This version of the form is not currently in use and is provided for reference only. Download this version of

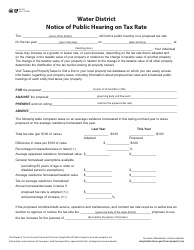

Form 50-860

for the current year.

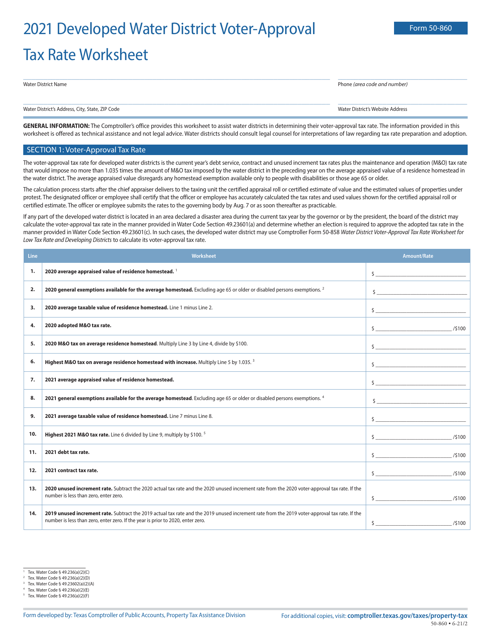

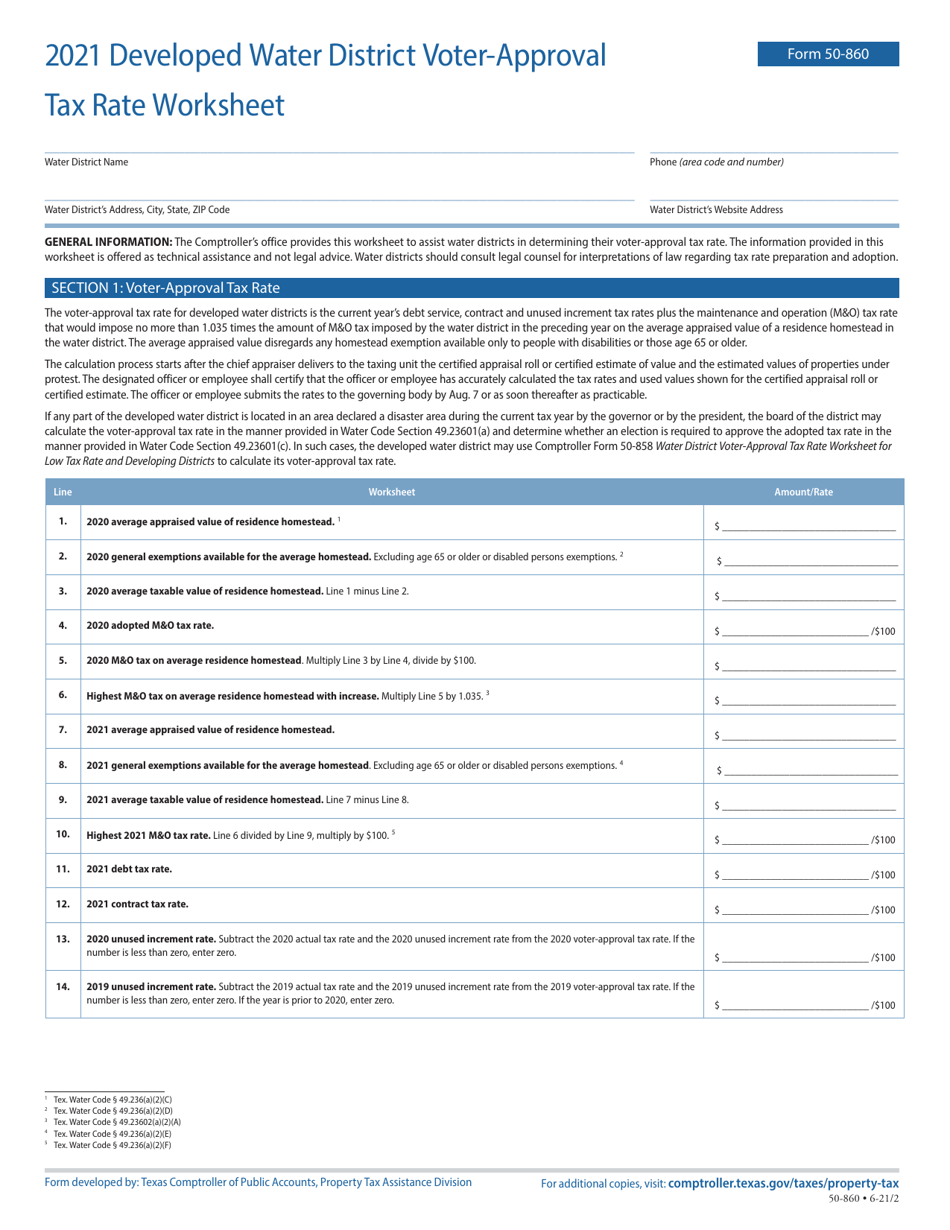

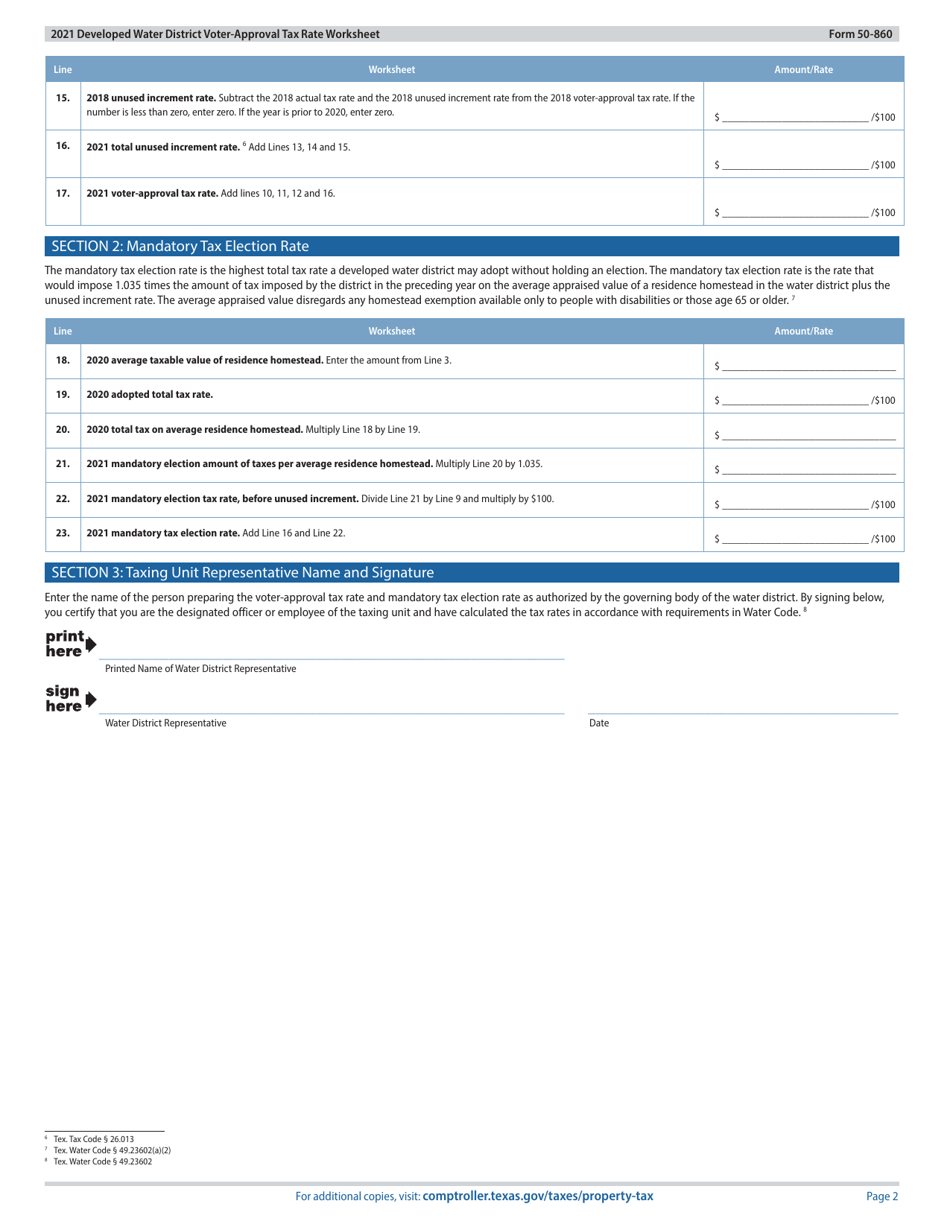

Form 50-860 Developed Water District Voter-Approval Tax Rate Worksheet - Texas

What Is Form 50-860?

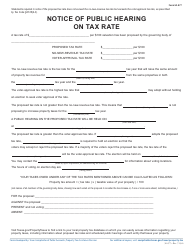

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-860?

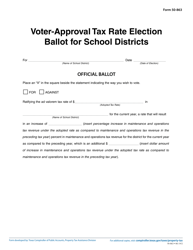

A: Form 50-860 is a worksheet used by developed water districts in Texas to calculate voter-approved tax rates.

Q: Who uses Form 50-860?

A: Developed water districts in Texas use Form 50-860.

Q: What is the purpose of Form 50-860?

A: The purpose of Form 50-860 is to help developed water districts calculate tax rates that have been approved by voters.

Q: What information is required on Form 50-860?

A: Form 50-860 requires information such as the district name, tax year, approved tax rate, and other financial details.

Q: Is Form 50-860 specific to Texas?

A: Yes, Form 50-860 is specific to developed water districts in Texas.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-860 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.