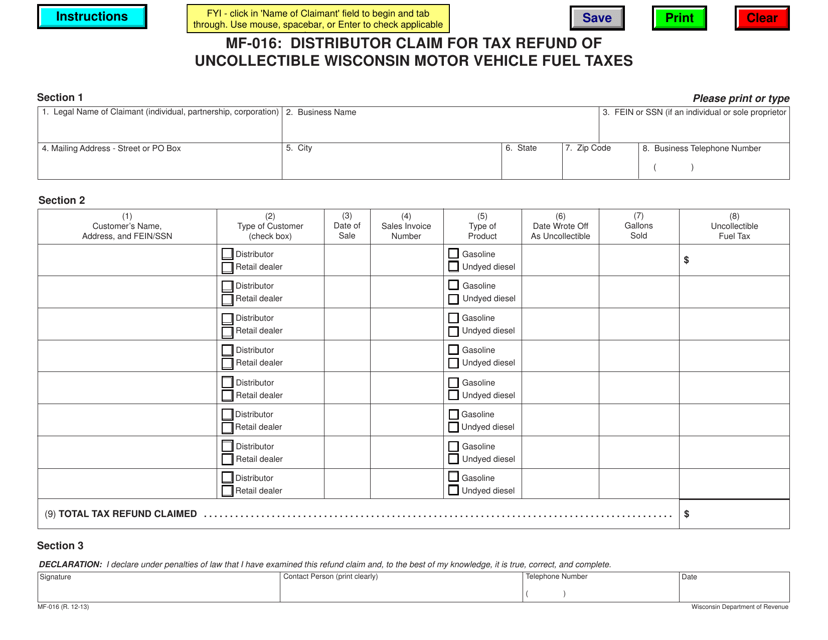

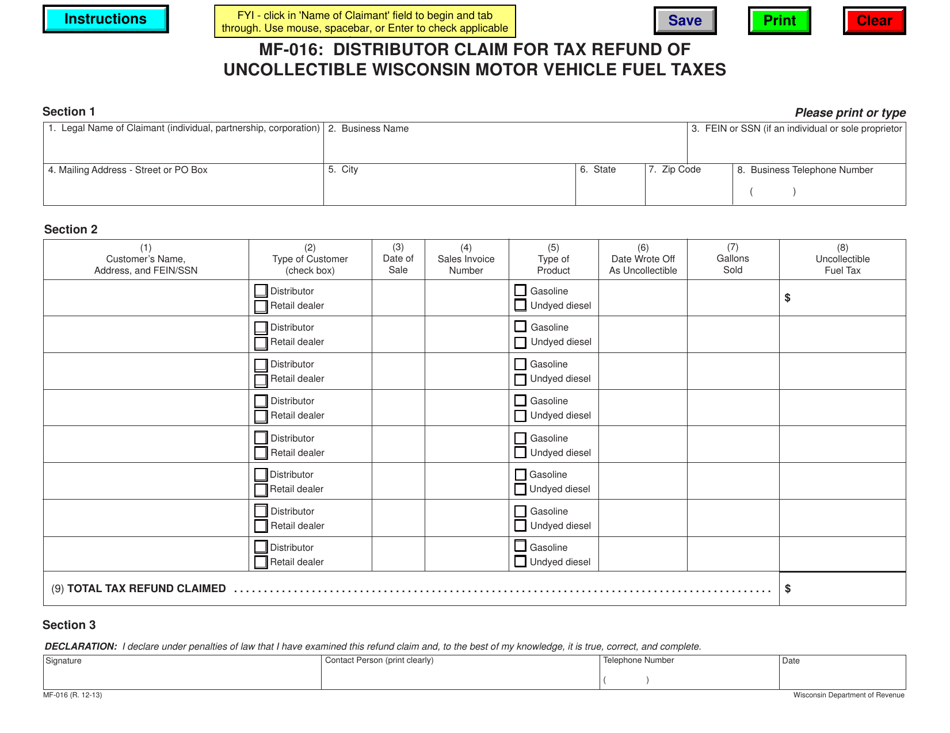

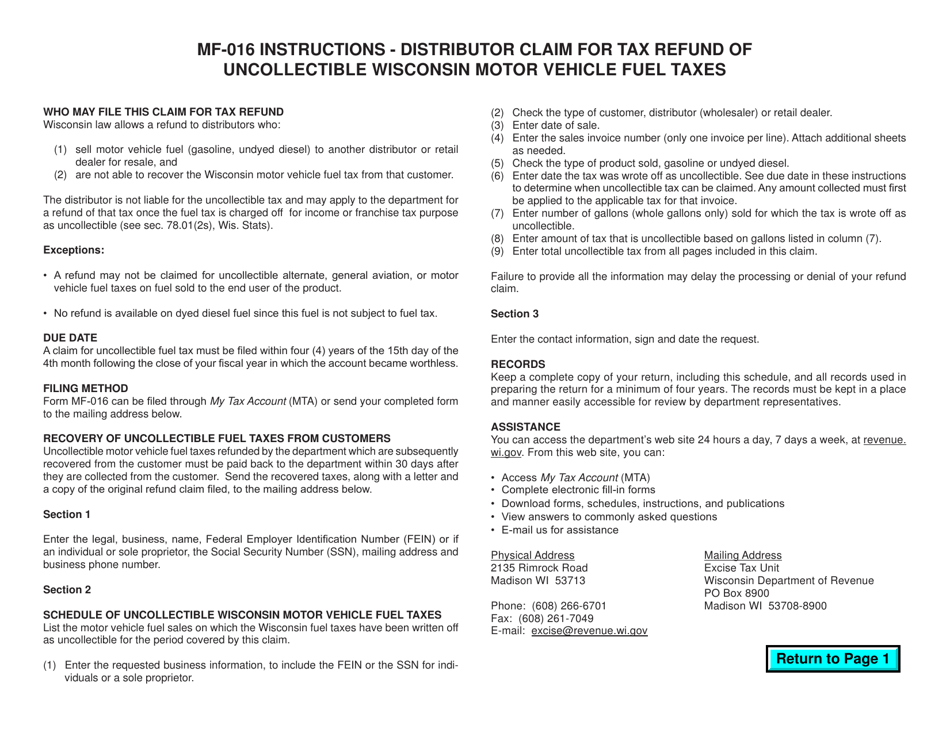

Form MF-016 Distributor Claim for Tax Refund of Uncollectible Wisconsin Motor Vehicle Fuel Taxes - Wisconsin

What Is Form MF-016?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MF-016?

A: The Form MF-016 is a form used for filing a distributor claim for a tax refund of uncollectible Wisconsin motor vehicle fuel taxes.

Q: Who needs to file Form MF-016?

A: Distributors who are seeking a refund for uncollectible Wisconsin motor vehicle fuel taxes need to file Form MF-016.

Q: What is a distributor claim?

A: A distributor claim is a request made by a fuel distributor to the state for a refund of motor vehicle fuel taxes that were uncollectible.

Q: What are uncollectible motor vehicle fuel taxes?

A: Uncollectible motor vehicle fuel taxes are taxes that a distributor is unable to collect from the purchaser of fuel.

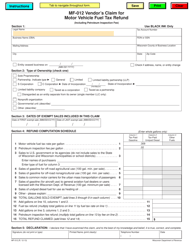

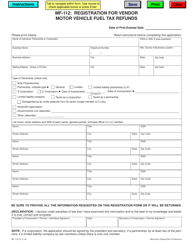

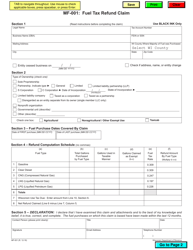

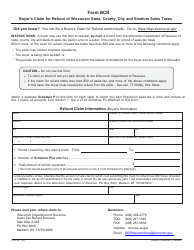

Q: What information is required on Form MF-016?

A: Form MF-016 requires information such as the distributor's name, address, fuel transactions, credits, taxes, and reasons for uncollectible taxes.

Q: When is the deadline for filing Form MF-016?

A: The deadline for filing Form MF-016 is typically the last day of the quarter following the quarter in which the uncollectible taxes were incurred.

Q: Are there any supporting documents required for Form MF-016?

A: Yes, supporting documents such as invoices, credit memos, and debtors' lists may be required to substantiate the distributor claim.

Q: Can I file Form MF-016 electronically?

A: Yes, Form MF-016 can be filed electronically through the Wisconsin Department of Revenue's e-file system.

Q: Is there a fee for filing Form MF-016?

A: No, there is no fee for filing Form MF-016.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-016 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.