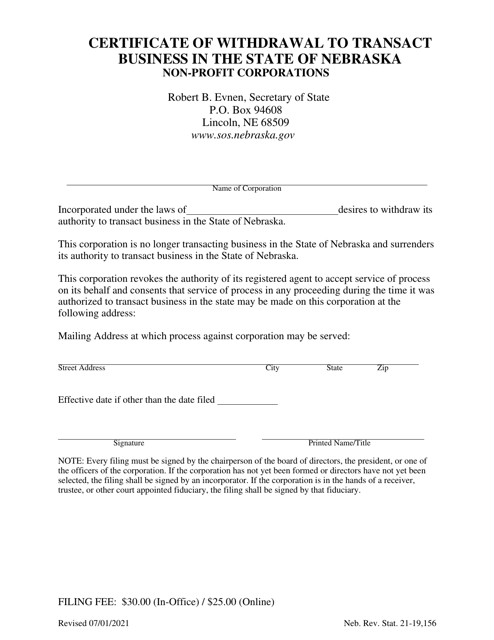

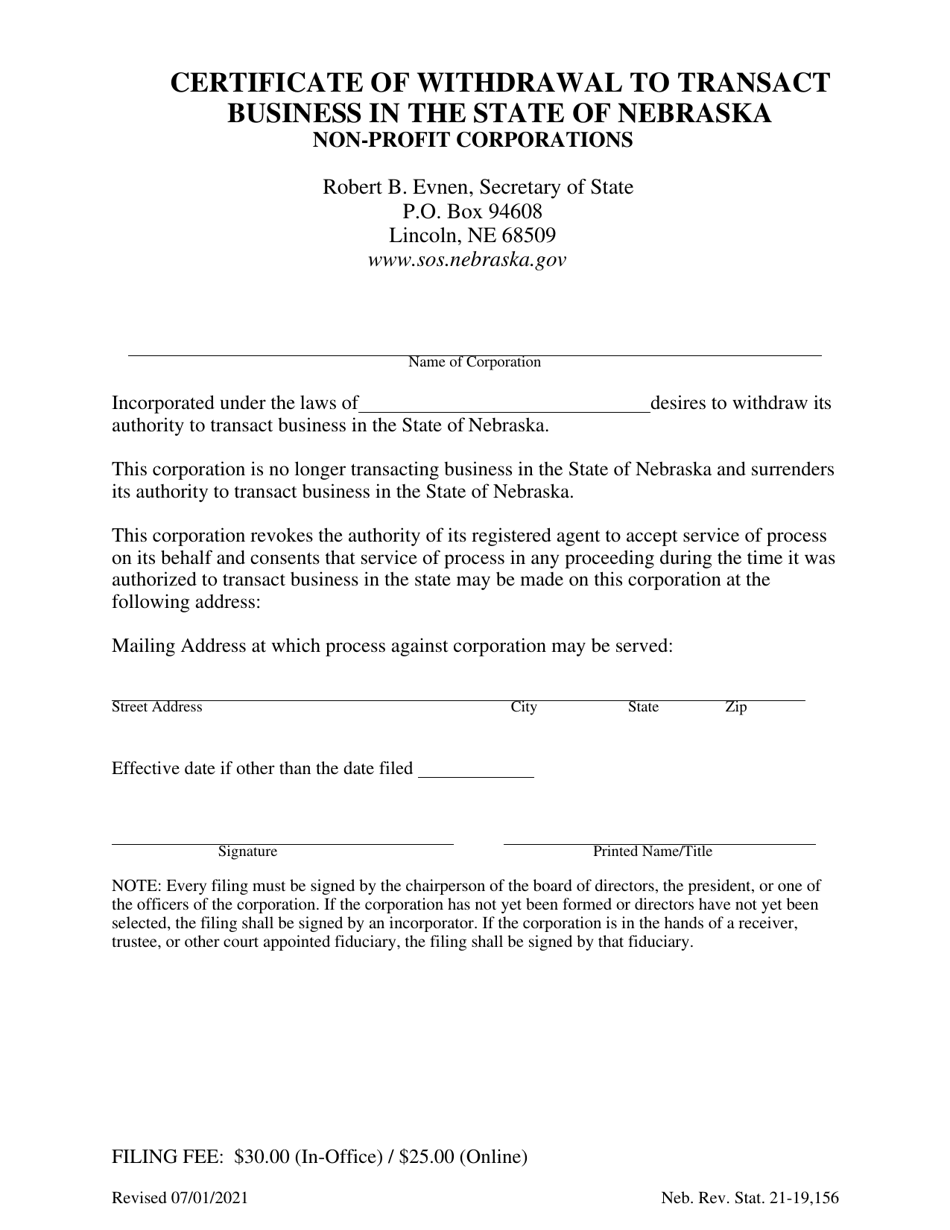

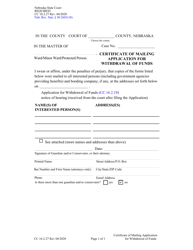

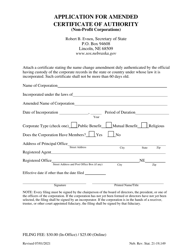

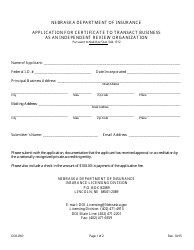

Certificate of Withdrawal to Transact Business in the State of Nebraska - Non-profit Corporations - Nebraska

Certificate of Withdrawal to Transact Business in the State of Nebraska - Non-profit Corporations is a legal document that was released by the Nebraska Secretary of State - a government authority operating within Nebraska.

FAQ

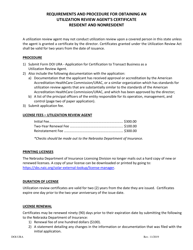

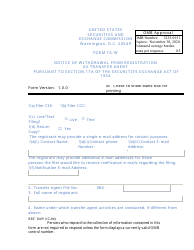

Q: What is a Certificate of Withdrawal?

A: A Certificate of Withdrawal is a document filed by a non-profit corporation in the state of Nebraska to officially withdraw from conducting business in the state.

Q: Who needs to file a Certificate of Withdrawal?

A: Non-profit corporations who have decided to cease their business activities in the state of Nebraska.

Q: What is the purpose of filing a Certificate of Withdrawal?

A: The purpose of filing a Certificate of Withdrawal is to notify the state of Nebraska that a non-profit corporation is no longer conducting business in the state.

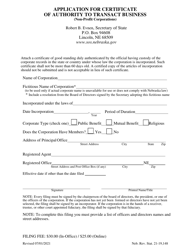

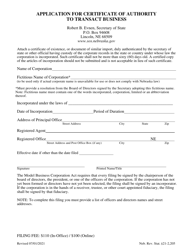

Q: How can a non-profit corporation file a Certificate of Withdrawal?

A: A non-profit corporation can file a Certificate of Withdrawal by submitting the completed form along with the required fee to the Nebraska Secretary of State.

Q: Are there any additional requirements for filing a Certificate of Withdrawal?

A: Yes, the non-profit corporation must be in good standing with the state of Nebraska and must have completed all necessary filings and obligations.

Q: What happens after filing a Certificate of Withdrawal?

A: After filing a Certificate of Withdrawal, the non-profit corporation is no longer required to file annual reports or pay annual fees to the state of Nebraska.

Q: Is there a deadline for filing a Certificate of Withdrawal?

A: There is no specific deadline for filing a Certificate of Withdrawal, but it is recommended to file as soon as the decision to cease business activities has been made.

Q: Can a non-profit corporation continue to conduct business in Nebraska after filing a Certificate of Withdrawal?

A: No, a non-profit corporation is not allowed to continue conducting business in Nebraska after filing a Certificate of Withdrawal.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Nebraska Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Secretary of State.