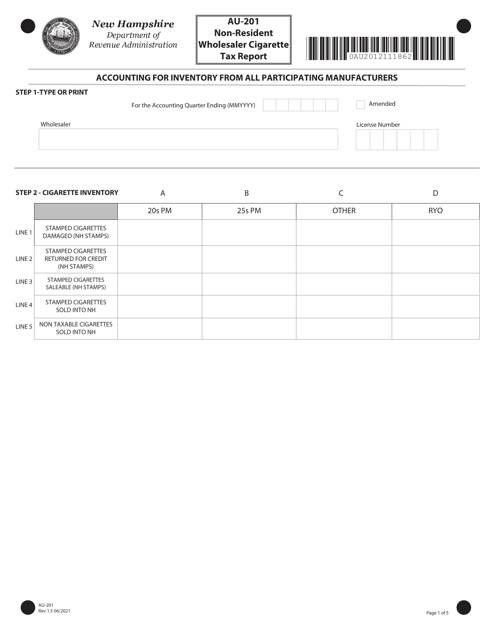

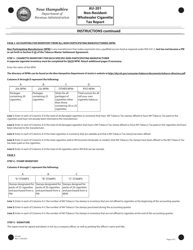

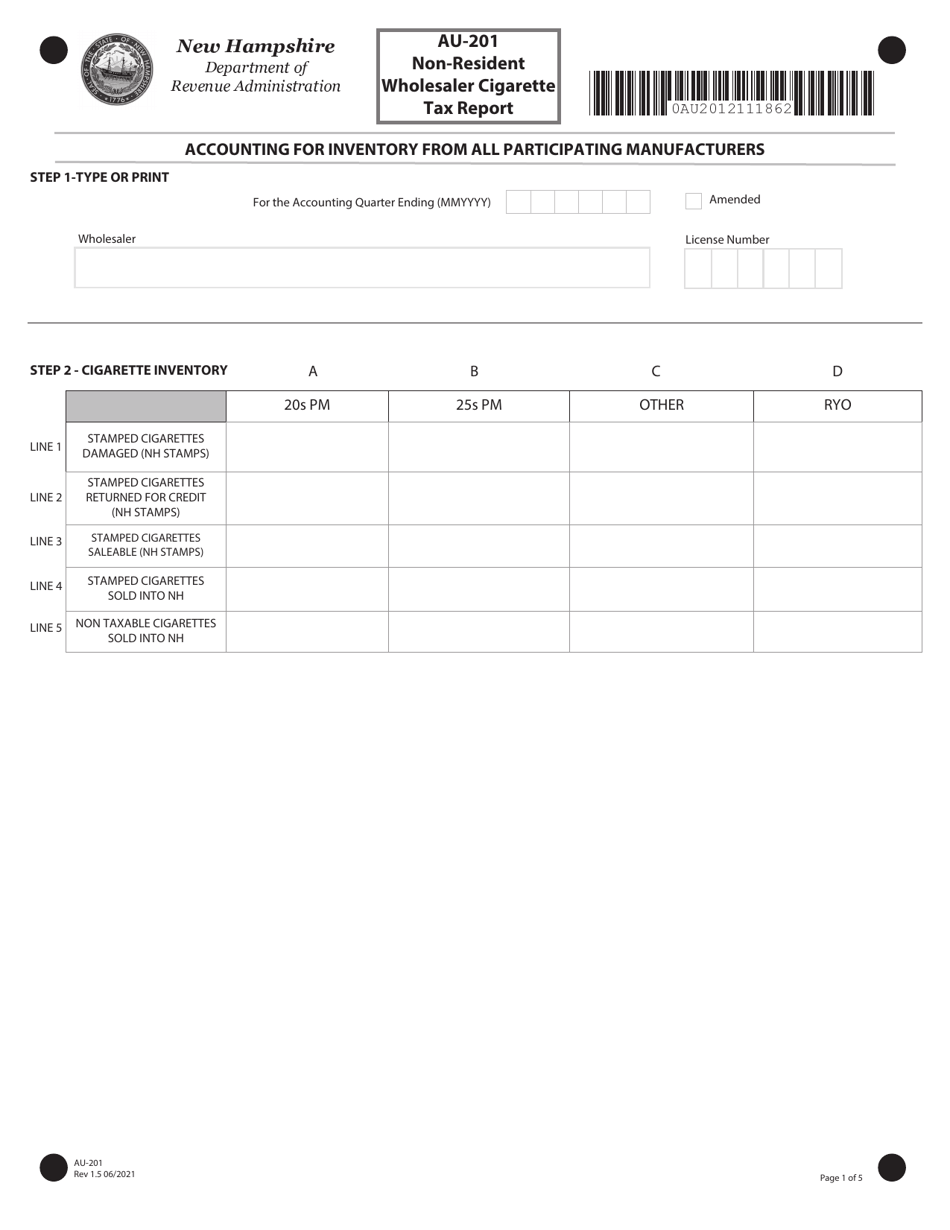

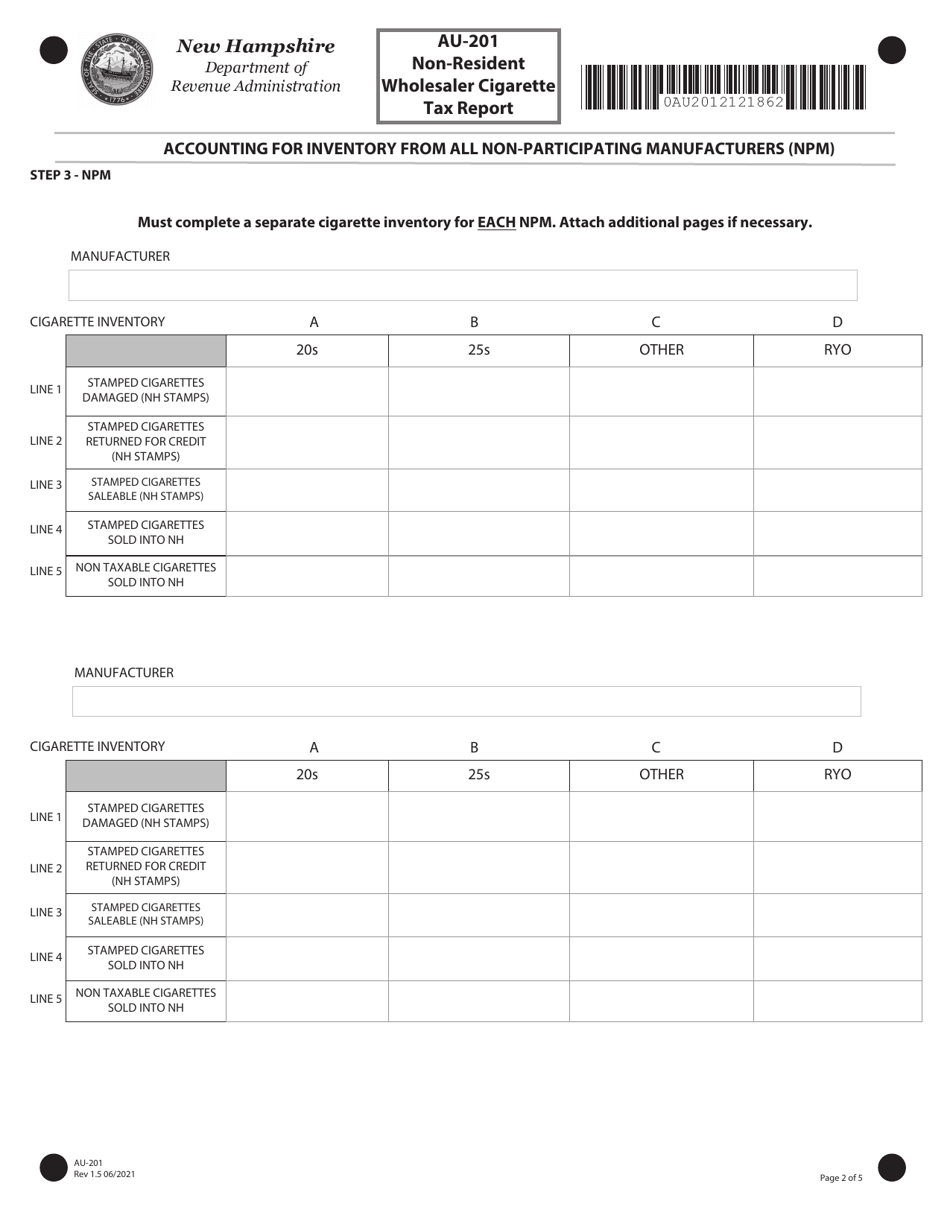

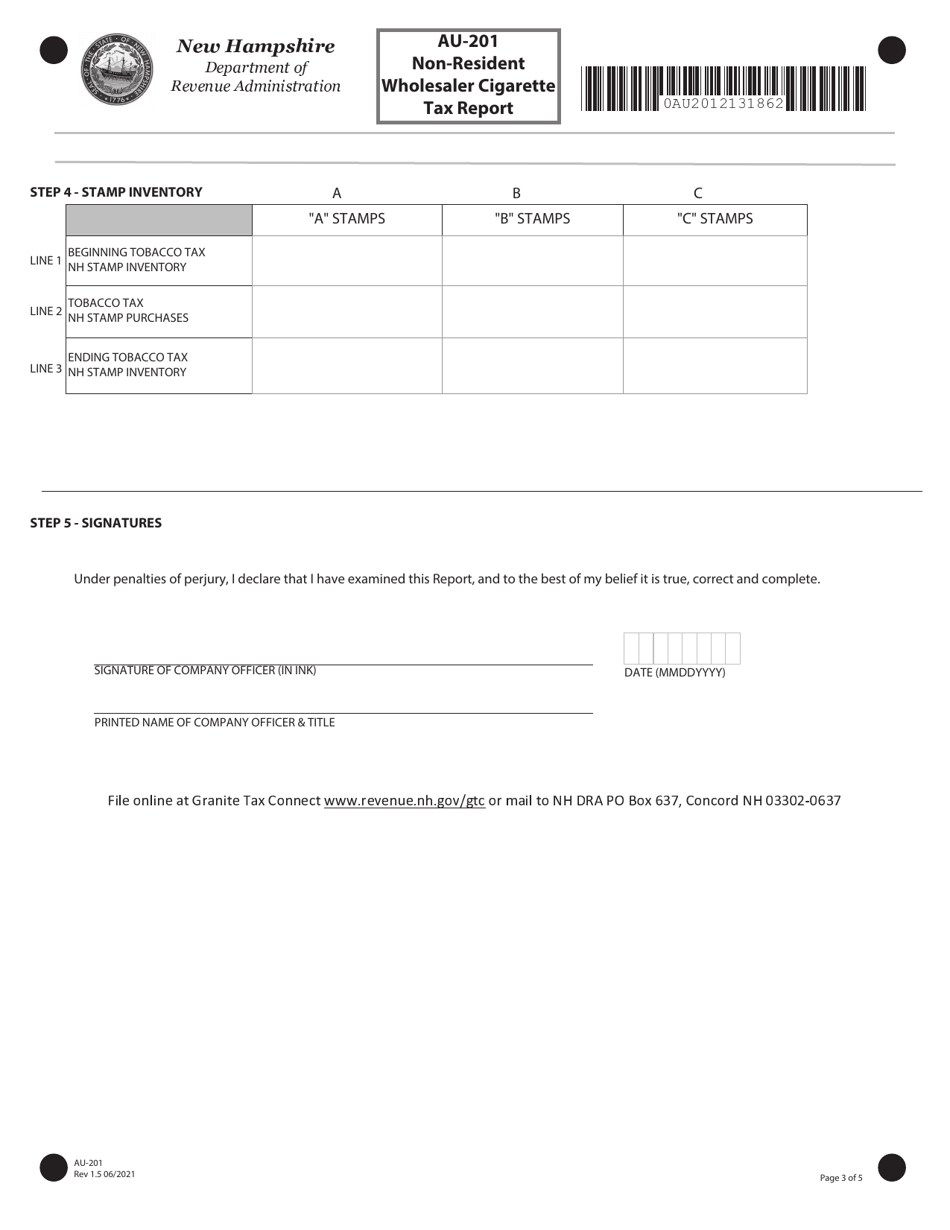

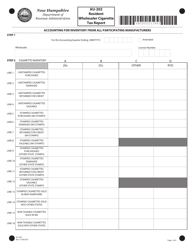

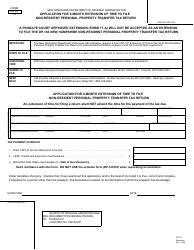

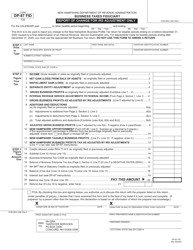

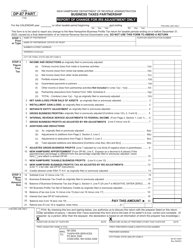

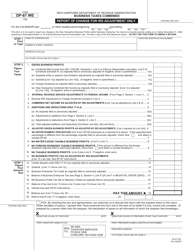

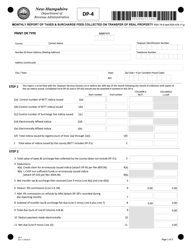

Form AU-201 Non-resident Wholesaler Cigarette Tax Report - New Hampshire

What Is Form AU-201?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-201?

A: Form AU-201 is the Non-resident Wholesaler Cigarette Tax Report for New Hampshire.

Q: Who needs to file Form AU-201?

A: Non-resident wholesalers of cigarettes who do business in New Hampshire need to file Form AU-201.

Q: What is the purpose of Form AU-201?

A: Form AU-201 is used to report and pay the cigarette tax owed by non-resident wholesalers for sales made in New Hampshire.

Q: How often should Form AU-201 be filed?

A: Form AU-201 should be filed on a monthly basis.

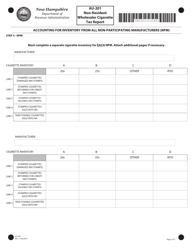

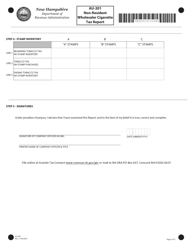

Q: What information is required on Form AU-201?

A: Form AU-201 requires information on the quantity of cigarettes sold, the amount of tax due, and other related details.

Q: Are there any penalties for not filing Form AU-201?

A: Yes, failure to file Form AU-201 or pay the required tax may result in penalties and interest.

Q: Can I claim a refund on Form AU-201?

A: No, Form AU-201 is used only for reporting and paying the cigarette tax, not for claiming refunds.

Q: Are there any exemptions to filing Form AU-201?

A: There are no exemptions for non-resident wholesalers from filing Form AU-201 if they do business in New Hampshire.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-201 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.