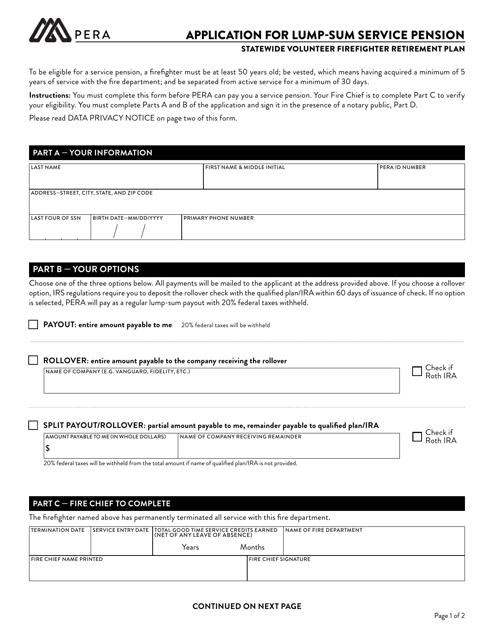

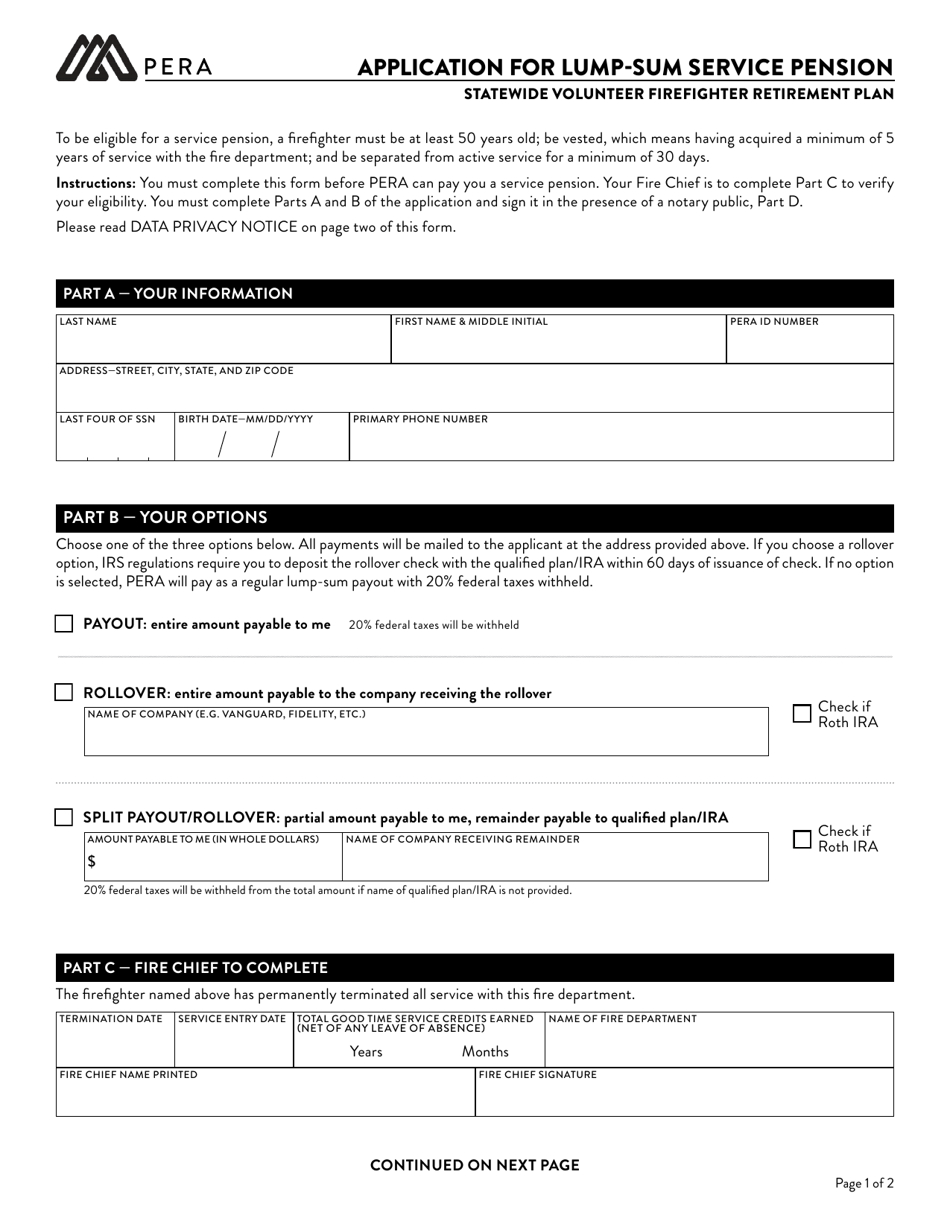

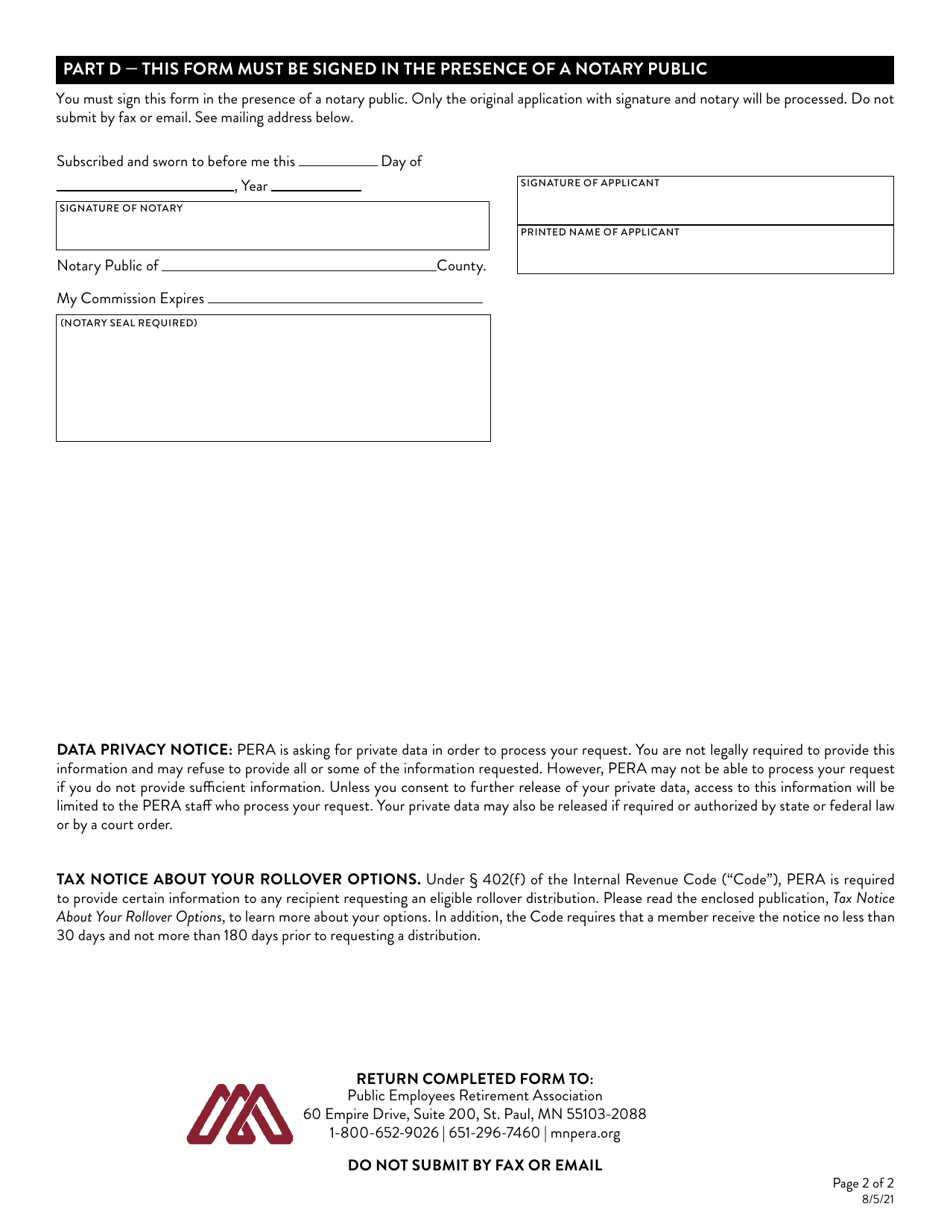

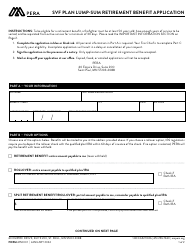

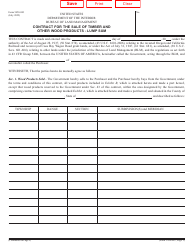

Application for Lump-Sum Service Pension - Minnesota

Application for Lump-Sum Service Pension is a legal document that was released by the Minnesota Public Employees Retirement Association - a government authority operating within Minnesota.

FAQ

Q: What is the Lump-Sum Service Pension?

A: The Lump-Sum Service Pension is a retirement benefit provided by the state of Minnesota.

Q: Who is eligible for the Lump-Sum Service Pension?

A: To be eligible for the Lump-Sum Service Pension, you must have been an employee of the state of Minnesota and have completed at least 5 years of service.

Q: How do I apply for the Lump-Sum Service Pension?

A: To apply for the Lump-Sum Service Pension, you need to complete the application form provided by the Minnesota State Retirement System (MSRS) and submit it to the MSRS.

Q: What documents do I need to submit with my application?

A: You will need to submit proof of your employment and service with the state of Minnesota, such as pay stubs or personnel records.

Q: When should I apply for the Lump-Sum Service Pension?

A: It is recommended to apply for the Lump-Sum Service Pension at least 90 days before your intended retirement date.

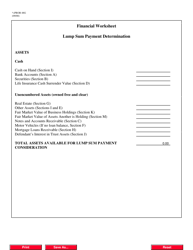

Q: How much is the Lump-Sum Service Pension?

A: The amount of the Lump-Sum Service Pension varies depending on your years of service and average salary.

Q: Can I receive a partial Lump-Sum Service Pension?

A: No, the Lump-Sum Service Pension is paid out as a one-time lump sum.

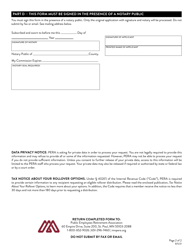

Q: Is the Lump-Sum Service Pension taxable?

A: Yes, the Lump-Sum Service Pension is subject to federal income tax.

Form Details:

- Released on August 5, 2021;

- The latest edition currently provided by the Minnesota Public Employees Retirement Association;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Public Employees Retirement Association.