This version of the form is not currently in use and is provided for reference only. Download this version of

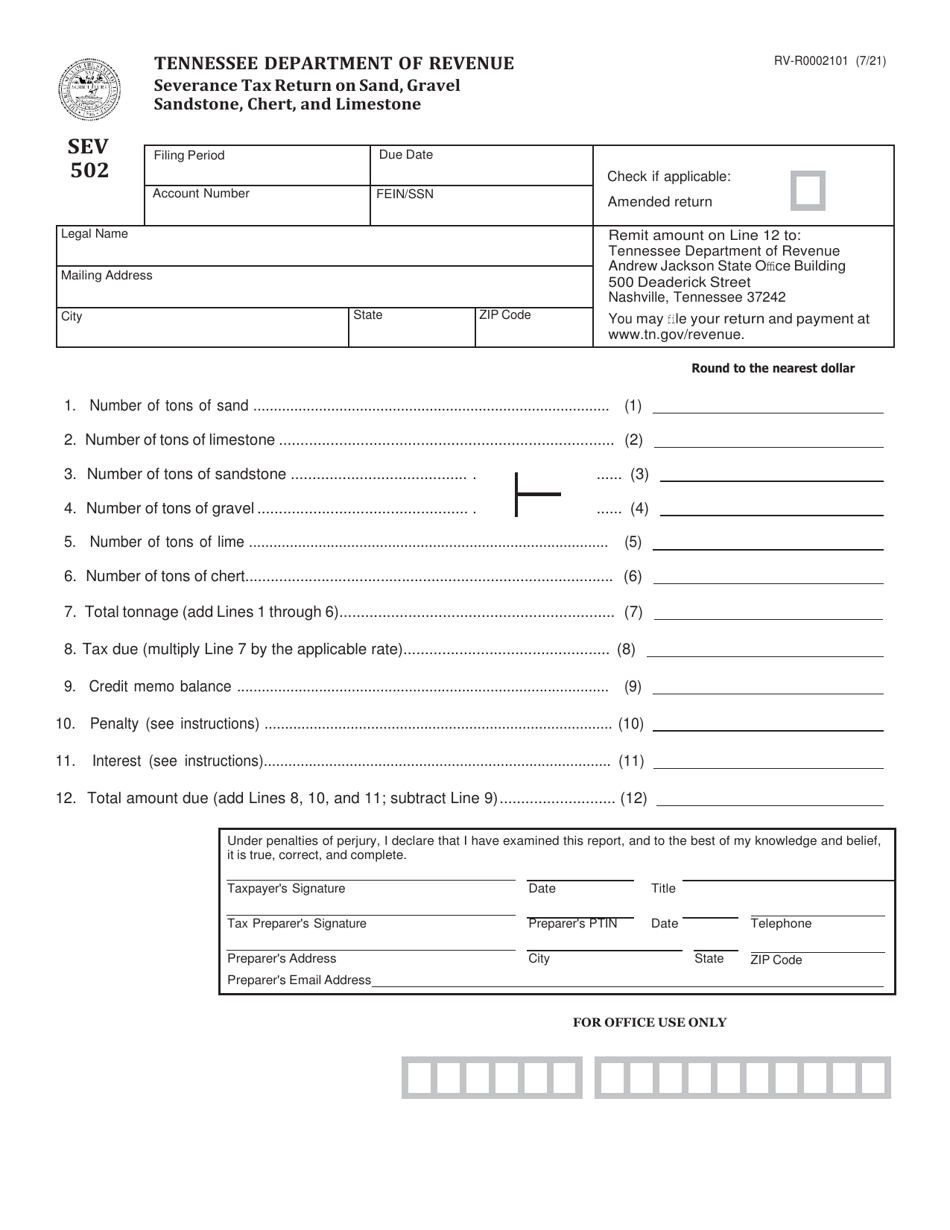

Form SEV502 (RV-R0002101)

for the current year.

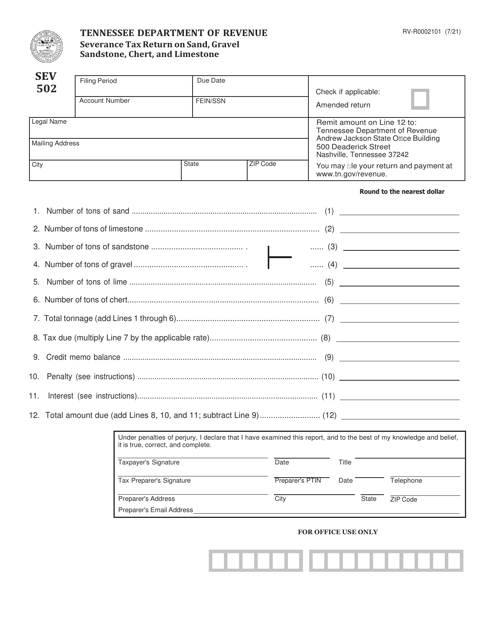

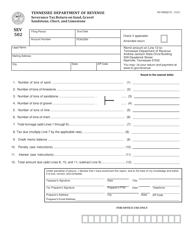

Form SEV502 (RV-R0002101) Severance Tax Return on Sand, Gravel Sandstone, Chert, and Limestone - Tennessee

What Is Form SEV502 (RV-R0002101)?

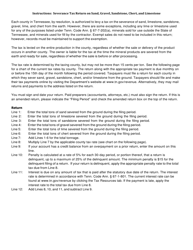

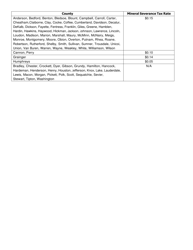

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEV502 (RV-R0002101)?

A: Form SEV502 (RV-R0002101) is the Severance Tax Return on Sand, Gravel Sandstone, Chert, and Limestone for the state of Tennessee.

Q: Who needs to file Form SEV502 (RV-R0002101)?

A: Anyone engaged in the business of severing or extracting sand, gravel, sandstone, chert, or limestone in Tennessee needs to file Form SEV502 (RV-R0002101).

Q: What is the purpose of Form SEV502 (RV-R0002101)?

A: Form SEV502 (RV-R0002101) is used to report and remit the severance tax owed on sand, gravel, sandstone, chert, and limestone extracted in Tennessee.

Q: How often is Form SEV502 (RV-R0002101) filed?

A: Form SEV502 (RV-R0002101) is filed monthly.

Q: Is there a deadline for filing Form SEV502 (RV-R0002101)?

A: Yes, Form SEV502 (RV-R0002101) must be filed on or before the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form SEV502 (RV-R0002101) or pay the severance tax?

A: Failure to file Form SEV502 (RV-R0002101) or pay the severance tax can result in penalties, interest, and potential legal action.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV502 (RV-R0002101) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.