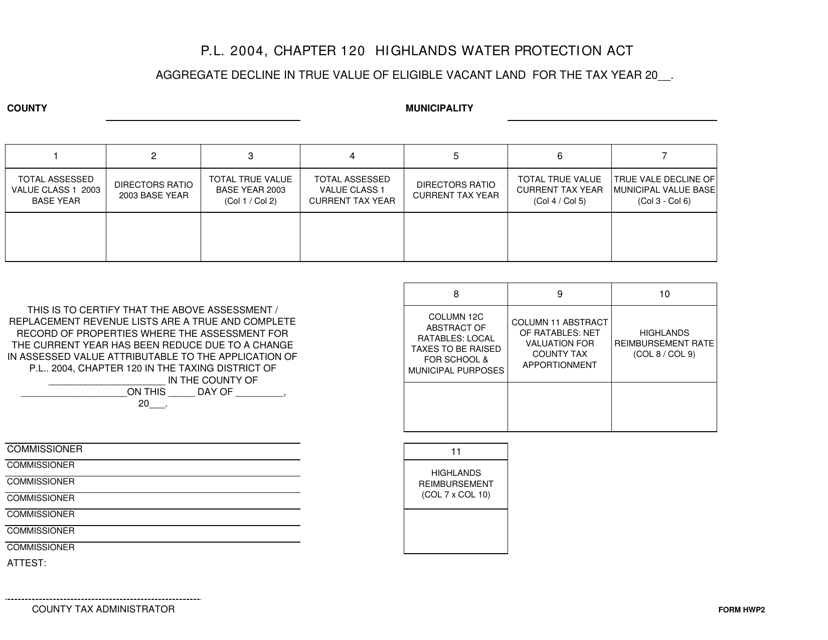

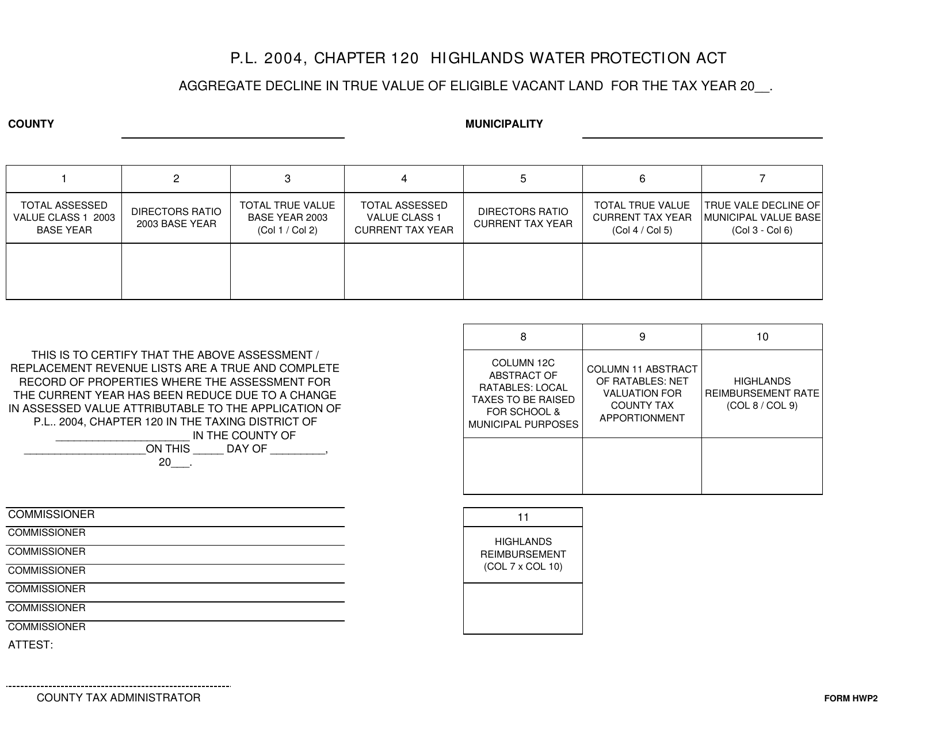

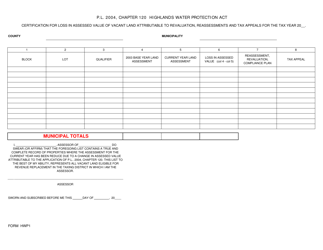

Form HWP2 Aggregate Decline in True Value of Eligible Vacant Land - New Jersey

What Is Form HWP2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HWP2?

A: Form HWP2 is a document related to the decline in the true value of eligible vacant land in New Jersey.

Q: What does the form measure?

A: The form measures the aggregate decline in the true value of eligible vacant land in New Jersey.

Q: Why is the decline in true value important?

A: The decline in true value is important for assessing the property tax burden and determining appropriate reductions or adjustments.

Q: Who is eligible for the form?

A: Property owners of vacant land in New Jersey are eligible for the form.

Q: What information is required in the form?

A: The form requires information such as the block and lot numbers, assessed value, and documentation supporting the decline in true value.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HWP2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.