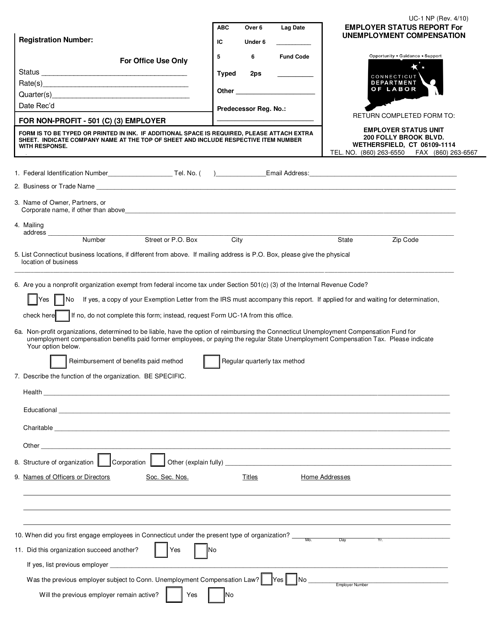

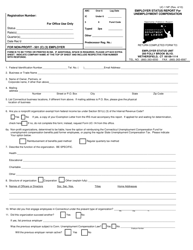

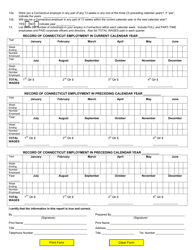

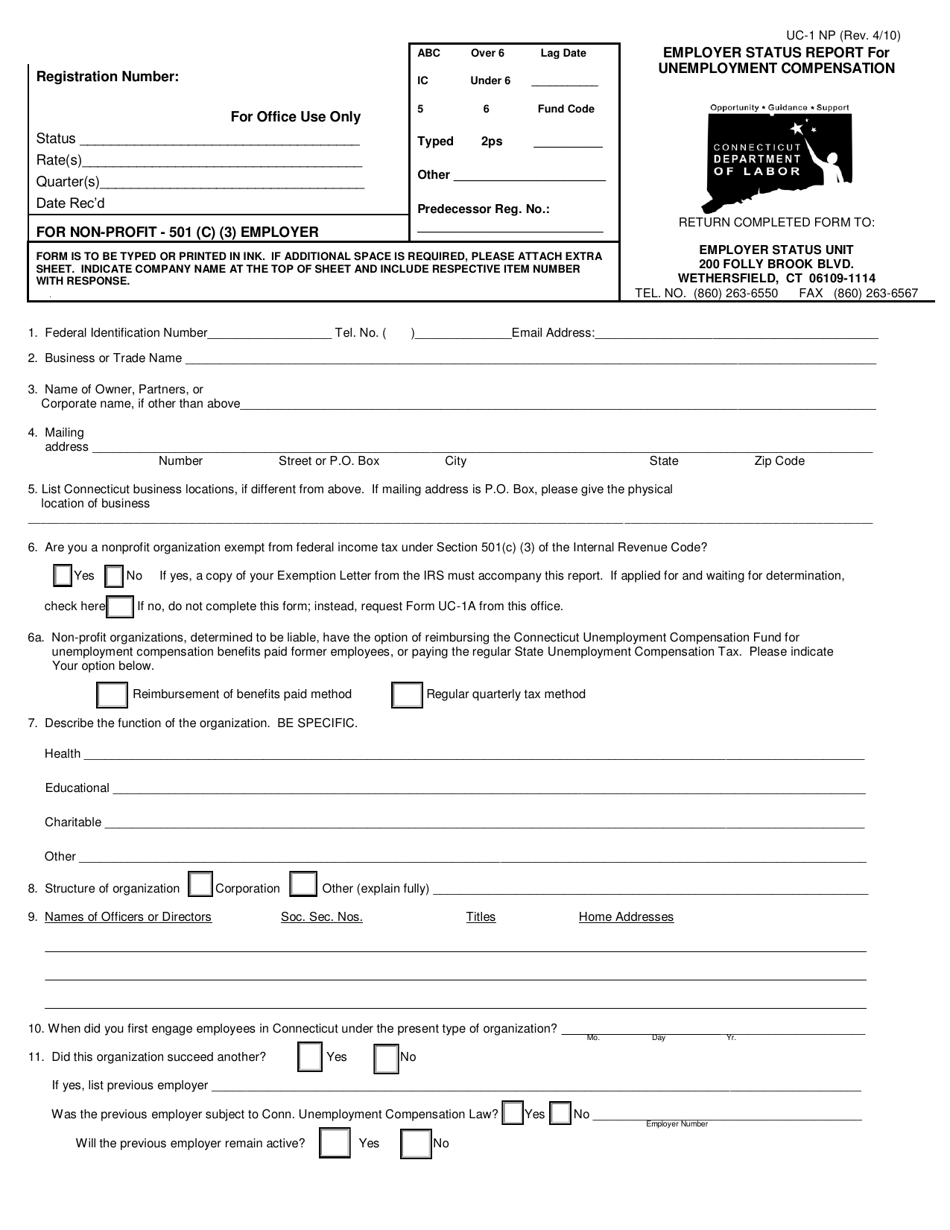

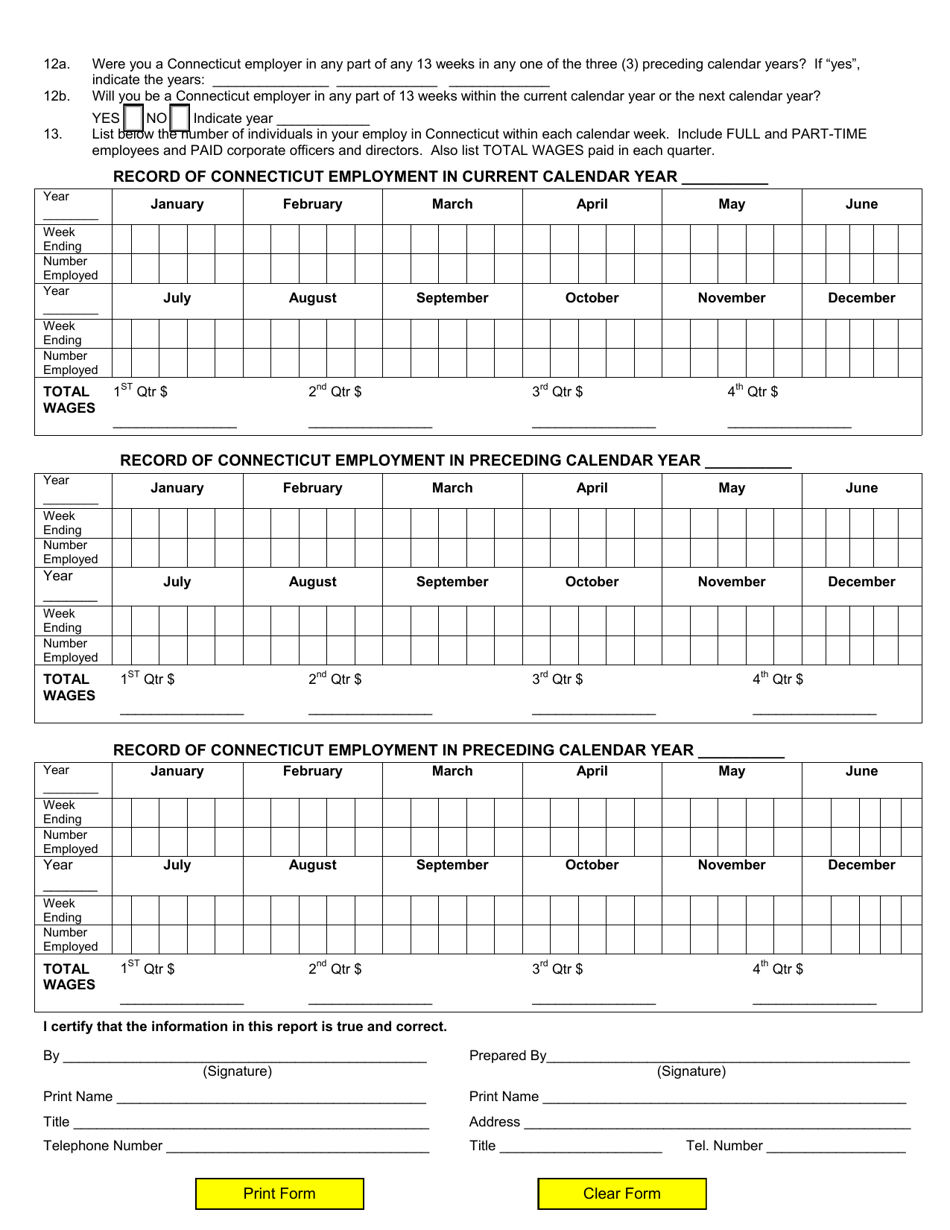

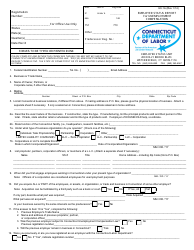

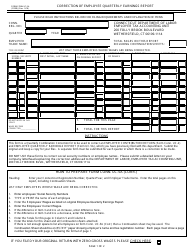

Form UC-1NP Employer Status Report for Unemployment Compensation - Connecticut

What Is Form UC-1NP?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UC-1NP?

A: UC-1NP is a form used by employers in Connecticut to report their status for unemployment compensation.

Q: Who is required to submit Form UC-1NP?

A: All employers in Connecticut are required to submit Form UC-1NP.

Q: When should Form UC-1NP be submitted?

A: Form UC-1NP should be submitted within 20 days of becoming liable for unemployment compensation.

Q: Are there any penalties for failing to submit Form UC-1NP?

A: Yes, there may be penalties for failing to submit Form UC-1NP, including fines and other legal consequences.

Q: What information is required on Form UC-1NP?

A: Form UC-1NP requires information such as the employer's name, address, contact information, and details about the business.

Q: Can Form UC-1NP be submitted electronically?

A: Yes, employers have the option to submit Form UC-1NP electronically.

Q: Is Form UC-1NP confidential?

A: Yes, the information provided on Form UC-1NP is confidential and will only be used for official purposes.

Q: What happens after Form UC-1NP is submitted?

A: After Form UC-1NP is submitted, the employer's status for unemployment compensation will be determined and communicated to them.

Q: Can Form UC-1NP be amended if there are changes to the employer's status?

A: Yes, employers can file an amended Form UC-1NP if there are changes to their status for unemployment compensation.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-1NP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.