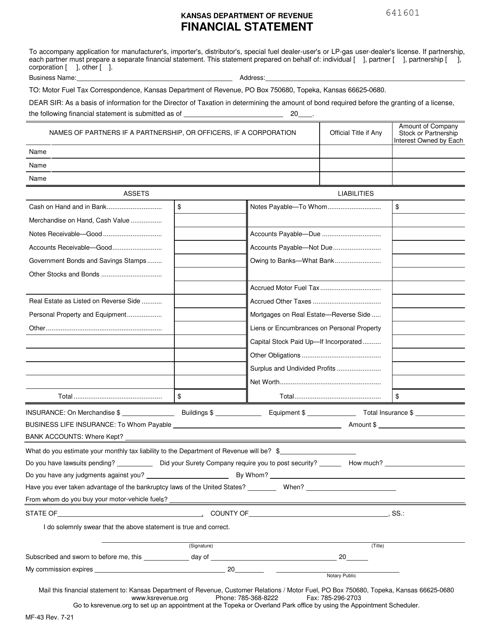

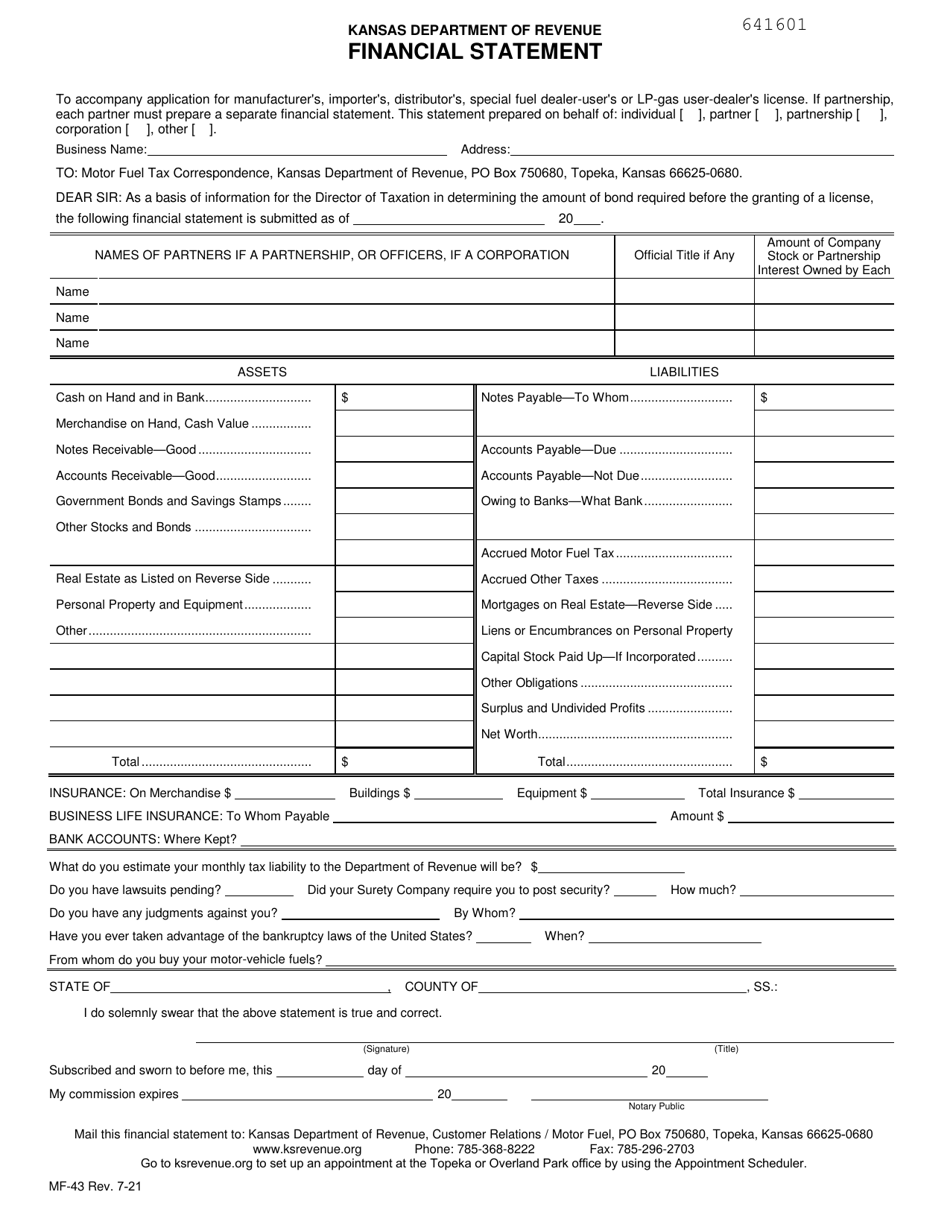

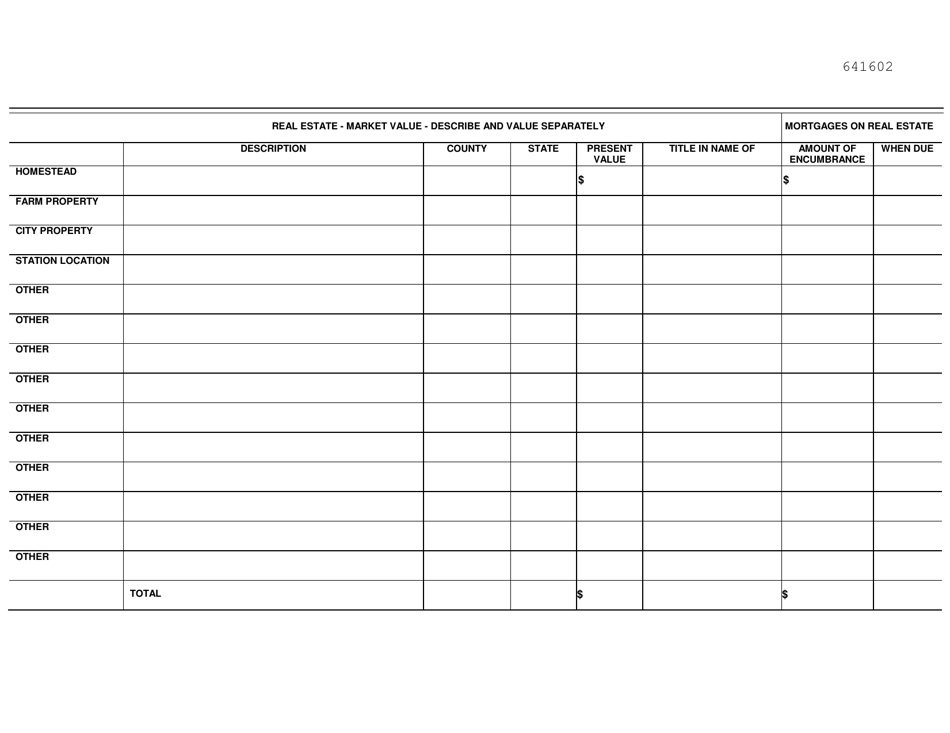

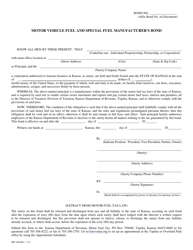

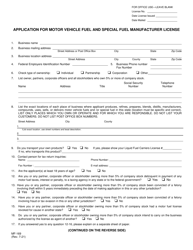

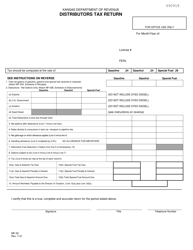

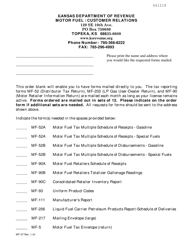

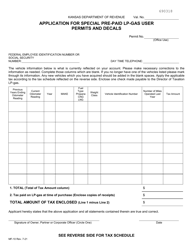

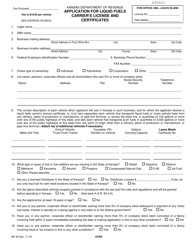

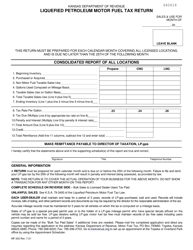

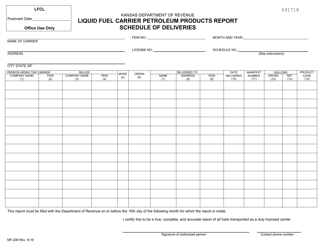

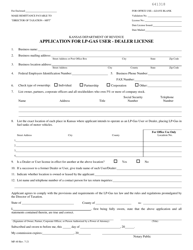

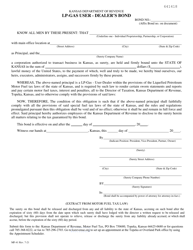

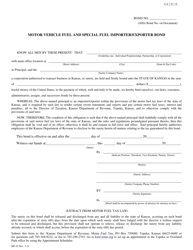

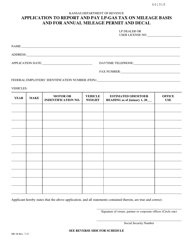

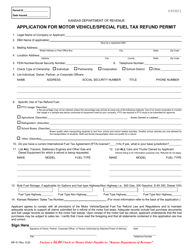

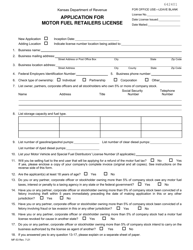

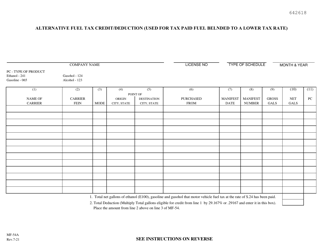

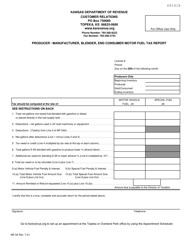

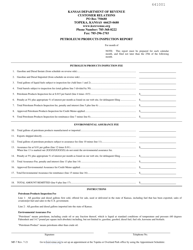

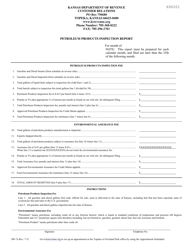

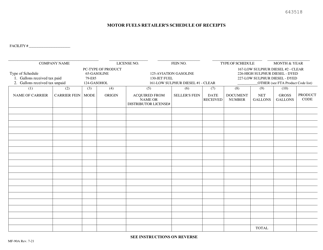

Form MF-43 Financial Statement - Kansas

What Is Form MF-43?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-43?

A: Form MF-43 is a financial statement used in the state of Kansas.

Q: Who needs to fill out Form MF-43?

A: Form MF-43 needs to be filled out by individuals or businesses who are required to report their financial information to the state of Kansas.

Q: What is the purpose of Form MF-43?

A: The purpose of Form MF-43 is to provide the state of Kansas with the necessary financial information to assess tax liability or eligibility for certain programs.

Q: When is Form MF-43 due?

A: The due date for Form MF-43 varies depending on the specific requirements of the state of Kansas. It is advisable to consult the official instructions or contact the relevant authorities for the specific due date.

Q: Are there any penalties for not filing Form MF-43?

A: Penalties for not filing Form MF-43 or filing it late may vary depending on the specific rules and regulations in Kansas. It is important to comply with the deadlines and requirements to avoid potential penalties.

Q: Is Form MF-43 used in other states besides Kansas?

A: No, Form MF-43 is specific to the state of Kansas and is not required in any other states.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-43 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.