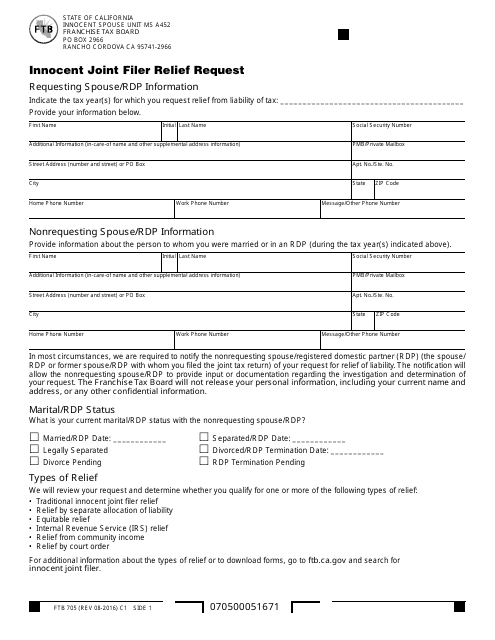

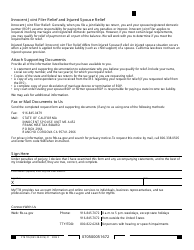

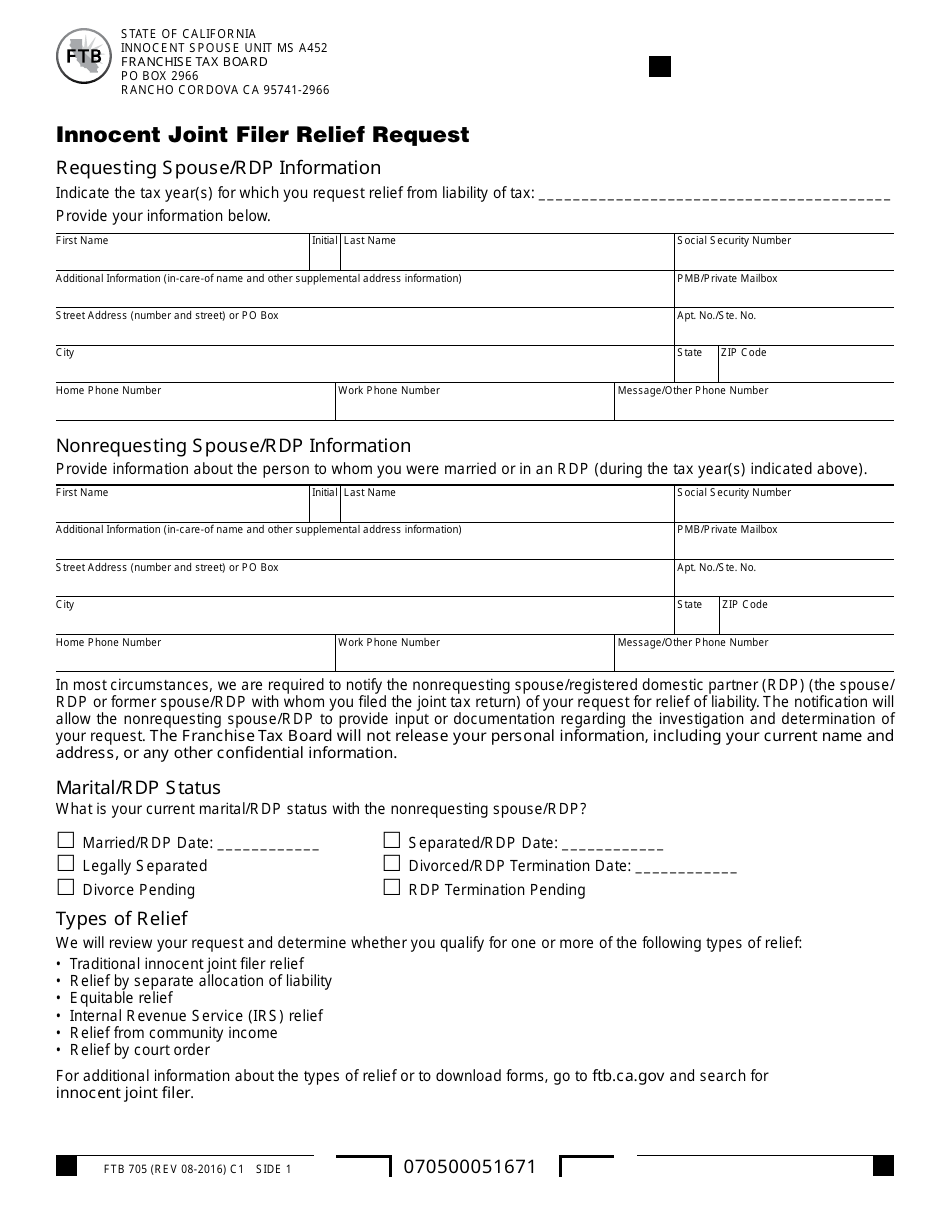

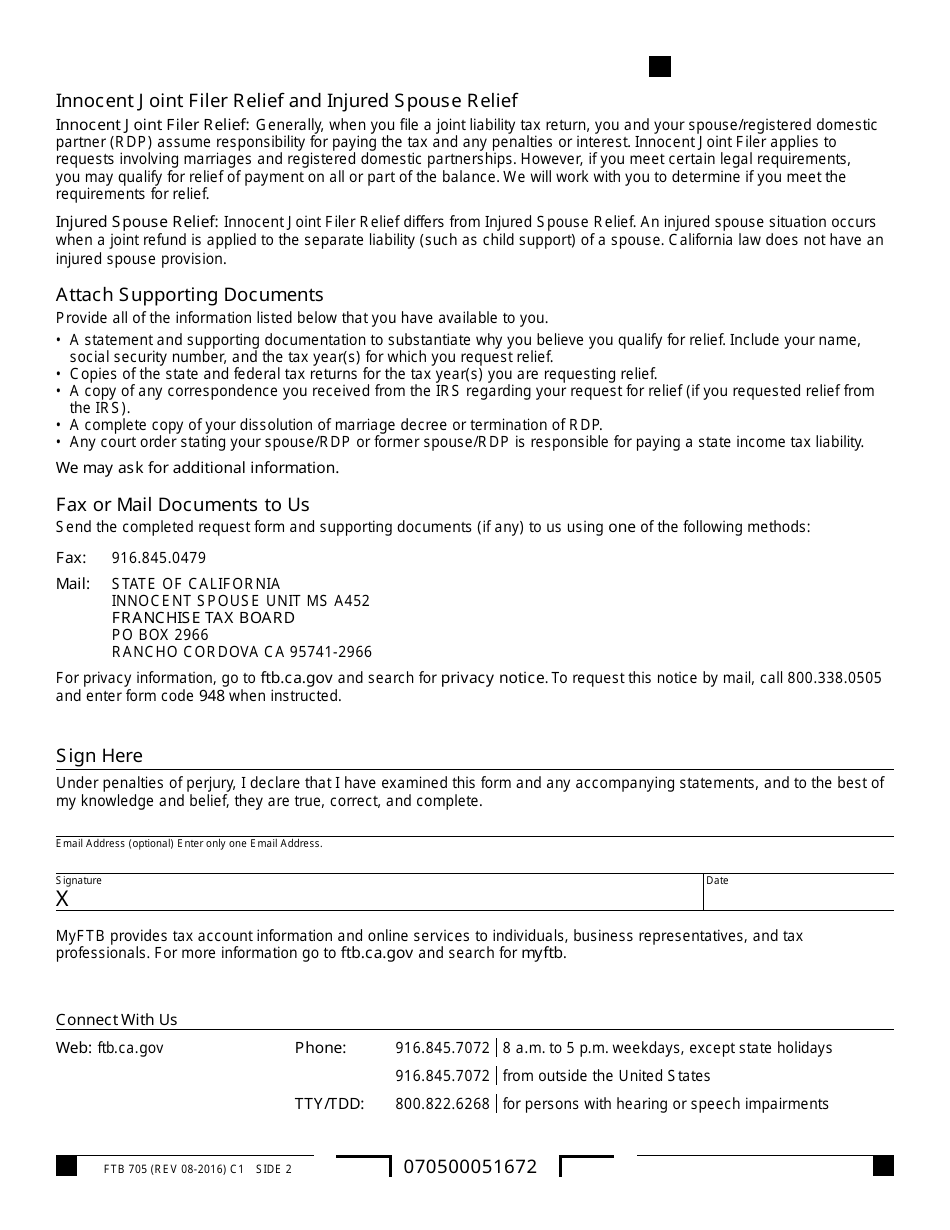

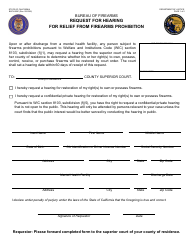

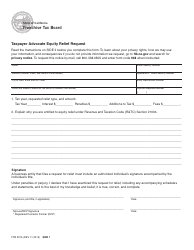

Form FTB705 Innocent Joint Filer Relief Request - California

What Is Form FTB705?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

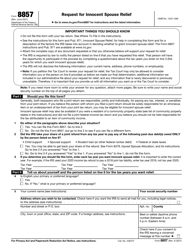

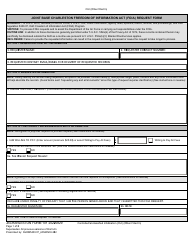

Q: What is Form FTB705?

A: Form FTB705 is a form used to request Innocent Joint Filer Relief in the state of California.

Q: Who can use Form FTB705?

A: You can use Form FTB705 if you filed a joint tax return with your spouse or registered domestic partner, and you believe you should not be held responsible for the tax liability.

Q: What is Innocent Joint Filer Relief?

A: Innocent Joint Filer Relief allows an individual to be relieved of a tax liability that was caused by the actions or omissions of their spouse or registered domestic partner.

Q: What are the requirements for Innocent Joint Filer Relief?

A: To qualify for Innocent Joint Filer Relief, you must meet various conditions, such as not knowing about the incorrect item or omission on your tax return when you signed it.

Q: How do I complete Form FTB705?

A: You must provide detailed information about your situation, including the reasons why you believe you should be granted Innocent Joint Filer Relief.

Q: Is there a deadline to submit Form FTB705?

A: Yes, you must submit Form FTB705 within a certain time period, which is generally within two years from the date the FTB first attempts to collect the tax.

Q: Can I appeal if my request for Innocent Joint Filer Relief is denied?

A: Yes, if your request is denied, you can appeal the decision by following the instructions provided by the FTB.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB705 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.