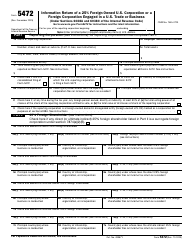

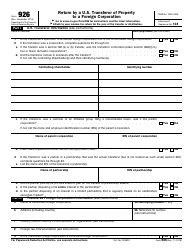

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

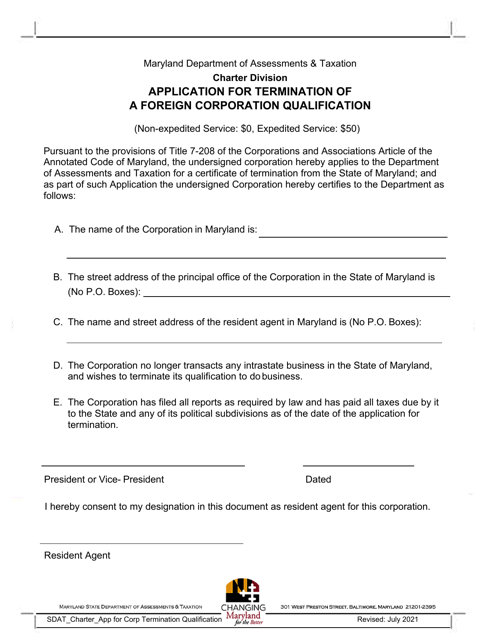

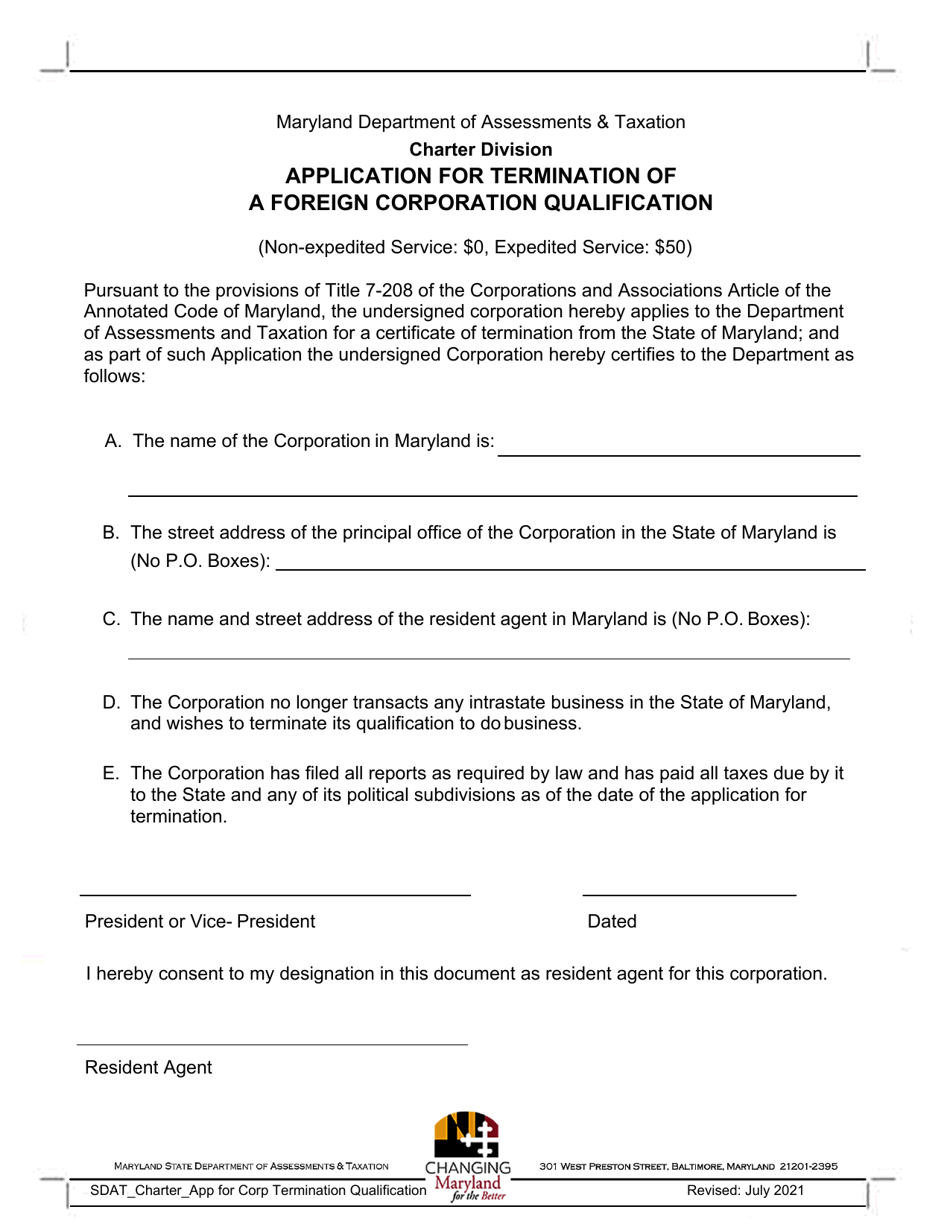

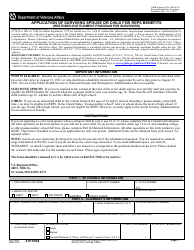

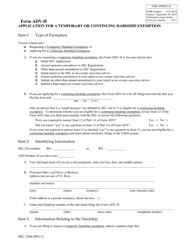

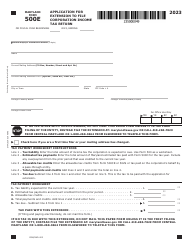

Application for Termination of a Foreign Corporation Qualification - Maryland

Application for Termination of a Foreign Corporation Qualification is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Foreign Corporation?

A: A foreign corporation is a business entity that is incorporated in a different state or country than where it conducts its business.

Q: Why would a foreign corporation terminate its qualification in Maryland?

A: A foreign corporation may choose to terminate its qualification in Maryland if it no longer wishes to do business in the state or if it is dissolving or ceasing operations.

Q: How do I apply for termination of a foreign corporation qualification in Maryland?

A: You can apply for termination by filing an Application for Termination of a Foreign Corporation Qualification with the Maryland Department of Assessments and Taxation.

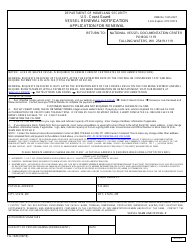

Q: What documents are required to apply for termination?

A: You will need to submit a completed Application for Termination, a Certificate of Good Standing from the state of incorporation, and a filing fee.

Q: What happens after I submit the application?

A: Once your application is processed and approved, the Department of Assessments and Taxation will issue a Certificate of Termination.

Q: Are there any tax or reporting obligations after termination?

A: You may still have tax or reporting obligations even after termination. It is important to consult with a tax professional or attorney to ensure compliance.

Q: Is there a deadline for filing the application?

A: There is no specific deadline for filing the application, but it is recommended to file as soon as possible after the decision to terminate has been made.

Q: Can I withdraw the application for termination?

A: Yes, you can withdraw the application for termination by submitting a written request to the Maryland Department of Assessments and Taxation.

Q: What happens if I do not terminate my foreign corporation qualification in Maryland?

A: If you continue to conduct business in Maryland without a valid qualification, you may be subject to penalties, fines, or legal consequences.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.