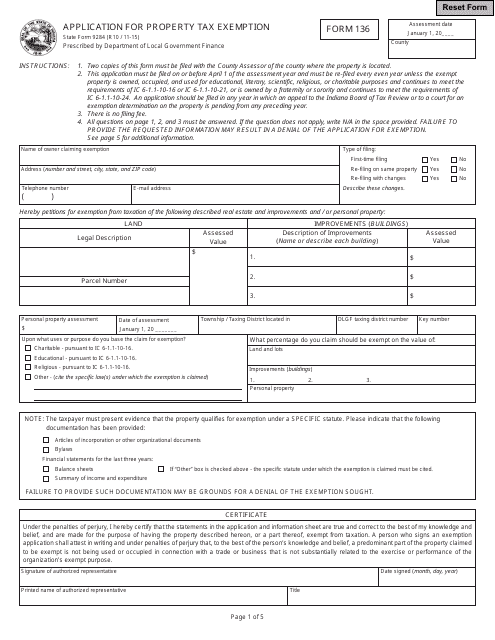

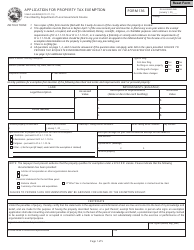

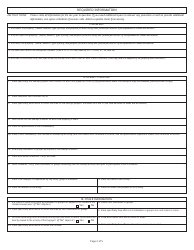

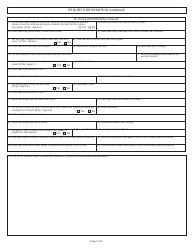

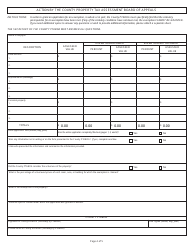

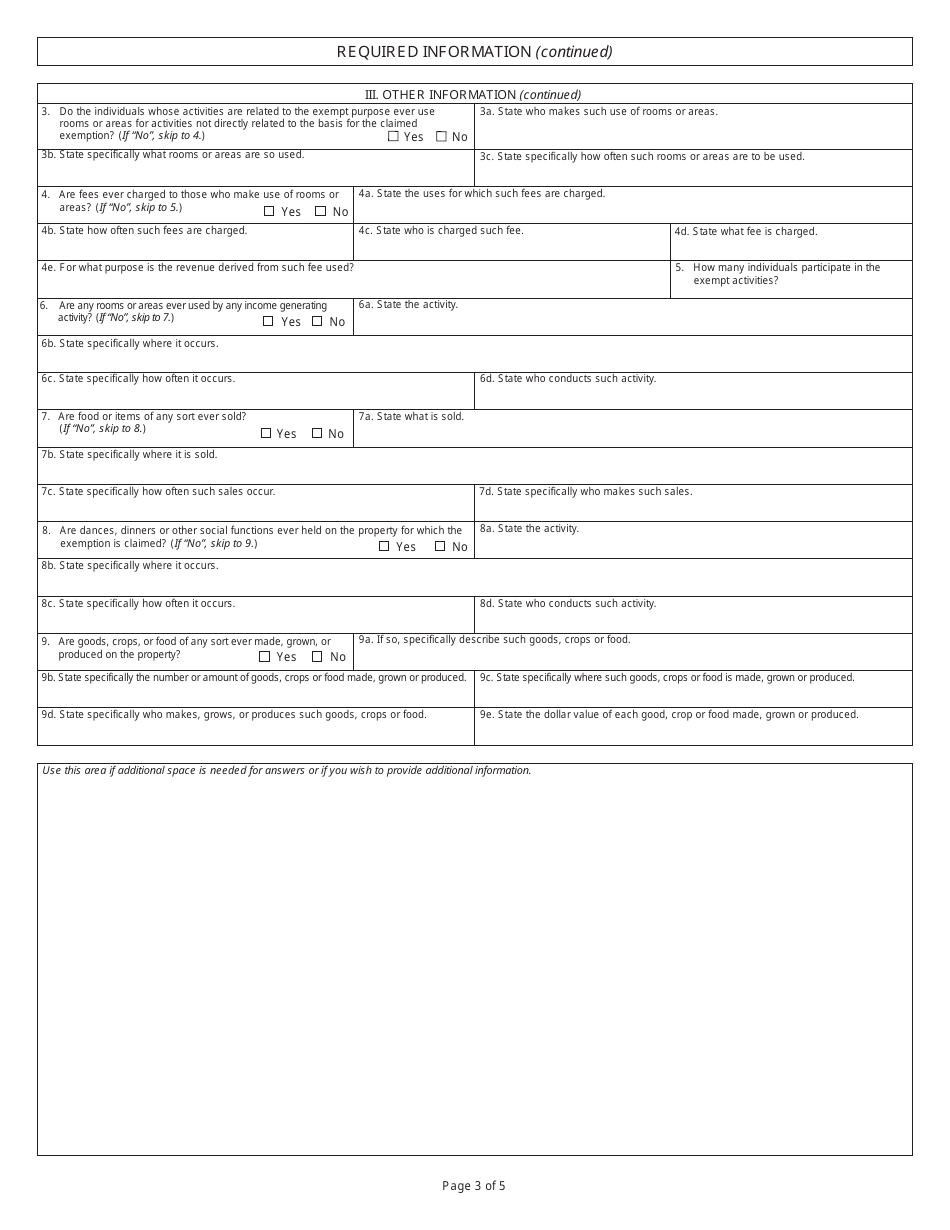

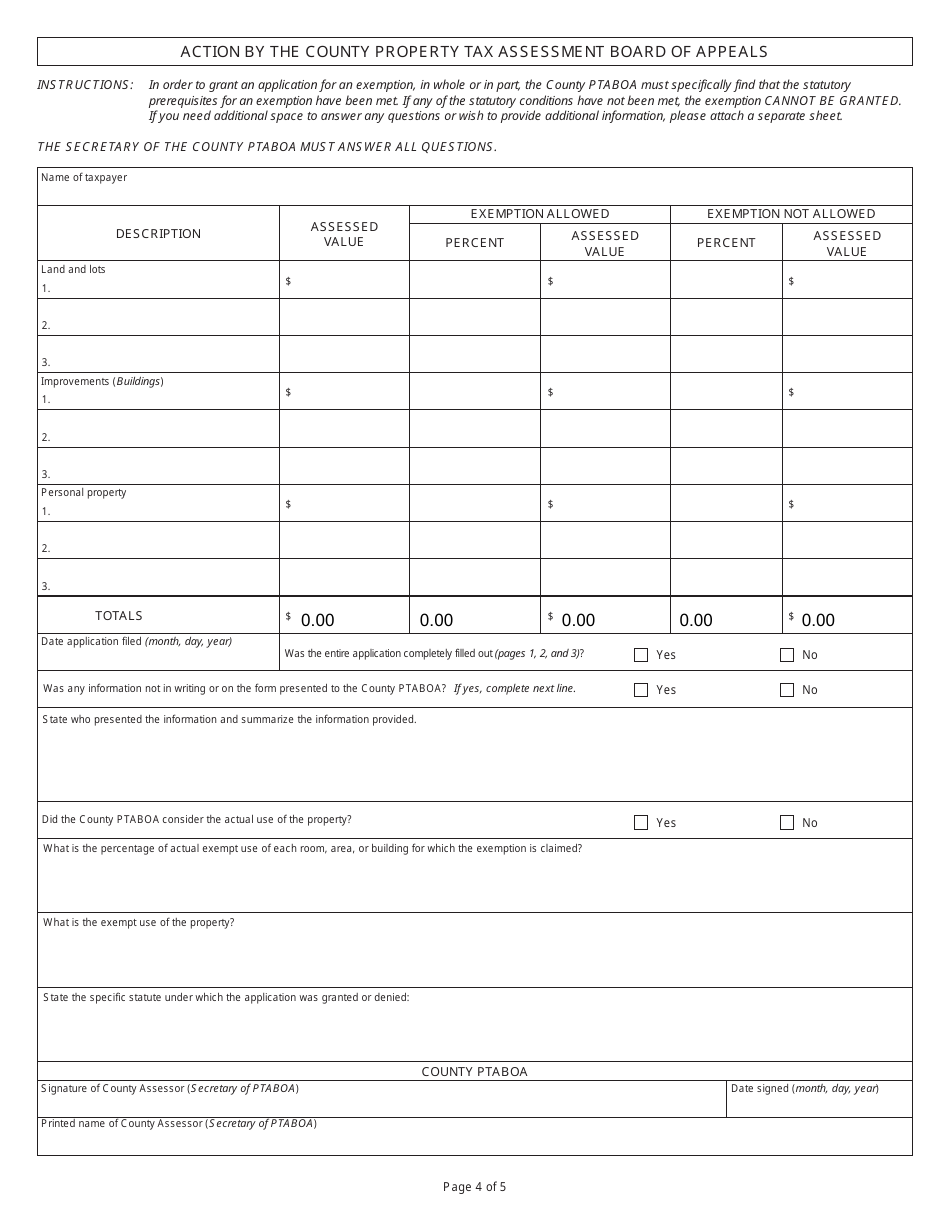

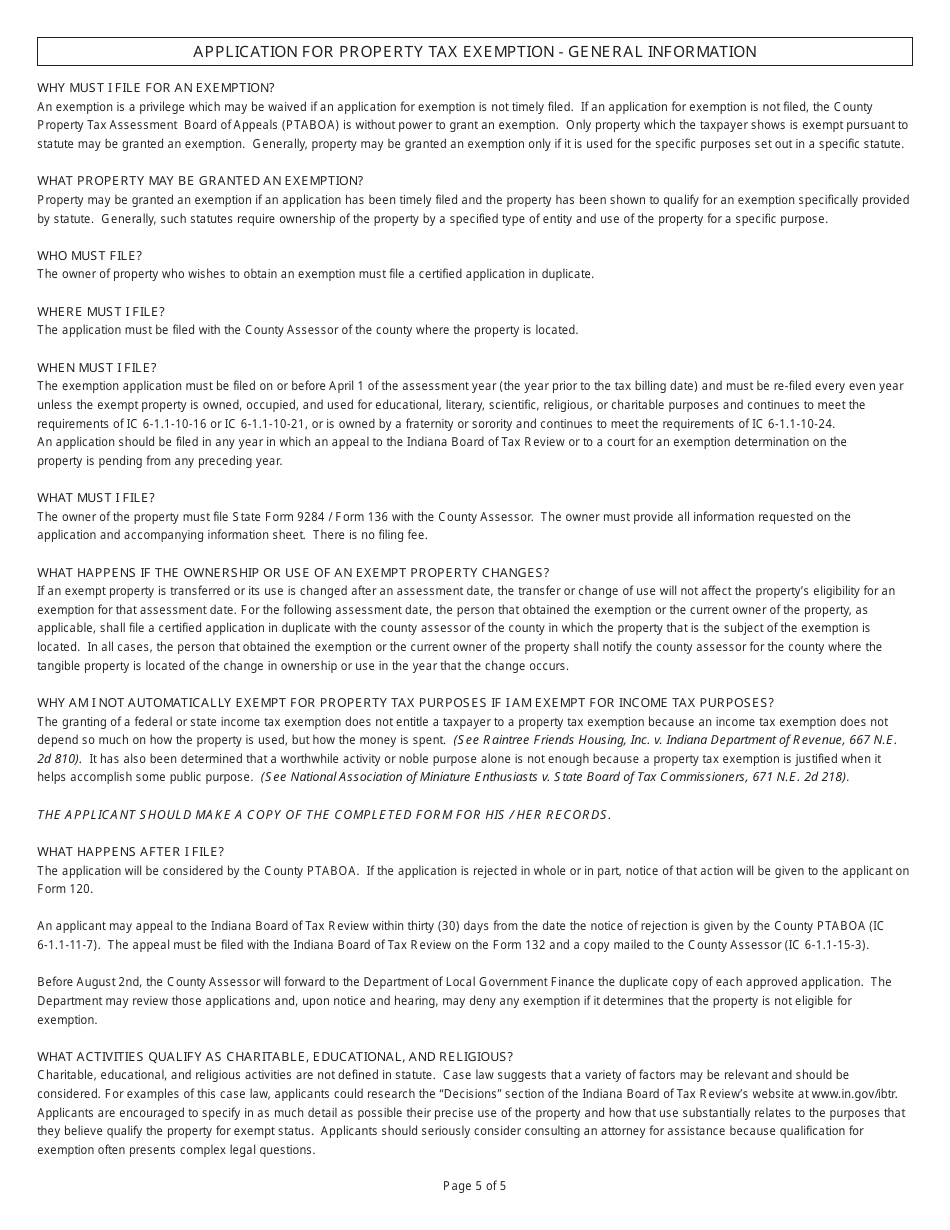

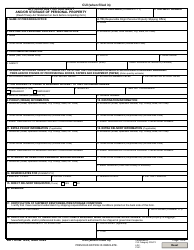

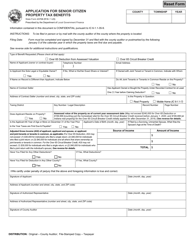

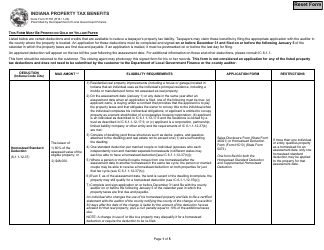

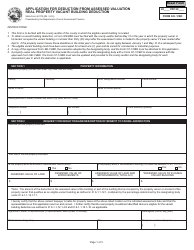

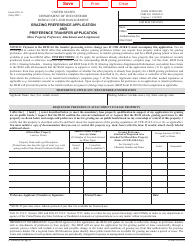

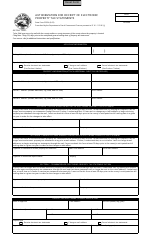

Form 136 (State Form 9284) Application for Property Tax Exemption - Indiana

What Is Form 136 (State Form 9284)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 136 (State Form 9284)?

A: Form 136 (State Form 9284) is the Application for Property Tax Exemption in Indiana.

Q: Who needs to fill out Form 136?

A: Property owners in Indiana who are seeking a property tax exemption need to fill out Form 136.

Q: What is the purpose of Form 136?

A: The purpose of Form 136 is to apply for a property tax exemption in Indiana.

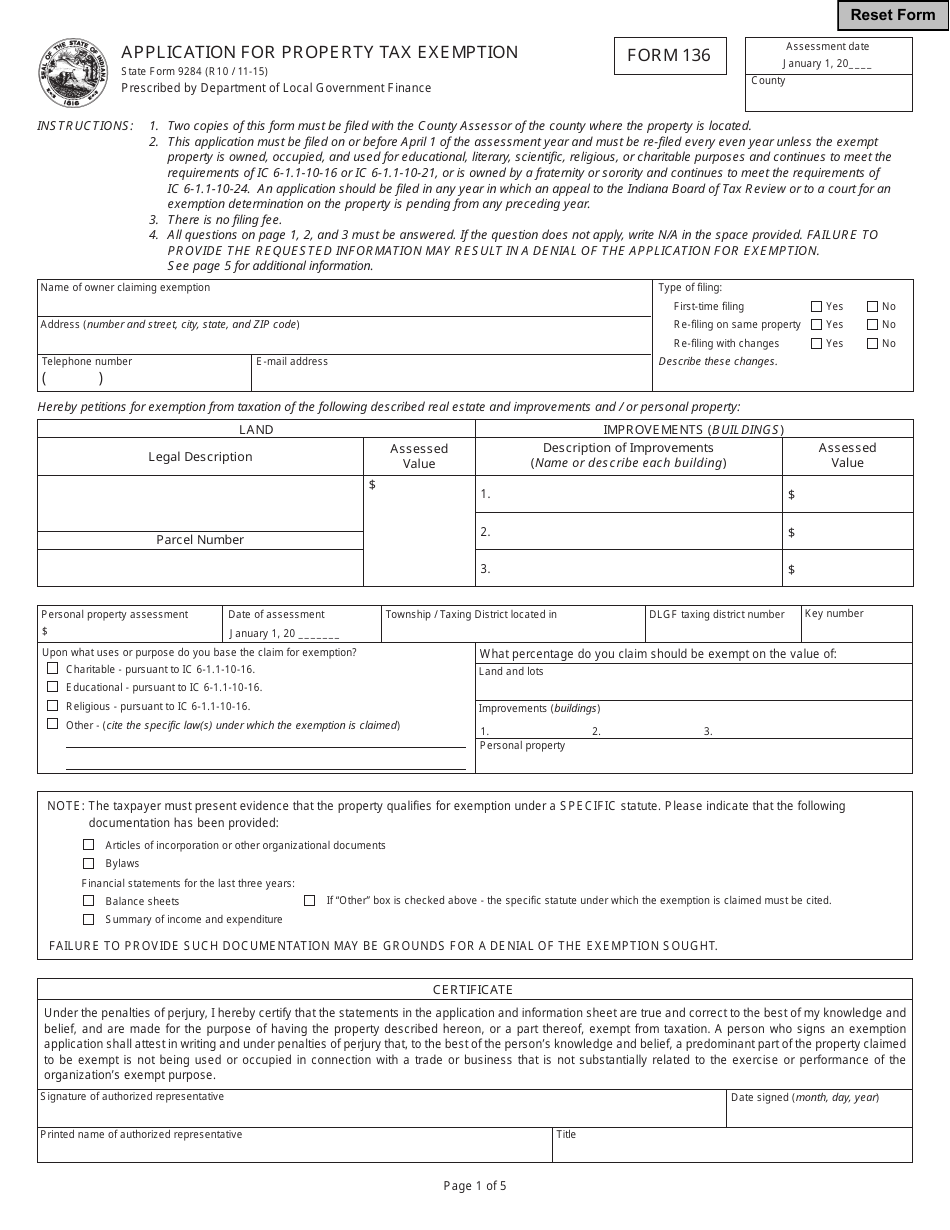

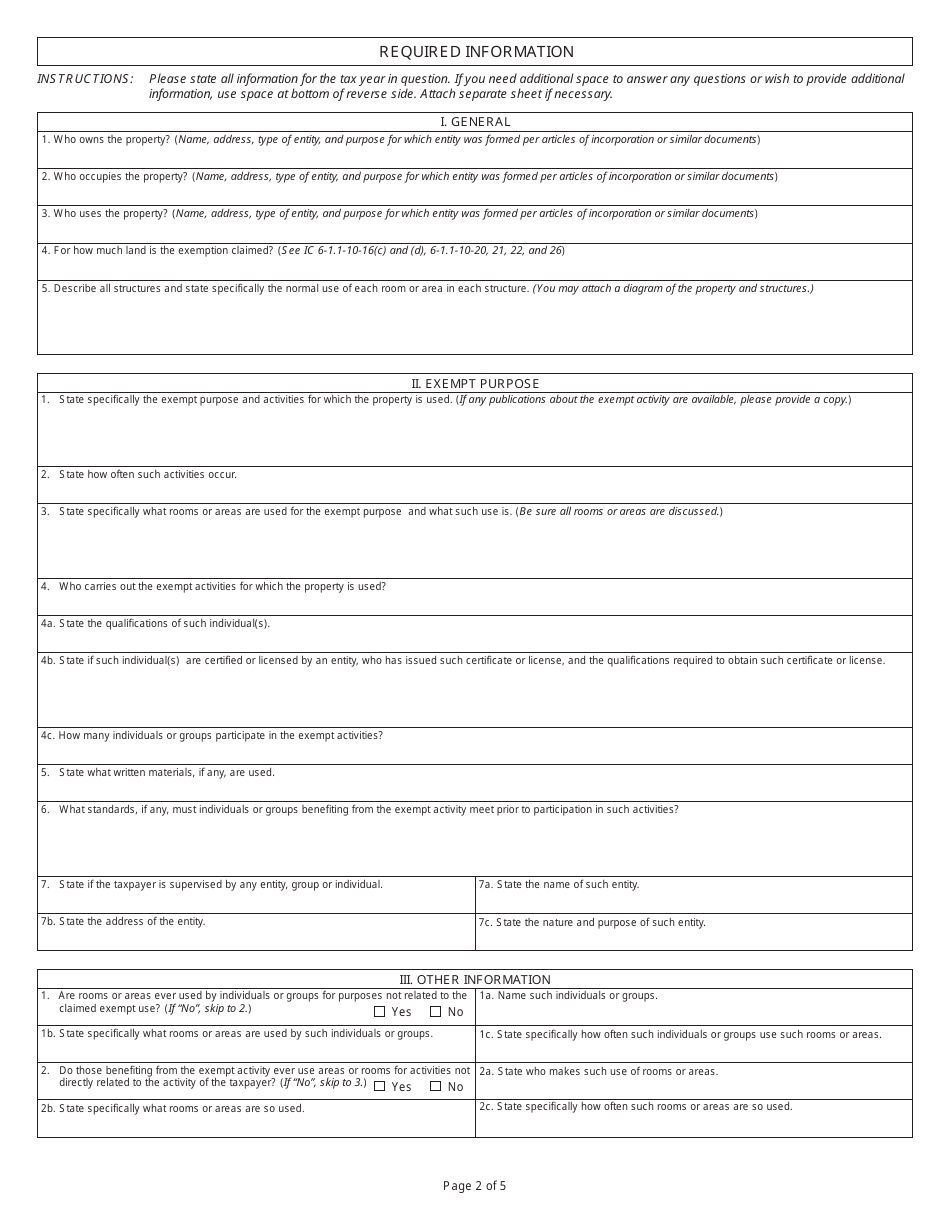

Q: What information is required on Form 136?

A: Form 136 requires information about the property owner, property description, and the reason for seeking a tax exemption.

Q: Are there any filing deadlines for Form 136?

A: Yes, the filing deadlines for Form 136 vary depending on the type of exemption being sought. It is best to consult with the County Assessor's office for specific deadlines.

Q: Is there a fee for filing Form 136?

A: No, there is no fee for filing Form 136.

Q: What happens after Form 136 is submitted?

A: After Form 136 has been submitted, it will be reviewed by the County Assessor's office and a determination will be made regarding the eligibility for a tax exemption.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 136 (State Form 9284) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.