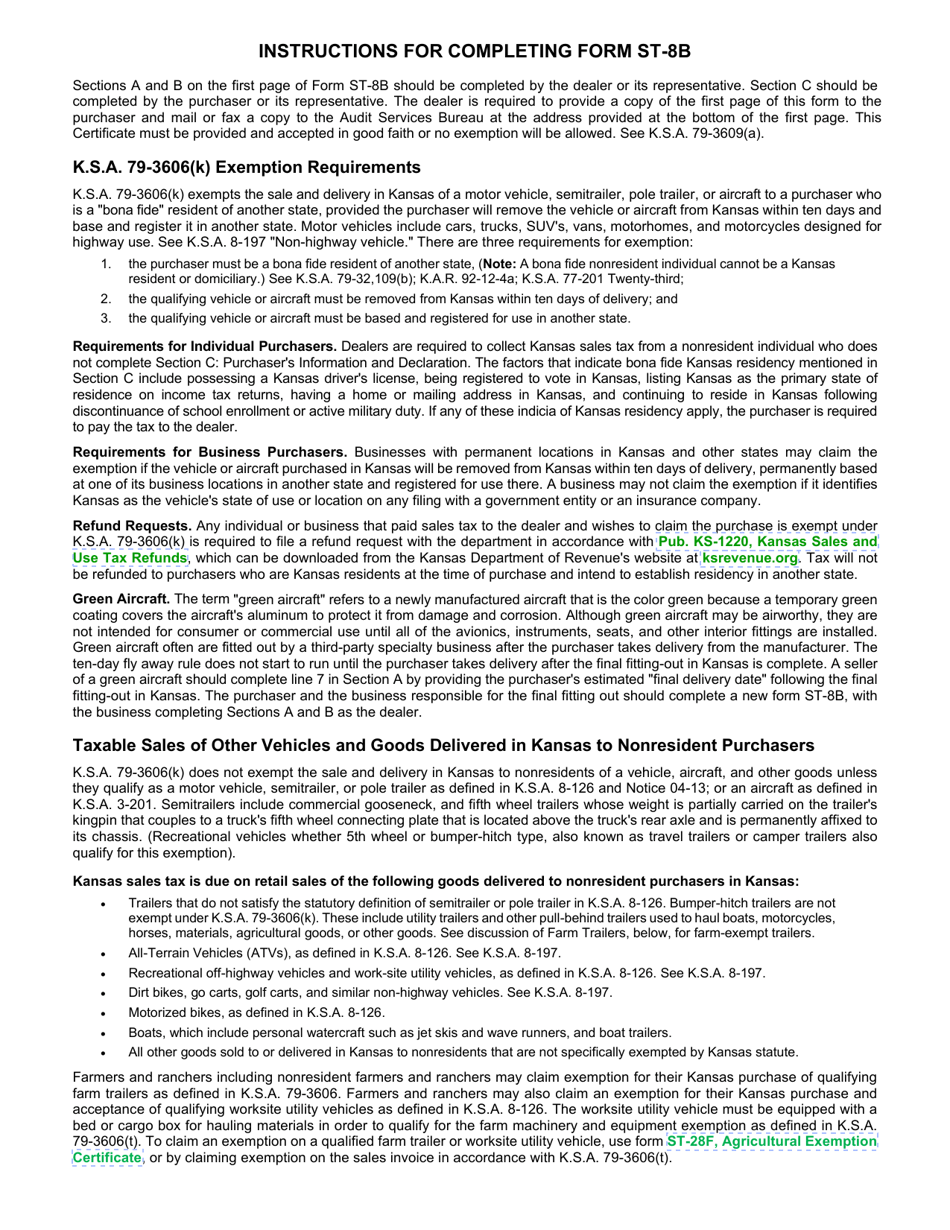

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-8B

for the current year.

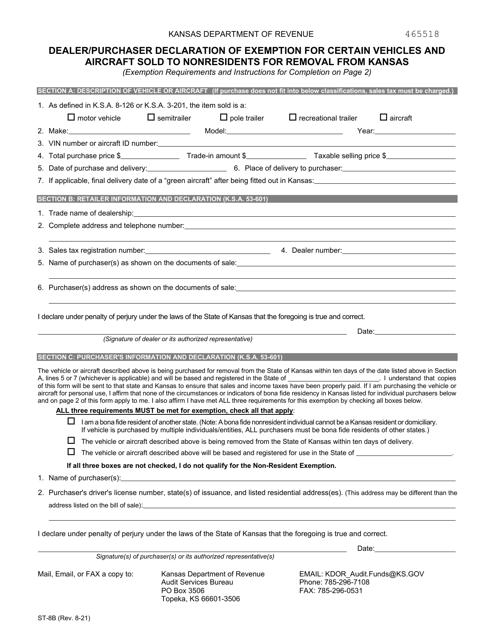

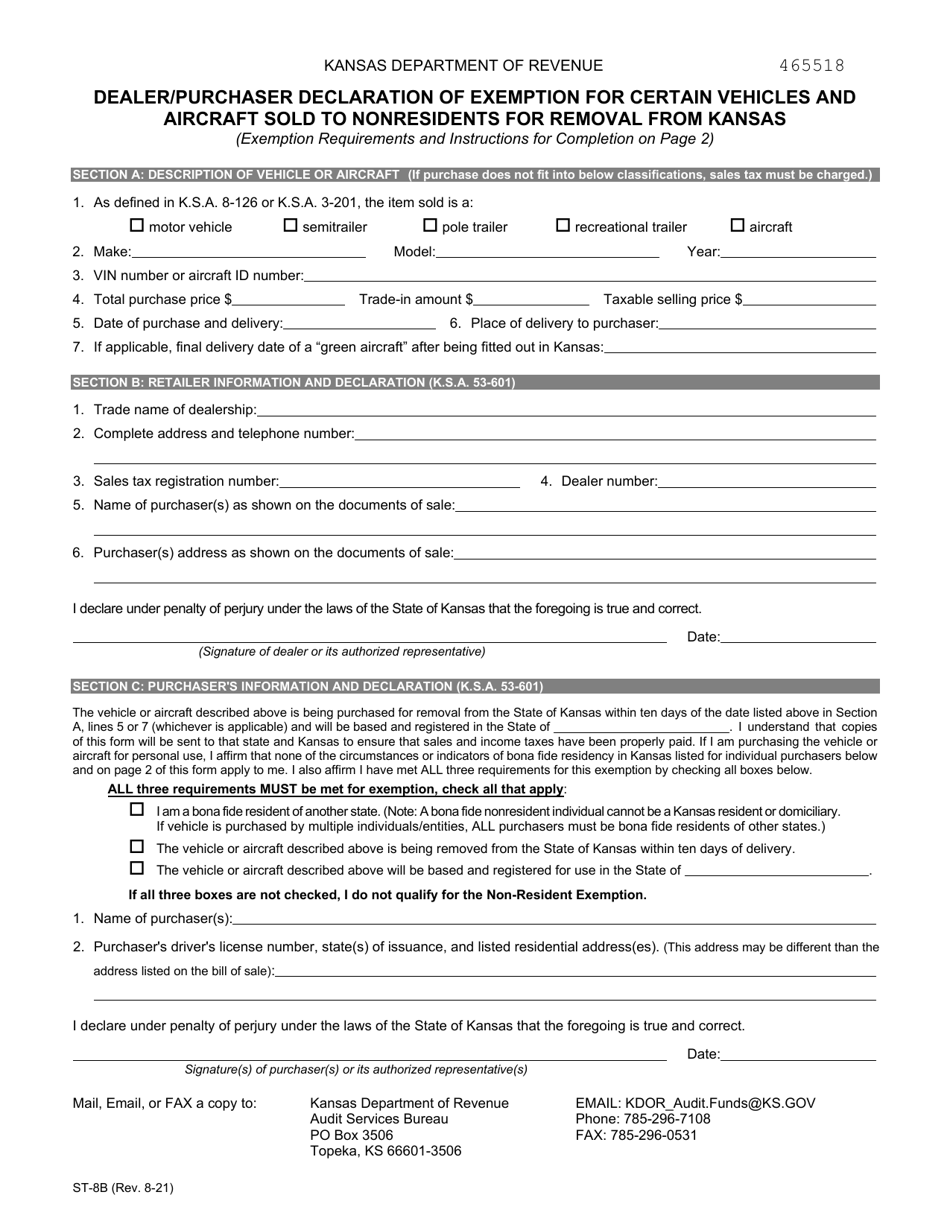

Form ST-8B Dealer / Purchaser Declaration of Exemption for Certain Vehicles and Aircraft Sold to Nonresidents for Removal From Kansas - Kansas

What Is Form ST-8B?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-8B?

A: Form ST-8B is a declaration of exemption for certain vehicles and aircraft sold to nonresidents for removal from Kansas.

Q: Who is required to use Form ST-8B?

A: Dealers and purchasers involved in the sale of vehicles and aircraft to nonresidents for removal from Kansas are required to use Form ST-8B.

Q: What is the purpose of Form ST-8B?

A: The purpose of Form ST-8B is to declare the exemption of vehicles and aircraft sold to nonresidents for removal from Kansas from certain taxes and fees.

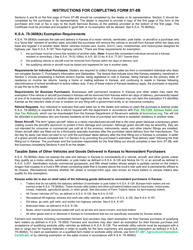

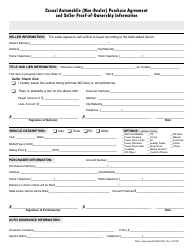

Q: What information is required on Form ST-8B?

A: Form ST-8B requires information such as the buyer's name and address, vehicle or aircraft details, and a declaration of the tax exemption.

Q: Are there any deadlines for filing Form ST-8B?

A: Yes, Form ST-8B should be filed within 30 days of the sale or removal of the vehicle or aircraft from Kansas.

Q: What happens after I submit Form ST-8B?

A: After submitting Form ST-8B, the buyer may be eligible for exemption from certain taxes and fees related to the sale of vehicles and aircraft to nonresidents for removal from Kansas.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-8B by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.