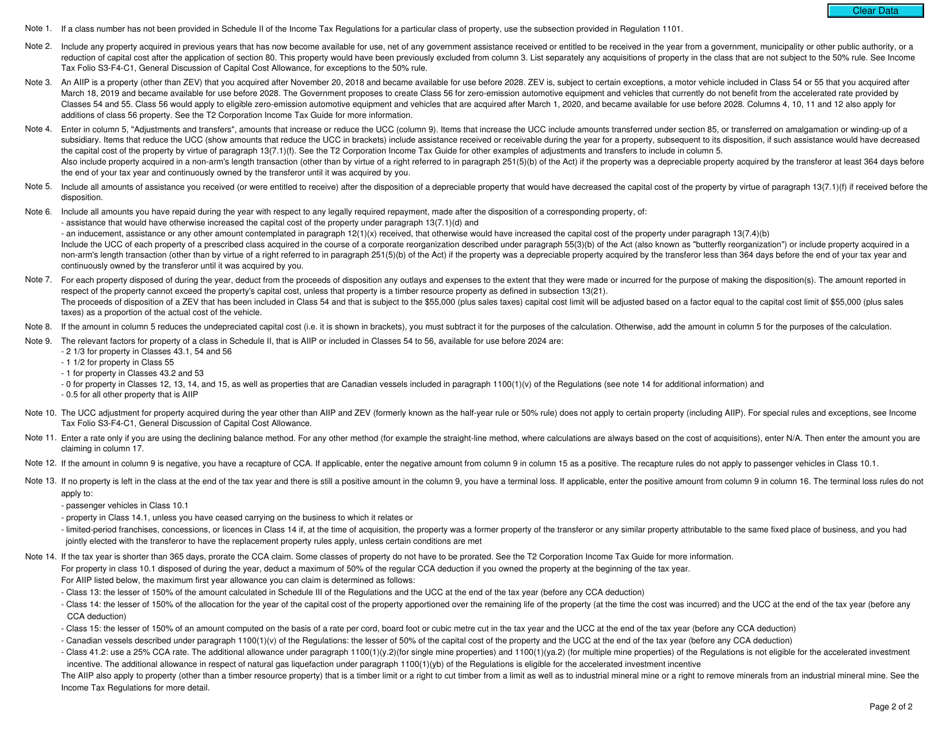

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 8

for the current year.

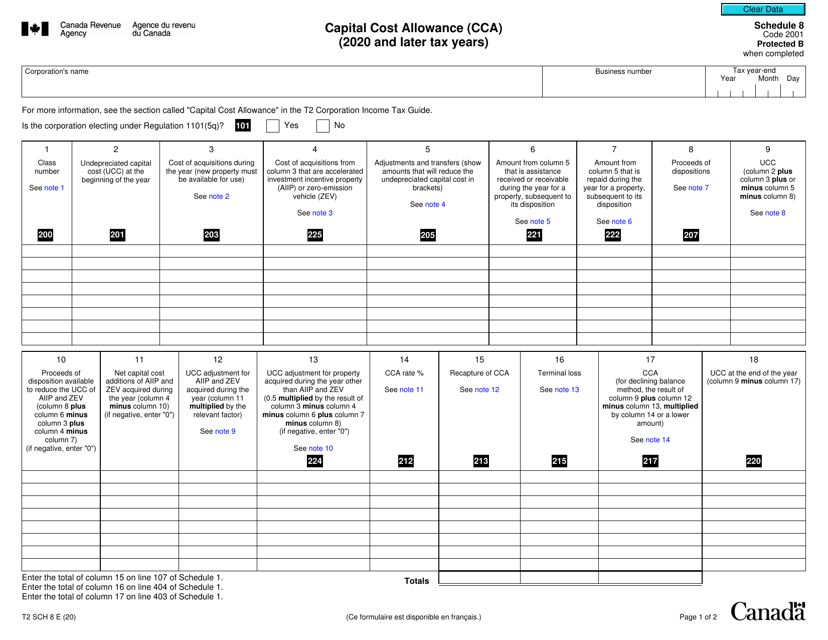

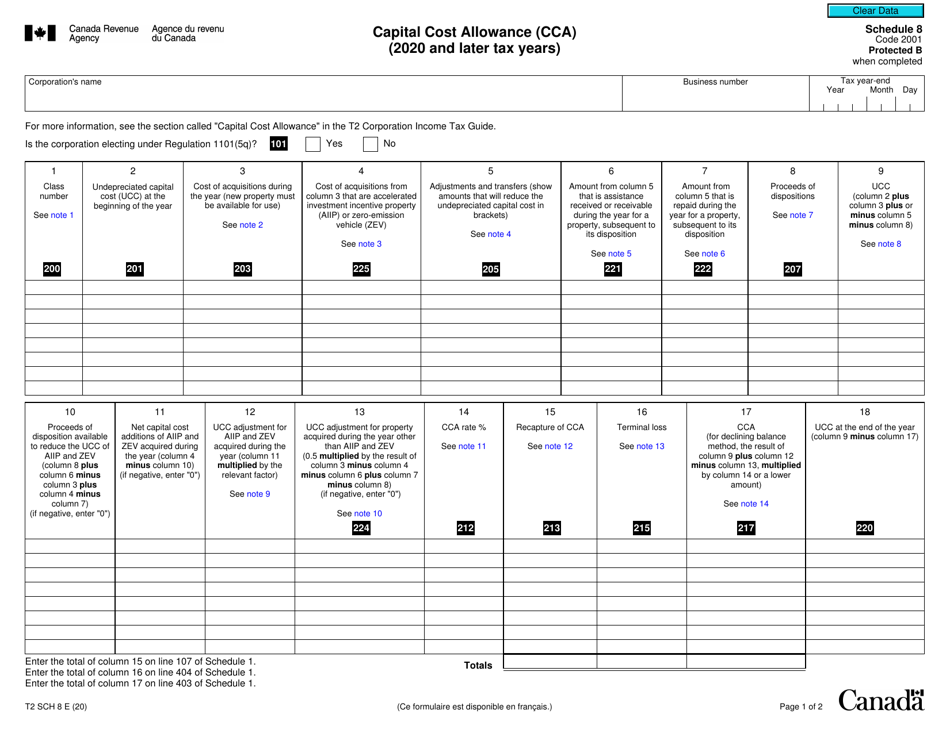

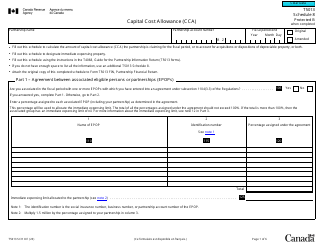

Form T2 Schedule 8 Capital Cost Allowance (Cca) (2020 and Later Tax Years) - Canada

Form T2 Schedule 8 Capital Cost Allowance (CCA) in Canada is used to calculate and claim tax deductions for depreciation on capital assets (such as buildings, equipment, and vehicles) owned by a business. The form helps businesses calculate the amount of CCA they can deduct from their taxable income.

The Form T2 Schedule 8 Capital Cost Allowance (CCA) is typically filed by Canadian corporations or businesses to claim tax deductions for capital assets they have acquired.

FAQ

Q: What is Form T2 Schedule 8?

A: Form T2 Schedule 8 is a tax form used in Canada to calculate the Capital Cost Allowance (CCA) for a corporation.

Q: What is Capital Cost Allowance (CCA)?

A: Capital Cost Allowance (CCA) is a tax deduction that allows Canadian businesses to recover the cost of capital assets over time.

Q: What is the purpose of Form T2 Schedule 8?

A: The purpose of Form T2 Schedule 8 is to calculate the allowable CCA deduction for a corporation's tax return.

Q: Which tax years does Form T2 Schedule 8 apply to?

A: Form T2 Schedule 8 applies to tax years 2020 and later.

Q: How do I fill out Form T2 Schedule 8?

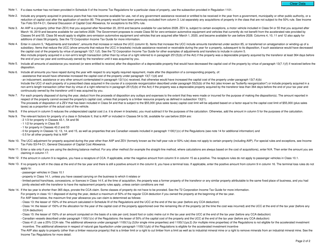

A: To fill out Form T2 Schedule 8, you need to provide information about the corporation's capital assets, including their cost, class, and CCA rate.