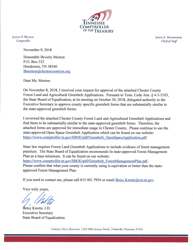

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

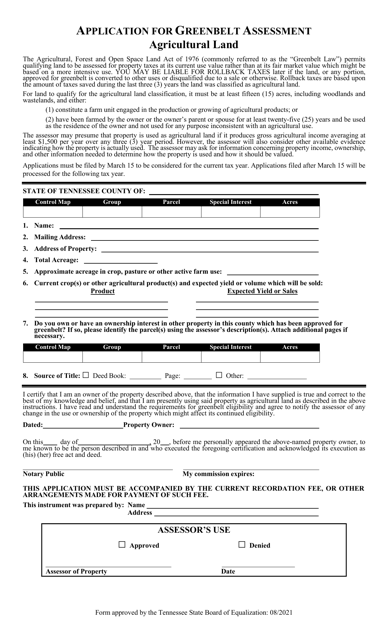

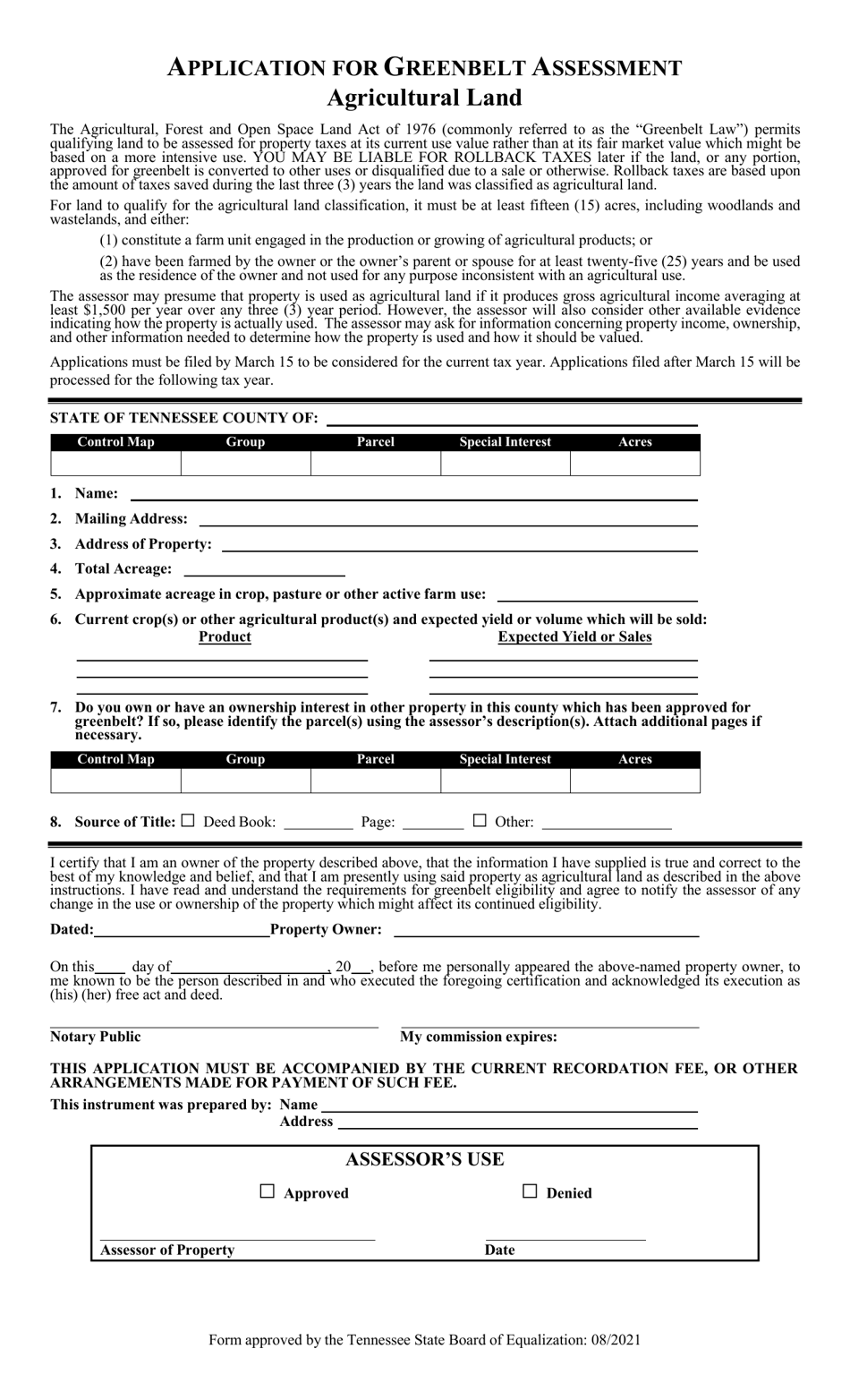

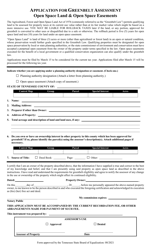

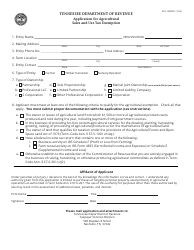

Application for Greenbelt Assessment - Agricultural Land - Tennessee

Application for Greenbelt Assessment - Agricultural Land is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee.

FAQ

Q: What is the Greenbelt Assessment for agricultural land in Tennessee?

A: The Greenbelt Assessment is a program in Tennessee that provides property tax benefits for agricultural land.

Q: Who is eligible for the Greenbelt Assessment for agricultural land?

A: Landowners in Tennessee who actively engage in agricultural practices on their property are eligible for the Greenbelt Assessment.

Q: What are the benefits of the Greenbelt Assessment for agricultural land in Tennessee?

A: The benefits of the Greenbelt Assessment include reduced property taxes for qualified agricultural land.

Q: How can I apply for the Greenbelt Assessment for agricultural land in Tennessee?

A: You can apply for the Greenbelt Assessment by submitting an application to the Tennessee Department of Agriculture.

Q: What are the requirements for maintaining the Greenbelt Assessment for agricultural land in Tennessee?

A: To maintain the Greenbelt Assessment, landowners must continue to engage in agricultural practices and meet certain criteria set by the Tennessee Department of Agriculture.

Q: Are there any penalties for not meeting the requirements of the Greenbelt Assessment for agricultural land in Tennessee?

A: Yes, there are penalties for non-compliance with the requirements of the Greenbelt Assessment, including back taxes and potential removal from the program.

Q: Is the Greenbelt Assessment available for all types of agricultural land in Tennessee?

A: Yes, the Greenbelt Assessment is available for all types of agricultural land in Tennessee, including crop production, livestock farming, and forestry.

Q: Can I apply for the Greenbelt Assessment if I have a small farm or only a few acres of agricultural land?

A: Yes, there is no minimum size requirement for applying for the Greenbelt Assessment. Even small farms or a few acres of agricultural land can be eligible.

Q: How long does the Greenbelt Assessment last for agricultural land in Tennessee?

A: The Greenbelt Assessment is typically granted for a 10-year period, but it must be renewed periodically to maintain the tax benefits.

Form Details:

- Released on August 1, 2021;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.