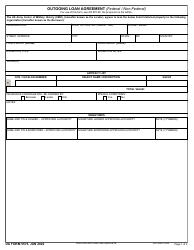

Q: What is a capital loan?

A: A capital loan is a type of loan that is used to finance the purchase or improvement of assets, such as equipment, buildings, or vehicles.

Q: Why is the checklist important?

A: The checklist is important because it helps ensure that all necessary aspects of a capital loan agreement are considered and addressed.

Q: What are some items included in the checklist?

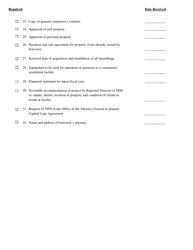

A: Some items included in the checklist may include loan terms, interest rates, collateral requirements, repayment terms, and any additional fees or charges.

Q: Who should use the checklist?

A: The checklist can be used by individuals or businesses in Connecticut who are considering taking out a capital loan.

Q: Can the checklist be customized?

A: Yes, the checklist can be customized to fit the specific needs and requirements of the borrower and lender.

Q: Is the checklist legally binding?

A: No, the checklist itself is not legally binding. It is a tool to help ensure that all necessary considerations are addressed in the loan agreement.

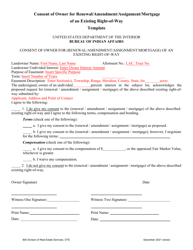

Q: What other documents may be required for a capital loan in Connecticut?

A: Other documents that may be required include a loan application, financial statements, tax returns, and proof of collateral.

Q: Is it necessary to consult a legal advisor when using the checklist?

A: While it is not required, consulting a legal advisor can help ensure that all legal aspects of the loan agreement are properly addressed.

Form Details:

- The latest edition currently provided by the Connecticut Department of Developmental Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Department of Developmental Services.