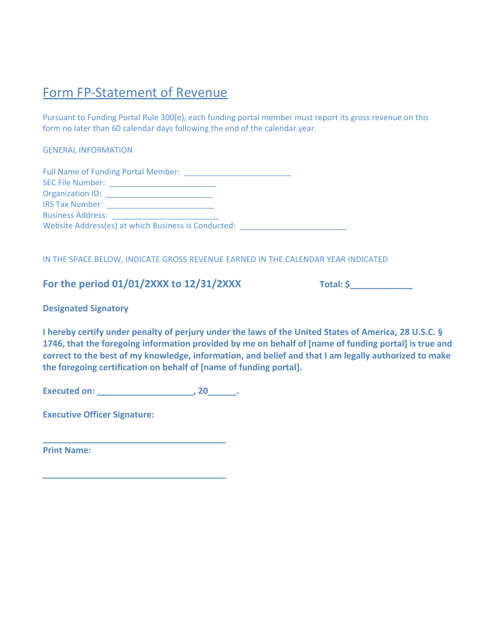

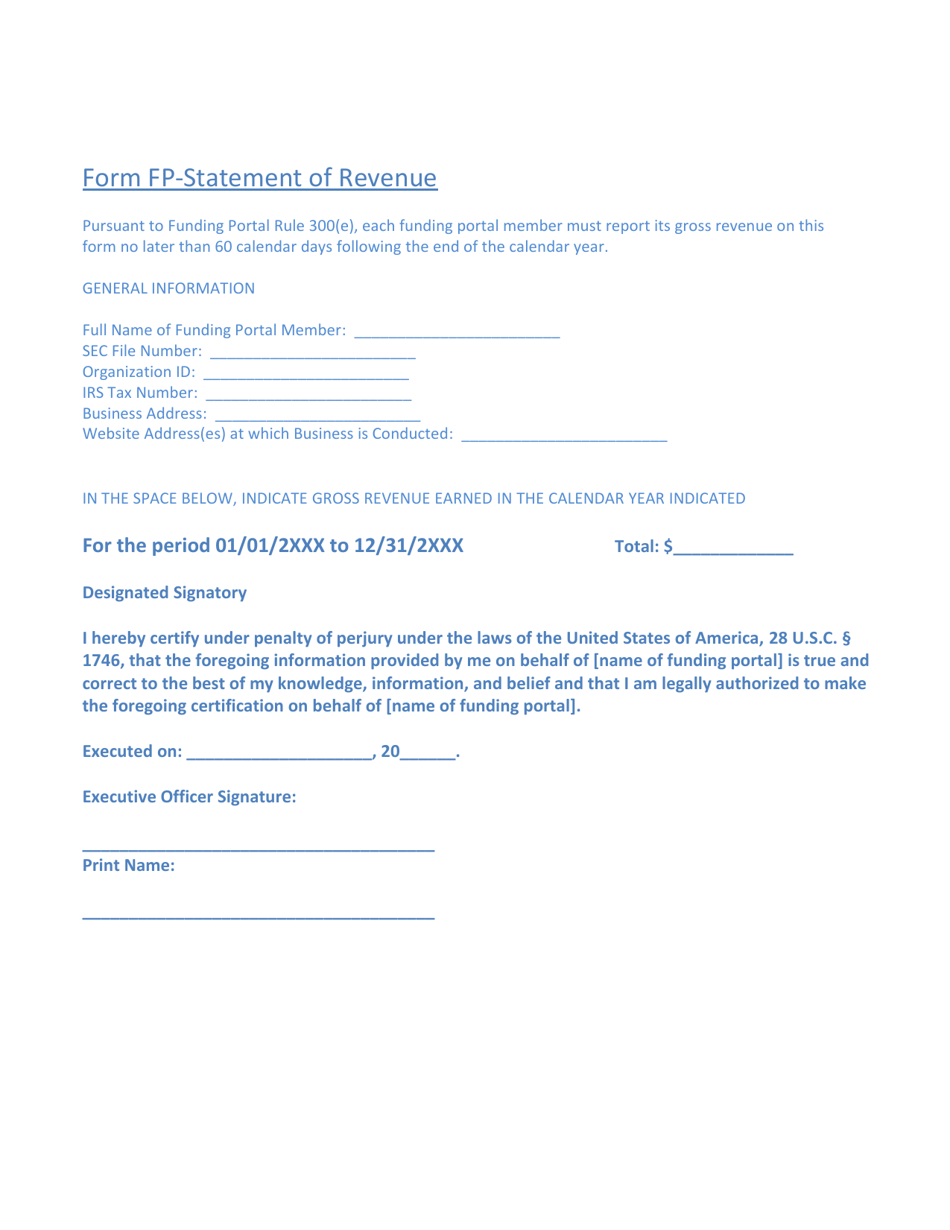

Form FP Statement of Revenue

What Is Form FP?

This is a legal form that was released by the Financial Industry Regulatory Authority (FINRA) and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FP Statement of Revenue?

A: Form FP Statement of Revenue is a tax form used by individuals and businesses in Canada to report their financial information and calculate their taxes.

Q: Who needs to fill out Form FP Statement of Revenue?

A: Individuals and businesses in Canada who have income from self-employment, partnerships, rentals, or certain other sources need to fill out Form FP Statement of Revenue.

Q: What information do I need to fill out Form FP Statement of Revenue?

A: You will need to provide details about your income, expenses, and deductions related to self-employment, partnerships, rentals, or other sources of income.

Q: When is the deadline to file Form FP Statement of Revenue?

A: The deadline to file Form FP Statement of Revenue is generally April 30th of the following year. However, if you or your spouse or common-law partner is self-employed, the deadline is extended to June 15th.

Q: What happens if I don't file Form FP Statement of Revenue?

A: If you are required to file Form FP Statement of Revenue and fail to do so, you may face penalties and interest charges from the CRA.

Q: Do I need to keep a copy of Form FP Statement of Revenue after filing?

A: Yes, it is recommended to keep a copy of Form FP Statement of Revenue and any supporting documents for at least six years in case of future audits or inquiries from the CRA.

Form Details:

- The latest available edition released by the Financial Industry Regulatory Authority (FINRA);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FP by clicking the link below or browse more documents and templates provided by the Financial Industry Regulatory Authority (FINRA).