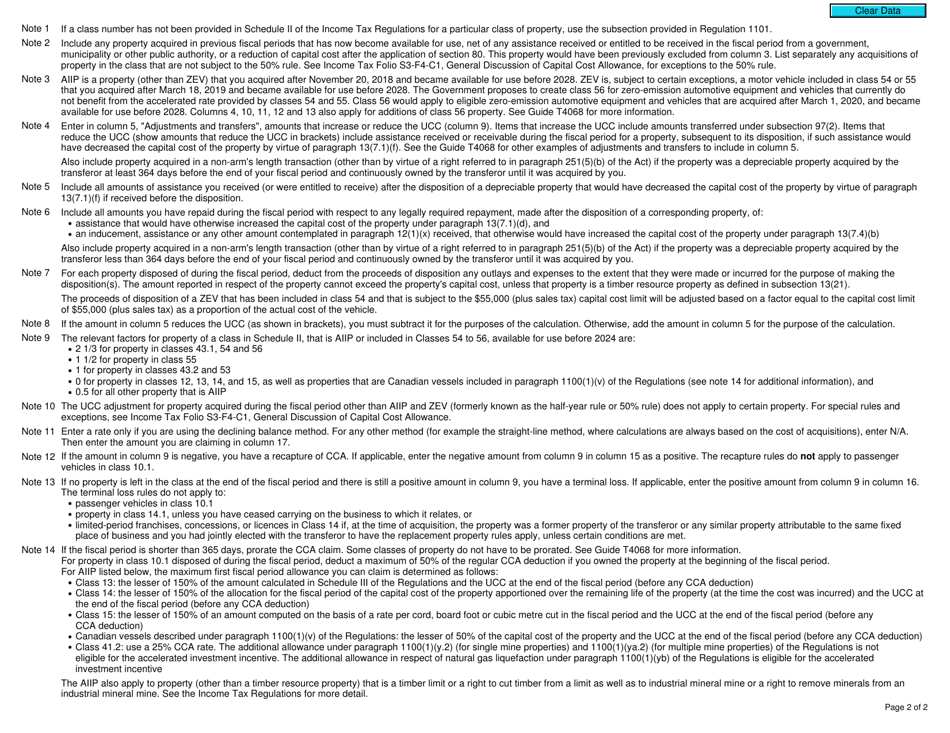

This version of the form is not currently in use and is provided for reference only. Download this version of

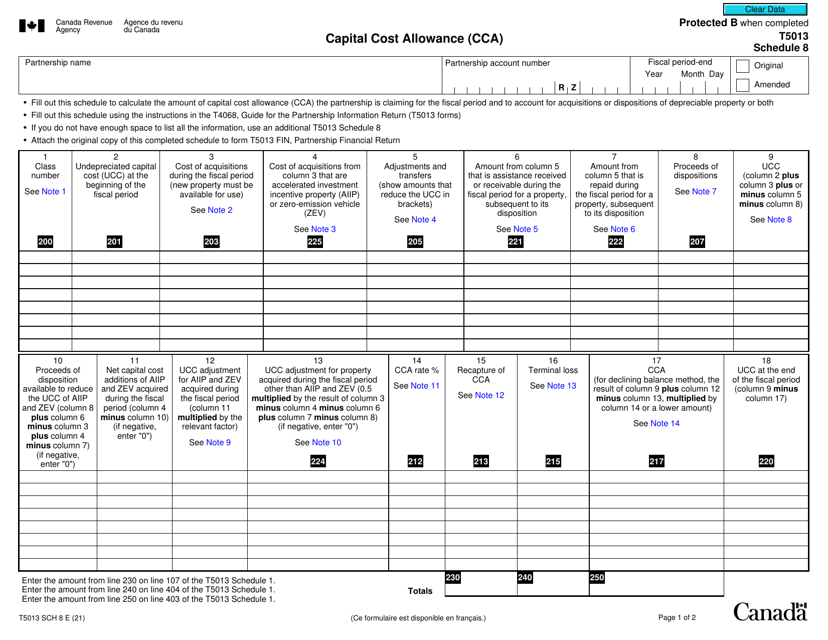

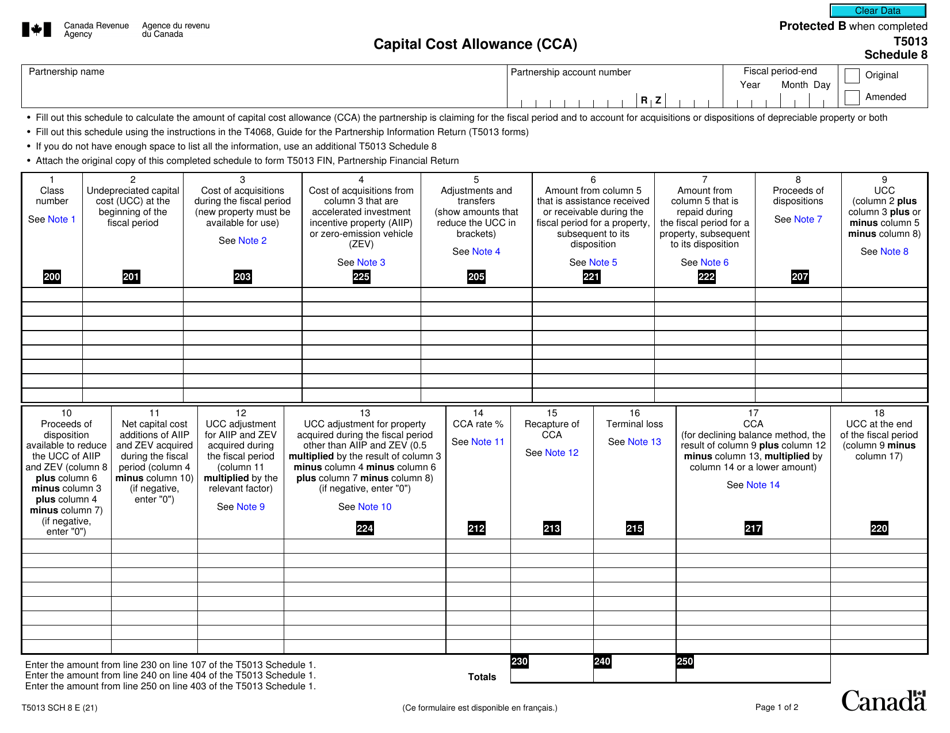

Form T5013 Schedule 8

for the current year.

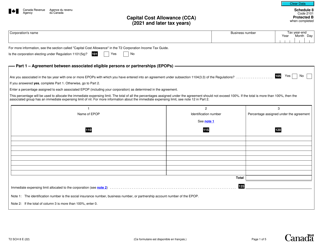

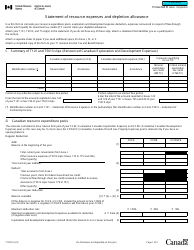

Form T5013 Schedule 8 Capital Cost Allowance (Cca) - Canada

Form T5013 Schedule 8 Capital Cost Allowance (CCA) in Canada is used to calculate the amount of capital cost allowance (or depreciation) that can be deducted for tax purposes on business assets.

Form T5013 Schedule 8 Capital Cost Allowance (CCA) in Canada is filed by businesses that have partnerships.

FAQ

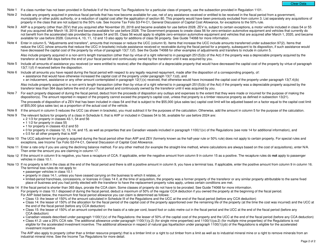

Q: What is Form T5013 Schedule 8?

A: Form T5013 Schedule 8 is a schedule used in Canada for reporting Capital Cost Allowance (CCA) deductions.

Q: What is Capital Cost Allowance (CCA)?

A: Capital Cost Allowance (CCA) is a tax deduction in Canada that allows businesses to recover the cost of certain capital assets over time.

Q: Who needs to complete Form T5013 Schedule 8?

A: Partnerships in Canada that have capital cost allowance (CCA) deductions to claim need to complete Form T5013 Schedule 8.

Q: What information is required to complete Form T5013 Schedule 8?

A: To complete Form T5013 Schedule 8, you will need to provide details about the property, including the class number, acquisition date, and capital cost.

Q: How is Capital Cost Allowance (CCA) calculated?

A: Capital Cost Allowance (CCA) is calculated based on the class and rate specified by the Canada Revenue Agency (CRA) for each type of asset.

Q: Is there a deadline to submit Form T5013 Schedule 8?

A: The deadline to submit Form T5013 Schedule 8 is within 90 days of the partnership's fiscal period end.

Q: What happens if Form T5013 Schedule 8 is not filed on time?

A: Failing to file Form T5013 Schedule 8 on time may result in penalties and interest charges.