This version of the form is not currently in use and is provided for reference only. Download this version of

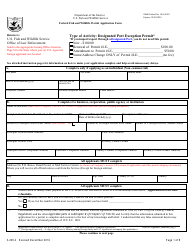

Form 533

for the current year.

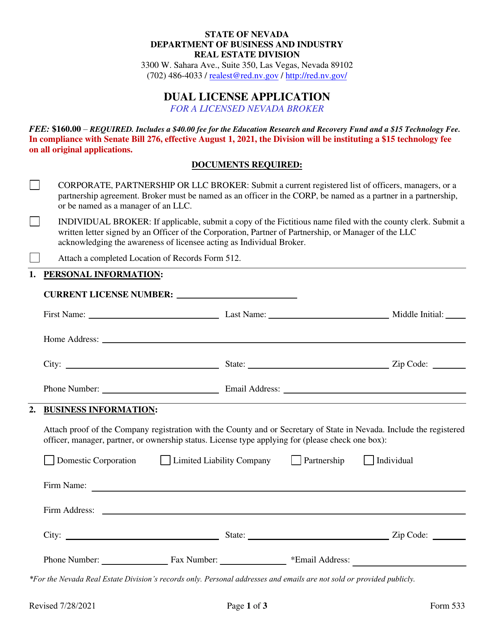

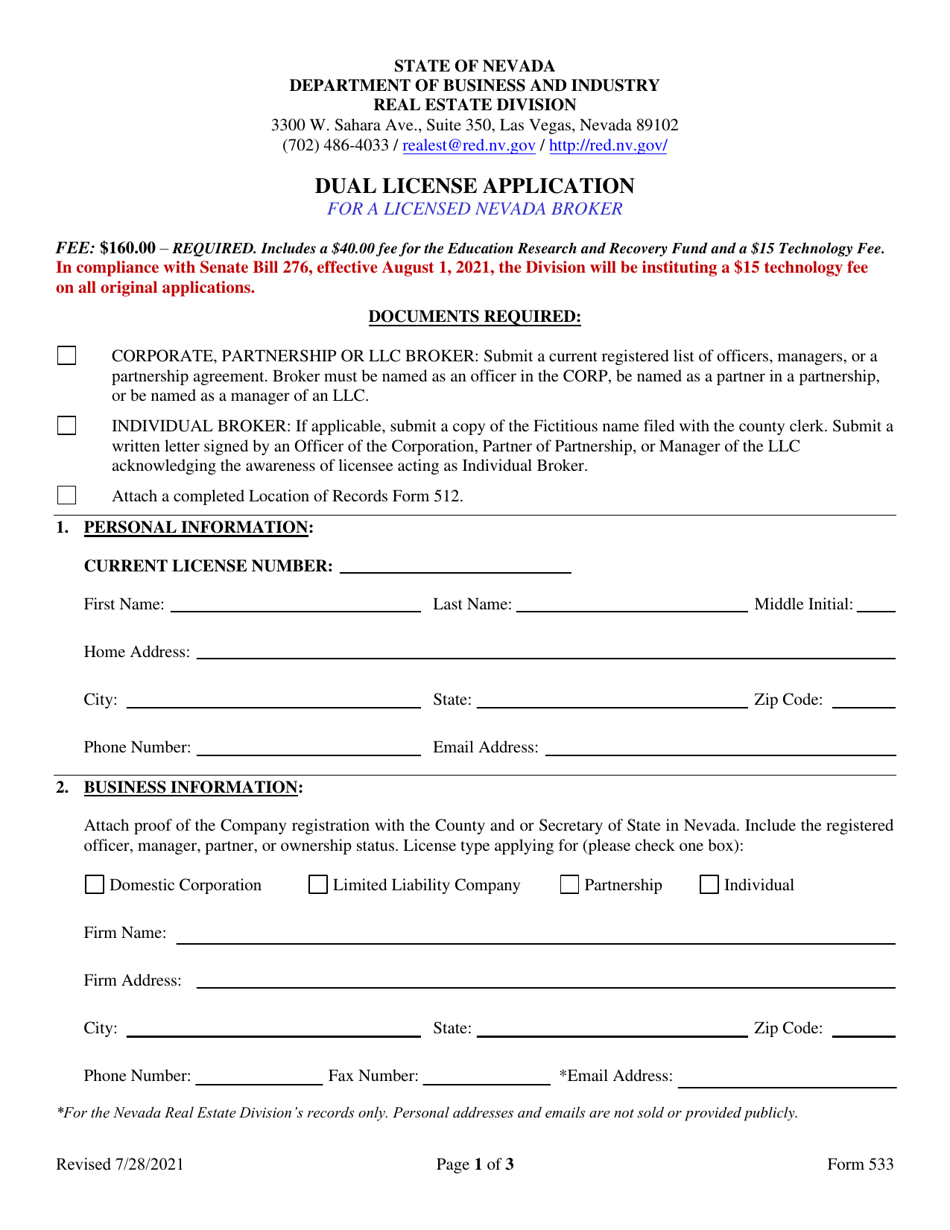

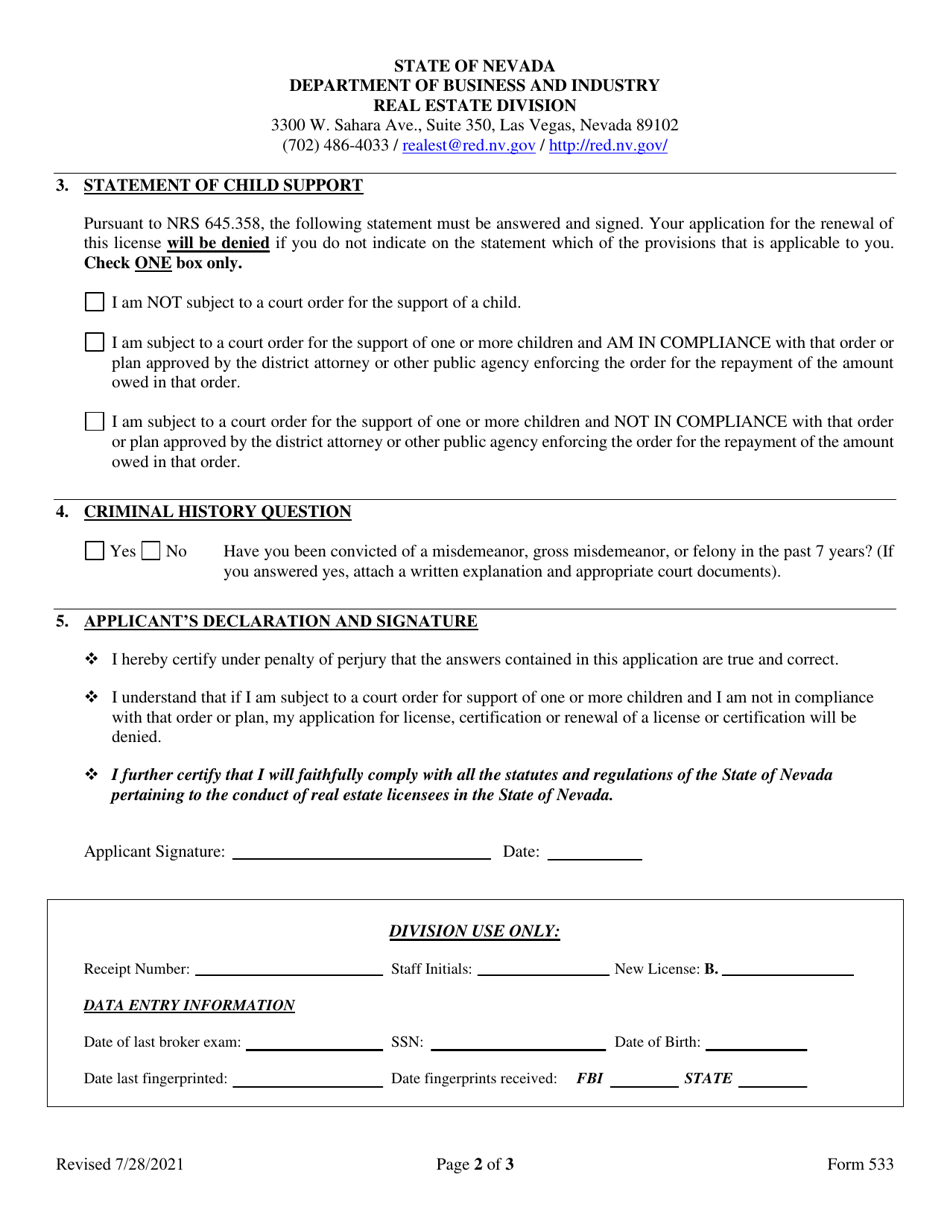

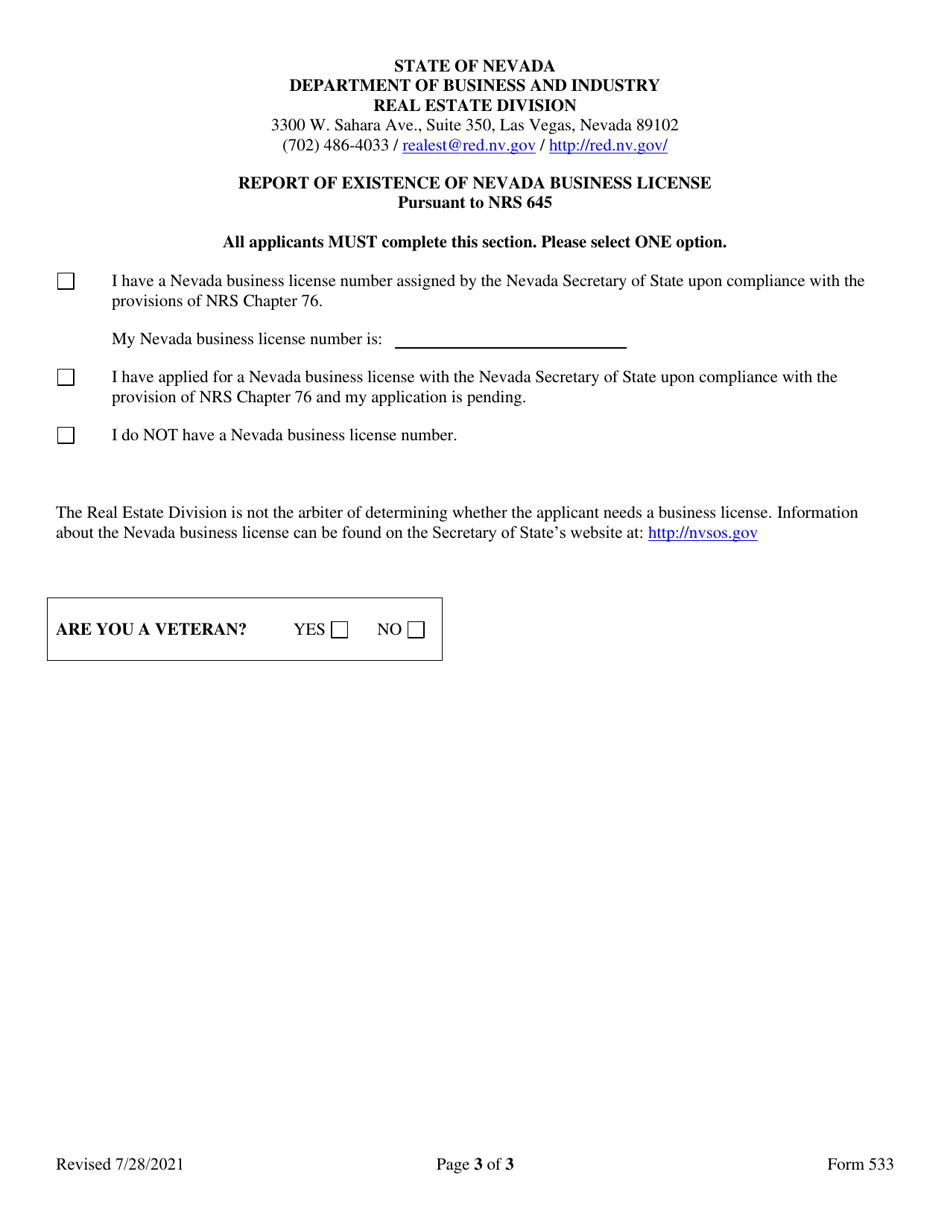

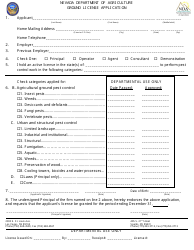

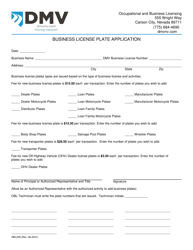

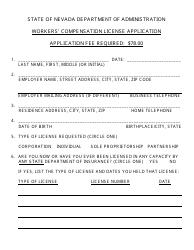

Form 533 Dual License Application - Nevada

What Is Form 533?

This is a legal form that was released by the Nevada Department of Business and Industry - Real Estate Division - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 533?

A: Form 533 is the Dual License Application for Nevada.

Q: What is the purpose of Form 533?

A: The purpose of Form 533 is to apply for a dual license in Nevada.

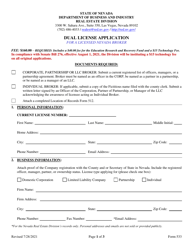

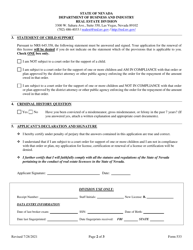

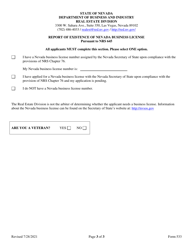

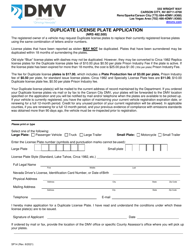

Q: What information do I need to provide on Form 533?

A: You will need to provide detailed information about your business, including its structure, activities, and ownership.

Q: Are there any fees associated with submitting Form 533?

A: Yes, there are fees associated with submitting Form 533. The exact amount depends on the type of business and its annual revenue.

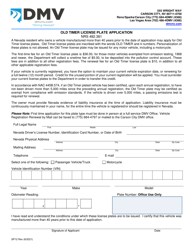

Q: Is there a deadline for submitting Form 533?

A: Yes, there is a deadline for submitting Form 533. The exact deadline varies based on the specific requirements of your business.

Q: What happens after I submit Form 533?

A: After you submit Form 533, the Nevada Department of Taxation will review your application and notify you of their decision.

Q: Can I appeal if my Form 533 application is denied?

A: Yes, you can appeal if your Form 533 application is denied. You will need to follow the appeals process outlined by the Nevada Department of Taxation.

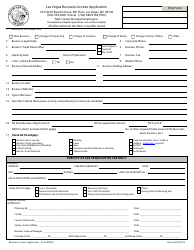

Form Details:

- Released on July 28, 2021;

- The latest edition provided by the Nevada Department of Business and Industry - Real Estate Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 533 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry - Real Estate Division.