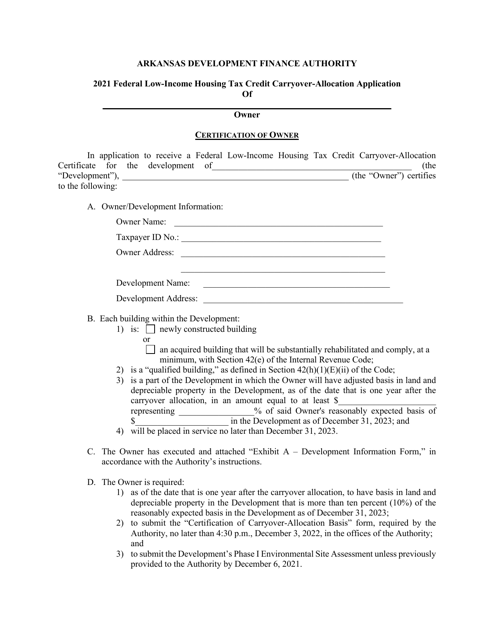

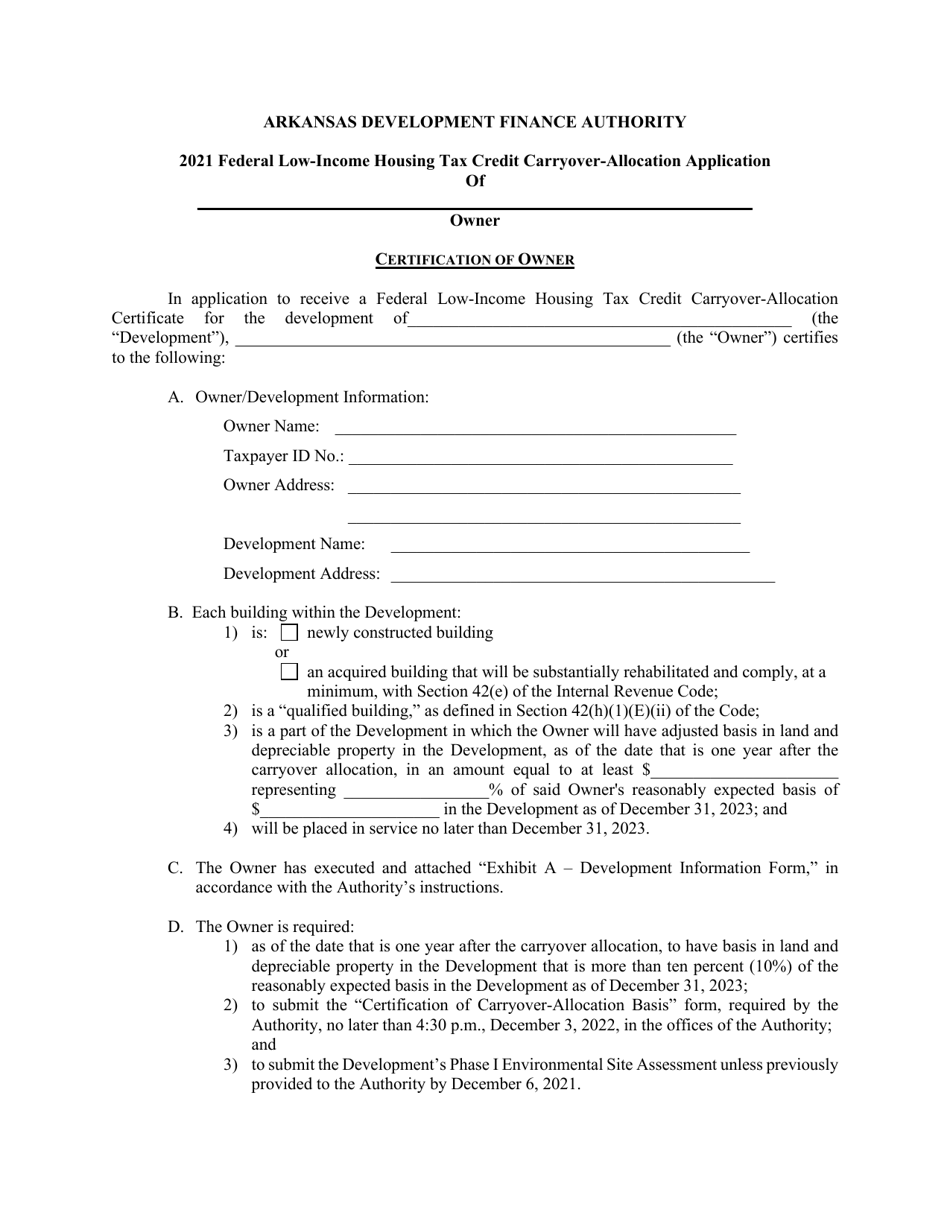

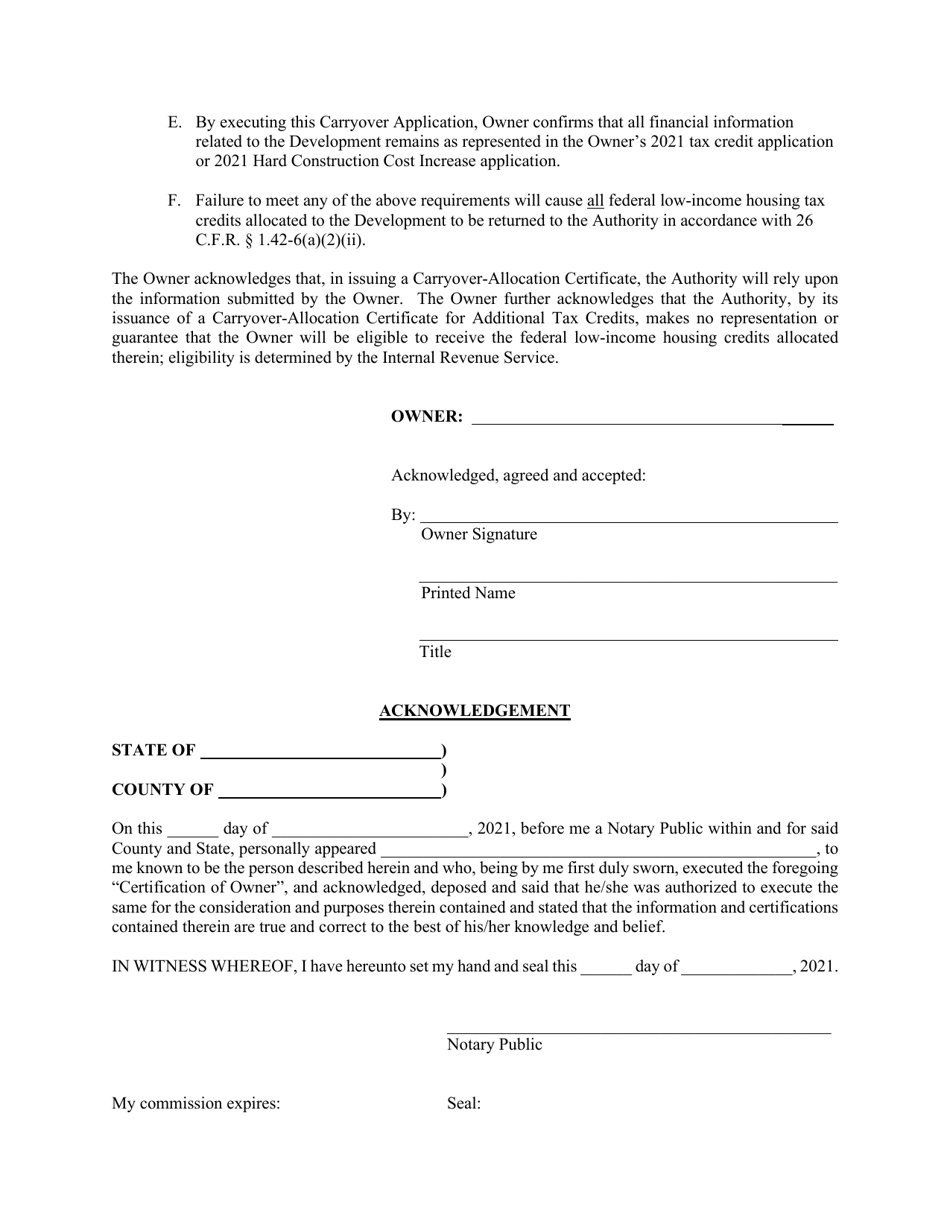

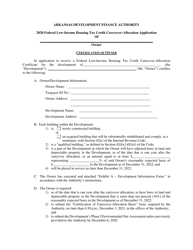

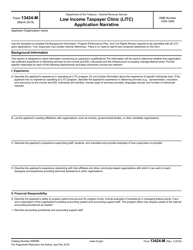

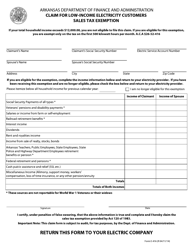

Federal Low-Income Housing Tax Credit Carryover-Allocation Application - Arkansas

Federal Low-Income Housing Tax Credit Carryover-Allocation Application is a legal document that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas.

FAQ

Q: What is the Federal Low-Income Housing Tax Credit?

A: The Federal Low-Income Housing Tax Credit is a tax incentive program that encourages the development of affordable rental housing.

Q: What is a Carryover-Allocation Application?

A: A Carryover-Allocation Application is a request for the allocation of unused Housing Tax Credits from a previous year that can be used in the current year's affordable housing project.

Q: Who can apply for the Federal Low-Income Housing Tax Credit Carryover-Allocation?

A: Developers and sponsors of affordable housing projects in Arkansas can apply for the Carryover-Allocation.

Q: How does the Carryover-Allocation application process work?

A: The application process involves submitting a detailed proposal for the affordable housing project, demonstrating its feasibility and compliance with program guidelines.

Q: What are the benefits of receiving a Carryover-Allocation?

A: Receiving a Carryover-Allocation allows developers to access additional funding for their affordable housing projects, making them financially viable.

Q: Are there any deadlines for submitting the Carryover-Allocation application?

A: Yes, there are usually specific deadlines for submitting the application, which vary depending on the state and program guidelines.

Form Details:

- The latest edition currently provided by the Arkansas Department of Finance & Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.