This version of the form is not currently in use and is provided for reference only. Download this version of

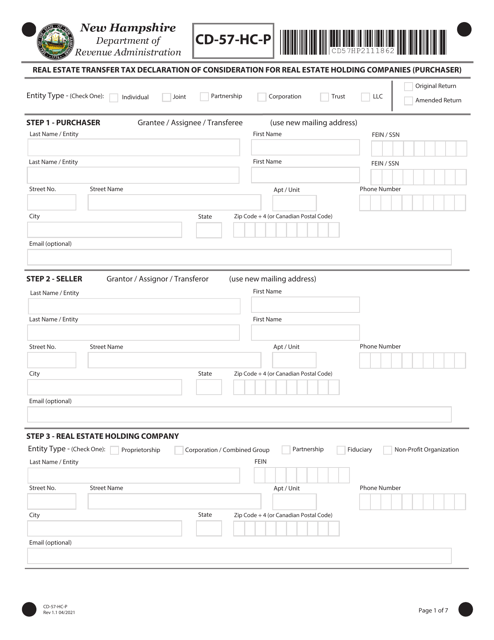

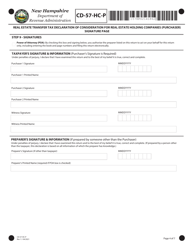

Form CD-57-HC-P

for the current year.

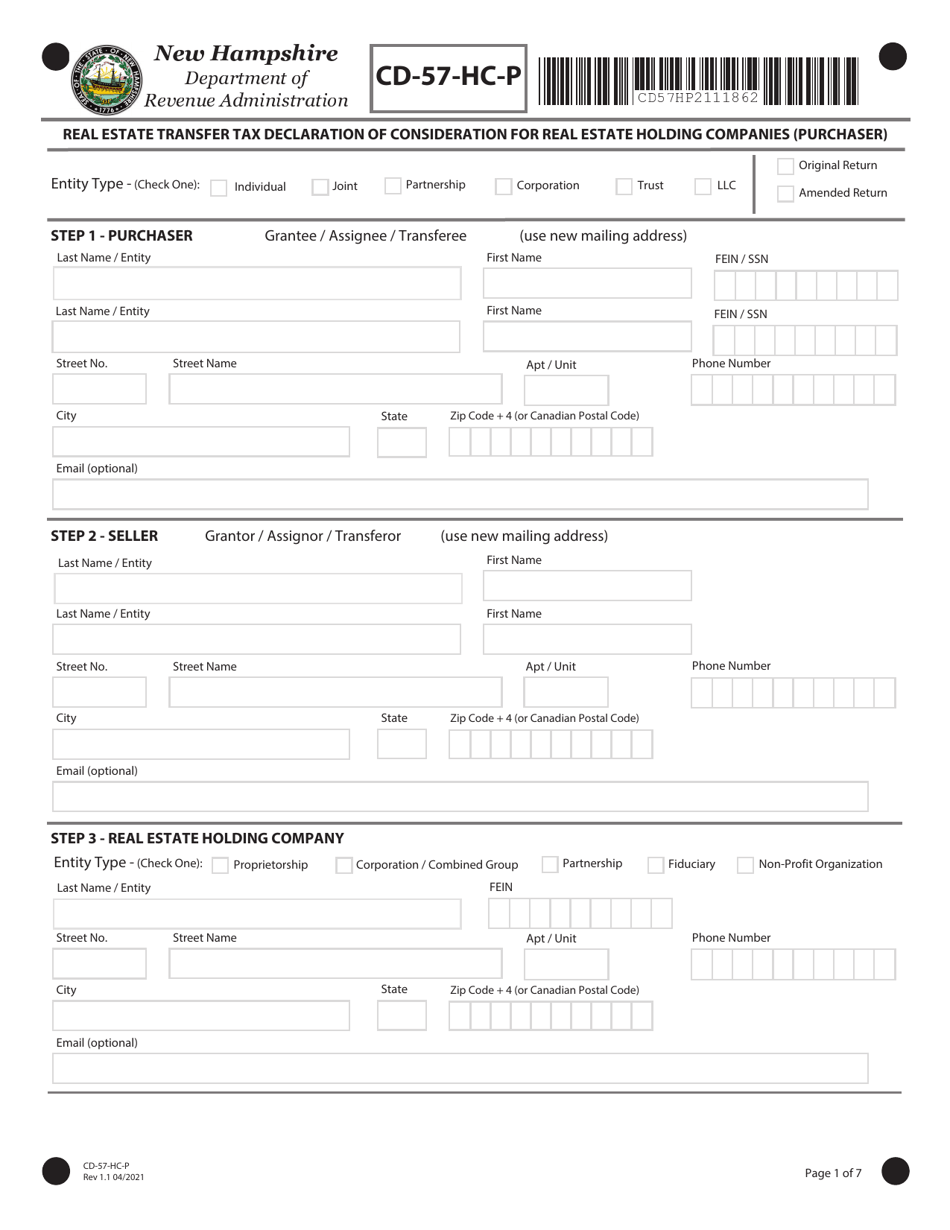

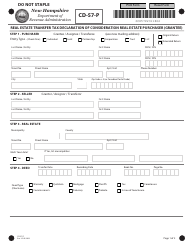

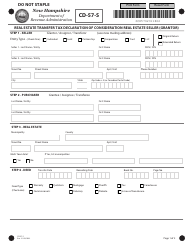

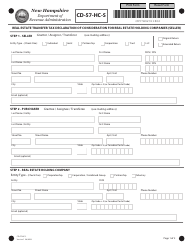

Form CD-57-HC-P Real Estate Transfer Tax Declaration of Consideration for Real Estate Holding Companies (Purchaser) - New Hampshire

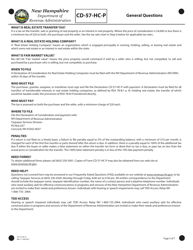

What Is Form CD-57-HC-P?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-57-HC-P?

A: Form CD-57-HC-P is the Real Estate Transfer Tax Declaration of Consideration for Real Estate Holding Companies (Purchaser) in New Hampshire.

Q: Who needs to fill out Form CD-57-HC-P?

A: Real estate holding companies who are purchasing property in New Hampshire need to fill out this form.

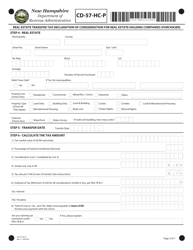

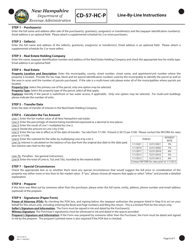

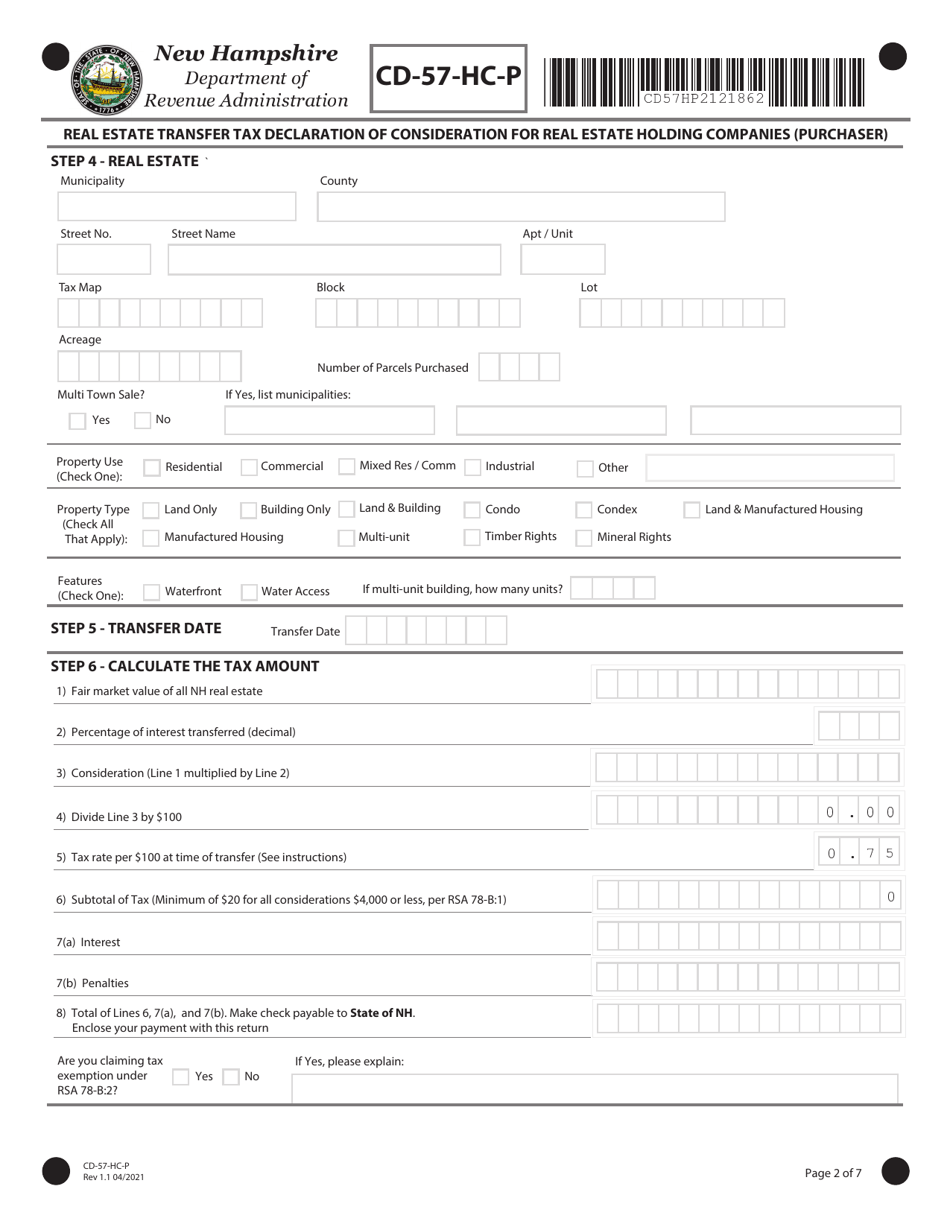

Q: What is the purpose of Form CD-57-HC-P?

A: The purpose of this form is to declare the consideration, or the amount paid, for the real estate being purchased by the holding company.

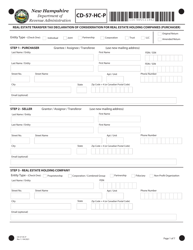

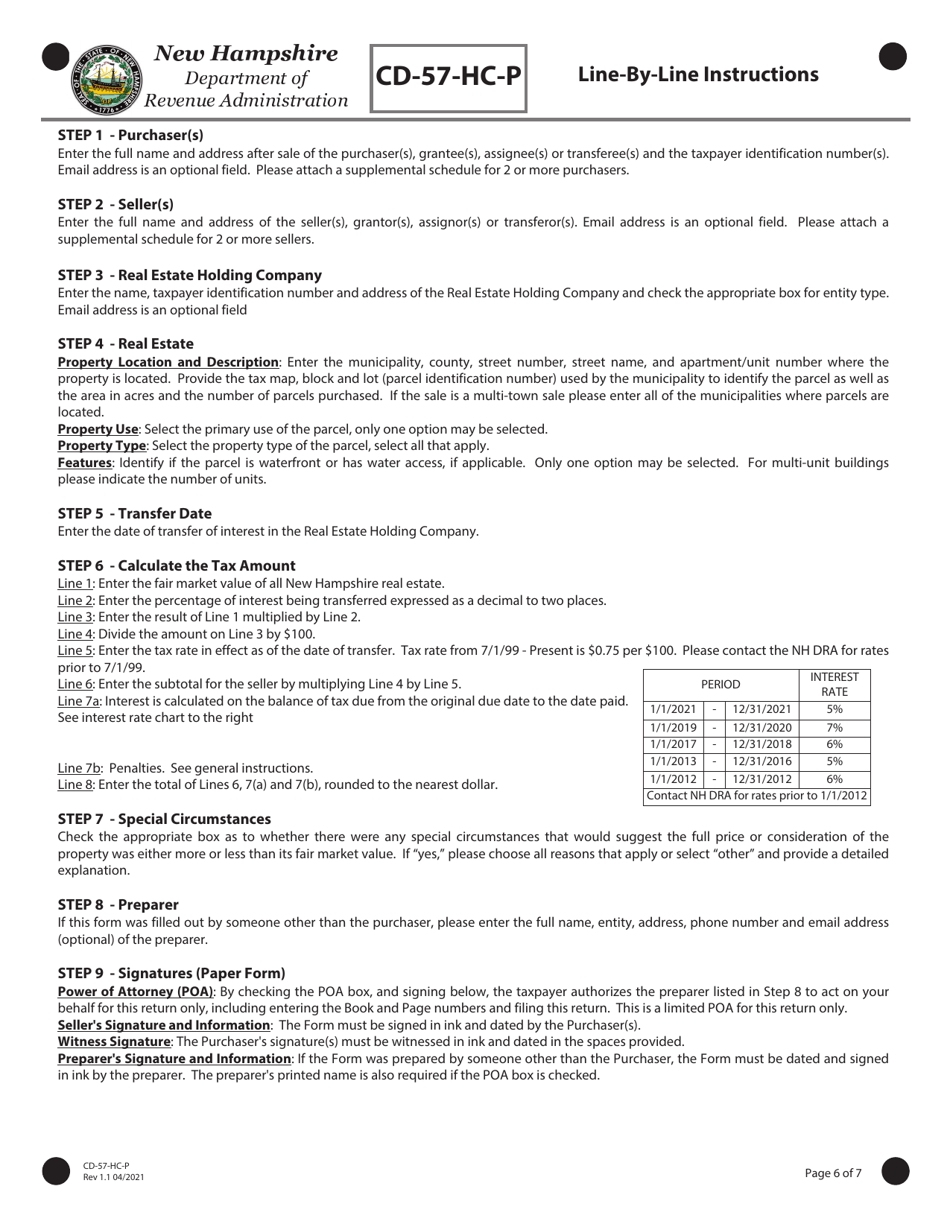

Q: When should Form CD-57-HC-P be filed?

A: Form CD-57-HC-P should be filed at the time of recording the deed transferring the real estate.

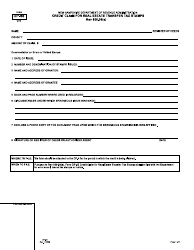

Q: What supporting documents are required with Form CD-57-HC-P?

A: Along with the completed form, you will need to include a copy of the deed and any other relevant documentation related to the real estate transaction.

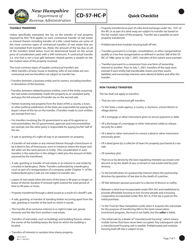

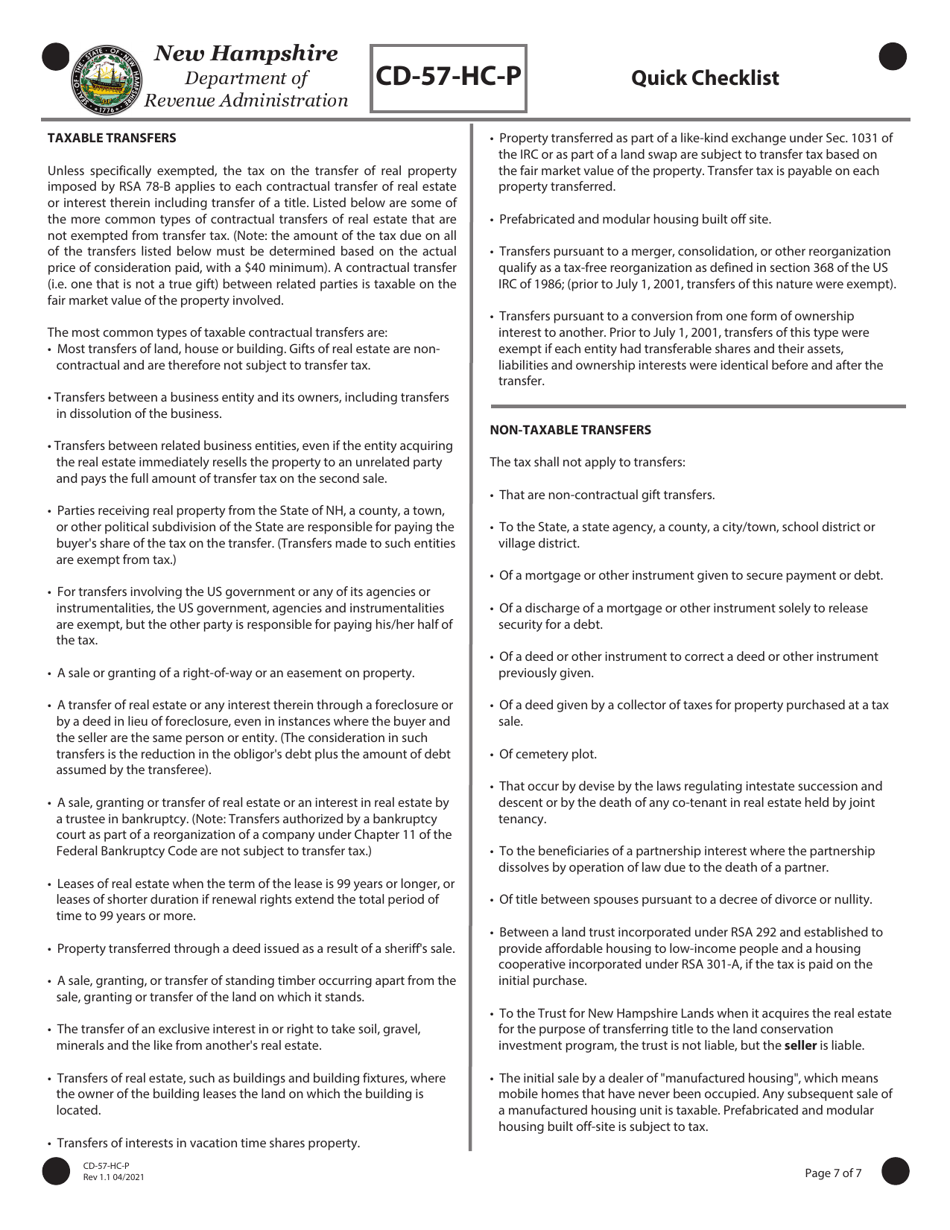

Q: Are there any exemptions to the Real Estate Transfer Tax for holding companies?

A: Yes, there are certain exemptions available. It is important to consult the New Hampshire Department of Revenue Administration or a tax professional to determine if your transaction qualifies for an exemption.

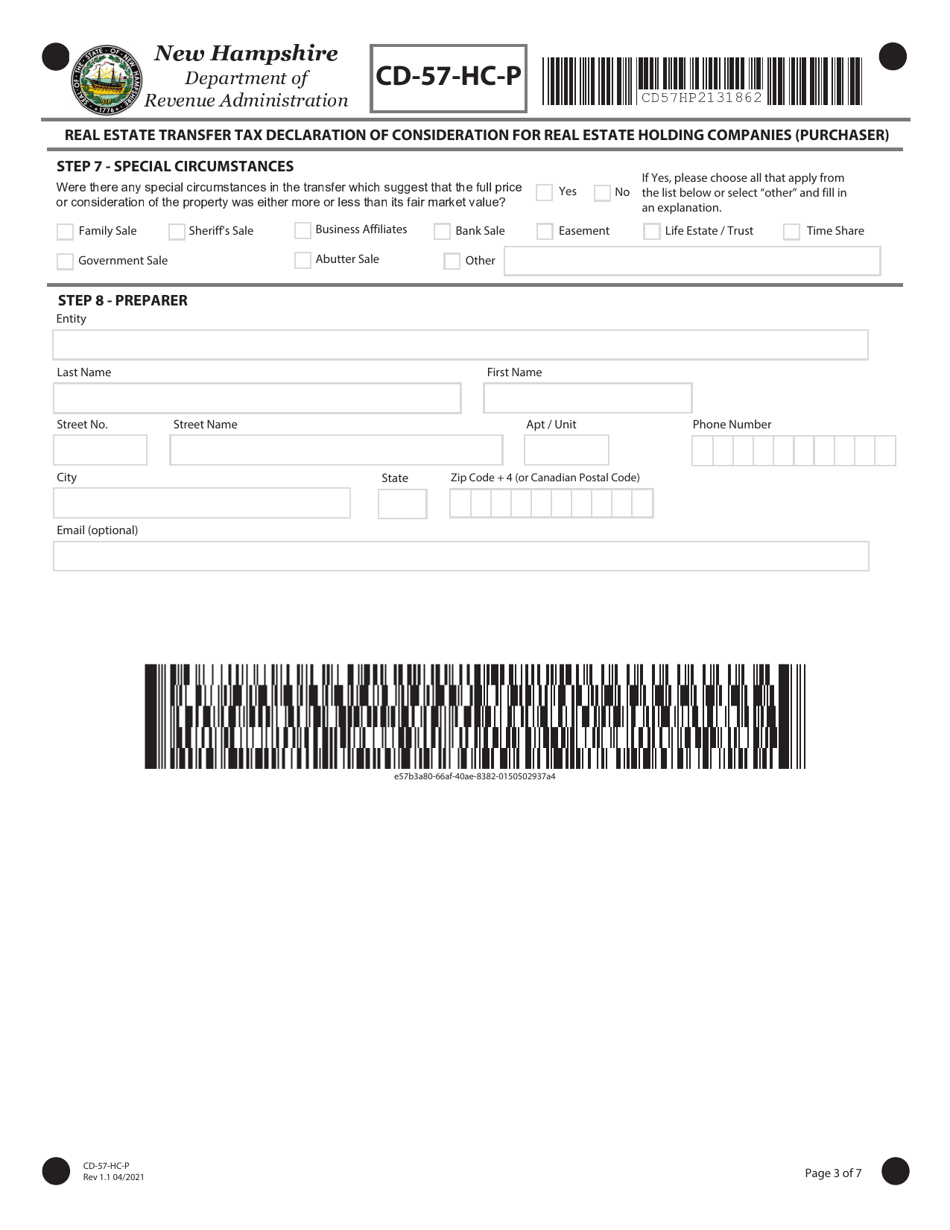

Q: What are the consequences of not filing Form CD-57-HC-P?

A: Failure to file this form or provide false information may result in penalties, fines, or legal consequences.

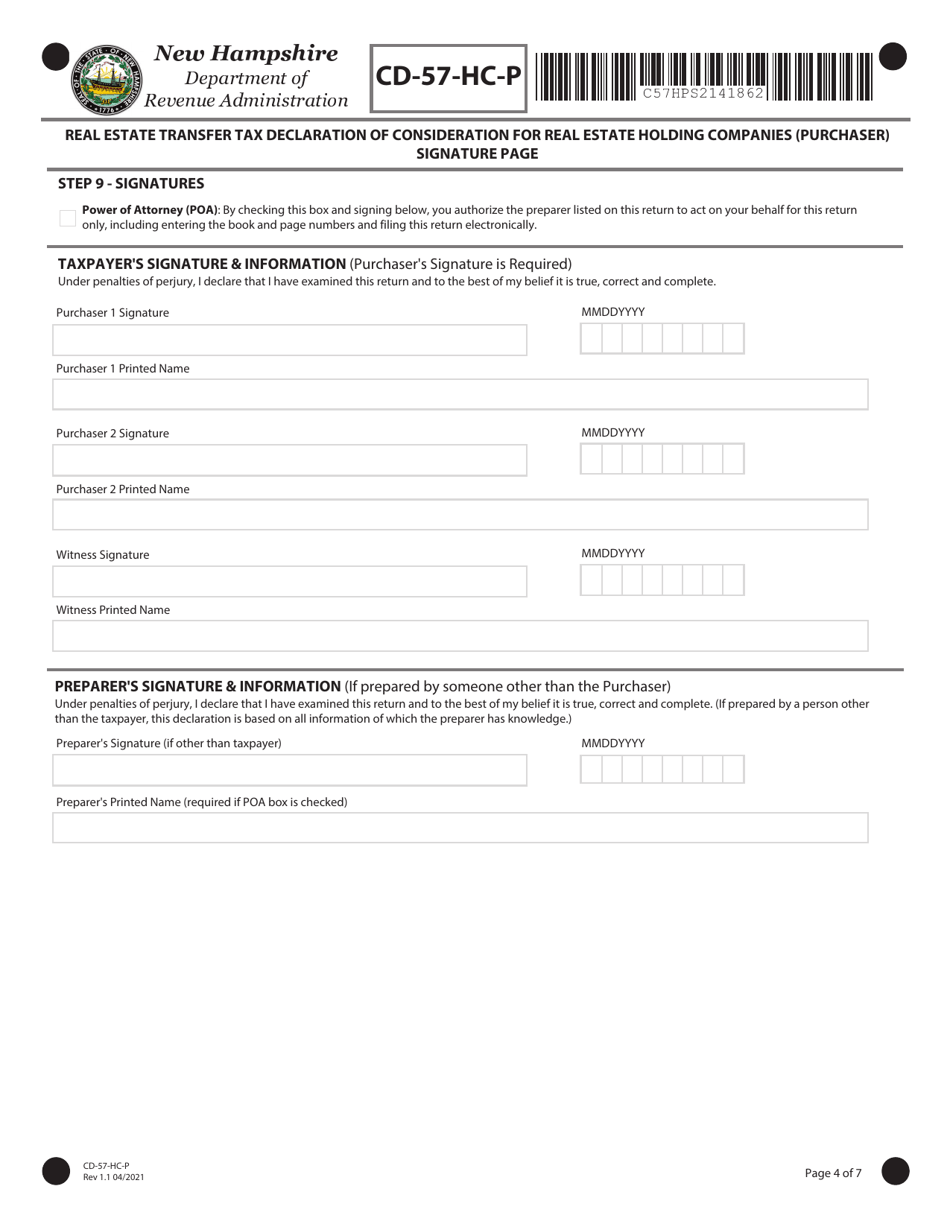

Q: Can I e-file Form CD-57-HC-P?

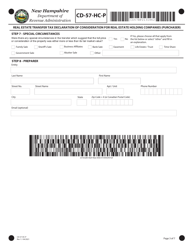

A: No, currently e-filing is not available for this form. It must be filed in paper format.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-HC-P by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.