This version of the form is not currently in use and is provided for reference only. Download this version of

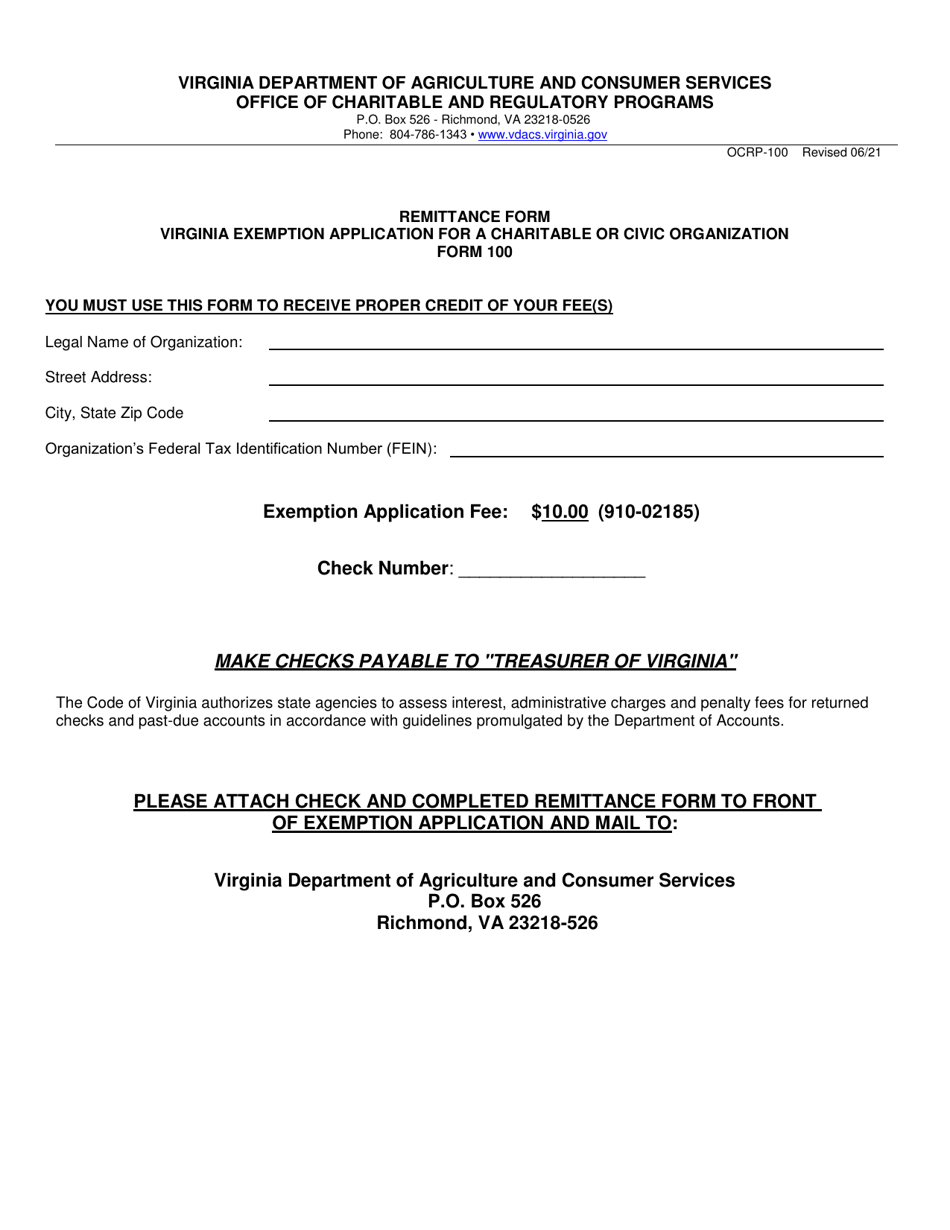

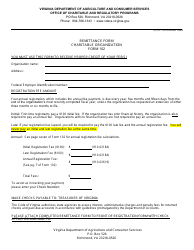

Form OCRP-100

for the current year.

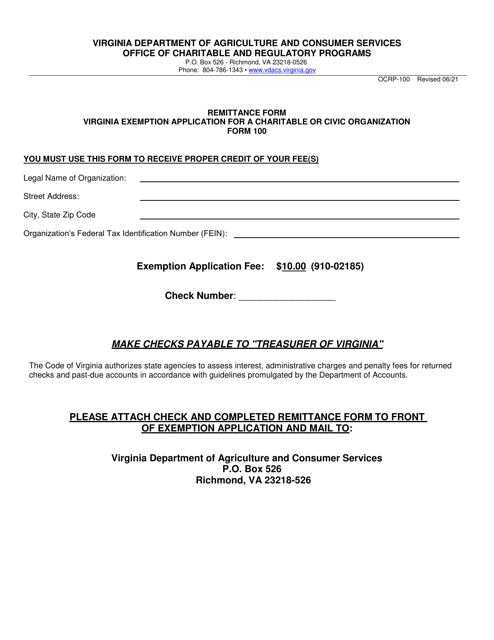

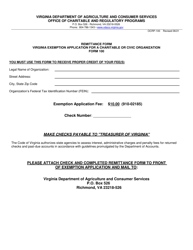

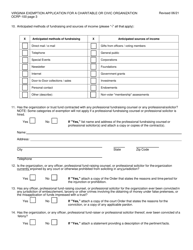

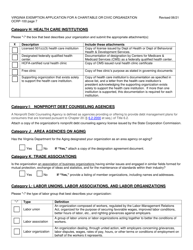

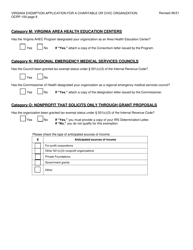

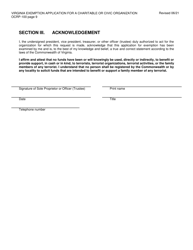

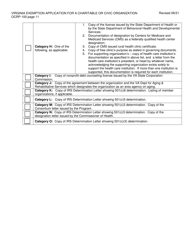

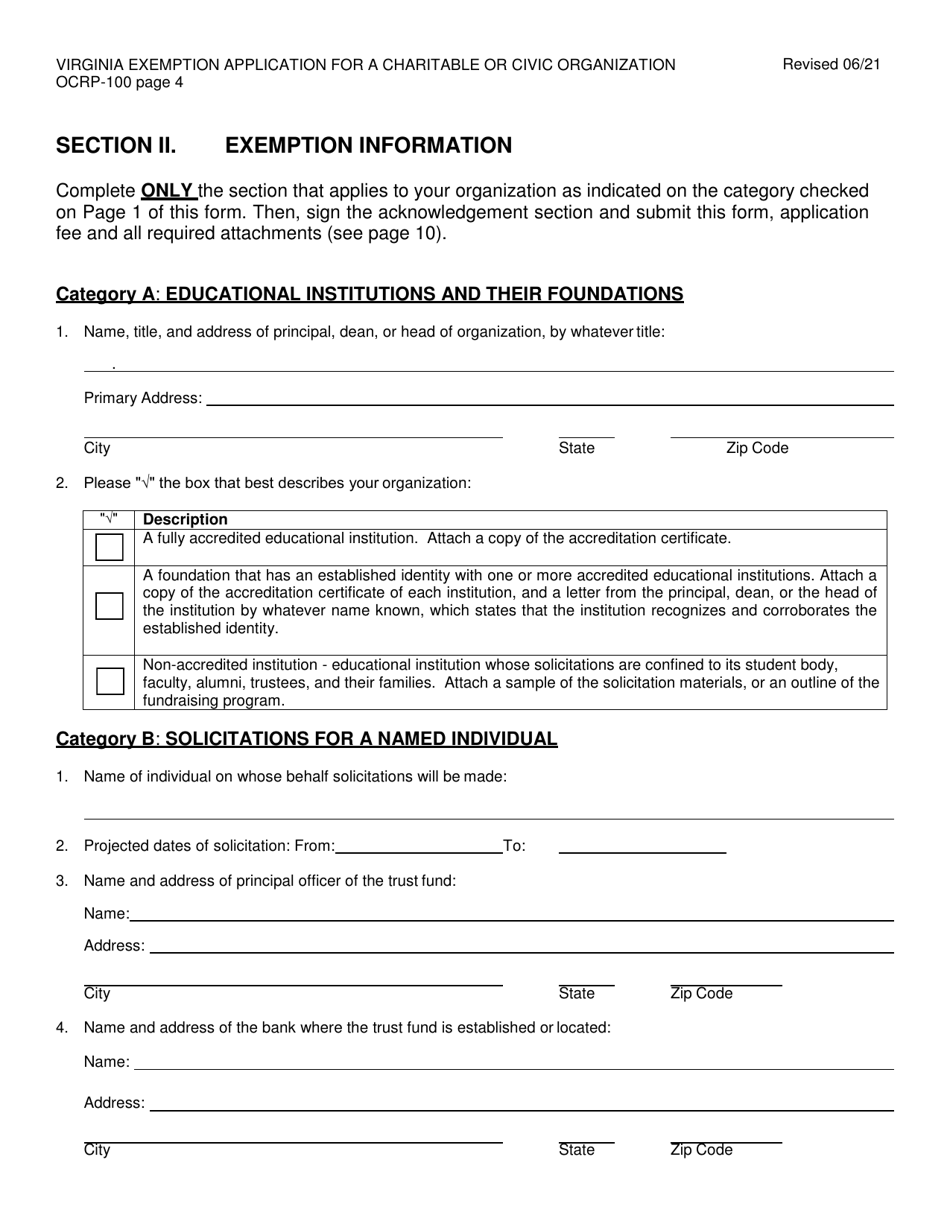

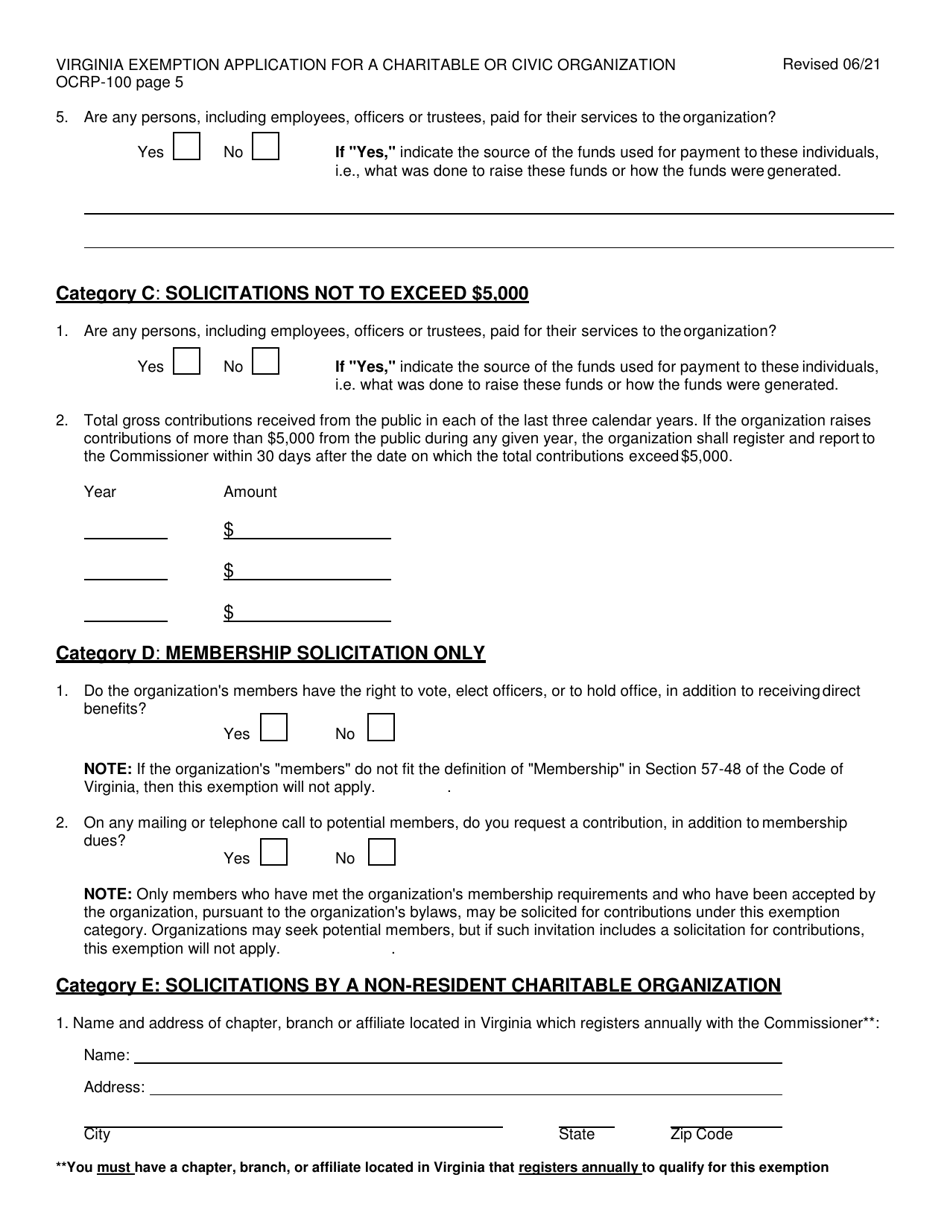

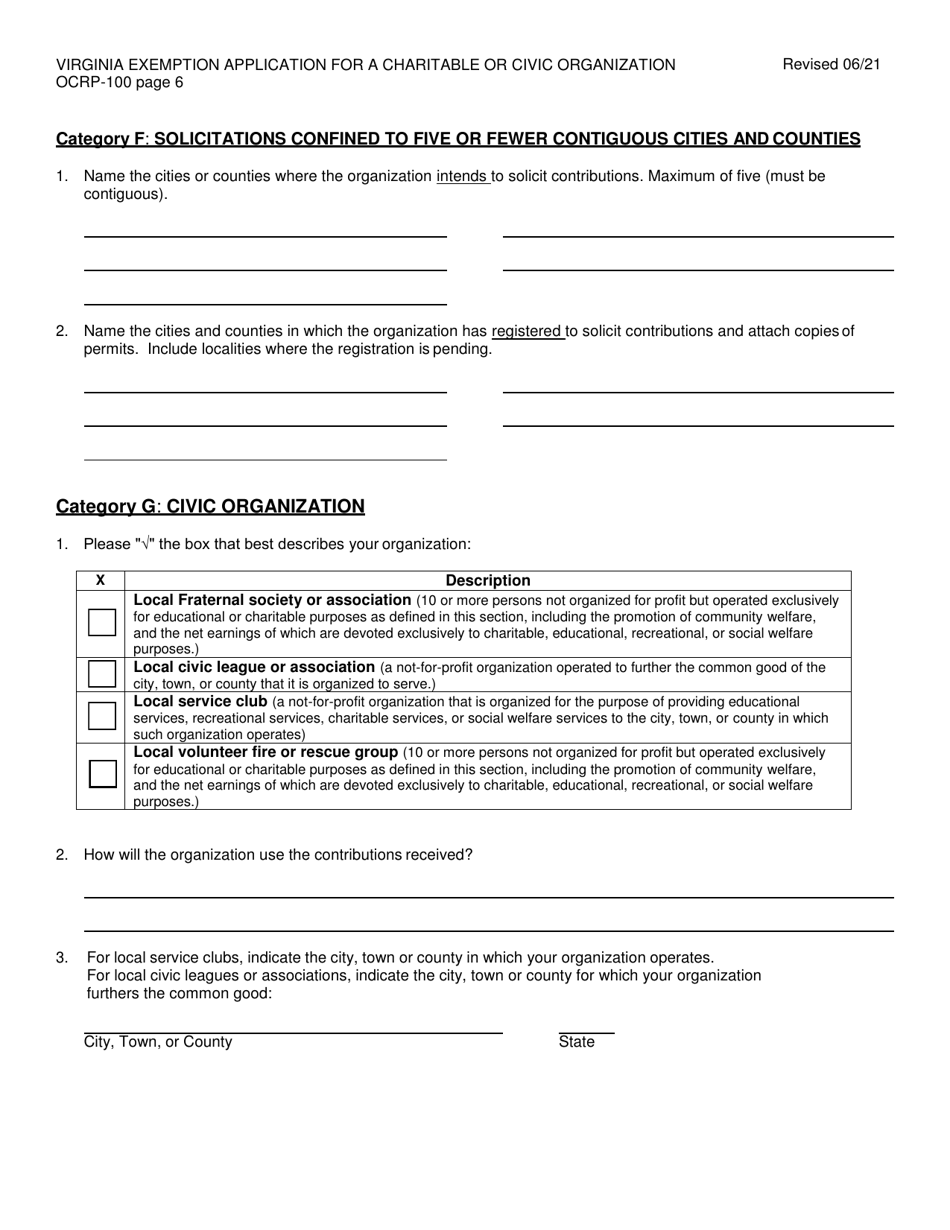

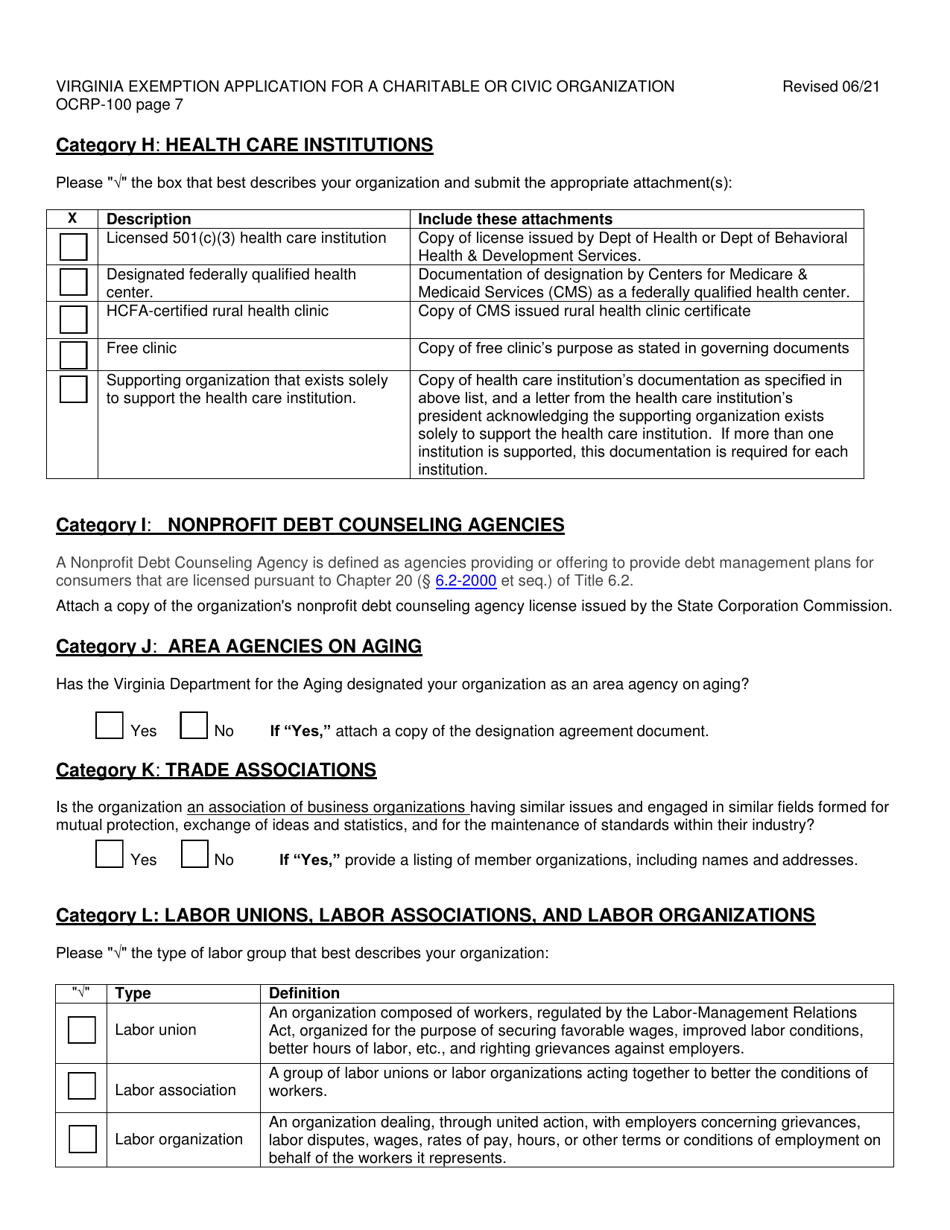

Form OCRP-100 Virginia Exemption Application for Charitable or Civic Organization - Virginia

What Is Form OCRP-100?

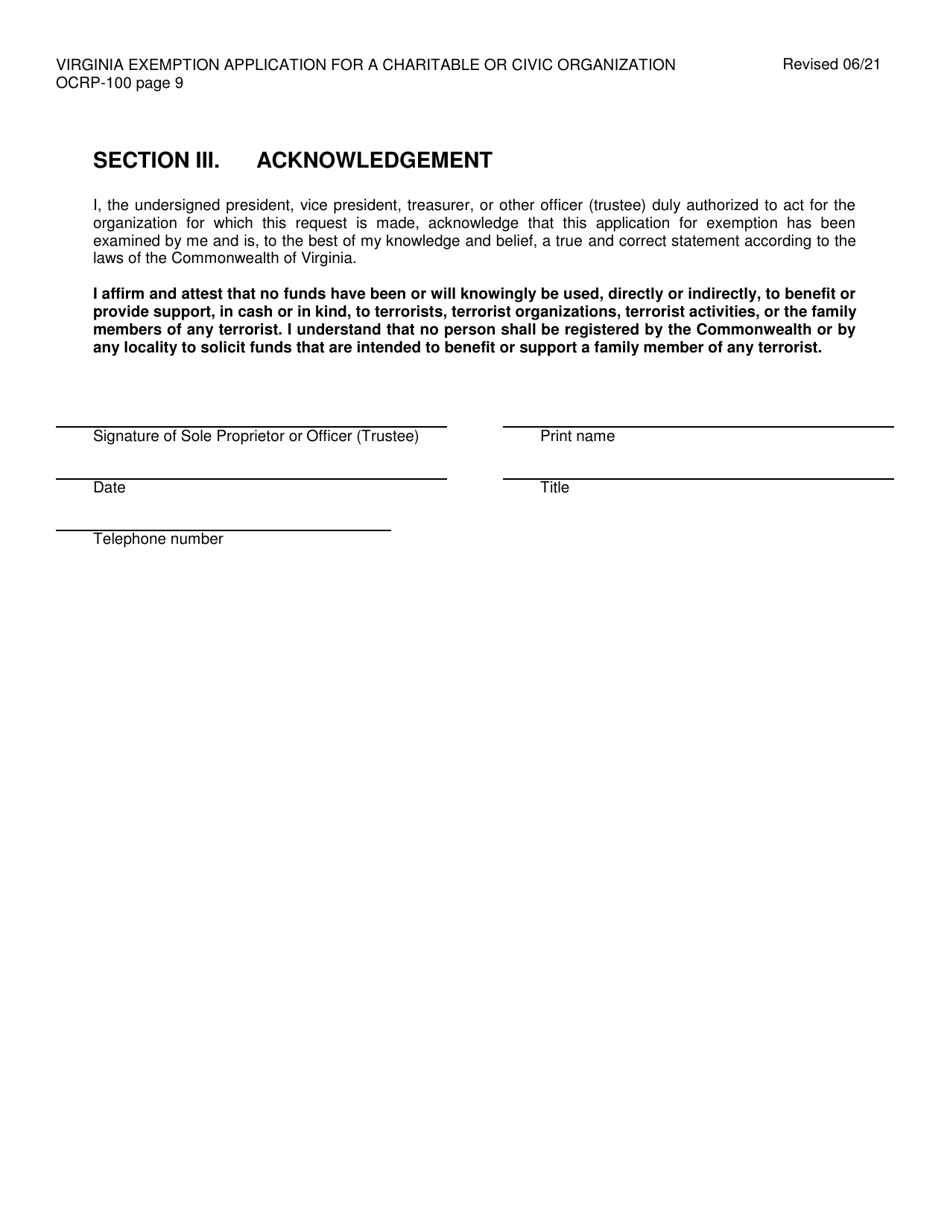

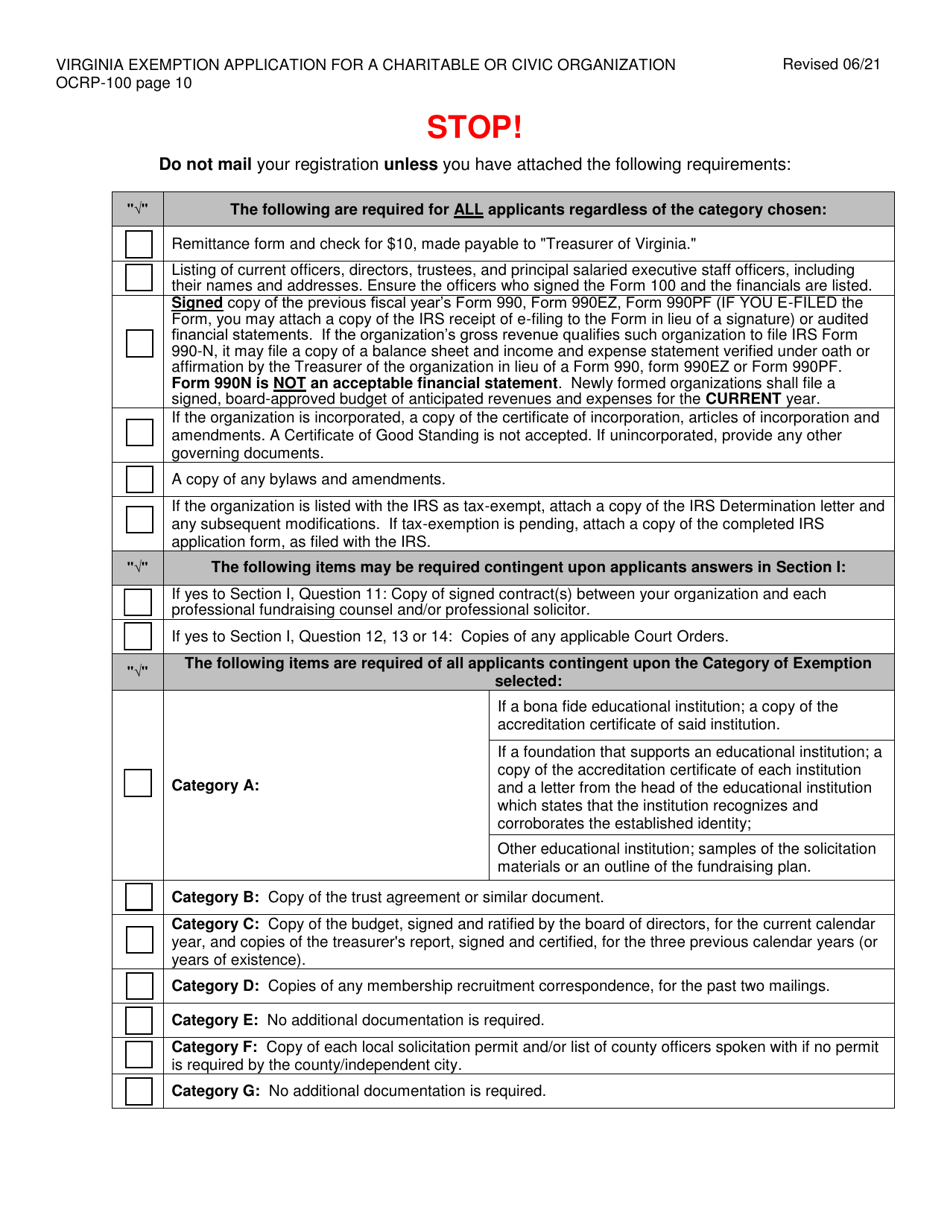

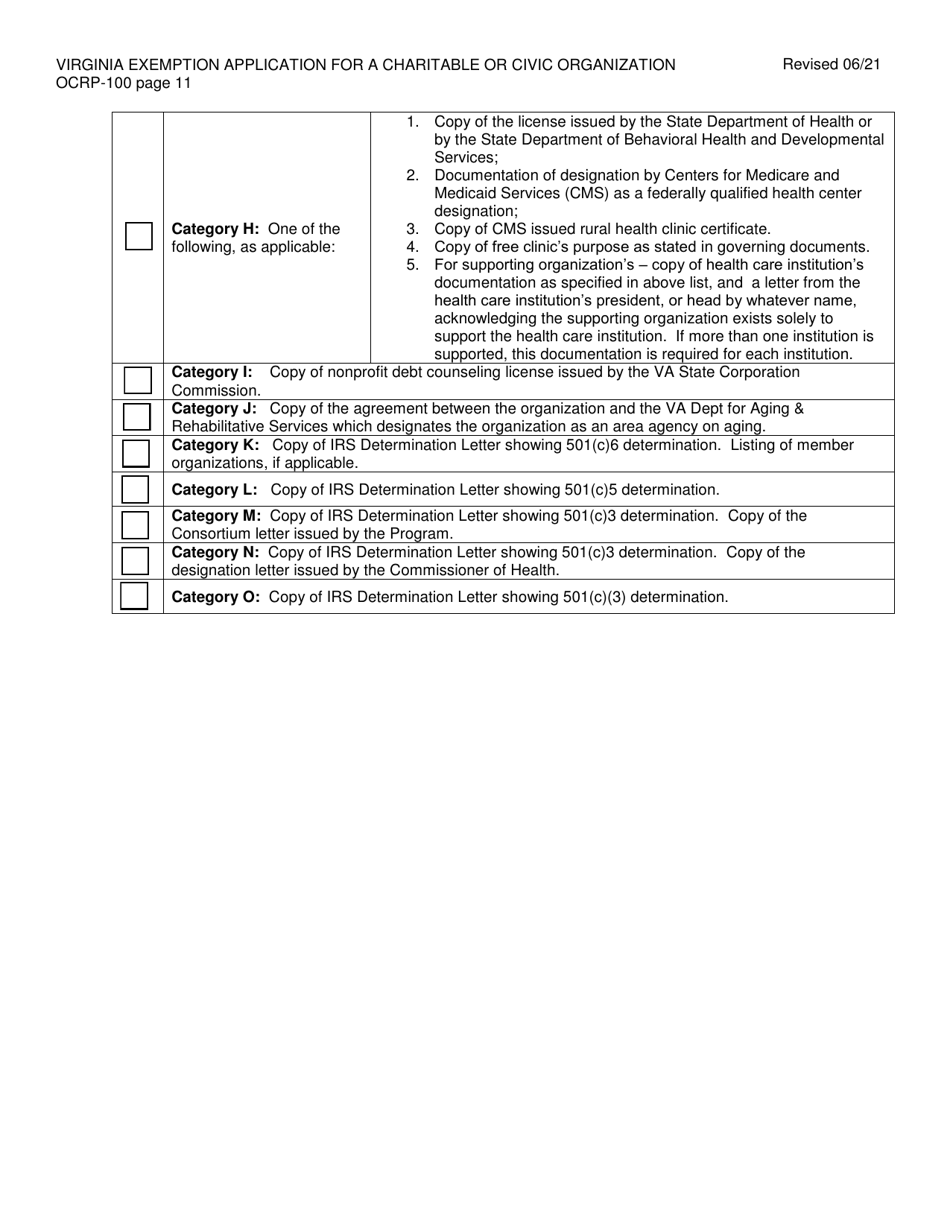

This is a legal form that was released by the Virginia Department of Agriculture and Consumer Services - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

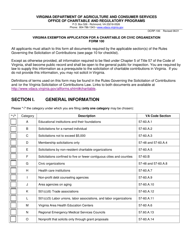

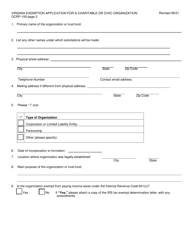

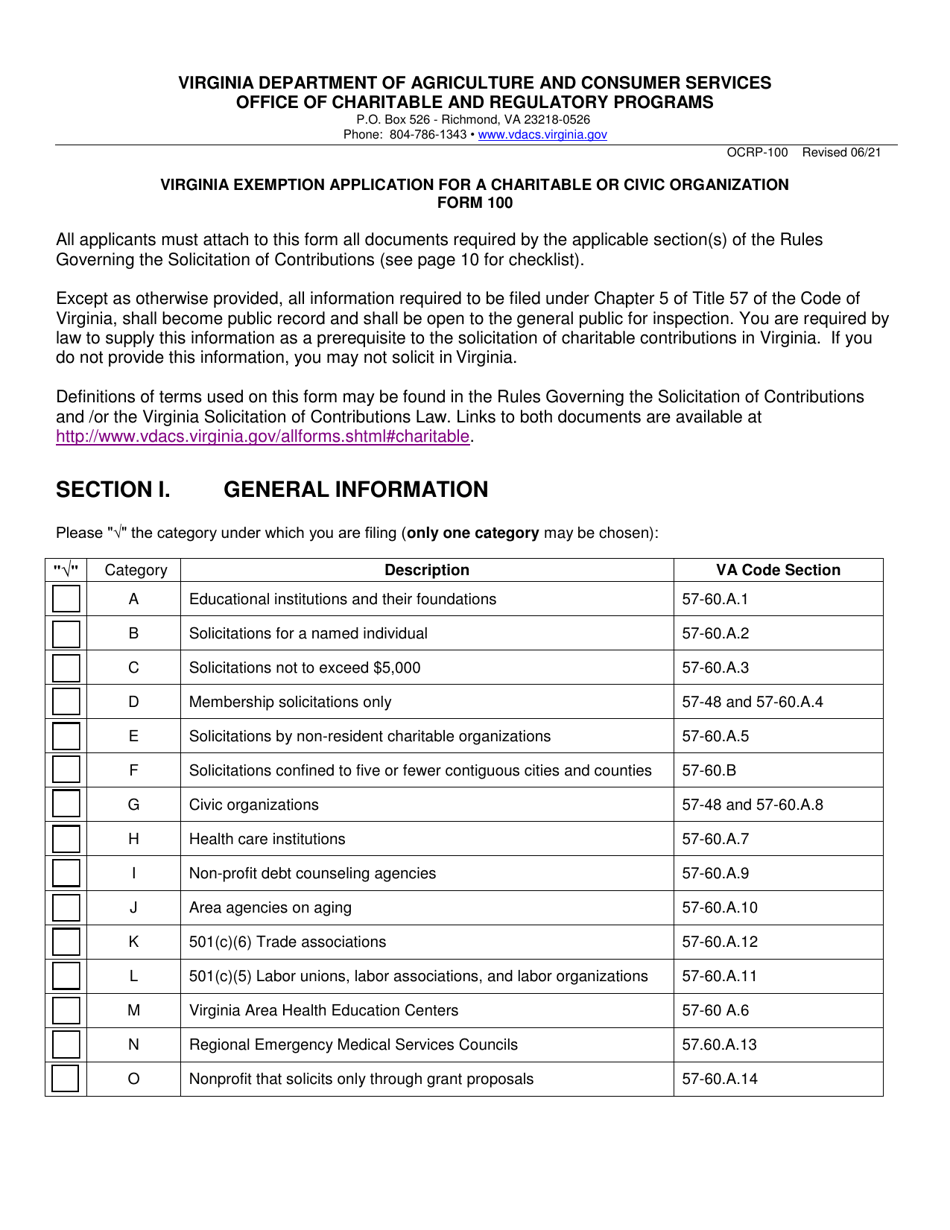

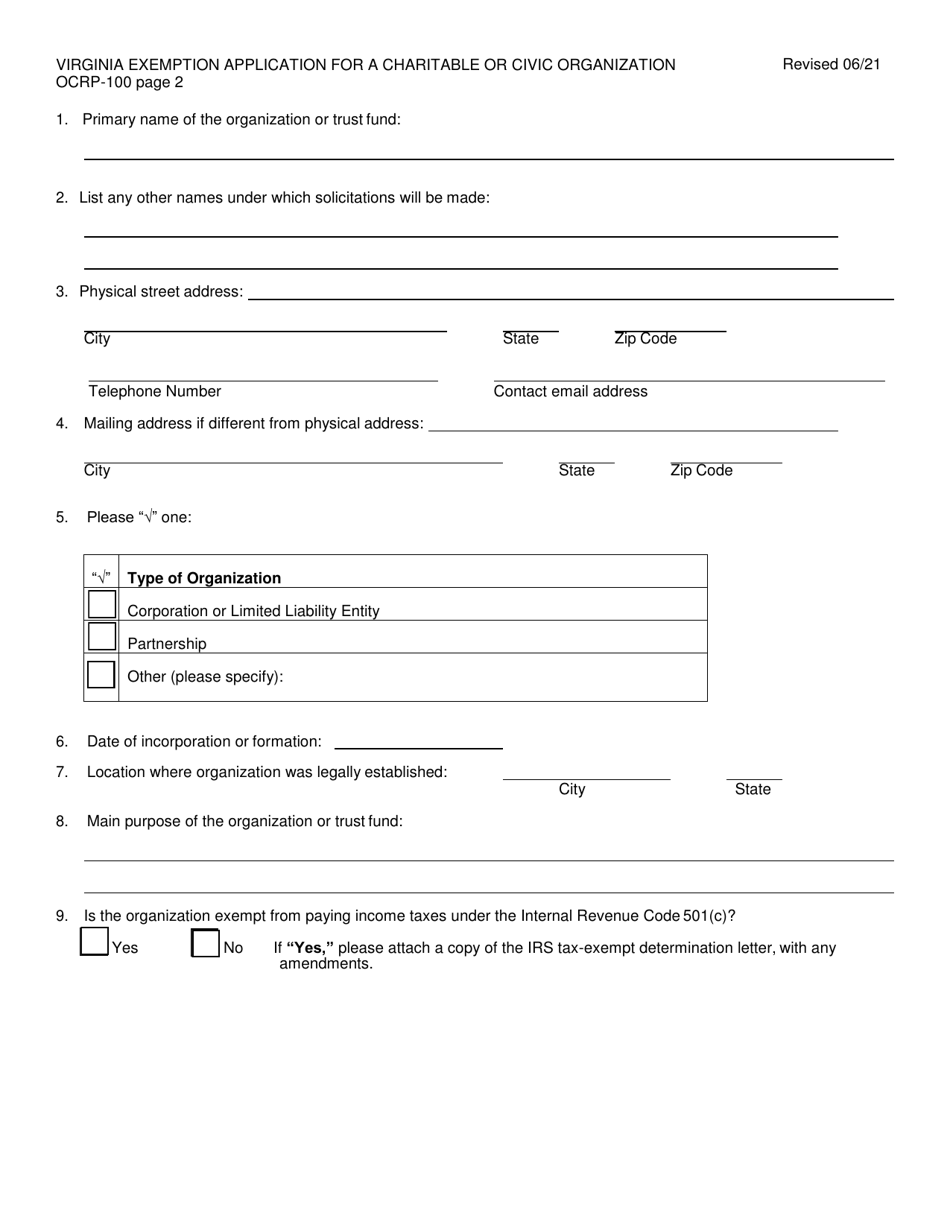

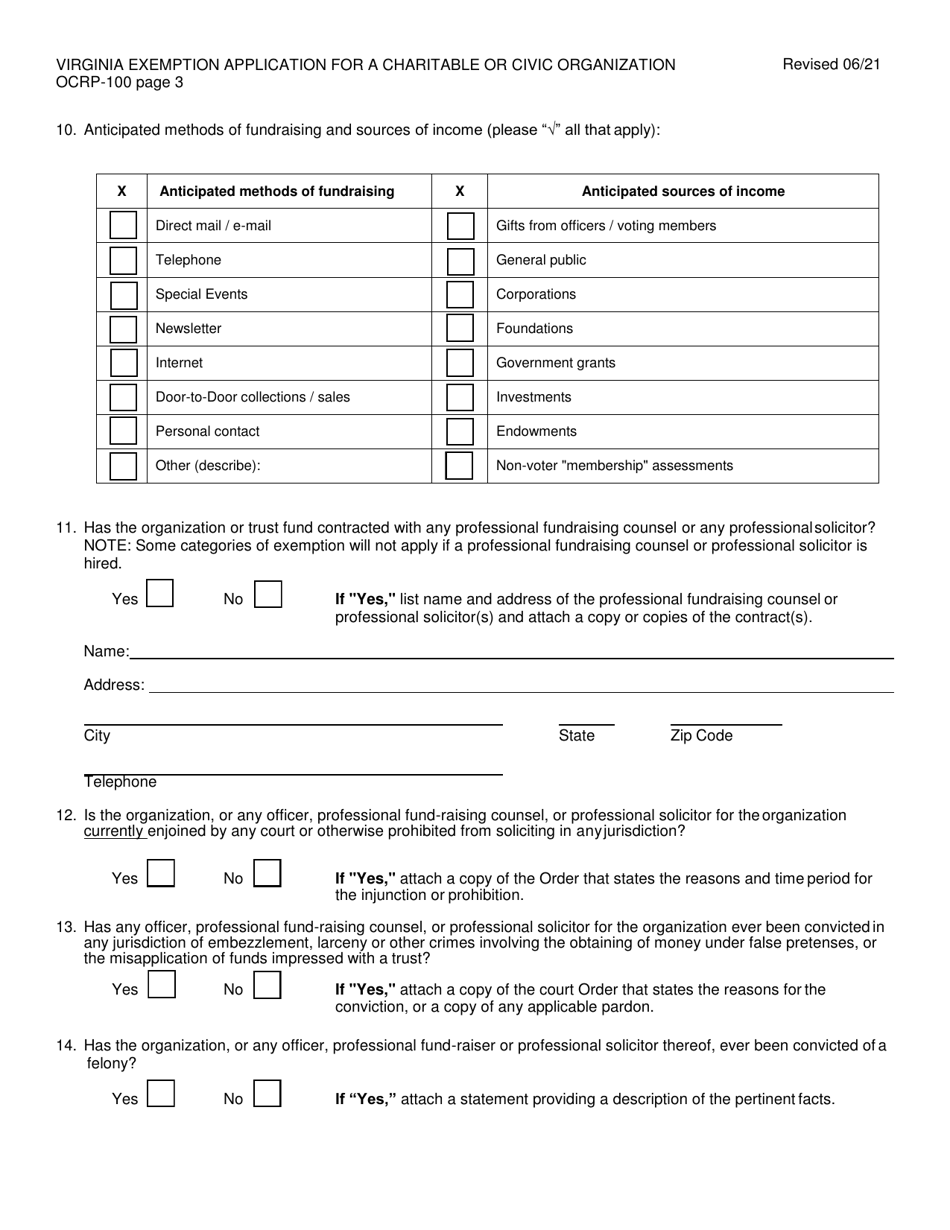

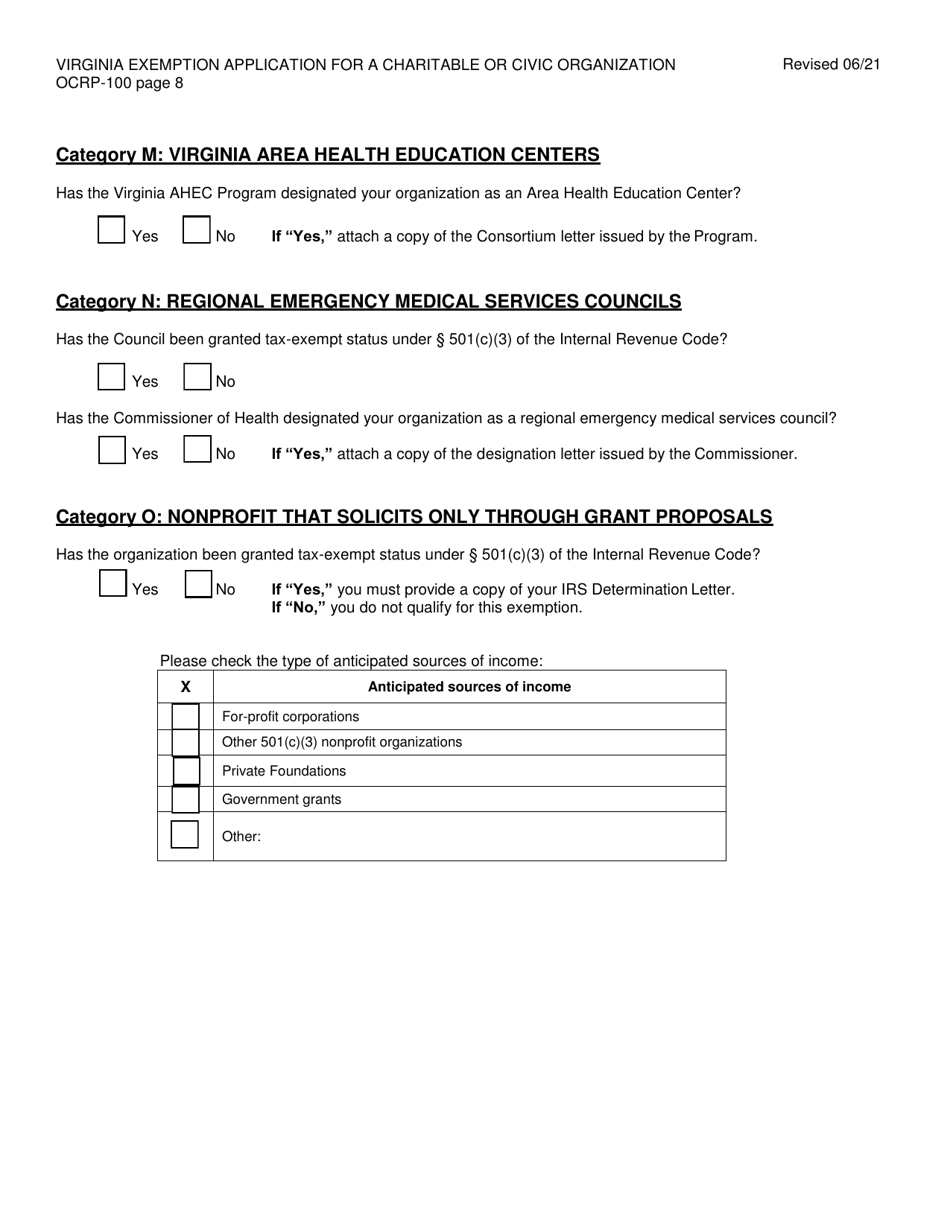

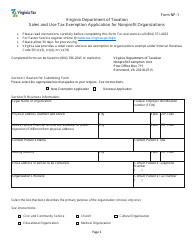

Q: What is the OCRP-100 form?

A: The OCRP-100 form is the Exemption Application for Charitable or Civic Organization in Virginia.

Q: Who can use the OCRP-100 form?

A: Charitable or civic organizations in Virginia can use the OCRP-100 form.

Q: What is the purpose of the OCRP-100 form?

A: The purpose of the OCRP-100 form is to apply for exemption from property taxes for charitable or civic organizations in Virginia.

Q: How do I submit the OCRP-100 form?

A: The completed OCRP-100 form should be submitted to your local tax commissioner's office in Virginia.

Q: Are all charitable or civic organizations eligible for exemption?

A: Not all charitable or civic organizations are eligible for exemption. The organization must meet certain criteria set by the state of Virginia.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Virginia Department of Agriculture and Consumer Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OCRP-100 by clicking the link below or browse more documents and templates provided by the Virginia Department of Agriculture and Consumer Services.