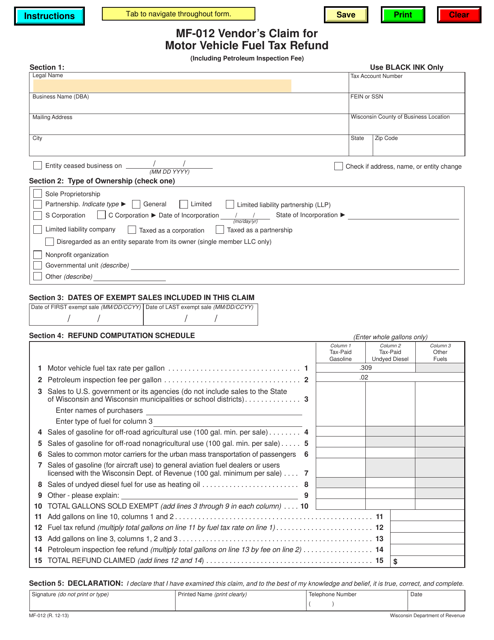

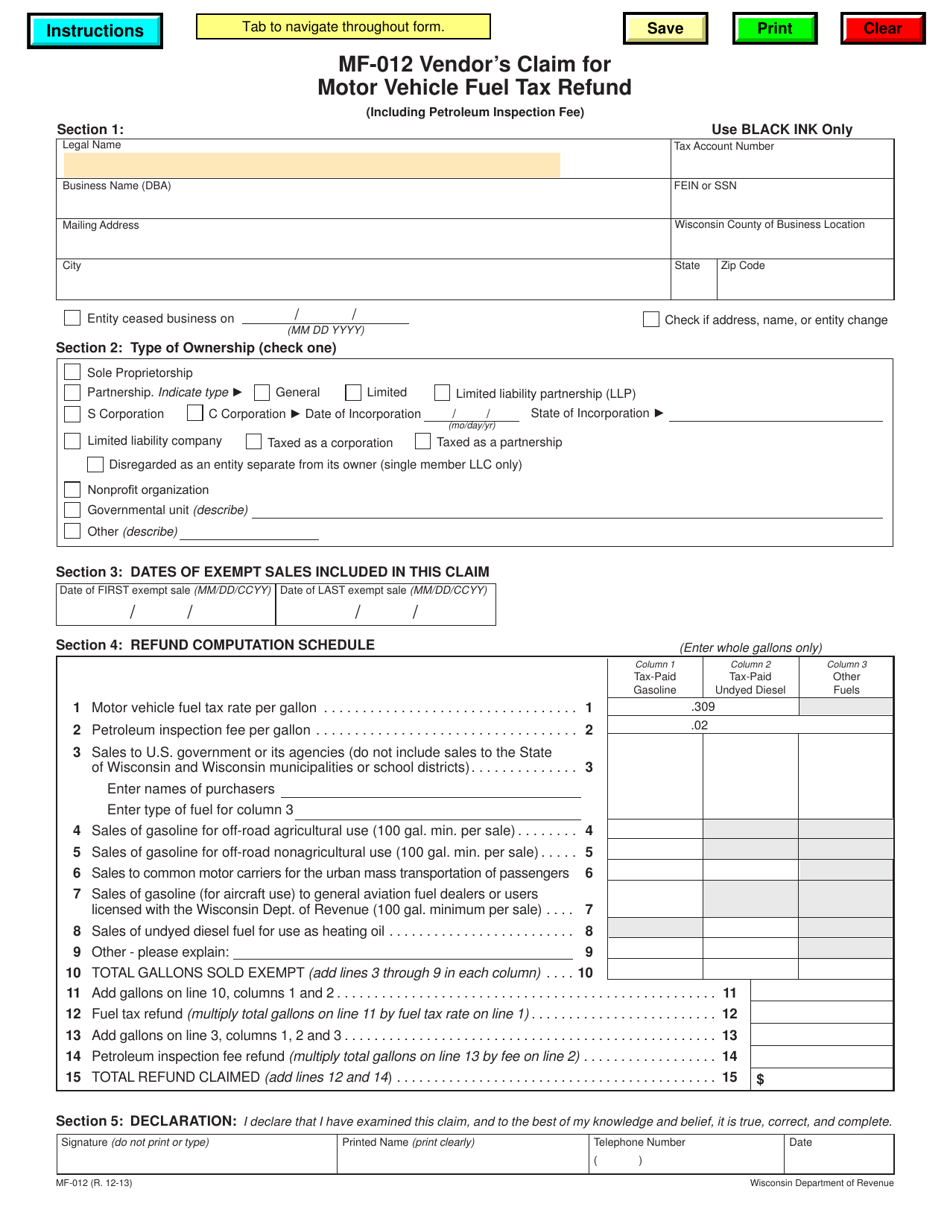

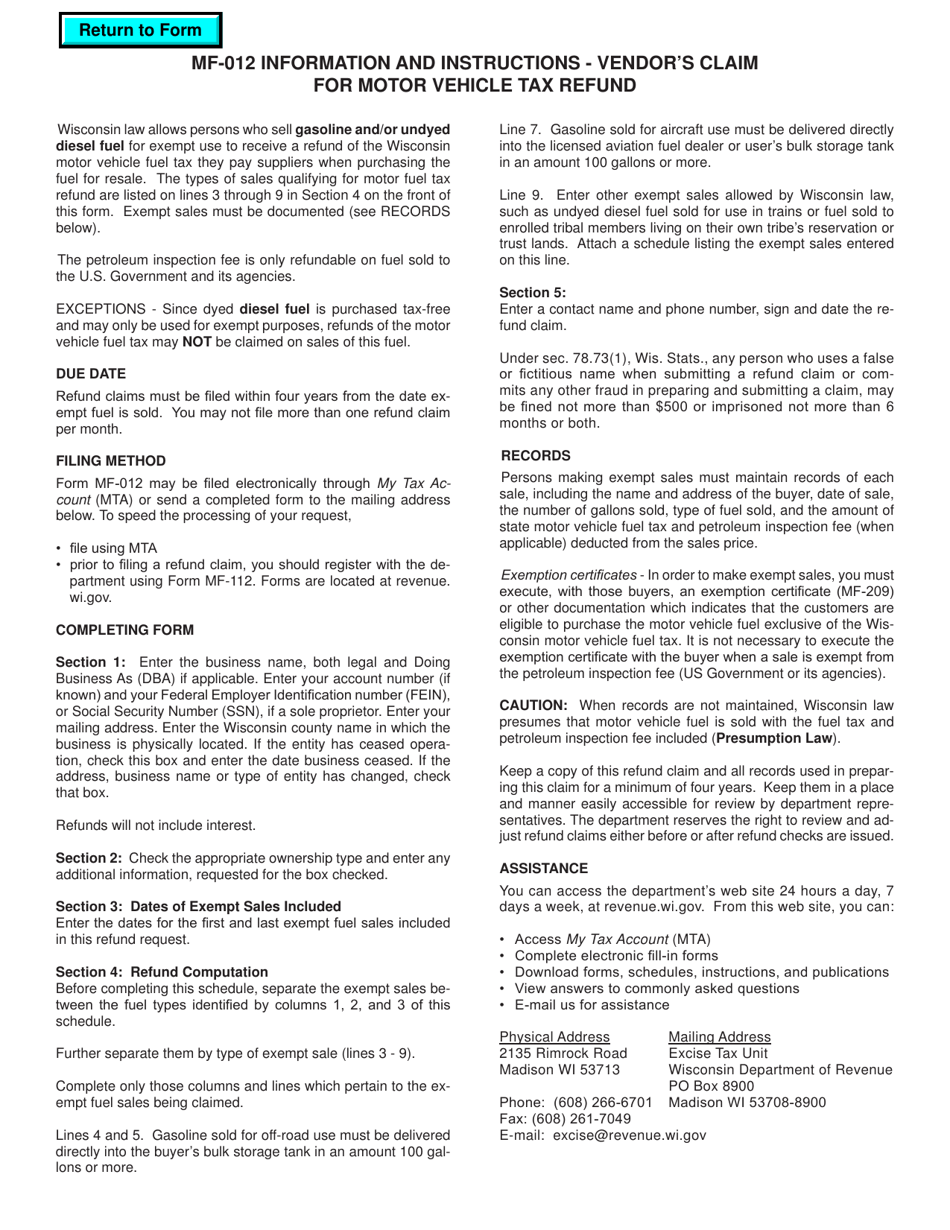

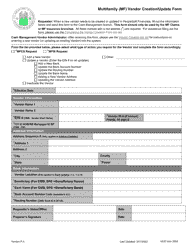

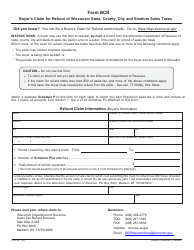

Form MF-012 Vendor's Claim for Motor Vehicle Fuel Tax Refund - Wisconsin

What Is Form MF-012?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-012?

A: Form MF-012 is the Vendor's Claim for Motor VehicleFuel Tax Refund in Wisconsin.

Q: Who can use Form MF-012?

A: Form MF-012 can be used by vendors seeking a refund of motor vehicle fuel tax paid in Wisconsin.

Q: What is the purpose of Form MF-012?

A: The purpose of Form MF-012 is to claim a refund of motor vehicle fuel tax paid in Wisconsin.

Q: What information is required on Form MF-012?

A: Form MF-012 requires information such as the vendor's name, address, fuel purchase details, and proof of tax payment.

Q: Are there any deadlines for filing Form MF-012?

A: Yes, there are specific deadlines for filing Form MF-012. It is important to refer to the instructions provided with the form for the applicable deadlines.

Q: What supporting documents do I need to include with Form MF-012?

A: You may need to include copies of fuel purchase receipts and proof of tax payment when submitting Form MF-012.

Q: How long does it take to receive a refund after filing Form MF-012?

A: The processing time for a refund after filing Form MF-012 may vary. It is best to check with the Wisconsin Department of Revenue for an estimate.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-012 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.