This version of the form is not currently in use and is provided for reference only. Download this version of

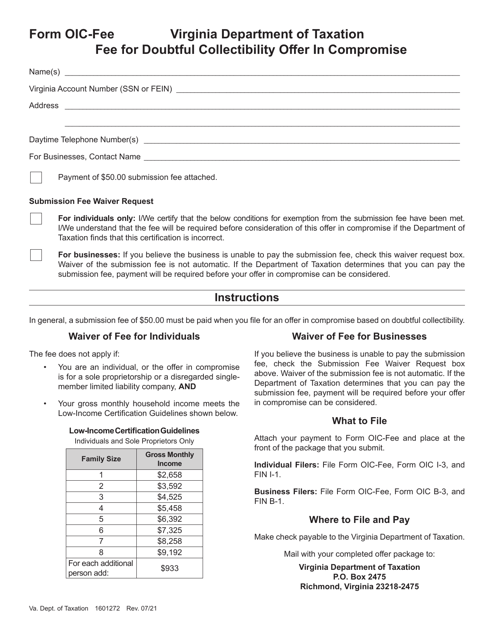

Form OIC-FEE

for the current year.

Form OIC-FEE Fee for Doubtful Collectibility Offer in Compromise - Virginia

What Is Form OIC-FEE?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OIC-FEE?

A: Form OIC-FEE is used for submitting the fee for Doubtful Collectibility Offer in Compromise in Virginia.

Q: What is a Doubtful Collectibility Offer in Compromise?

A: A Doubtful Collectibility Offer in Compromise is a tax settlement agreement where the taxpayer offers to pay a compromised amount to resolve their tax debt when there is doubt about the ability to collect the full amount owed.

Q: Who can use Form OIC-FEE?

A: Anyone in Virginia who is submitting a Doubtful Collectibility Offer in Compromise must use Form OIC-FEE to pay the required fee.

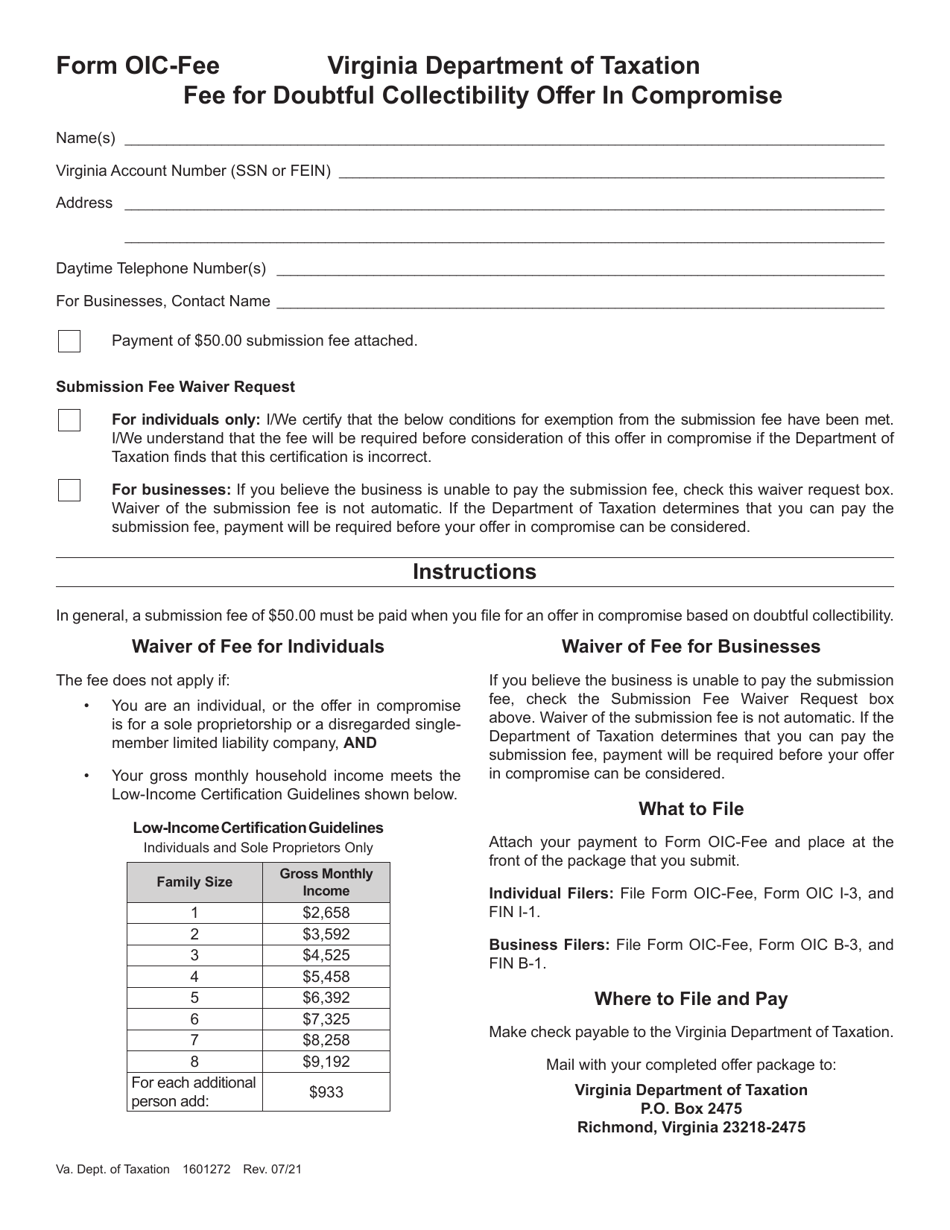

Q: How much is the fee for a Doubtful Collectibility Offer in Compromise in Virginia?

A: The fee amount for a Doubtful Collectibility Offer in Compromise in Virginia can vary. It is important to refer to the instructions on Form OIC-FEE for the current fee schedule.

Q: Are there any eligibility requirements for submitting a Doubtful Collectibility Offer in Compromise in Virginia?

A: Yes, there are eligibility requirements for submitting a Doubtful Collectibility Offer in Compromise in Virginia. It is recommended to review the guidelines provided by the Virginia Department of Taxation or consult a tax professional for more information.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OIC-FEE by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.