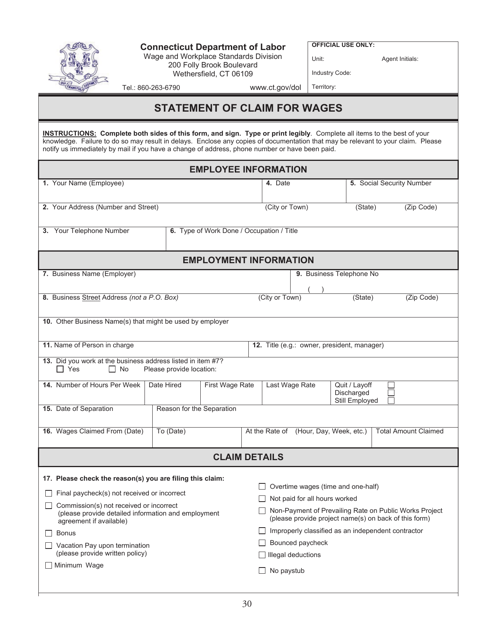

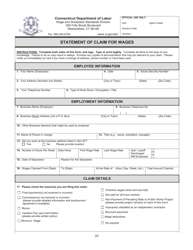

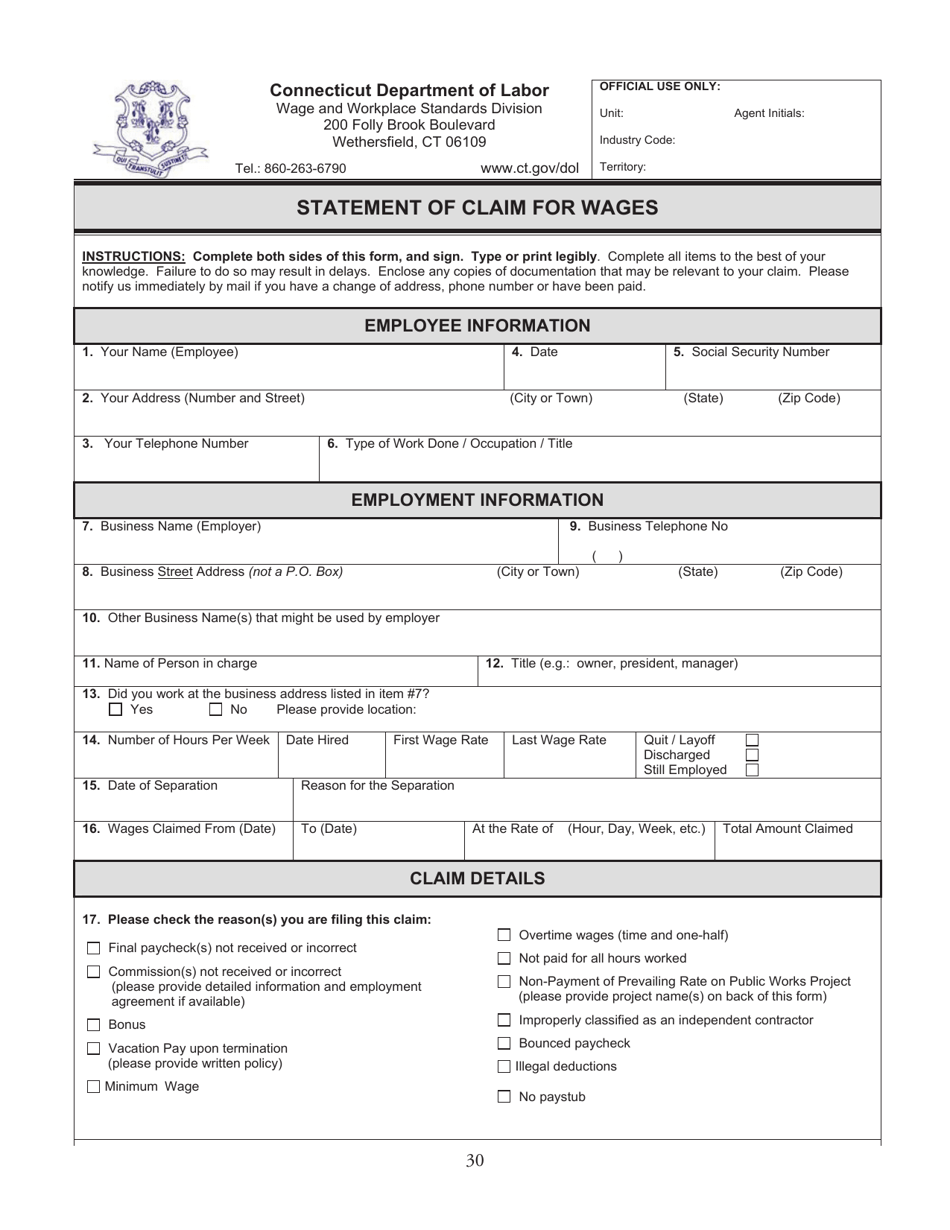

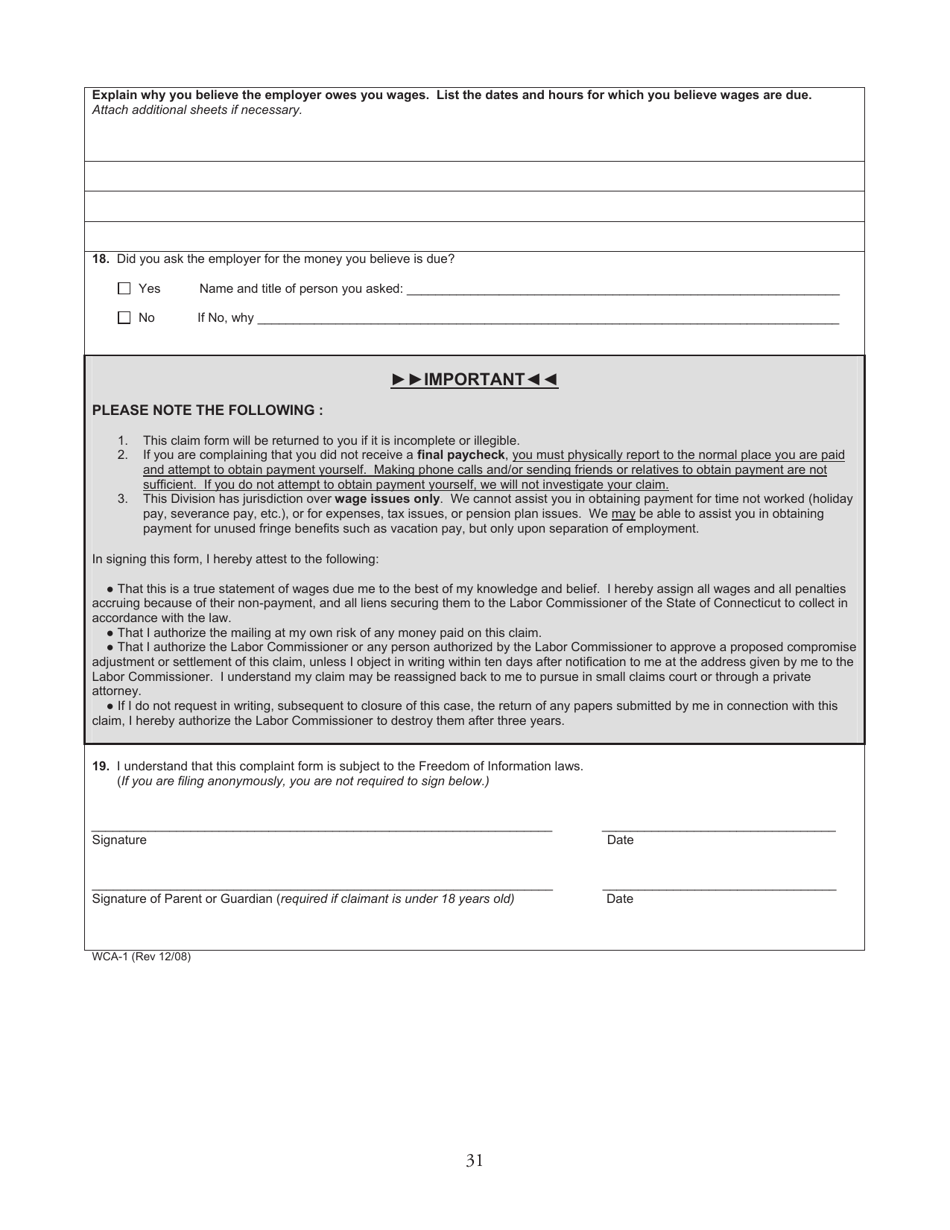

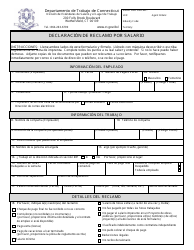

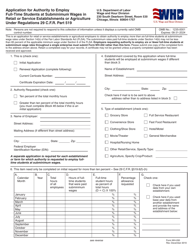

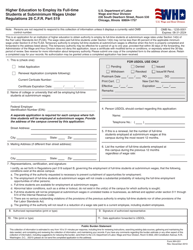

Form WCA-1 Statement of Claim for Wages - Connecticut

What Is Form WCA-1?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WCA-1?

A: Form WCA-1 is a Statement of Claim for Wages.

Q: What is the purpose of Form WCA-1?

A: The purpose of Form WCA-1 is to file a claim for unpaid wages in the state of Connecticut.

Q: How do I use Form WCA-1?

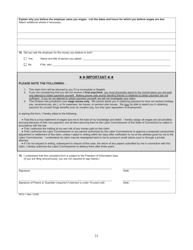

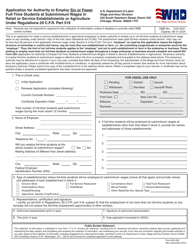

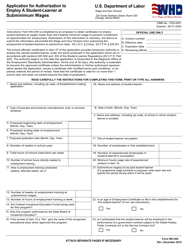

A: To use Form WCA-1, you need to fill in your personal information, provide details about your employer and the wages owed, and sign the form.

Q: Is there a deadline for filing Form WCA-1?

A: Yes, there is a deadline for filing Form WCA-1. It is generally within two years from the date the wages were due.

Q: Do I need to provide any supporting documents with Form WCA-1?

A: Yes, you may need to provide supporting documents such as pay stubs or work records to substantiate your claim.

Q: What happens after I file Form WCA-1?

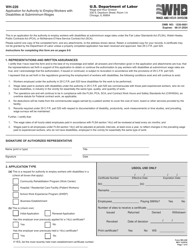

A: After you file Form WCA-1, the Connecticut Department of Labor will investigate your claim and determine if you are owed wages. They may also hold a hearing if necessary.

Q: Can I appeal if my claim is denied?

A: Yes, if your claim is denied, you have the right to appeal the decision.

Q: Is there a fee for filing Form WCA-1?

A: No, there is no fee for filing Form WCA-1.

Q: Can I file a claim for wages if I am an independent contractor?

A: No, Form WCA-1 is specifically for employees filing claims for unpaid wages.

Q: Are there any other forms I need to file along with Form WCA-1?

A: Depending on your situation, you may also need to file additional forms such as Form UC-1E Employer's First Report of Injury.

Q: What should I do if my employer retaliates against me for filing a claim?

A: If your employer retaliates against you for filing a claim, you should report the retaliation to the Connecticut Department of Labor.

Q: What if I have more questions about Form WCA-1?

A: If you have more questions about Form WCA-1, you can contact the Connecticut Department of Labor for assistance.

Q: Is Form WCA-1 specific to Connecticut?

A: Yes, Form WCA-1 is specific to the state of Connecticut.

Q: Can I use Form WCA-1 for wage claims in other states?

A: No, Form WCA-1 is only applicable for wage claims in Connecticut.

Q: What should I do if I need to file a wage claim in another state?

A: If you need to file a wage claim in another state, you should check with the respective state's labor department or agency for the appropriate forms and procedures.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WCA-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.