This version of the form is not currently in use and is provided for reference only. Download this version of

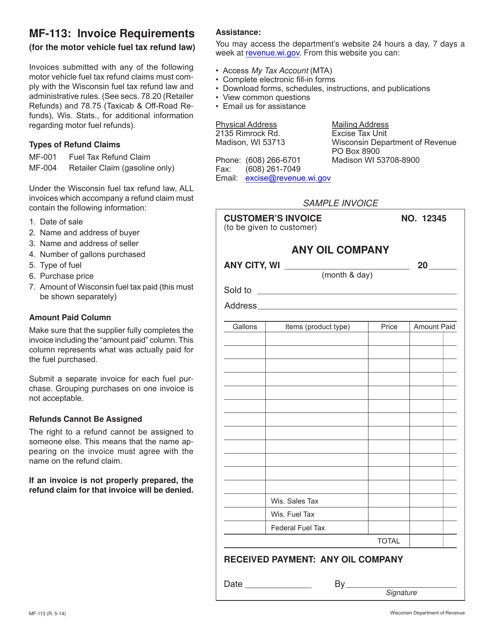

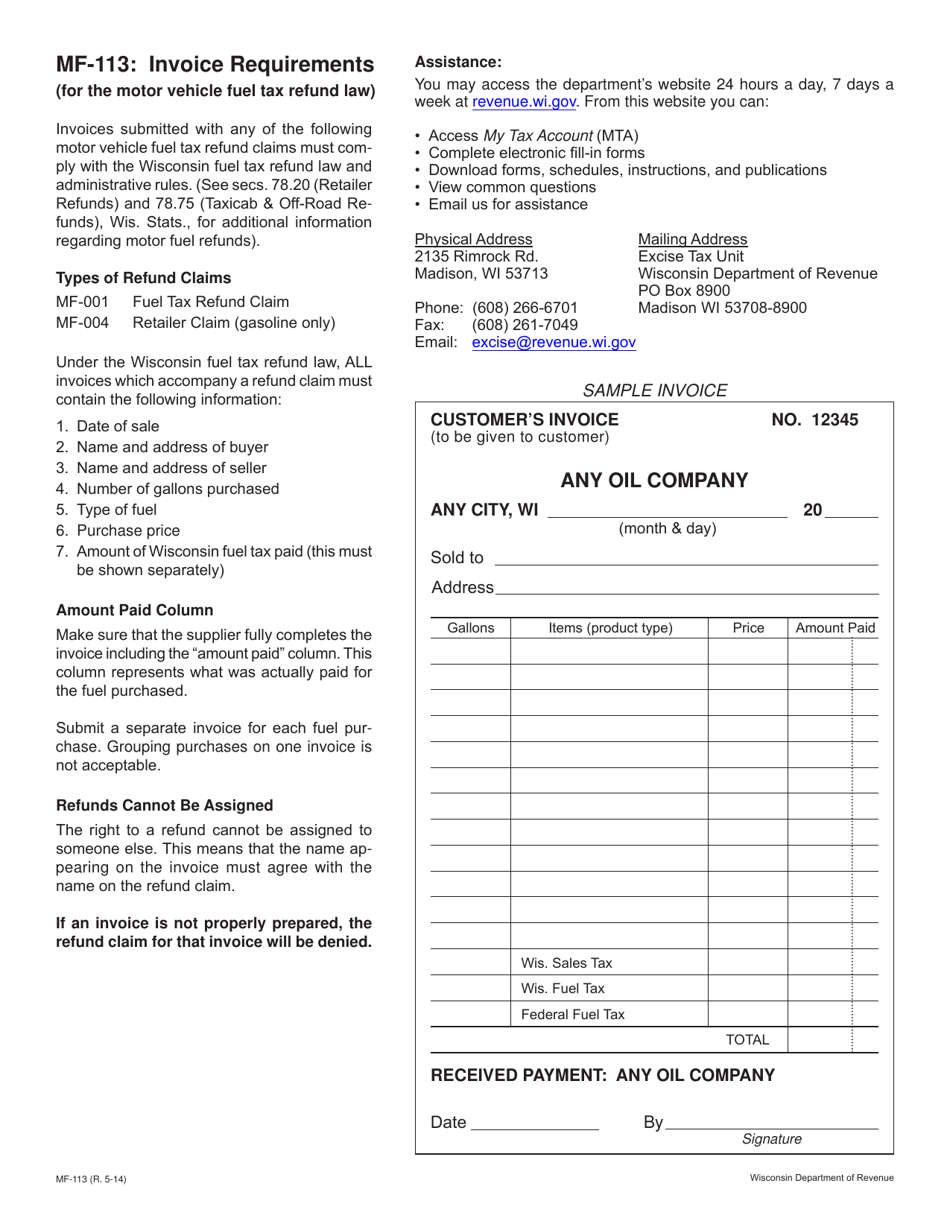

Form MF-113

for the current year.

Form MF-113 Invoice Requirements - Wisconsin

What Is Form MF-113?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-113?

A: Form MF-113 is an invoice form used in Wisconsin.

Q: Who needs to use Form MF-113?

A: Any business selling tangible personal property or taxable services in Wisconsin needs to use Form MF-113.

Q: What information is required on Form MF-113?

A: Form MF-113 requires information such as the seller's name and address, the buyer's name and address, a description of the items sold, the quantity and price of each item, and the total amount due.

Q: When should Form MF-113 be completed?

A: Form MF-113 should be completed at the time of sale or before delivery of the goods or services.

Q: Are there any penalties for not using Form MF-113?

A: Yes, failure to provide Form MF-113 to a buyer upon request can result in penalties and interest.

Q: Is there a deadline for submitting Form MF-113?

A: Form MF-113 should be submitted on a monthly basis, with the due date being the last day of the following month.

Q: Are there any exceptions to using Form MF-113?

A: There are certain exemptions and exceptions to using Form MF-113, such as sales of exempt items or sales made to tax-exempt organizations.

Q: What should I do if I have additional questions about Form MF-113?

A: If you have additional questions about Form MF-113, you should contact the Wisconsin Department of Revenue for further assistance.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MF-113 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.