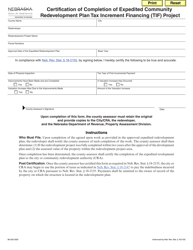

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

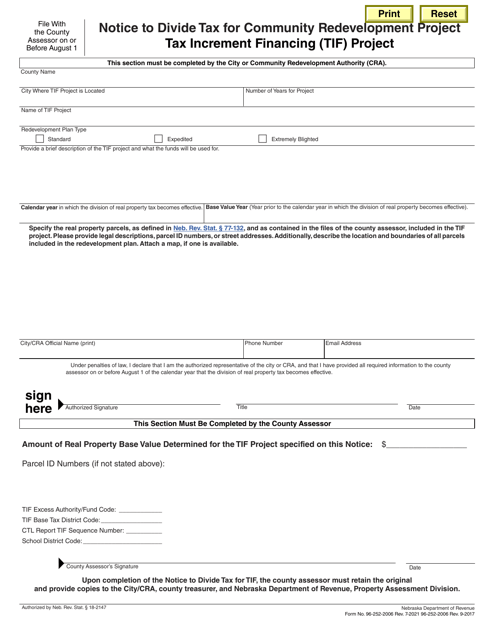

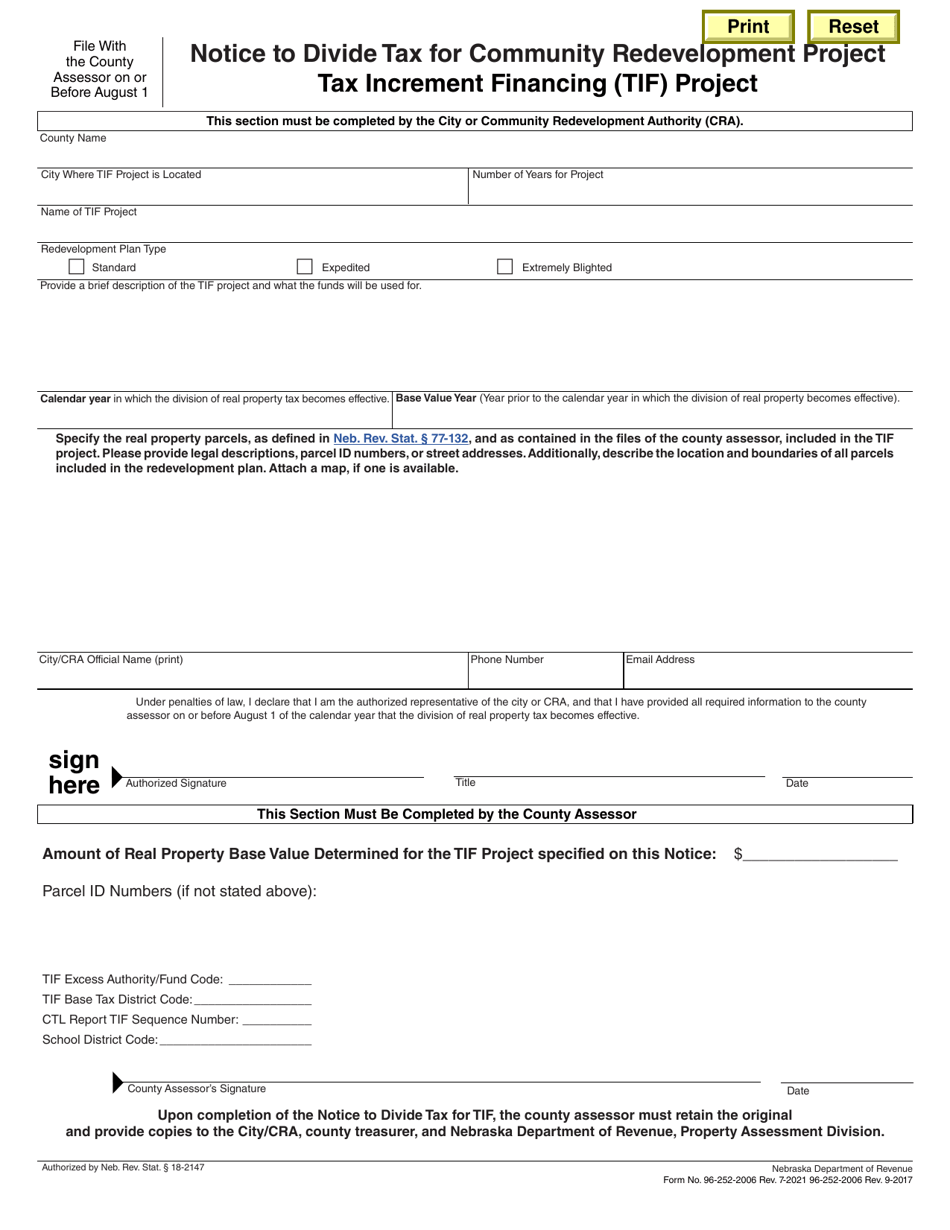

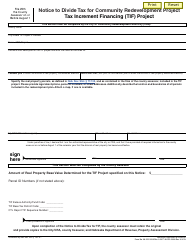

Notice to Divide Tax for Community Redevelopment Project Tax Increment Financing (Tif) Project - Nebraska

Notice to Divide Tax for Community Redevelopment Project Tax Increment Financing (Tif) Project is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

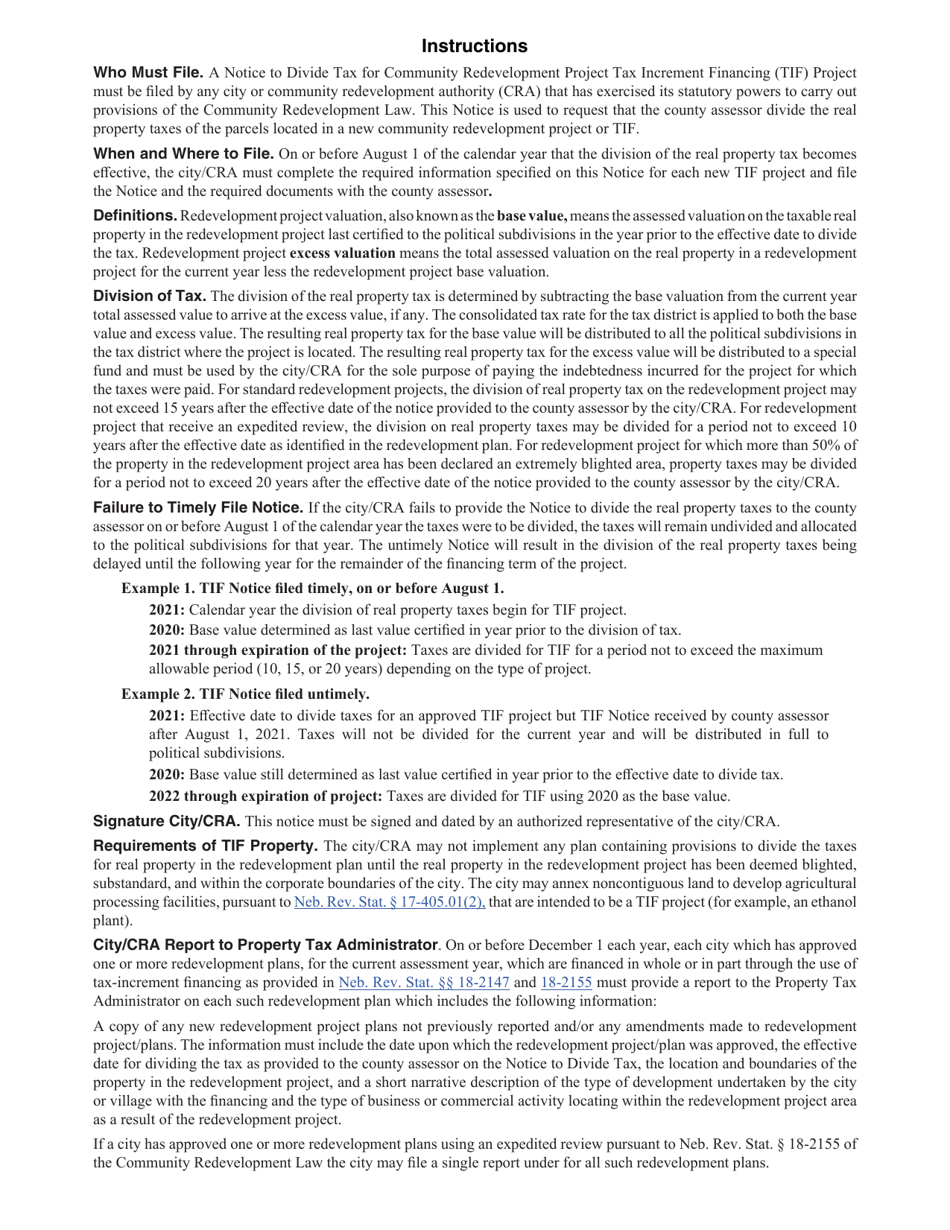

Q: What is a Tax Increment Financing (TIF) project?

A: A Tax Increment Financing (TIF) project is a type of public financing used for redevelopment or infrastructure projects.

Q: What is a Community Redevelopment Project?

A: A Community Redevelopment Project is a project aimed at revitalizing or improving a community or neighborhood.

Q: How does Tax Increment Financing (TIF) work?

A: Tax Increment Financing (TIF) works by diverting some of the property tax revenue generated by a specific project to fund the development or infrastructure costs of that project.

Q: What is the purpose of dividing the tax for a TIF project?

A: Dividing the tax for a TIF project allows a portion of the property tax revenue to be allocated towards the financing of the community redevelopment project.

Q: What are the benefits of Tax Increment Financing (TIF) projects?

A: Some benefits of TIF projects include stimulating economic growth, attracting private investment, creating jobs, and improving community infrastructure.

Q: Who is responsible for implementing Tax Increment Financing (TIF) projects?

A: Tax Increment Financing (TIF) projects are typically implemented by government entities, such as cities or redevelopment agencies.

Q: Are Tax Increment Financing (TIF) projects used in Nebraska?

A: Yes, Tax Increment Financing (TIF) projects are utilized in Nebraska.

Q: How are Tax Increment Financing (TIF) projects beneficial for communities?

A: TIF projects can bring new development, economic opportunities, and improvements to the infrastructure of communities.

Q: Are there any limitations or challenges associated with Tax Increment Financing (TIF) projects?

A: Yes, some challenges or limitations of TIF projects include potential displacement of residents or businesses, prioritization of certain developments over others, and the need for careful planning and oversight.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.