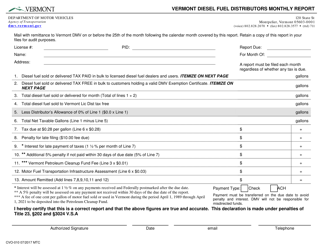

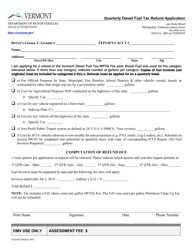

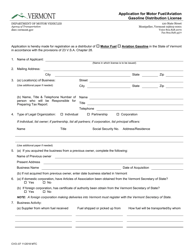

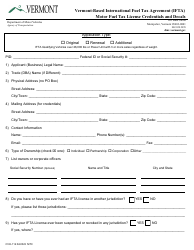

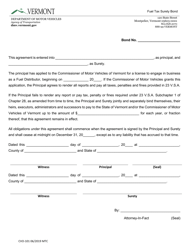

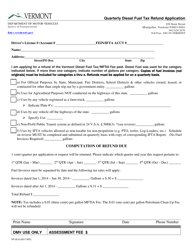

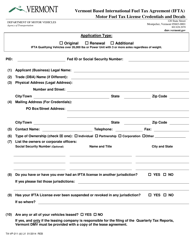

Form CVO-100 Fuel Tax Application - Vermont

What Is Form CVO-100?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

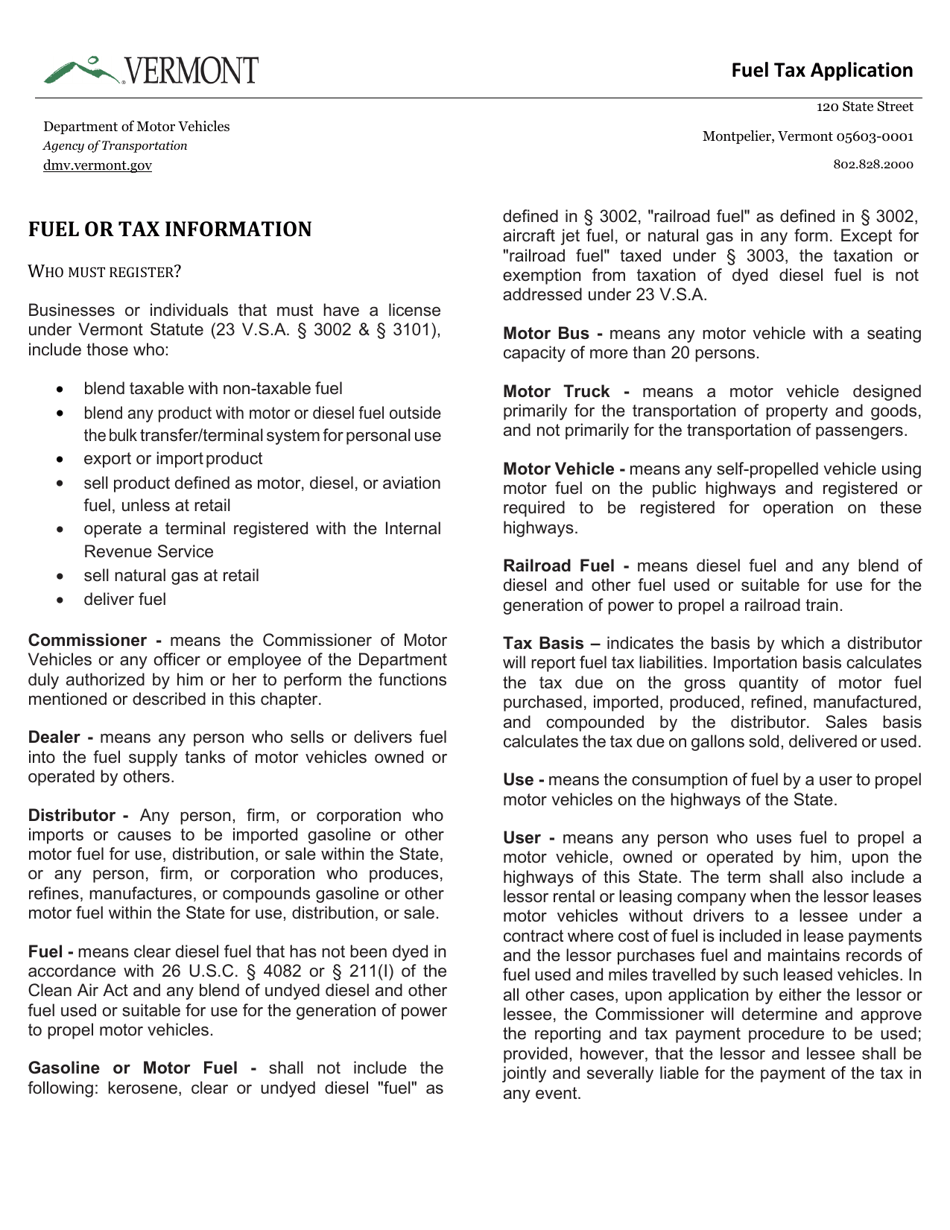

Q: What is the purpose of Form CVO-100?

A: Form CVO-100 is used to apply for a fuel tax license in Vermont.

Q: Who needs to file Form CVO-100?

A: Anyone who operates a motor vehicle in Vermont and is subject to the state fuel tax is required to file Form CVO-100.

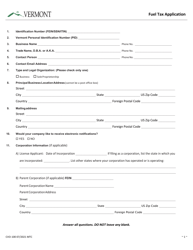

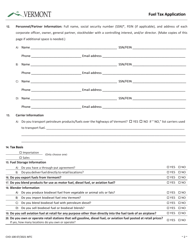

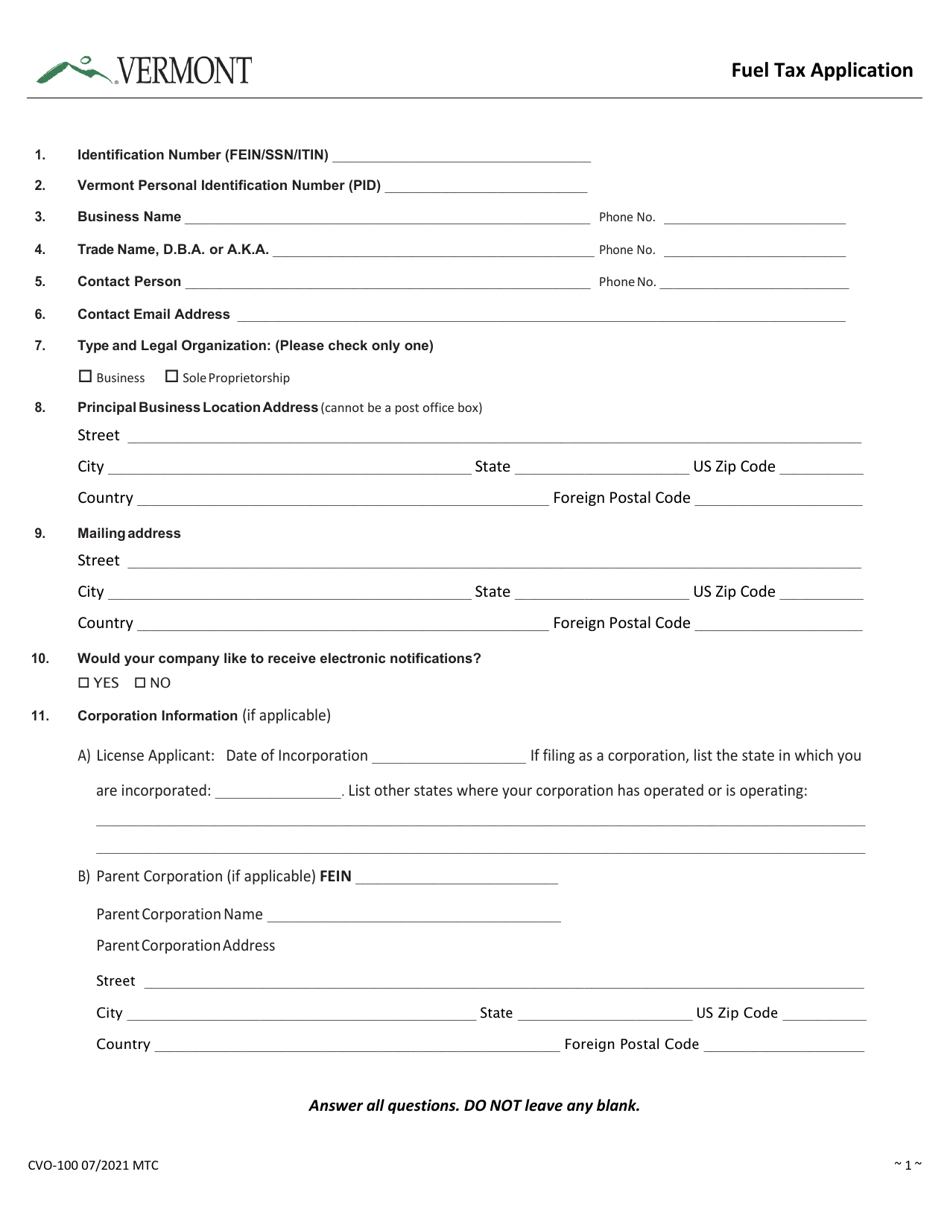

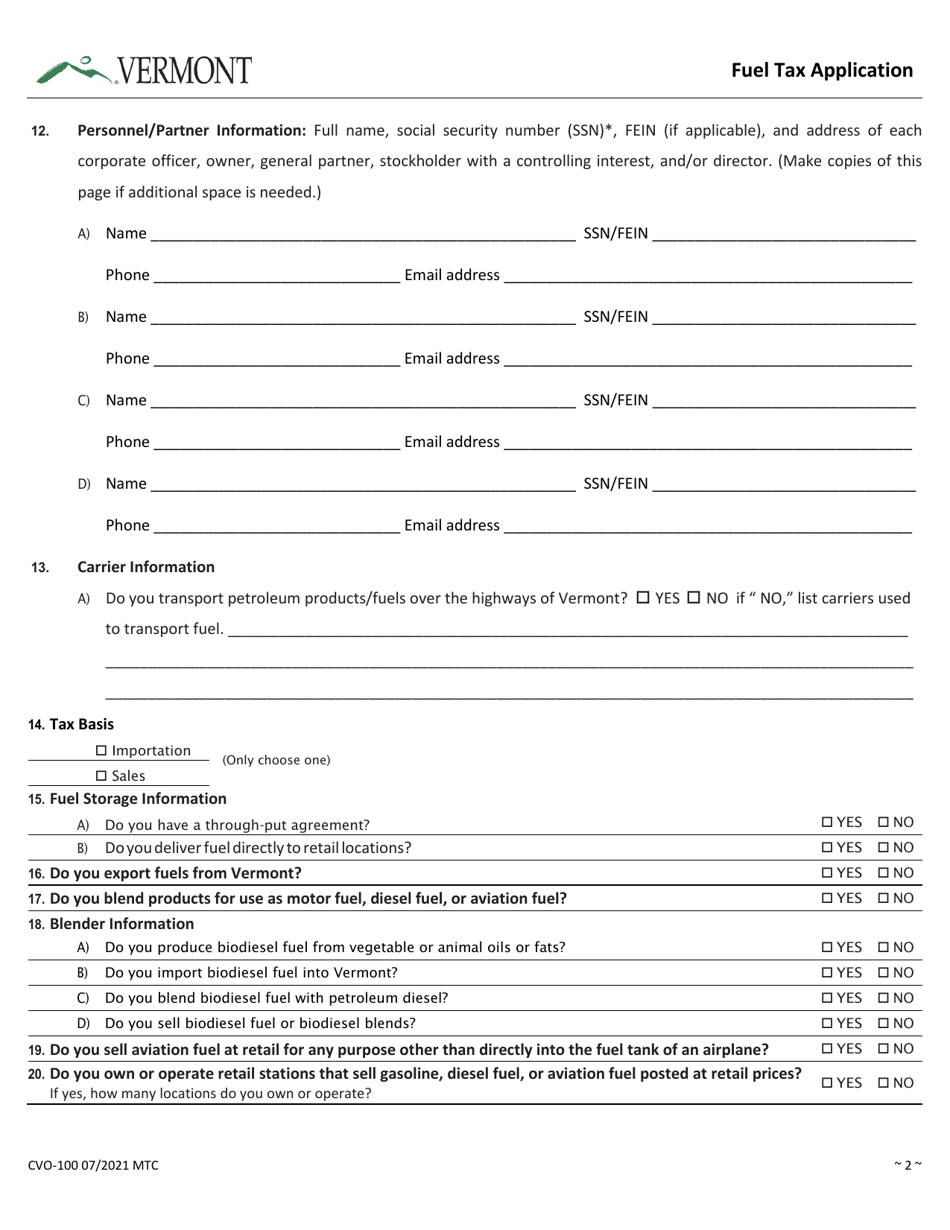

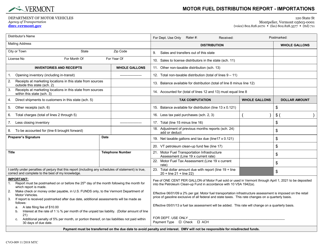

Q: What information is required on Form CVO-100?

A: You will need to provide your personal or business information, vehicle details, and fuel usage information.

Q: When is the deadline to file Form CVO-100?

A: Form CVO-100 must be filed annually by December 31st.

Q: What are the consequences of not filing Form CVO-100?

A: Failing to file Form CVO-100 can result in penalties, fines, and potential license suspension.

Q: Is there a fee to file Form CVO-100?

A: Yes, there is a $20 fee for filing Form CVO-100.

Q: Can I request an extension to file Form CVO-100?

A: Yes, you can request an extension by contacting the Vermont Department of Motor Vehicles.

Q: What other documents may be required along with Form CVO-100?

A: Depending on your situation, you may be required to submit additional documents such as vehicle registration and proof of fuel purchases.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-100 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.