This version of the form is not currently in use and is provided for reference only. Download this version of

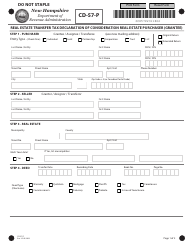

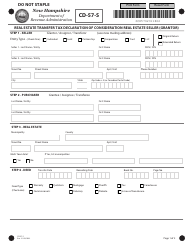

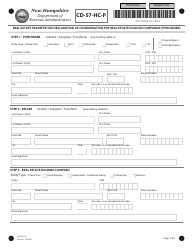

Form CD-57-HC-S

for the current year.

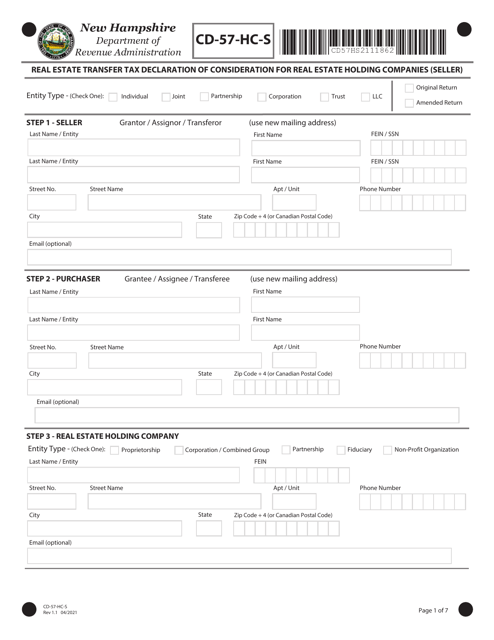

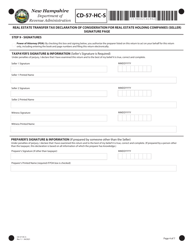

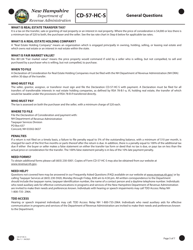

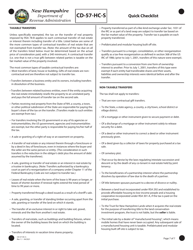

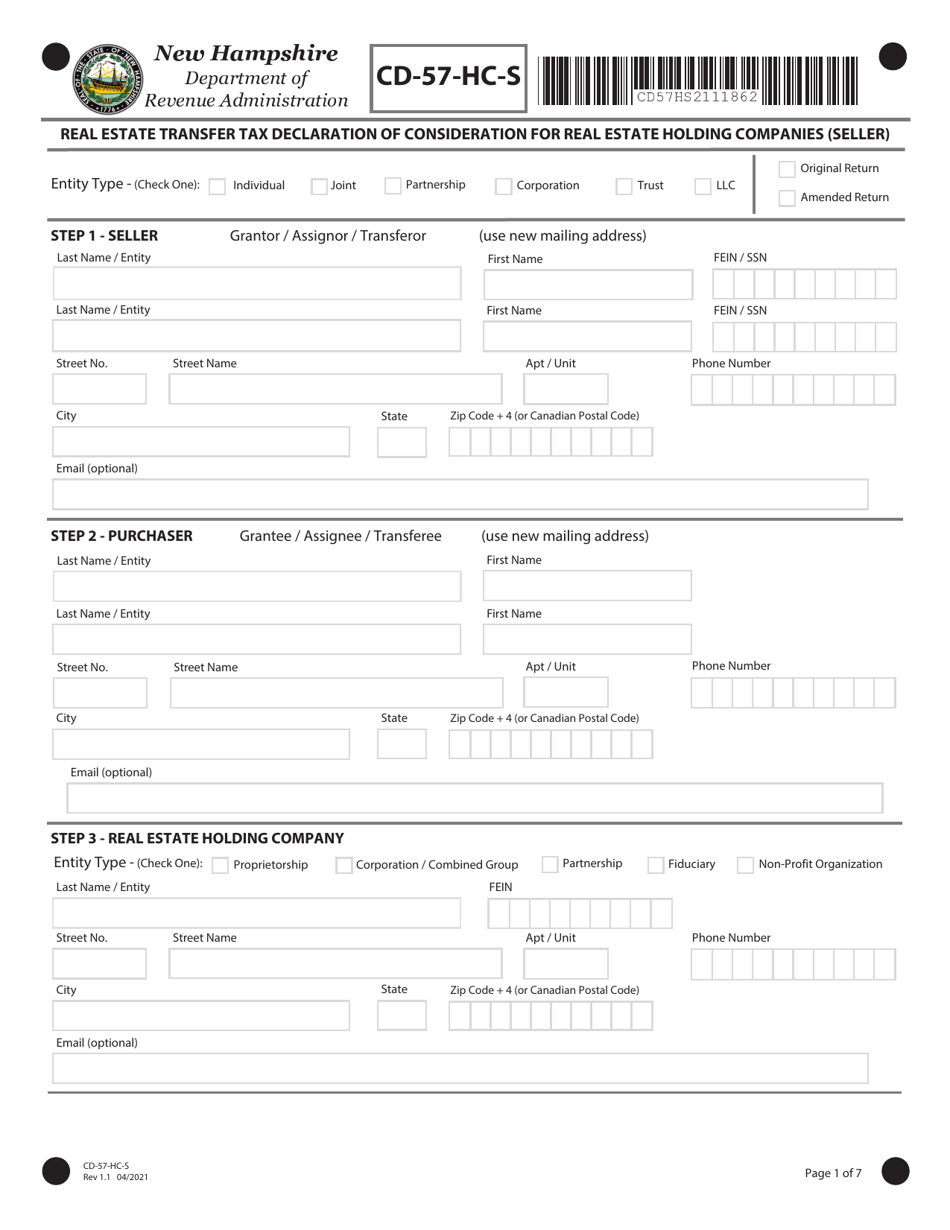

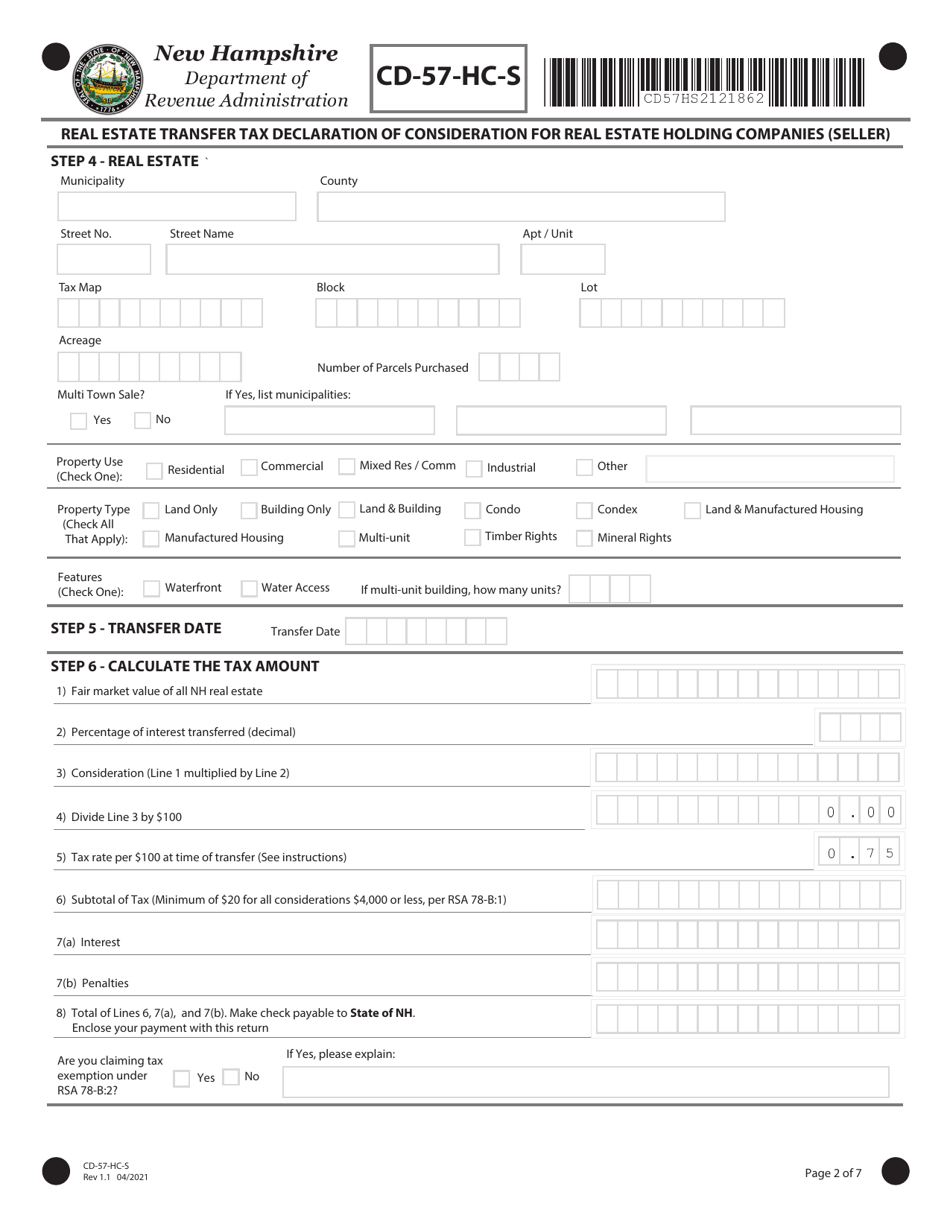

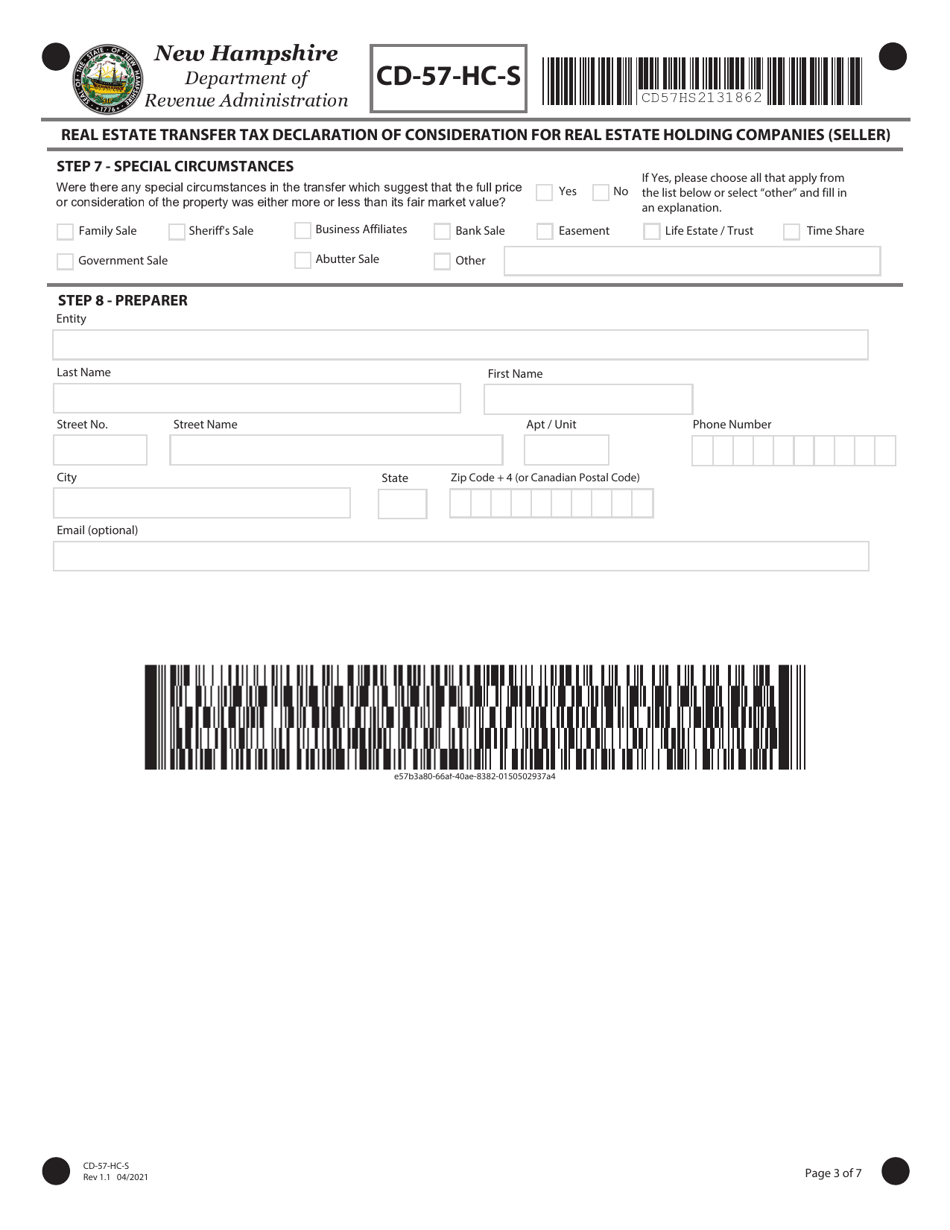

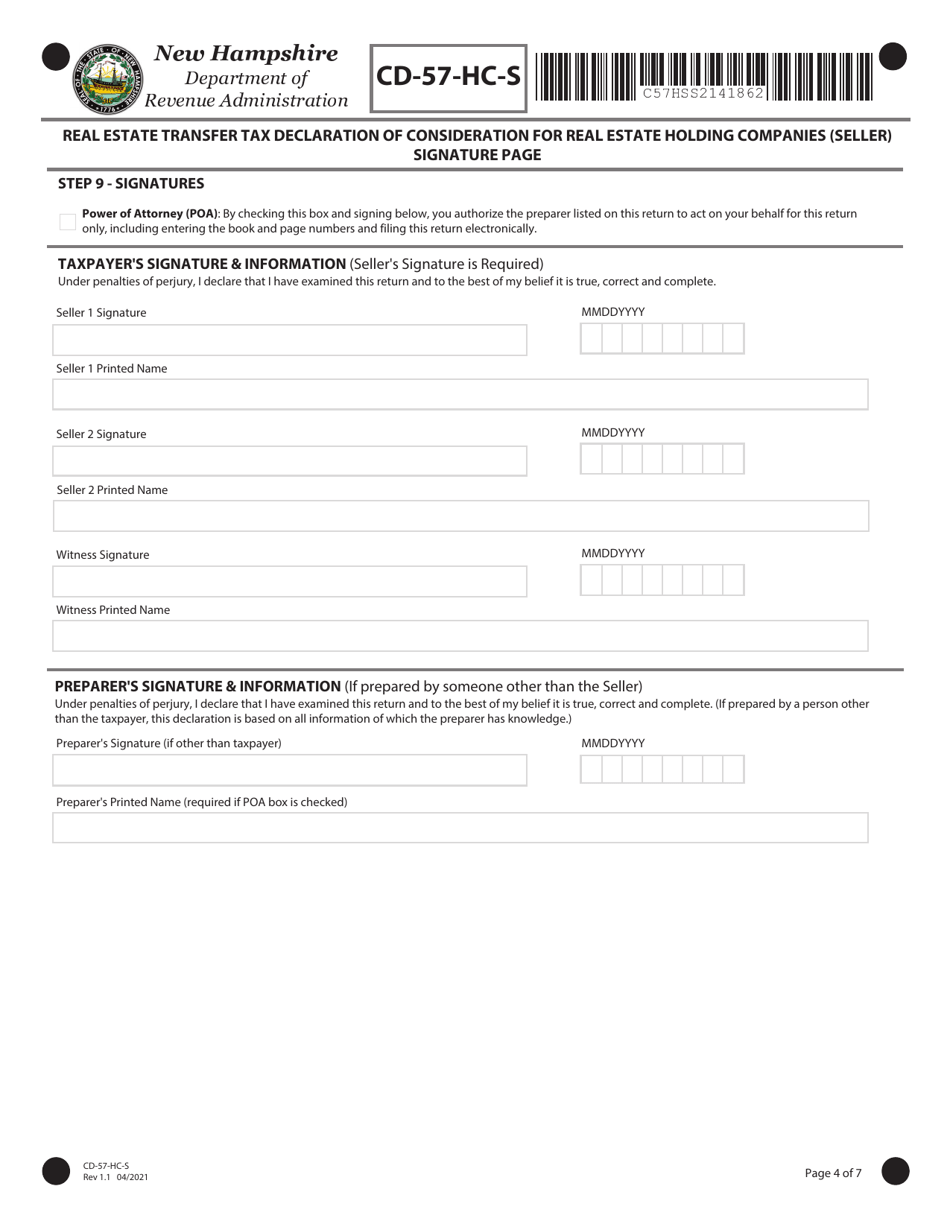

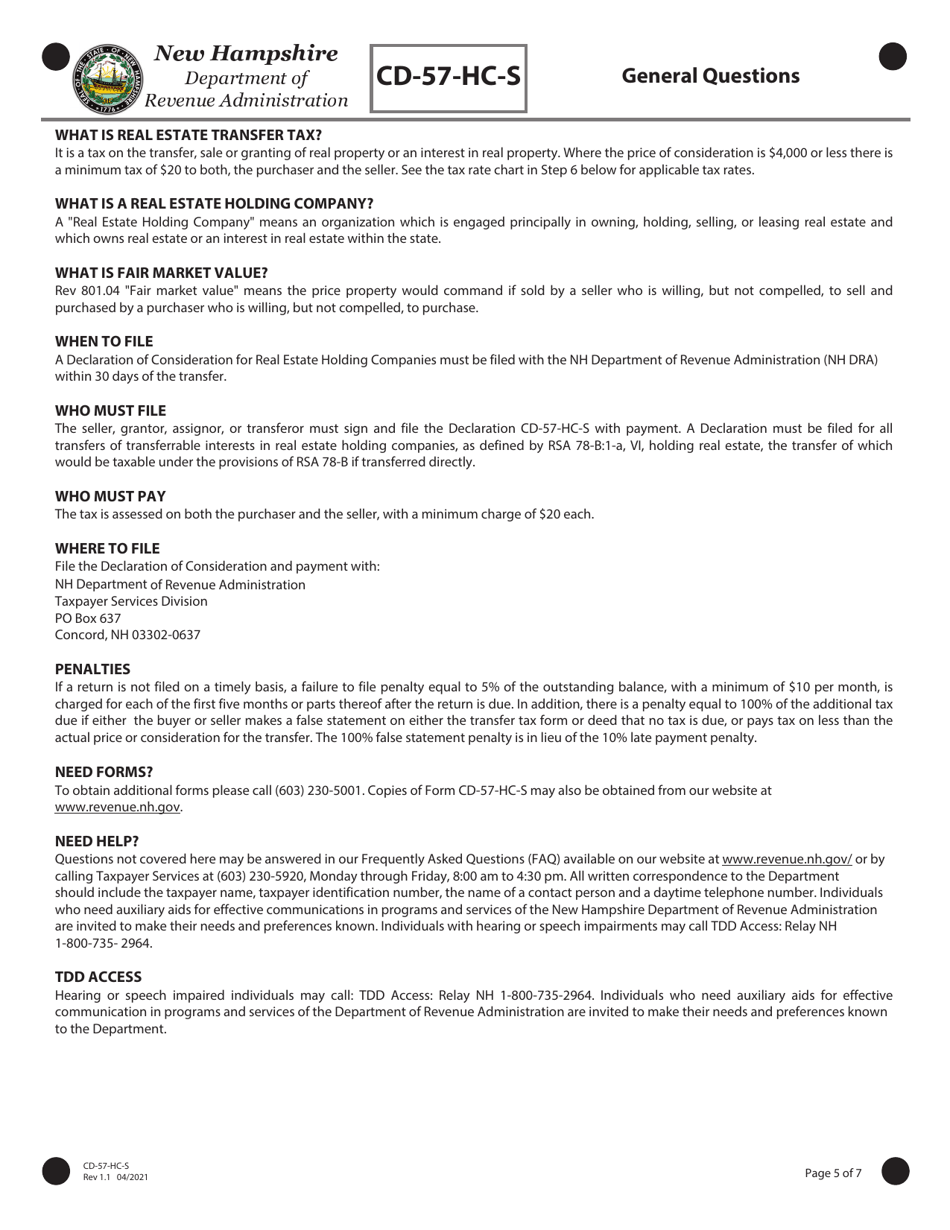

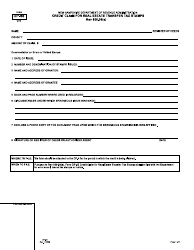

Form CD-57-HC-S Real Estate Transfer Tax Declaration of Consideration for Real Estate Holding Companies (Seller) - New Hampshire

What Is Form CD-57-HC-S?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-57-HC-S?

A: Form CD-57-HC-S is the Real Estate Transfer Tax Declaration of Consideration for Real Estate Holding Companies (Seller) in New Hampshire.

Q: Who needs to fill out Form CD-57-HC-S?

A: Real estate holding companies in New Hampshire who are the sellers of the property need to fill out this form.

Q: What is the purpose of Form CD-57-HC-S?

A: The purpose of this form is to declare the consideration for the transfer of real estate by a real estate holding company in New Hampshire.

Q: What information is required on Form CD-57-HC-S?

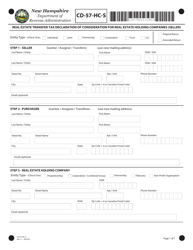

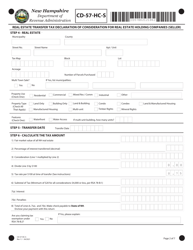

A: This form requires information such as the seller's name, address, federal identification number, buyer's name, property details, and the consideration amount.

Q: Is there a deadline for filing Form CD-57-HC-S?

A: Yes, Form CD-57-HC-S must be filed within 30 days of the transfer of the property.

Q: Are there any fees associated with filing Form CD-57-HC-S?

A: Yes, there is a fee for filing this form, which is based on the consideration amount.

Q: What happens after I submit Form CD-57-HC-S?

A: After submitting this form, you will need to pay the applicable transfer tax based on the consideration amount.

Q: What if I have more questions about Form CD-57-HC-S?

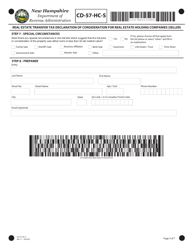

A: If you have additional questions or need further assistance, you can contact the New Hampshire Department of Revenue Administration for guidance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-HC-S by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.