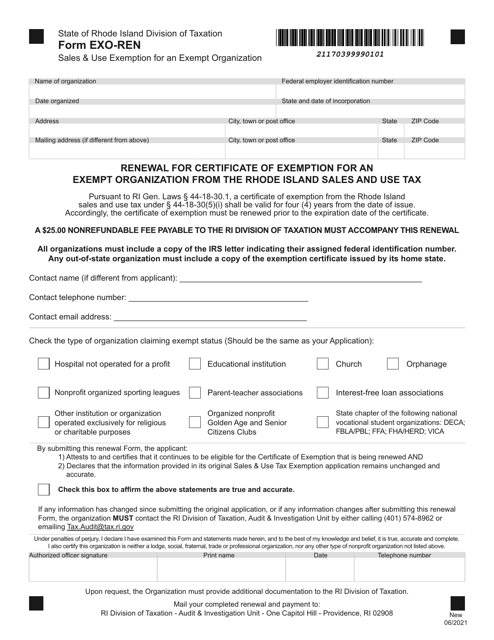

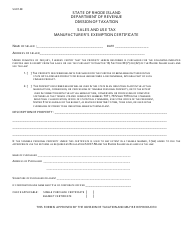

Form EXO-REN Renewal for Certificate of Exemption for an Exempt Organization From the Rhode Island Sales and Use Tax - Rhode Island

What Is Form EXO-REN?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

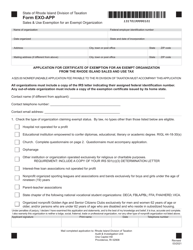

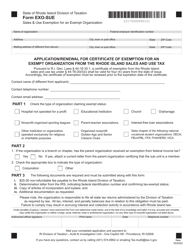

Q: What is Form EXO-REN?

A: Form EXO-REN is the Renewal for Certificate of Exemption for an Exempt Organization From the Rhode Island Sales and Use Tax in Rhode Island.

Q: Who needs to file Form EXO-REN?

A: Exempt organizations in Rhode Island that wish to renew their certificate of exemption for sales and use tax.

Q: What is the purpose of Form EXO-REN?

A: The purpose of Form EXO-REN is to renew the certificate of exemption for sales and use tax for exempt organizations in Rhode Island.

Q: Is there a deadline for filing Form EXO-REN?

A: Yes, Form EXO-REN must be filed by the due date specified on the form.

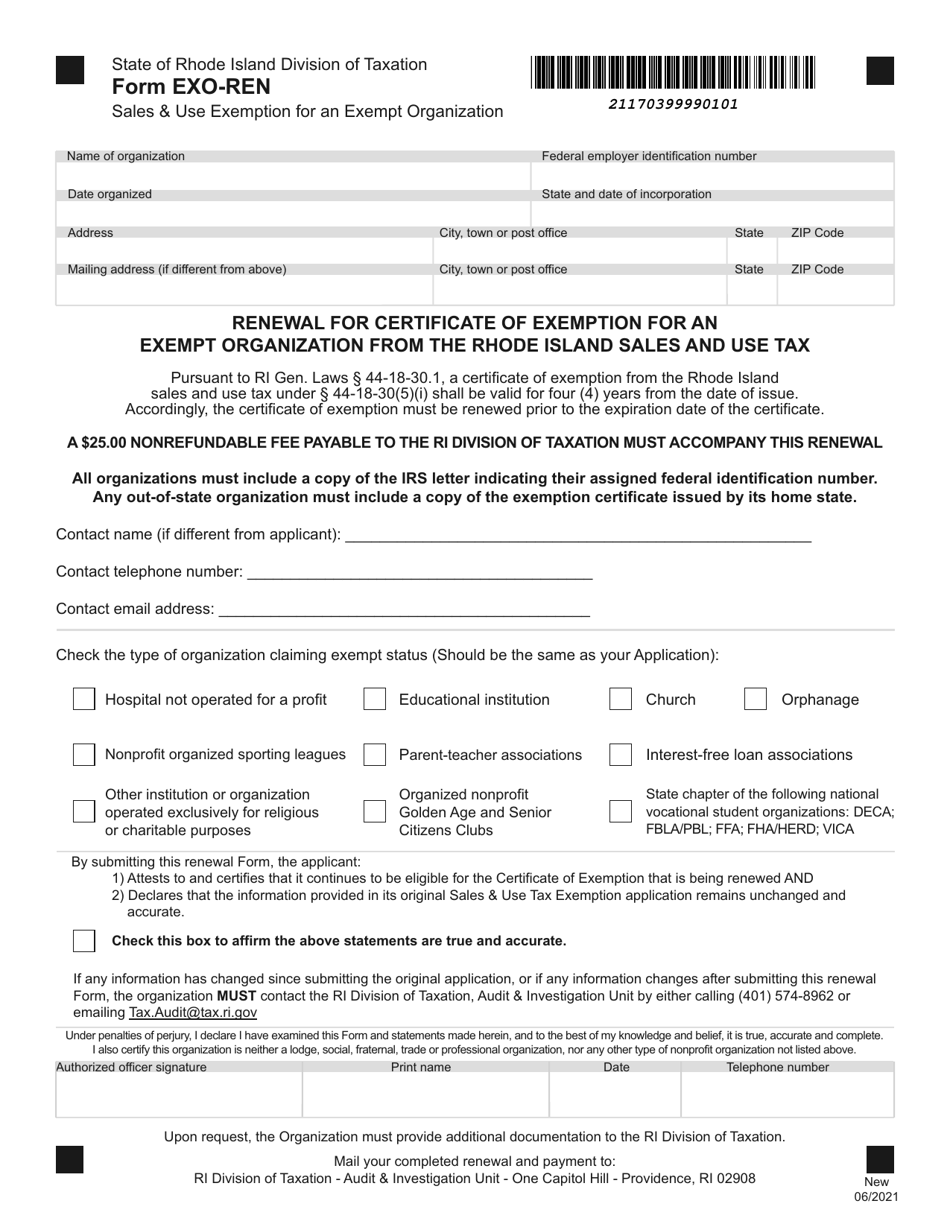

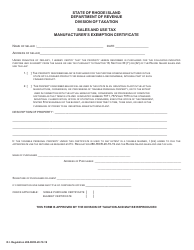

Q: What information is required on Form EXO-REN?

A: Form EXO-REN requires information such as the organization's name, address, taxpayer identification number, and certification statement.

Q: Are there any filing fees for Form EXO-REN?

A: No, there are no filing fees for Form EXO-REN.

Q: Is Form EXO-REN required every year?

A: Yes, Form EXO-REN must be filed annually to renew the certificate of exemption.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EXO-REN by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.