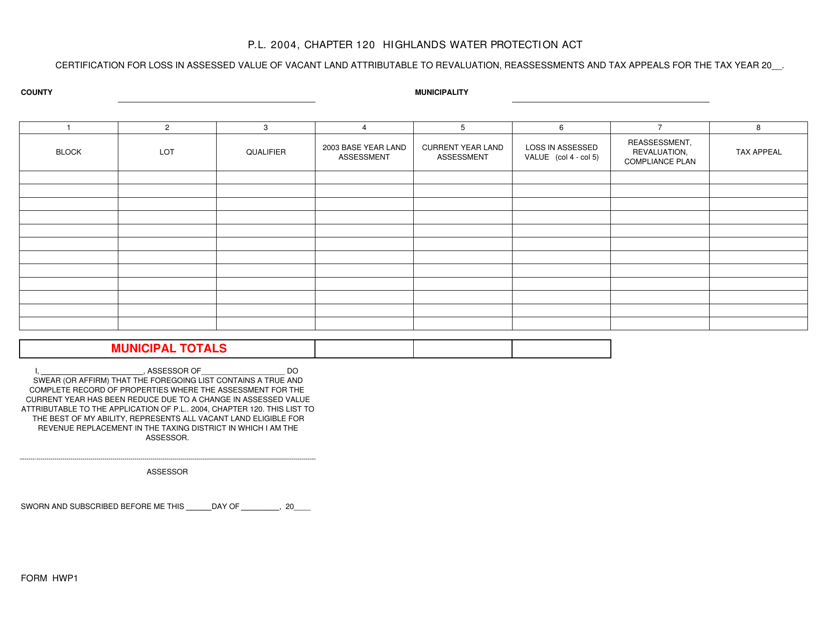

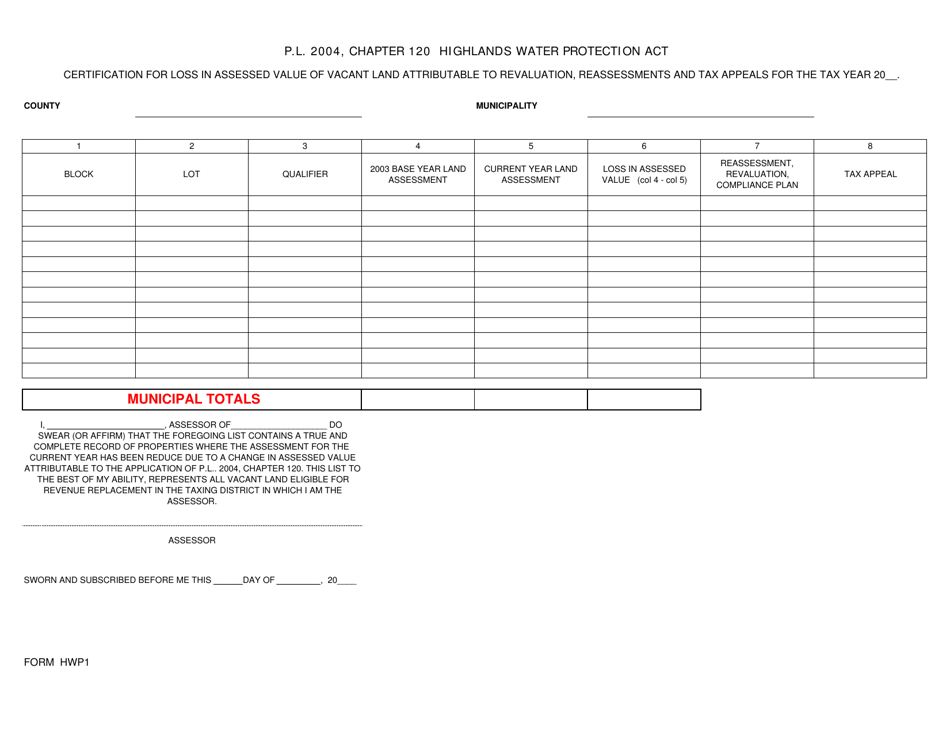

Form HWP-1 Certification for Loss in Assessed Value of Vacant Land Attributable to Revaluation, Reassessments and Tax Appeals - New Jersey

What Is Form HWP-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form HWP-1?

A: Form HWP-1 is a certification form for loss in assessed value of vacant land in New Jersey.

Q: Who is this form for?

A: This form is for property owners in New Jersey who have experienced a loss in assessed value of vacant land due to revaluation, reassessments, and tax appeals.

Q: What is the purpose of Form HWP-1?

A: The purpose of Form HWP-1 is to certify the loss in assessed value of vacant land, which may result in a reduction in property taxes.

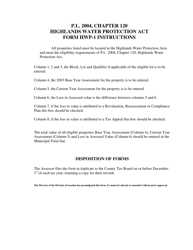

Q: What should be included in Form HWP-1?

A: Form HWP-1 should include information about the property, such as the block and lot numbers, and details about the loss in assessed value.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HWP-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.