This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form OR-NRC-CERT, 150-104-008

for the current year.

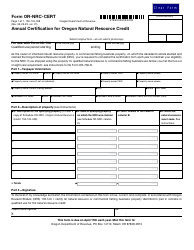

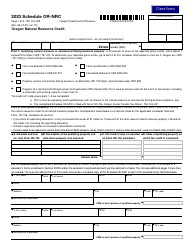

Instructions for Form OR-NRC-CERT, 150-104-008 Annual Certification for Oregon Natural Resource Credit - Oregon

This document contains official instructions for Form OR-NRC-CERT , and Form 150-104-008 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-NRC-CERT (150-104-008) is available for download through this link.

FAQ

Q: What is Form OR-NRC-CERT?

A: Form OR-NRC-CERT is the Annual Certification for Oregon Natural Resource Credit in Oregon.

Q: What is the purpose of Form OR-NRC-CERT?

A: The purpose of Form OR-NRC-CERT is to certify eligibility for the Oregon Natural Resource Credit.

Q: Who needs to file Form OR-NRC-CERT?

A: Anyone seeking to claim the Oregon Natural Resource Credit needs to file Form OR-NRC-CERT.

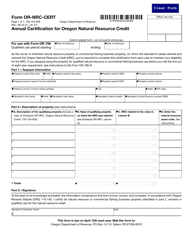

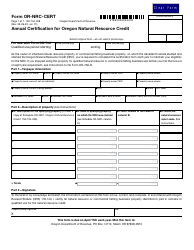

Q: What information is required on Form OR-NRC-CERT?

A: Form OR-NRC-CERT requires information about the taxpayer, the natural resource property, and the certified activities that qualify for the credit.

Q: When is Form OR-NRC-CERT due?

A: Form OR-NRC-CERT is due on or before the due date for the tax return for the year the credit is claimed.

Q: What happens after I file Form OR-NRC-CERT?

A: After filing, the Oregon Department of Revenue will review the form and notify the taxpayer of the eligibility for the credit.

Q: Can I claim the Oregon Natural Resource Credit without filing Form OR-NRC-CERT?

A: No, filing Form OR-NRC-CERT is necessary to claim the Oregon Natural Resource Credit.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit available to individuals and businesses that own, provide, or facilitate the use of qualified natural resource properties in Oregon.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.