This version of the form is not currently in use and is provided for reference only. Download this version of

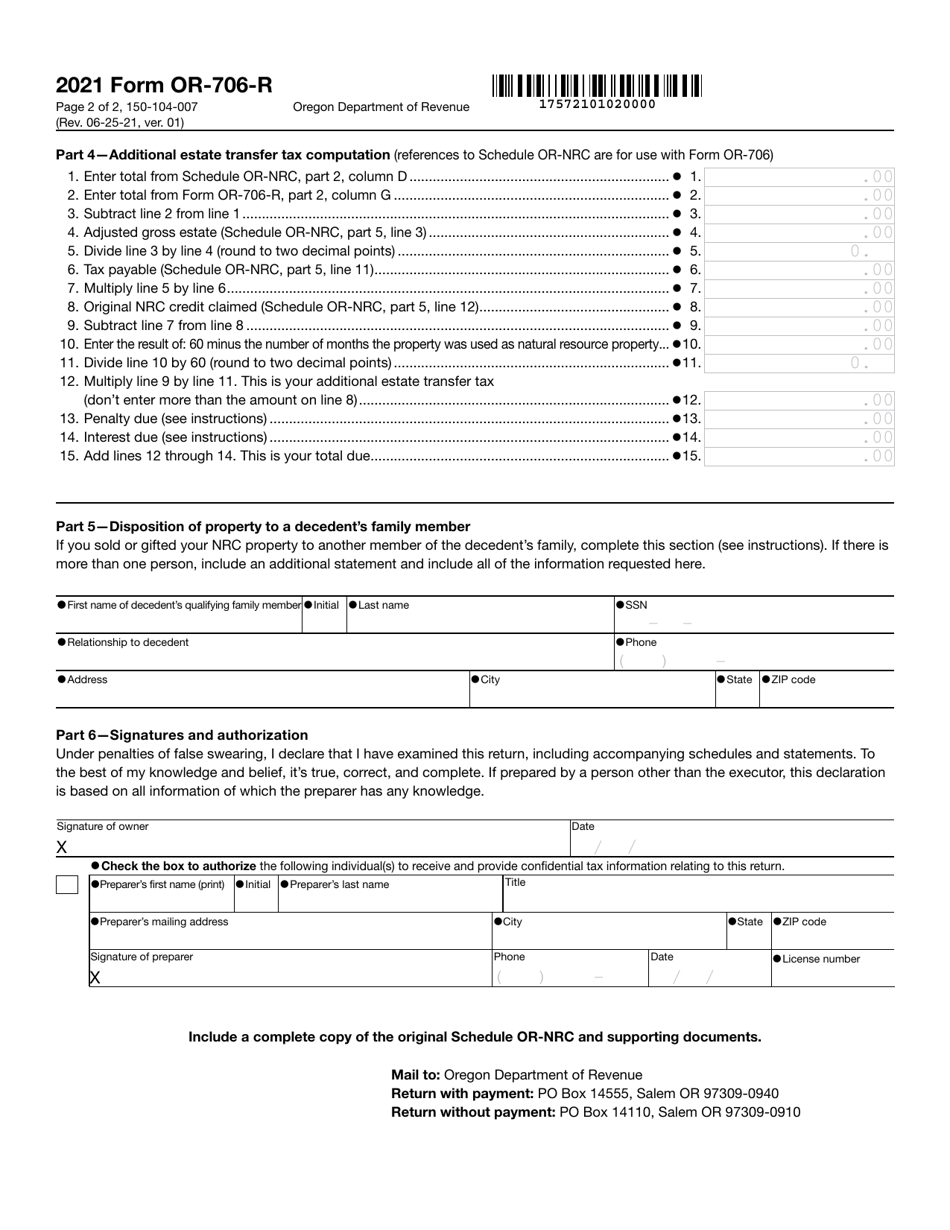

Form OR-706-R (150-104-007)

for the current year.

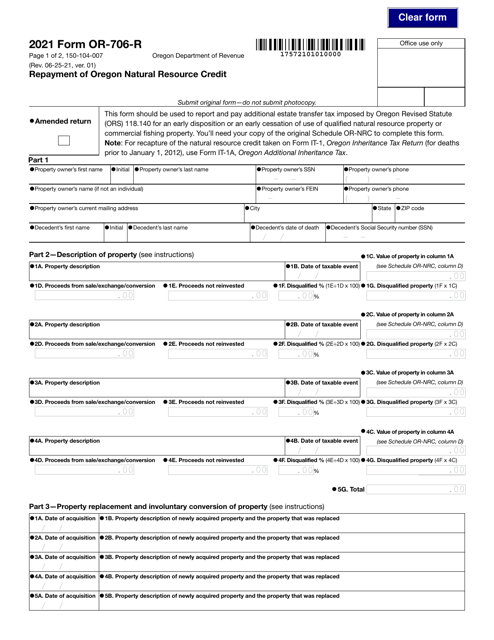

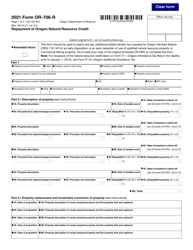

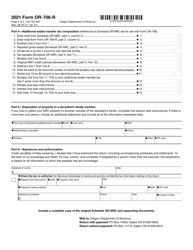

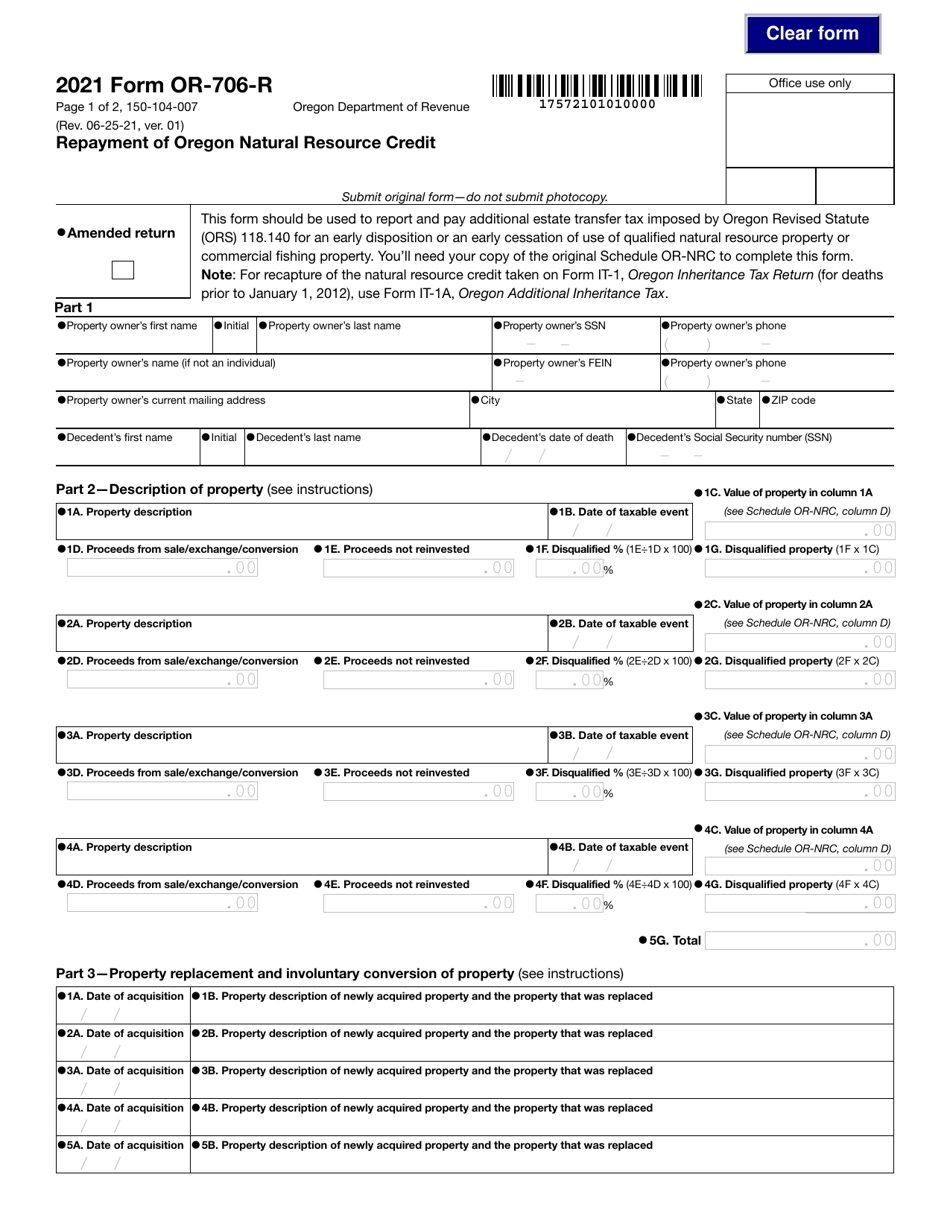

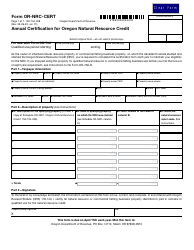

Form OR-706-R (150-104-007) Repayment of Oregon Natural Resource Credit - Oregon

What Is Form OR-706-R (150-104-007)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-706-R?

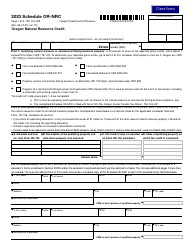

A: Form OR-706-R is a tax form used for the repayment of the Oregon Natural Resource Credit in the state of Oregon.

Q: What is the purpose of Form OR-706-R?

A: The purpose of Form OR-706-R is to calculate and repay the Oregon Natural Resource Credit that was previously claimed on an Oregon tax return.

Q: Who needs to file Form OR-706-R?

A: Anyone who claimed the Oregon Natural Resource Credit on their Oregon tax return and needs to repay all or part of the credit must file Form OR-706-R.

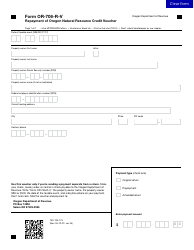

Q: What information is required on Form OR-706-R?

A: Form OR-706-R requires you to provide your personal information, details about the Oregon Natural Resource Credit claimed, and calculate the repayment amount.

Q: When is the deadline to file Form OR-706-R?

A: The deadline to file Form OR-706-R is usually the same as the deadline to file your Oregon tax return, which is April 15th of each year.

Q: Are there any penalties for not filing Form OR-706-R?

A: Yes, if you fail to file Form OR-706-R or repay the required amount, you may be subject to penalties and interest on the unpaid balance.

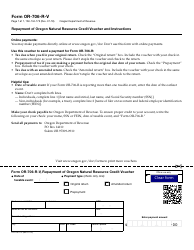

Q: Can I e-file Form OR-706-R?

A: No, Form OR-706-R cannot be filed electronically. It must be mailed to the Oregon Department of Revenue.

Q: What should I do after filing Form OR-706-R?

A: After filing Form OR-706-R, make sure to keep a copy for your records and retain any supporting documentation related to the repayment.

Form Details:

- Released on June 25, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706-R (150-104-007) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.