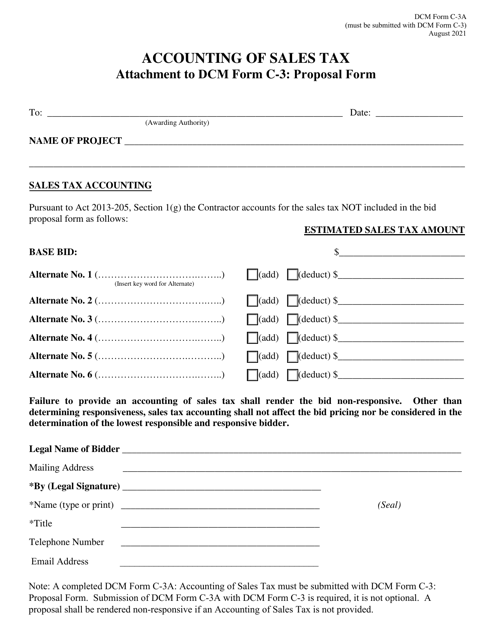

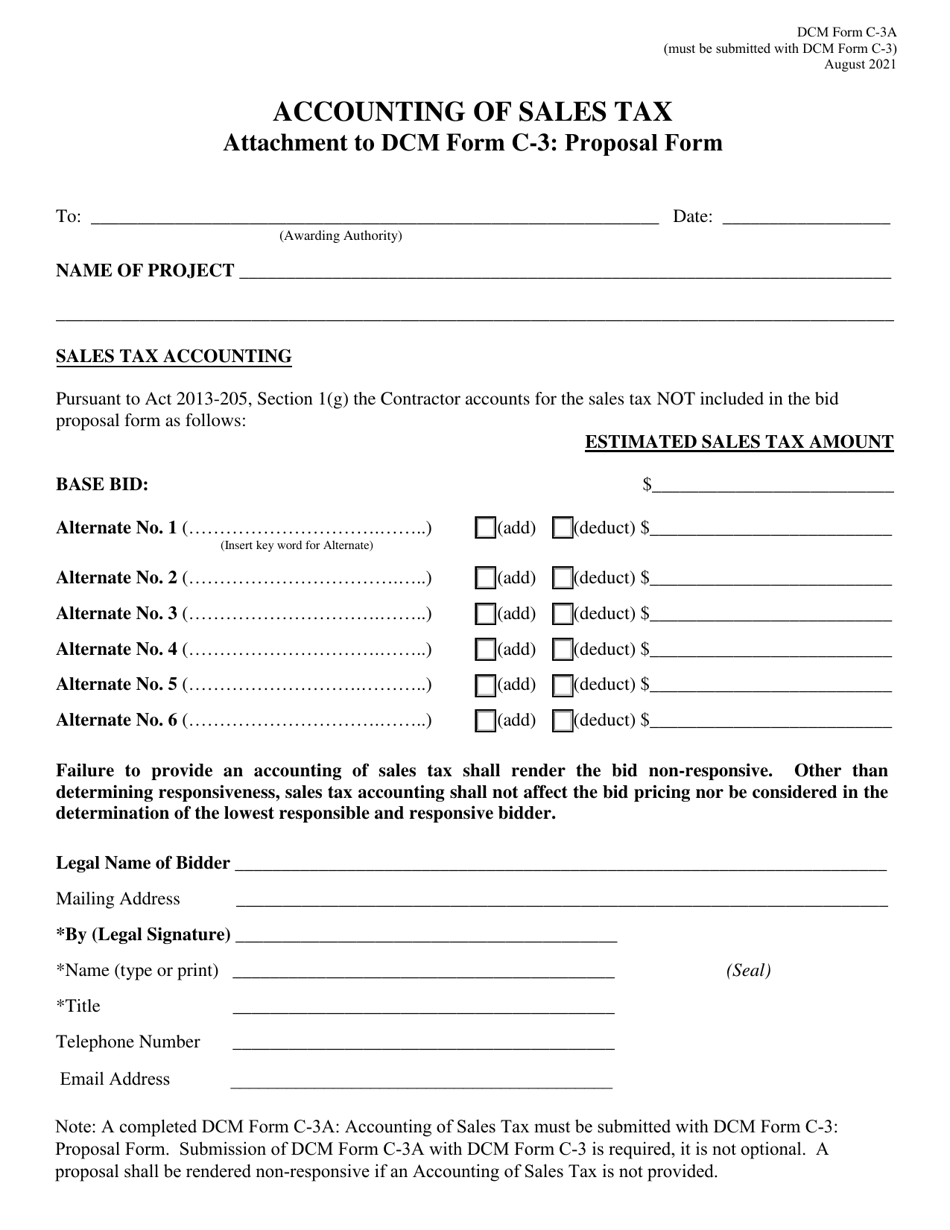

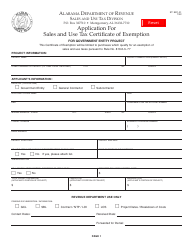

DCM Form C-3A Accounting of Sales Tax - Alabama

What Is DCM Form C-3A?

This is a legal form that was released by the Alabama Department of Finance, Real Property Management - Division of Construction Management - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

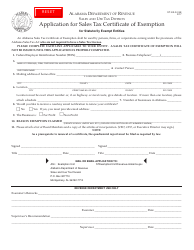

Q: What is DCM Form C-3A?

A: DCM Form C-3A is the Accounting of Sales Tax form used in Alabama.

Q: What is the purpose of DCM Form C-3A?

A: The purpose of DCM Form C-3A is to document and report sales tax transactions in Alabama.

Q: Who needs to file DCM Form C-3A?

A: Businesses and individuals who are required to collect sales tax in Alabama need to file DCM Form C-3A.

Q: When should DCM Form C-3A be filed?

A: DCM Form C-3A should be filed on a monthly basis, by the 20th day of the following month.

Q: Are there any penalties for not filing DCM Form C-3A?

A: Yes, failure to file DCM Form C-3A or filing it late may result in penalties and interest.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Alabama Department of Finance, Real Property Management - Division of Construction Management;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DCM Form C-3A by clicking the link below or browse more documents and templates provided by the Alabama Department of Finance, Real Property Management - Division of Construction Management.