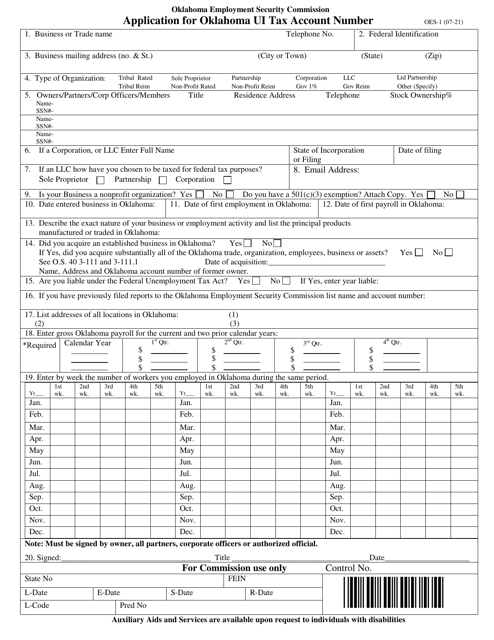

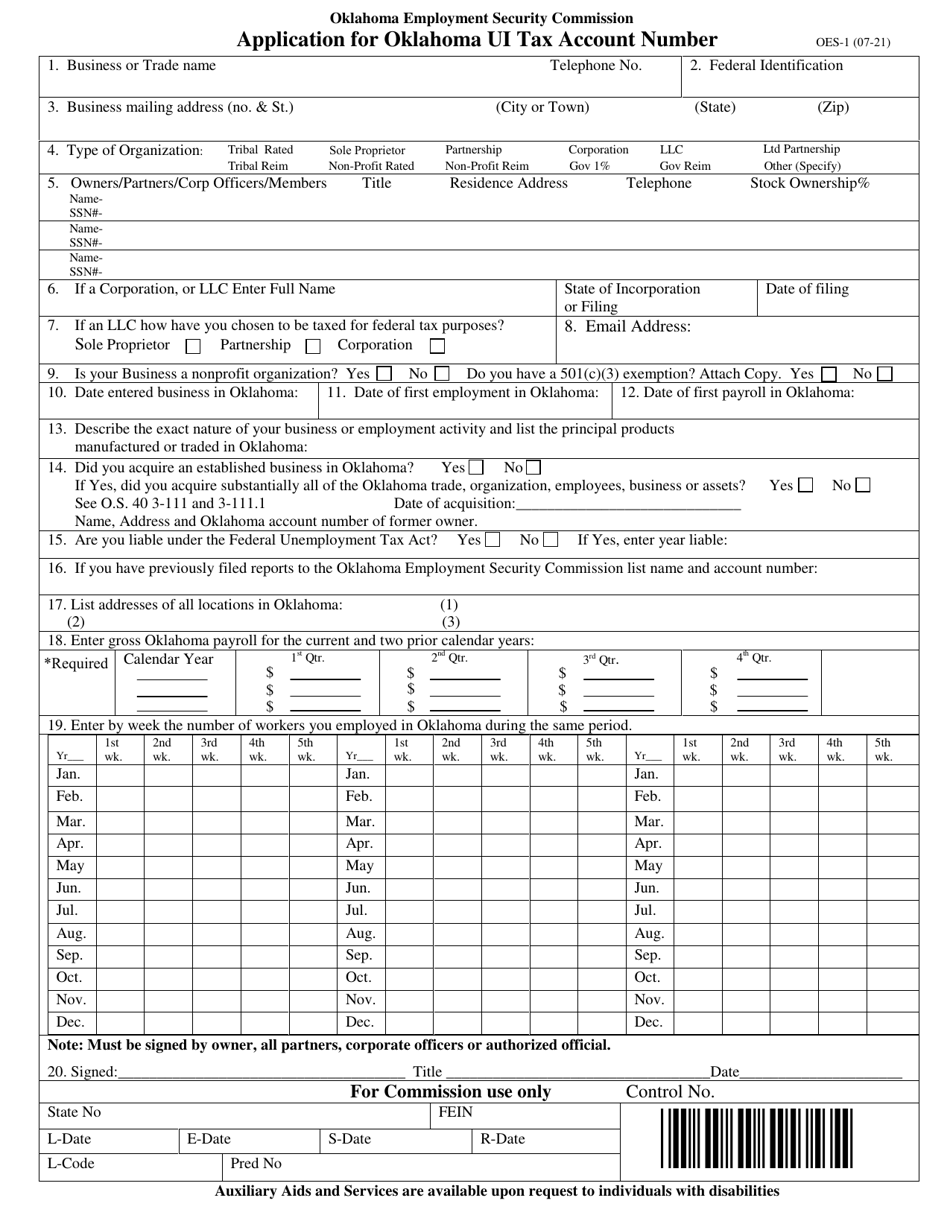

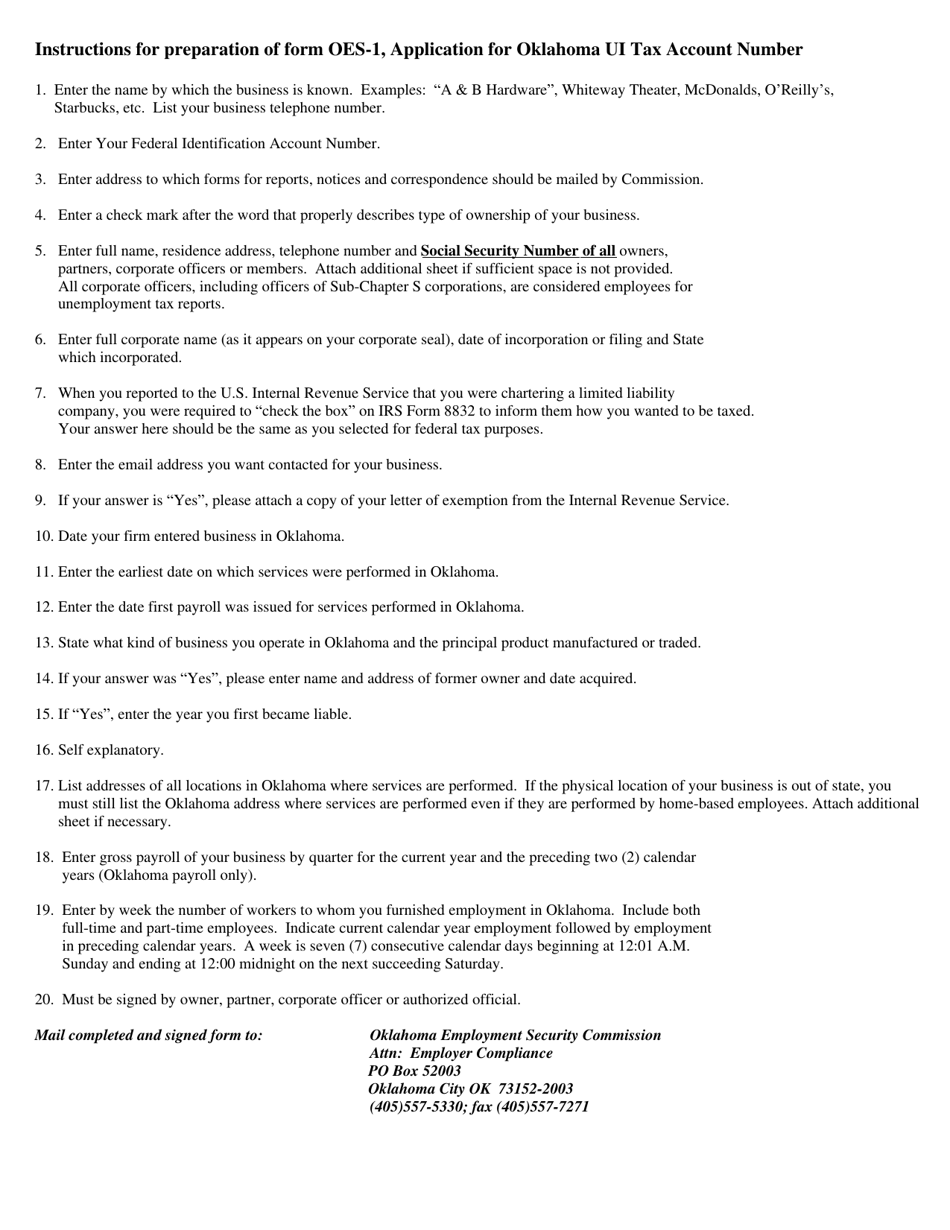

Form OES-1 Application for Oklahoma Ui Tax Account Number - Oklahoma

What Is Form OES-1?

This is a legal form that was released by the Oklahoma Employment Security Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OES-1 Application?

A: The OES-1 Application is a form used to apply for an Oklahoma UI (Unemployment Insurance) Tax Account Number.

Q: What is the purpose of the OES-1 Application?

A: The OES-1 Application is used to establish a UI Tax Account Number for businesses in Oklahoma.

Q: Who needs to fill out the OES-1 Application?

A: Businesses operating in Oklahoma that have employees and are required to pay unemployment insurance taxes need to fill out the OES-1 Application.

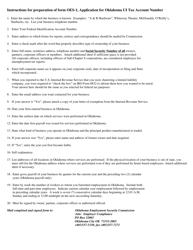

Q: What information is required on the OES-1 Application?

A: The OES-1 Application requires information such as business name, address, contact information, federal employer identification number (FEIN), and other details about the business.

Q: Is there a fee for applying for an Oklahoma UI Tax Account Number?

A: No, there is no fee for applying for an Oklahoma UI Tax Account Number.

Q: How long does it take to process the OES-1 Application?

A: Processing times may vary, but it typically takes a few business days to process the OES-1 Application.

Q: What should I do after submitting the OES-1 Application?

A: After submitting the OES-1 Application, you should receive a UI Tax Account Number from the Oklahoma Employment Security Commission. You will need to use this number when paying unemployment insurance taxes.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Oklahoma Employment Security Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OES-1 by clicking the link below or browse more documents and templates provided by the Oklahoma Employment Security Commission.