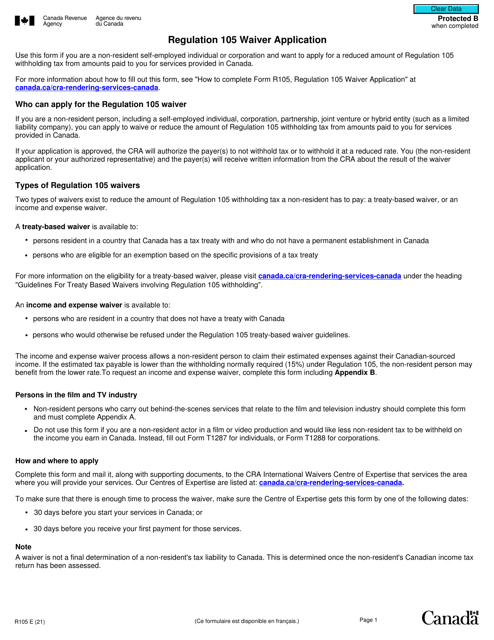

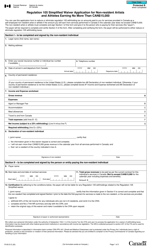

Form R105 Regulation 105 Waiver Application - Canada

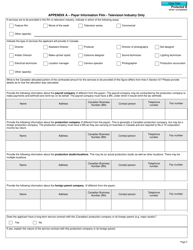

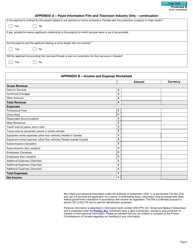

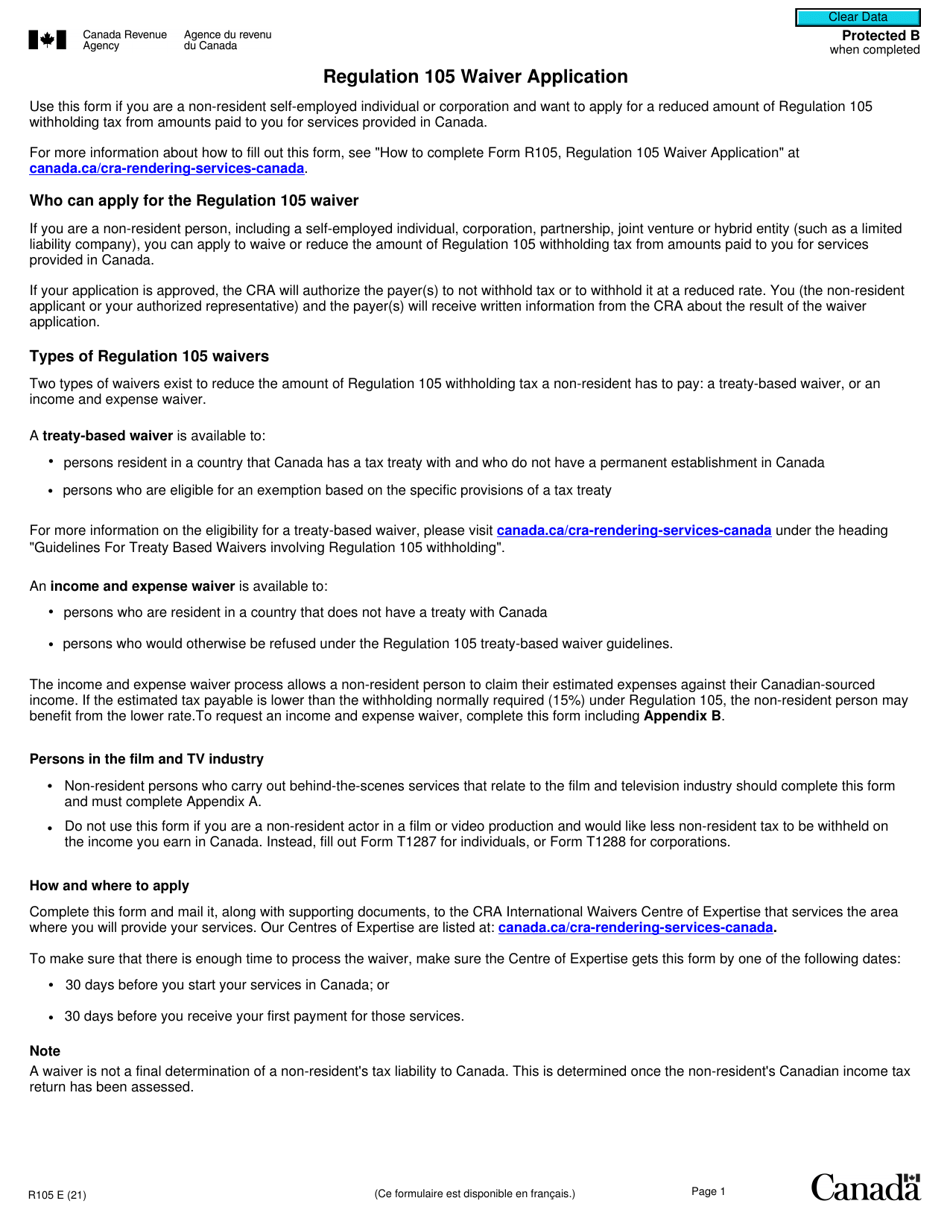

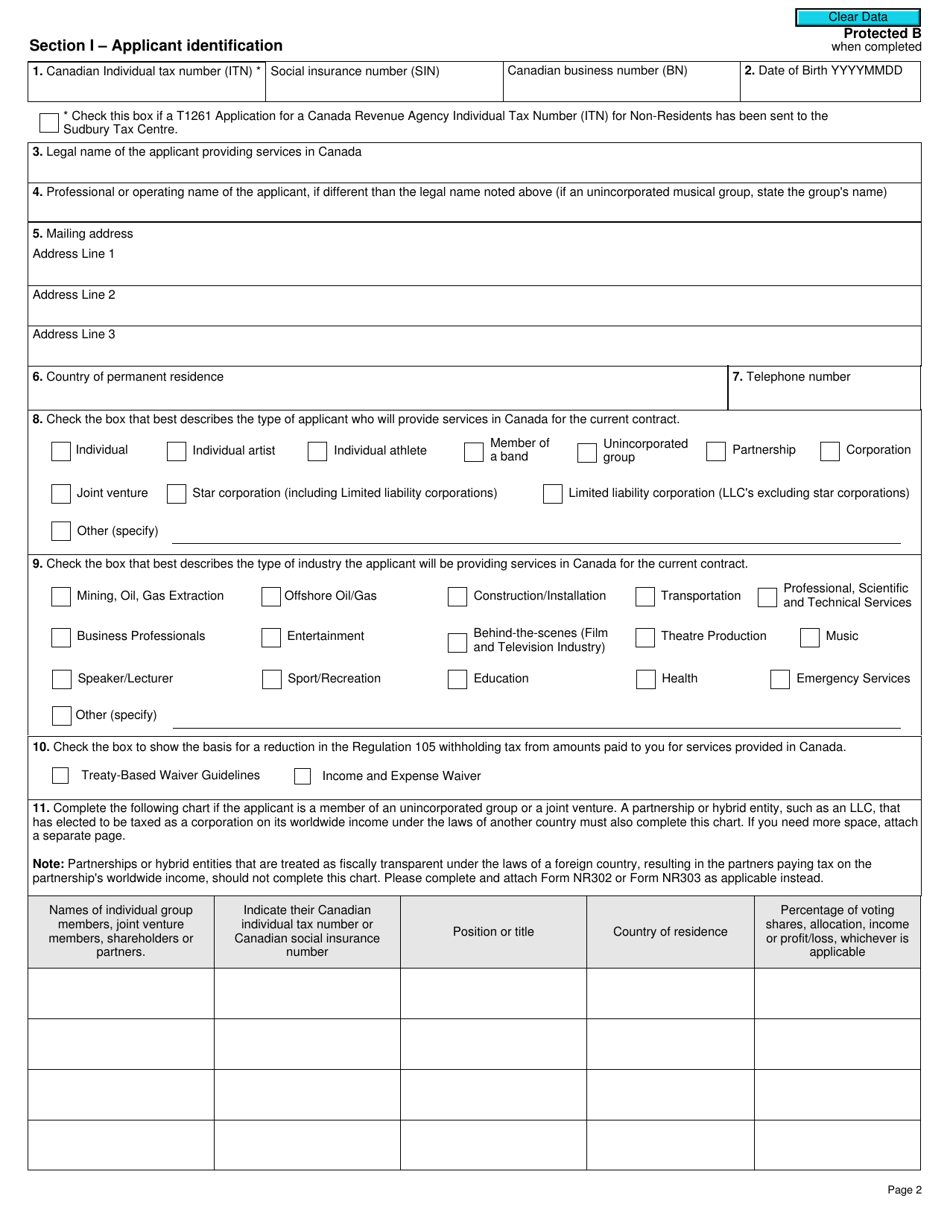

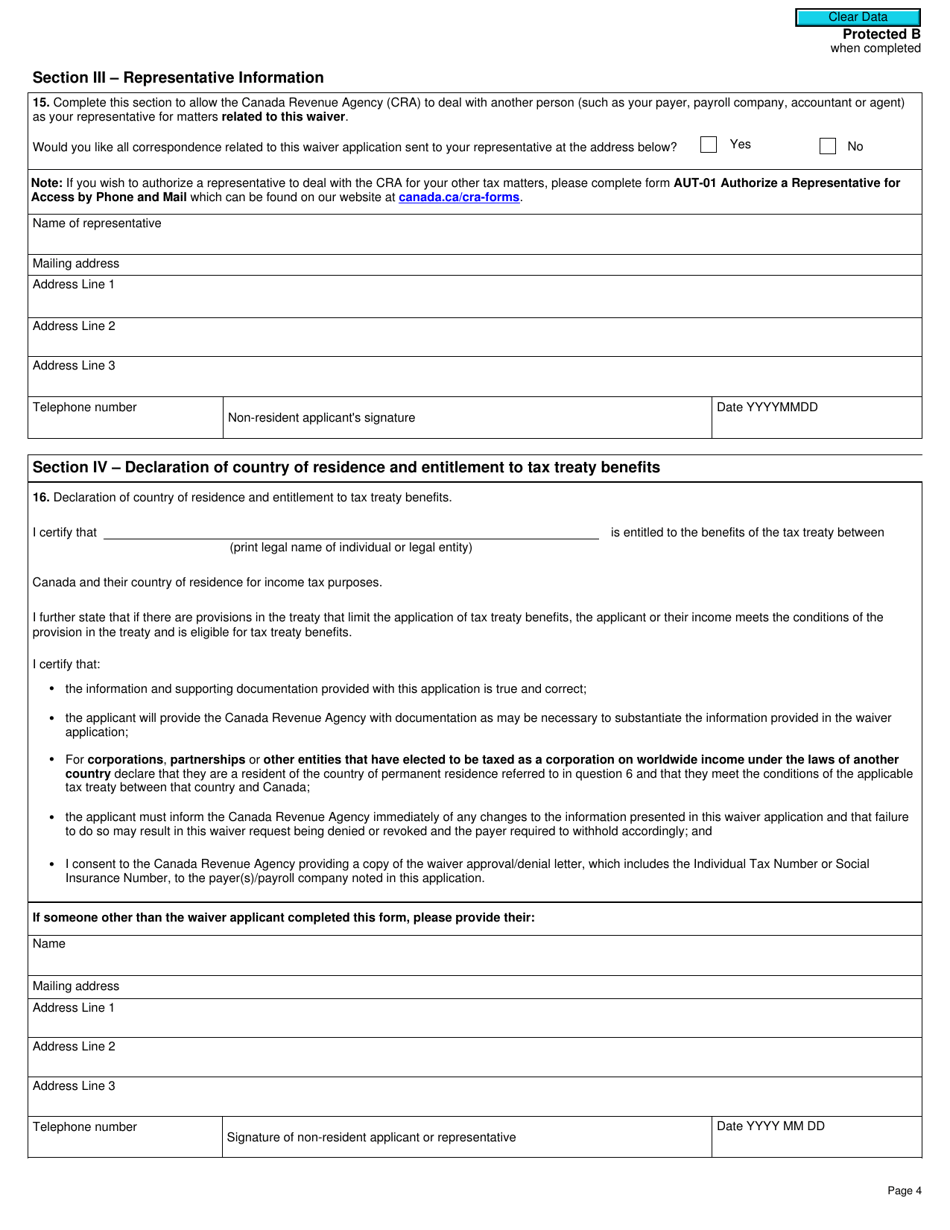

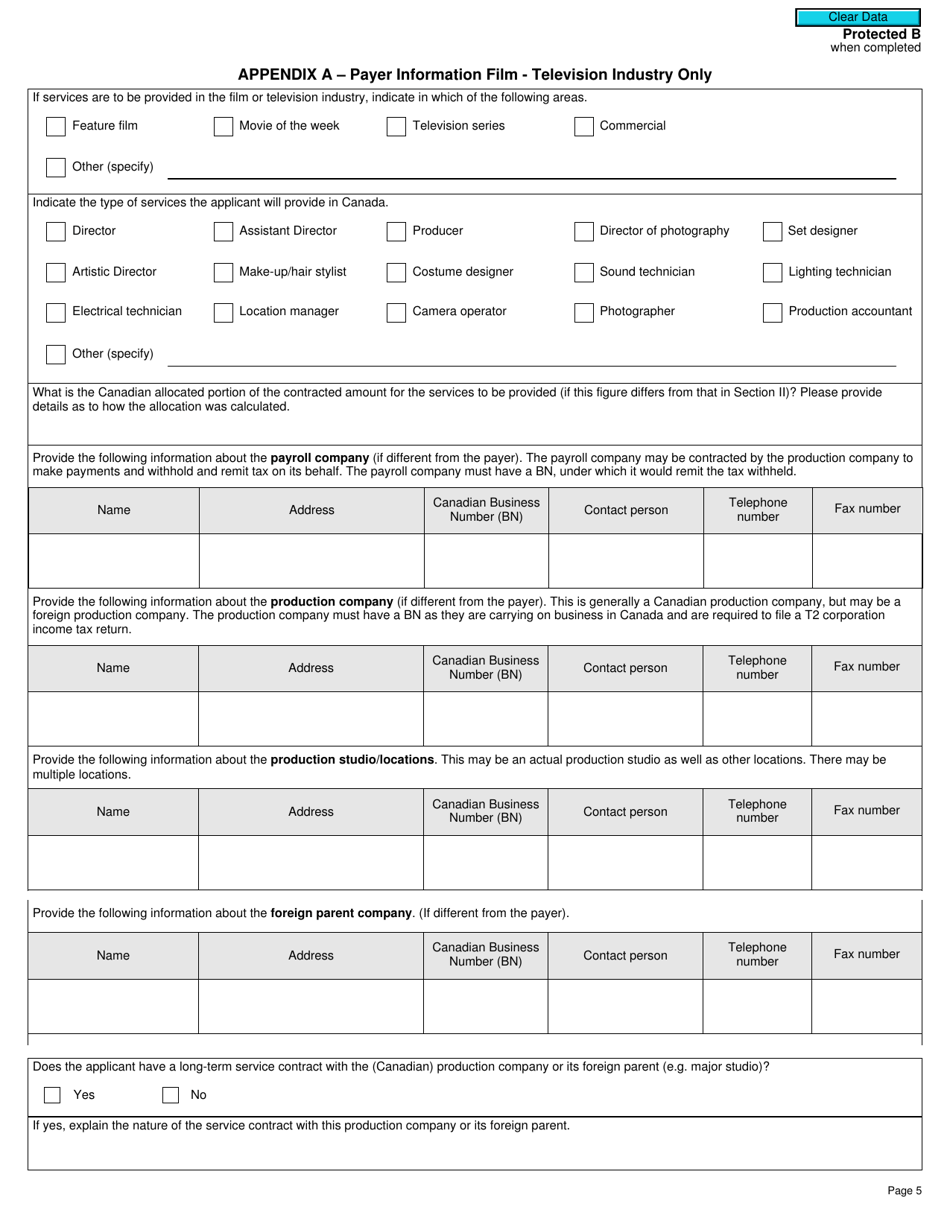

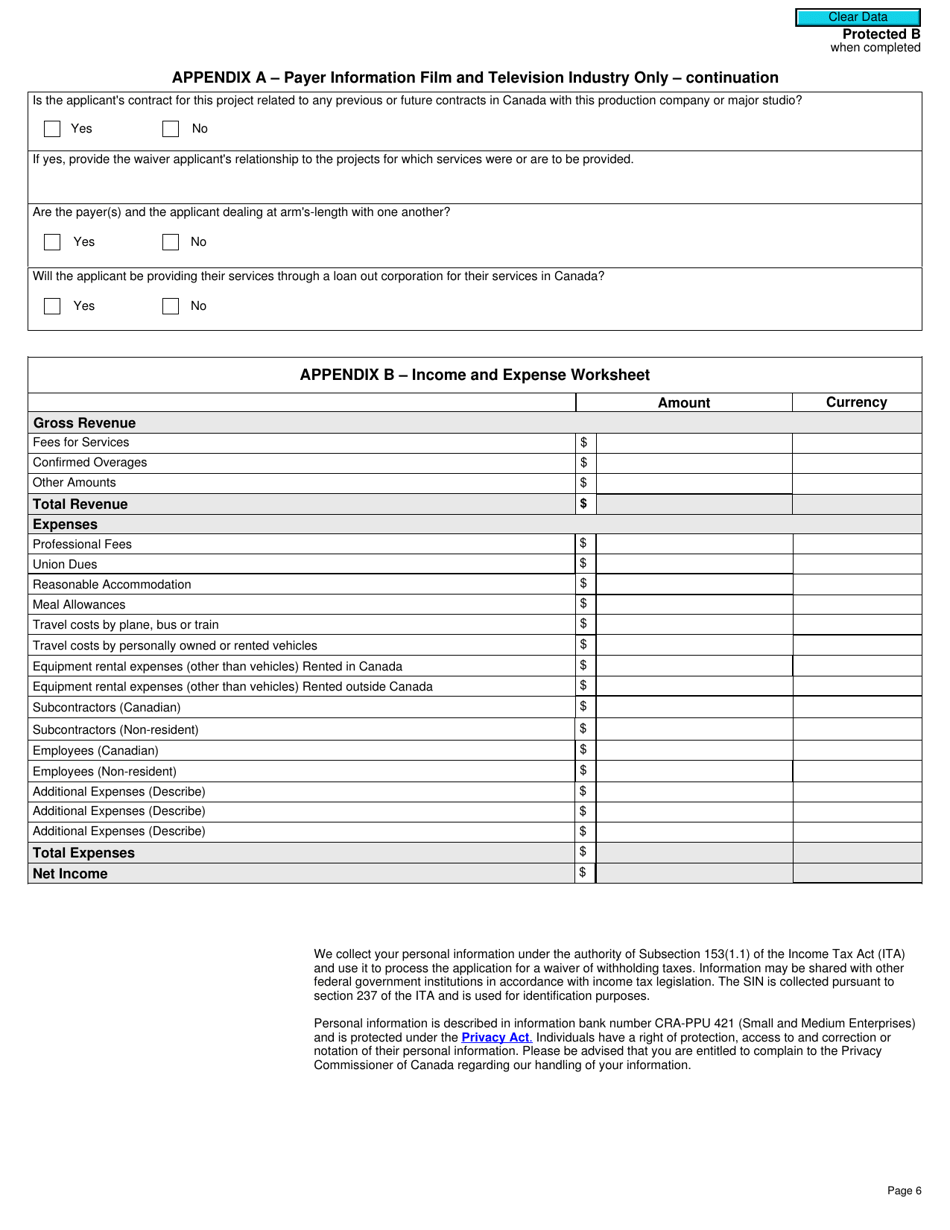

Form R105 Regulation 105 Waiver Application is used in Canada to apply for a waiver of withholding tax. This form allows non-residents to request a reduction or elimination of tax withholding on certain income they earn in Canada.

The Form R105 Regulation 105 waiver application in Canada is typically filed by the non-resident individual or business who wishes to obtain an exemption or reduction from withholding taxes.

FAQ

Q: What is Form R105?

A: Form R105 is a Regulation 105 Waiver Application in Canada.

Q: What is Regulation 105?

A: Regulation 105 is a Canadian tax regulation that requires non-residents to have tax withholding on certain types of income.

Q: Who needs to fill out Form R105?

A: Non-residents who are eligible for a Regulation 105 waiver in Canada need to fill out Form R105.

Q: What is the purpose of Form R105?

A: Form R105 is used to apply for a waiver from the tax withholding requirement under Regulation 105 for non-residents.

Q: How long does it take for a Form R105 application to be processed?

A: The processing time for a Form R105 application can vary, but it generally takes several weeks.

Q: Is there a fee to submit Form R105?

A: There is no fee to submit Form R105.

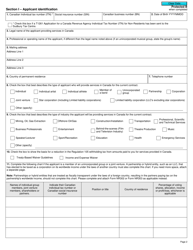

Q: What supporting documents are required with Form R105?

A: The specific supporting documents required with Form R105 vary depending on the individual situation, but generally include a letter of explanation and documentation related to the income in question.

Q: Can Form R105 be submitted electronically?

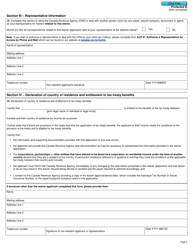

A: No, Form R105 cannot be submitted electronically. It must be printed and mailed to the CRA.

Q: Who can I contact for help with Form R105?

A: If you need assistance with Form R105, you can contact the CRA or consult with a tax professional.