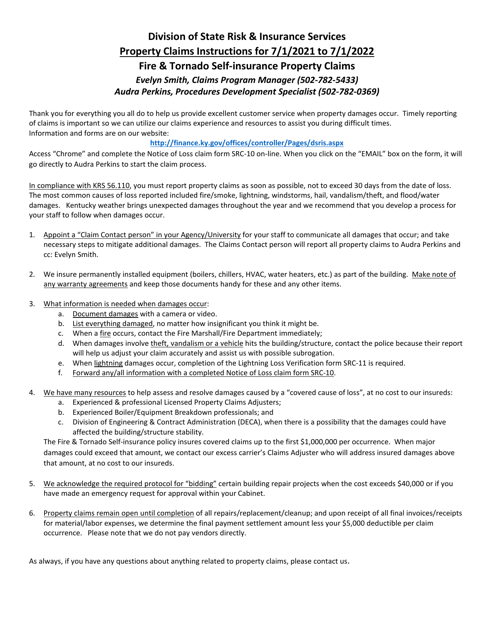

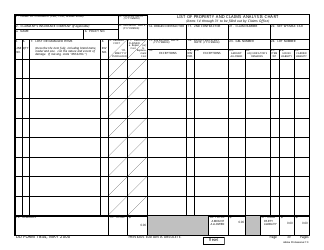

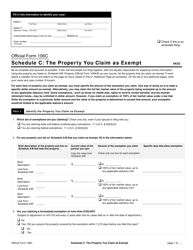

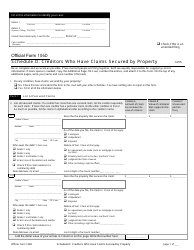

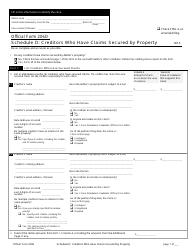

Property Claims Instructions - Fire & Tornado Self-insurance Property Claims - Kentucky

Property Claims Instructions - Fire & Tornado Self-insurance Property Claims is a legal document that was released by the Kentucky Finance and Administration Cabinet - a government authority operating within Kentucky.

FAQ

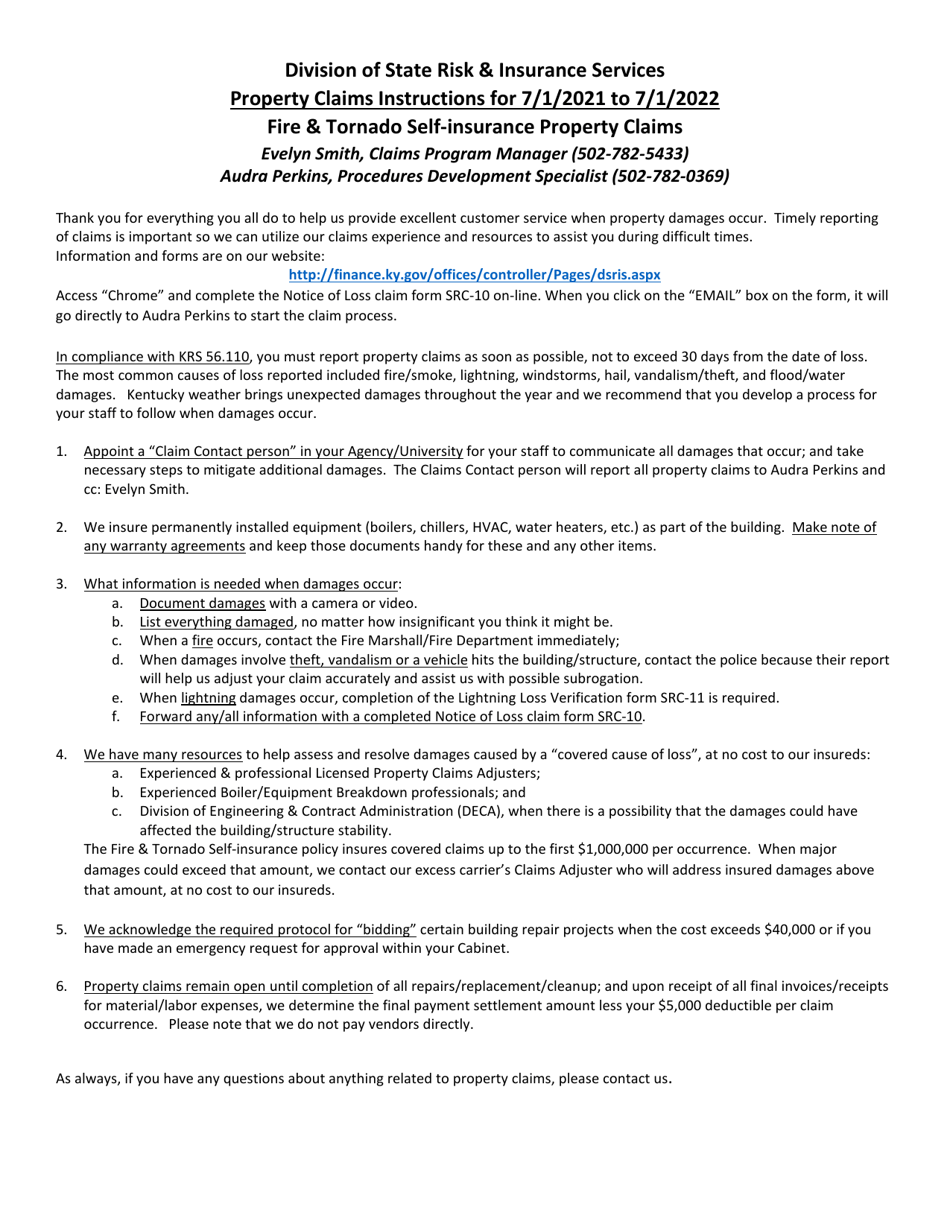

Q: What should I do if my property has been damaged by fire or tornado?

A: Contact your insurance company immediately and report the damage.

Q: What information should I provide to my insurance company when reporting the damage?

A: Provide your policy number, a description of the damage, and any relevant photos or documentation.

Q: Will my insurance company send someone to assess the damage?

A: Yes, your insurance company will likely send an adjuster to assess the damage.

Q: Can I start cleaning up or making repairs before the adjuster arrives?

A: It's best to wait for the adjuster to assess the damage before making any repairs or cleaning up.

Q: Should I keep records of any expenses related to the damage?

A: Yes, keep all receipts and records of any expenses related to temporary repairs or temporary living arrangements.

Q: What if I disagree with the insurance company's assessment of the damage?

A: You can negotiate with your insurance company or hire an independent appraiser to assess the damage.

Q: What if my claim is denied?

A: You can appeal the decision or seek legal advice to explore your options.

Q: Are there any time limits for filing a property claim?

A: Check your insurance policy for any specific time limits, but generally, it's best to file your claim as soon as possible.

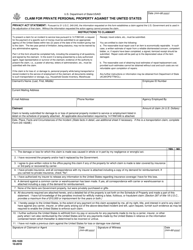

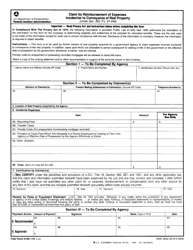

Form Details:

- The latest edition currently provided by the Kentucky Finance and Administration Cabinet;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Finance and Administration Cabinet.