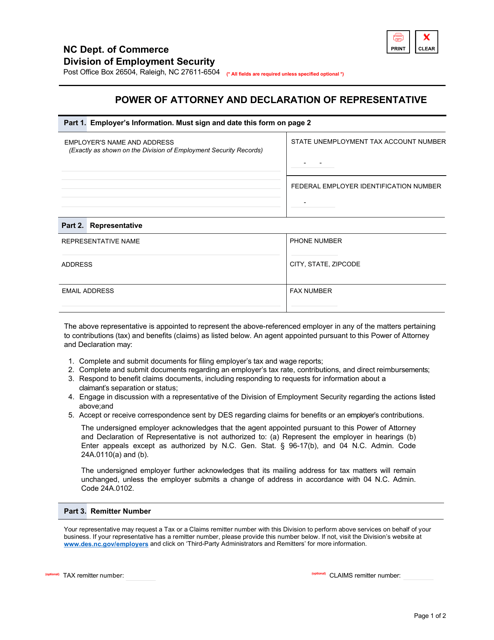

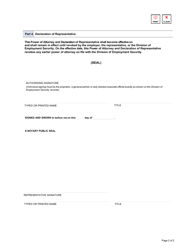

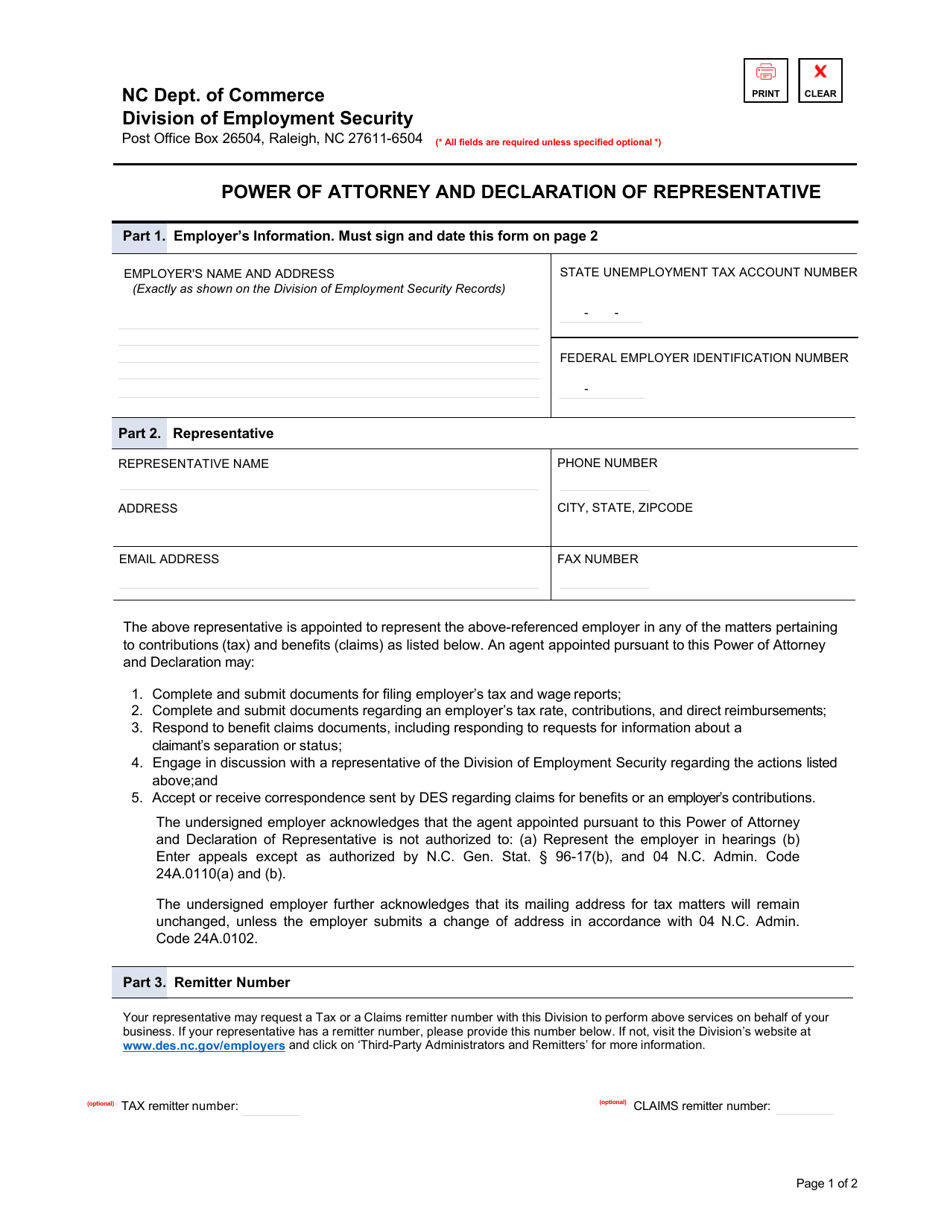

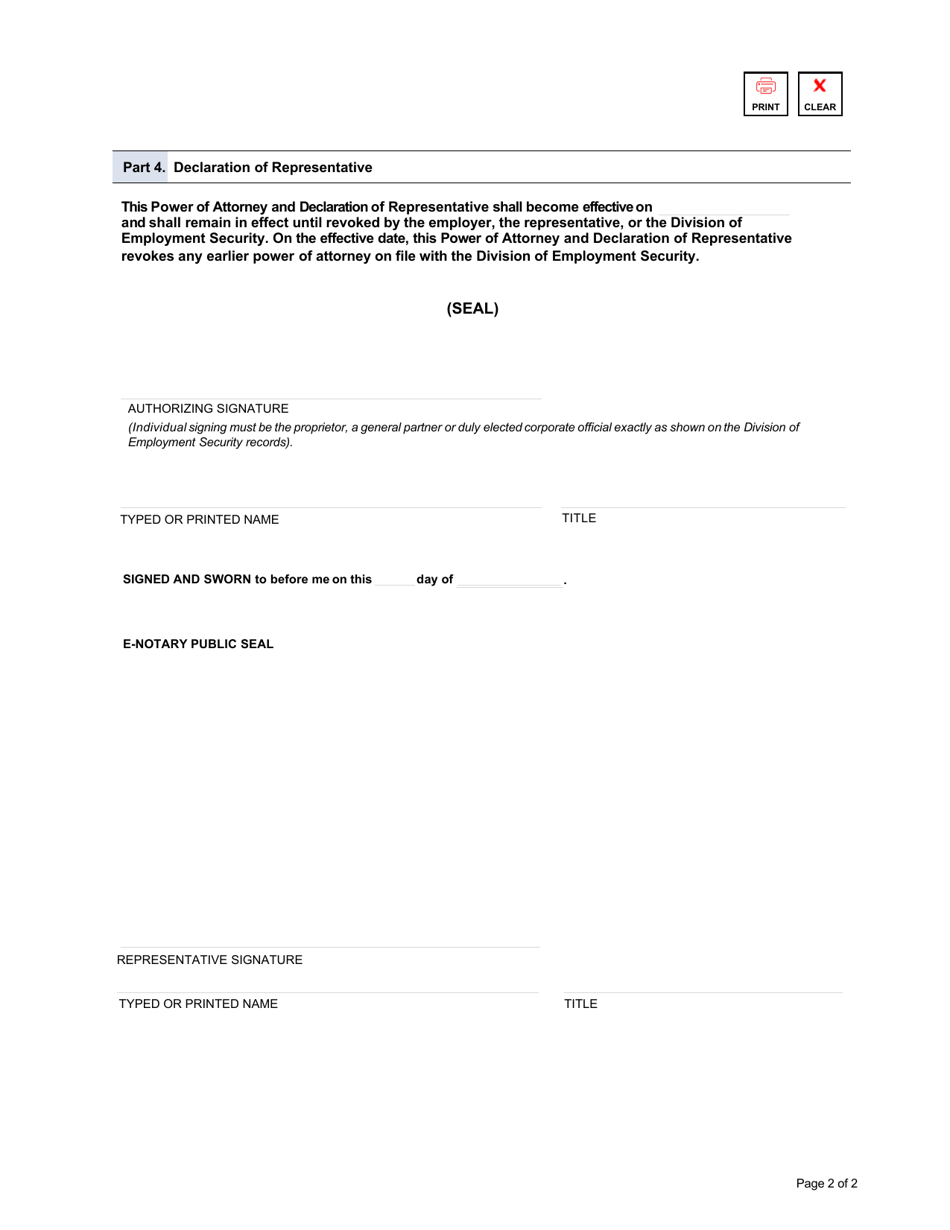

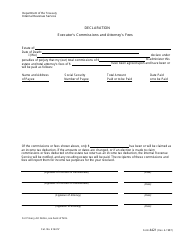

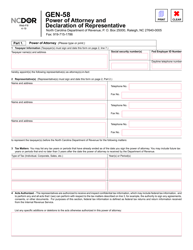

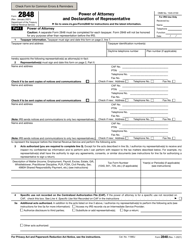

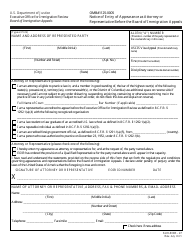

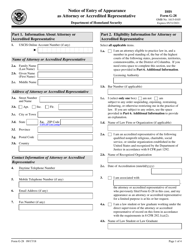

Power of Attorney and Declaration of Representative - North Carolina

Power of Attorney and Declaration of Representative is a legal document that was released by the North Carolina Department of Commerce - a government authority operating within North Carolina.

FAQ

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that grants someone the authority to act on your behalf for financial or legal matters.

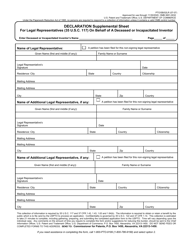

Q: What is a Declaration of Representative?

A: A Declaration of Representative is a document that authorizes someone to represent you before the IRS for tax matters.

Q: Why would I need a Power of Attorney?

A: You may need a Power of Attorney if you are unable to handle your own financial or legal affairs and need someone to act on your behalf.

Q: Why would I need a Declaration of Representative?

A: You may need a Declaration of Representative if you want someone to represent you before the IRS in tax-related matters, such as audits or appeals.

Q: Do I need a lawyer to create a Power of Attorney?

A: It is not required to have a lawyer, but it is recommended to consult with a lawyer to ensure the document is properly executed and meets your specific needs.

Q: Do I need a lawyer to create a Declaration of Representative?

A: A lawyer is not required, but it is advisable to consult with a tax professional or attorney to understand the implications of appointing a representative for tax matters.

Q: Can a Power of Attorney be revoked?

A: Yes, a Power of Attorney can be revoked at any time as long as you are still mentally competent.

Q: Can a Declaration of Representative be revoked?

A: Yes, a Declaration of Representative can be revoked by submitting a written notice to the IRS.

Form Details:

- The latest edition currently provided by the North Carolina Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Commerce.