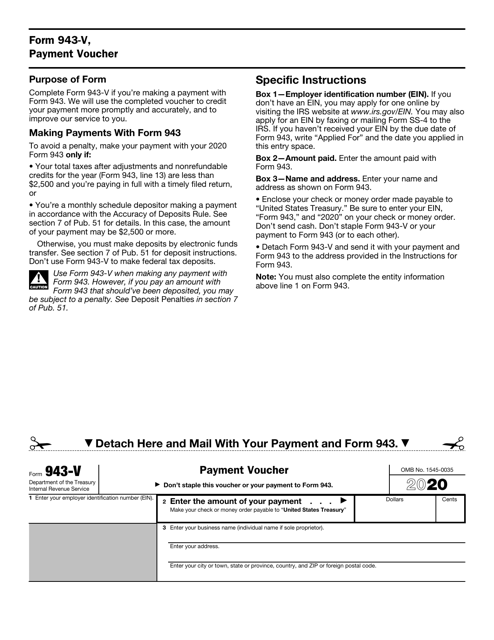

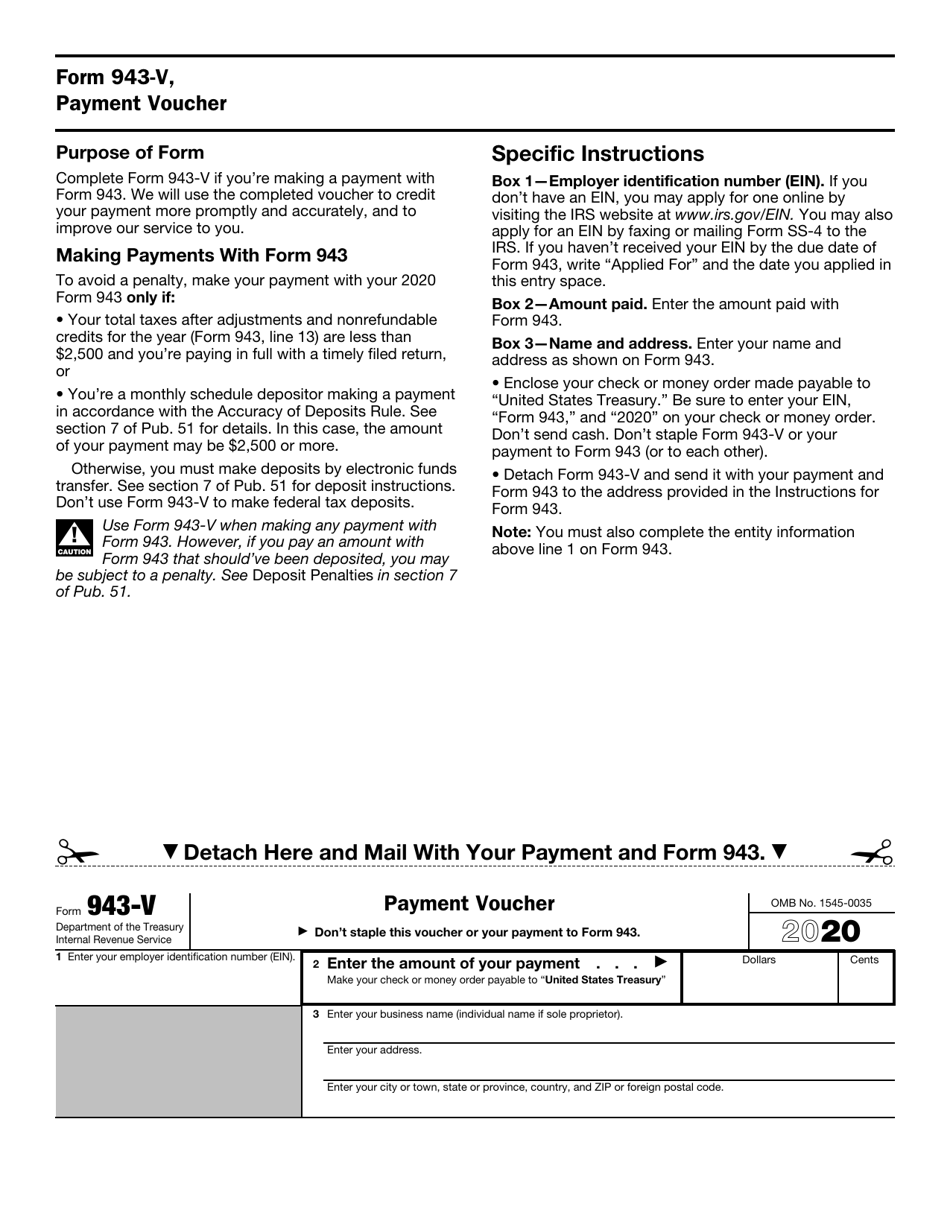

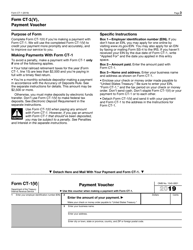

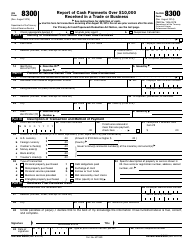

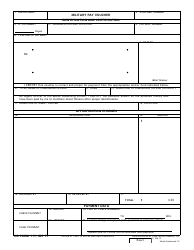

IRS Form 943-V Payment Voucher

What Is IRS Form 943-V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 943-V?

A: IRS Form 943-V is a payment voucher used to make payments for the employer's annual tax return for agricultural employees.

Q: Who needs to use IRS Form 943-V?

A: Employers who have paid wages to agricultural employees and need to make a payment with their Form 943 tax return.

Q: What is the purpose of IRS Form 943-V?

A: The purpose of IRS Form 943-V is to provide a payment voucher for employers to include with their tax payment for agricultural employees.

Q: When is IRS Form 943-V due?

A: IRS Form 943-V is due on or before the deadline for filing the employer's annual tax return for agricultural employees.

Q: What should I do if I make an error on my IRS Form 943-V?

A: If you make an error on your IRS Form 943-V, you should correct it as soon as possible and submit the corrected form to the IRS.

Q: Can I file IRS Form 943-V electronically?

A: No, IRS Form 943-V is a payment voucher and cannot be filed electronically. It should be sent by mail along with your tax payment.

Q: What is the penalty for late payment of IRS Form 943-V?

A: If you fail to make timely payment or pay less than the required amount on your IRS Form 943-V, you may be subject to penalties and interest.

Q: Can I use IRS Form 943-V for other tax returns?

A: No, IRS Form 943-V is specifically designed for the employer's annual tax return for agricultural employees and cannot be used for other tax returns.

Q: What payment methods can I use with IRS Form 943-V?

A: You can make your payment with IRS Form 943-V using electronic funds withdrawal, check, money order, or credit card.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 943-V through the link below or browse more documents in our library of IRS Forms.