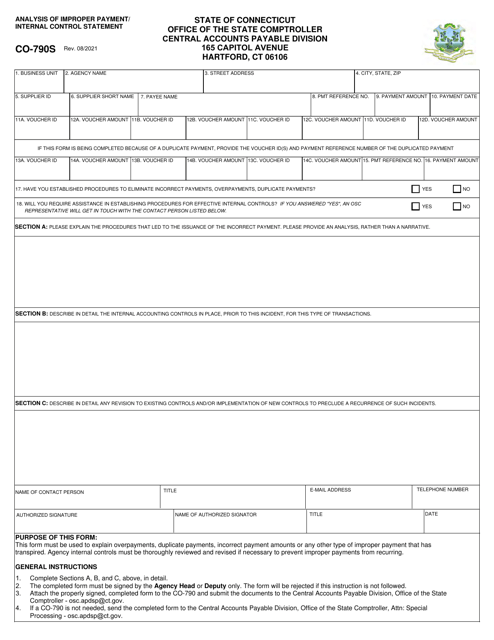

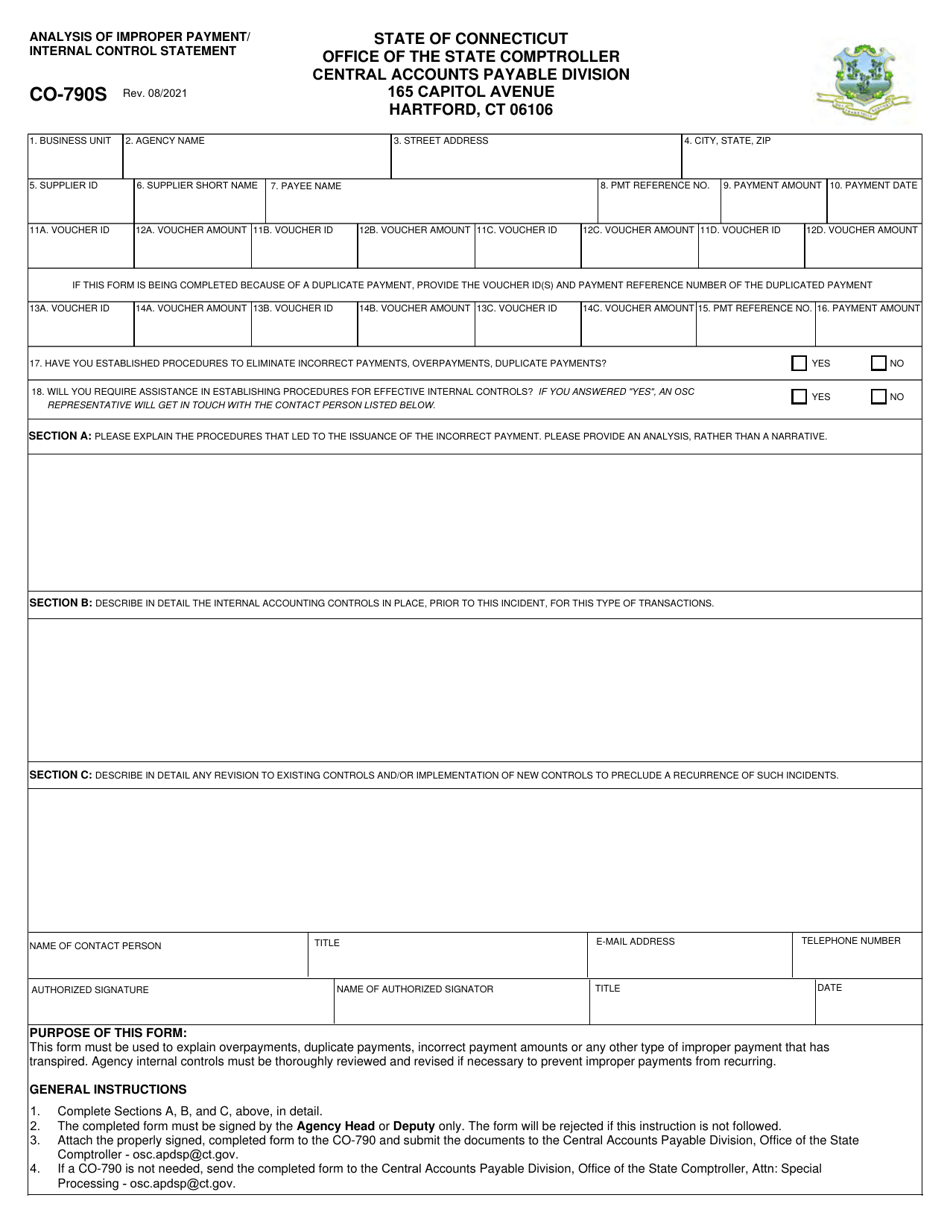

Form CO-790S Analysis of Improper Payment / Internal Control Statement - Connecticut

What Is Form CO-790S?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-790S?

A: Form CO-790S is an Analysis of Improper Payment/Internal Control Statement specifically for Connecticut.

Q: What is the purpose of Form CO-790S?

A: The purpose of Form CO-790S is to report and analyze improper payments and internal control issues in Connecticut.

Q: Who needs to fill out Form CO-790S?

A: Any organization or entity that receives state funds in Connecticut and is required to report improper payments and internal control issues needs to fill out Form CO-790S.

Q: When is Form CO-790S due?

A: Form CO-790S is typically due on a specific date designated by the Connecticut State Comptroller's Office.

Q: What information is required on Form CO-790S?

A: The form requires information such as the reporting entity's name, federal identification number, fiscal year, improper payment details, and a certification statement.

Q: Is there a penalty for not filing Form CO-790S?

A: Failure to file Form CO-790S or filing it inaccurately may result in penalties or other consequences as determined by the Connecticut State Comptroller's Office.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-790S by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.