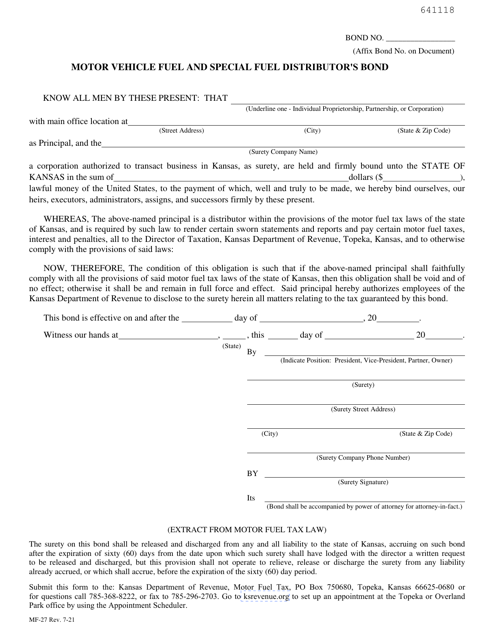

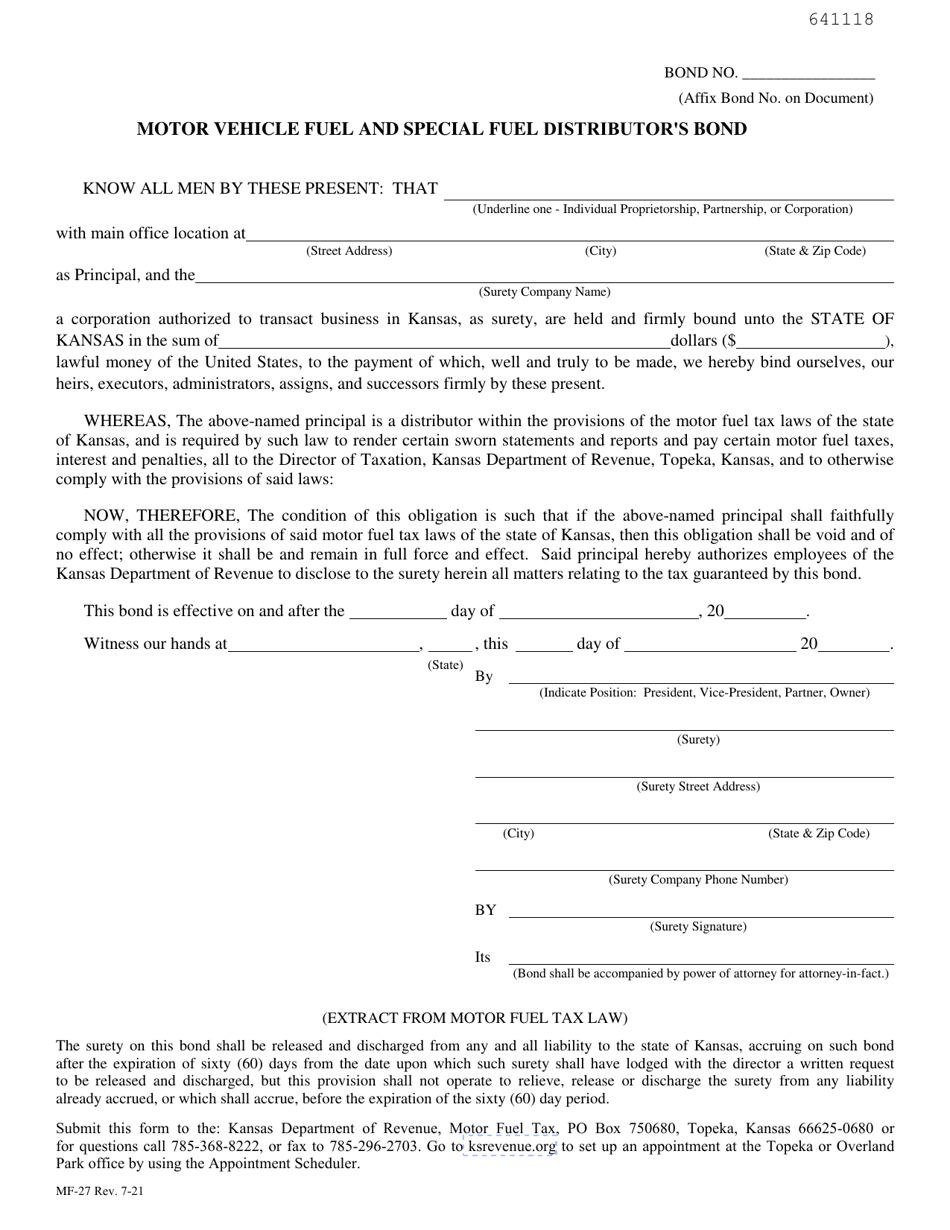

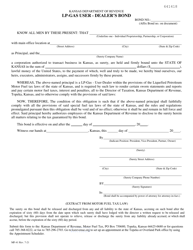

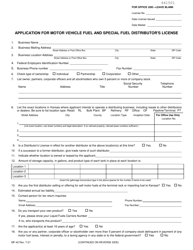

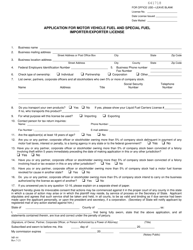

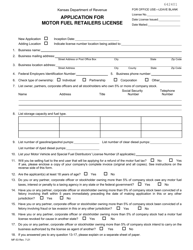

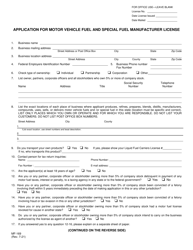

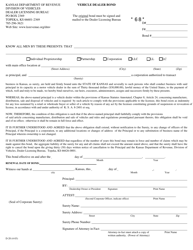

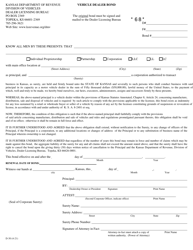

Form MF-27 Motor Vehicle Fuel and Special Fuel Distributor's Bond - Kansas

What Is Form MF-27?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-27?

A: Form MF-27 is the Motor Vehicle Fuel and Special Fuel Distributor's Bond required by the state of Kansas.

Q: Who needs to file Form MF-27?

A: Motor vehicle fuel and special fuel distributors in Kansas are required to file Form MF-27.

Q: What is the purpose of Form MF-27?

A: The purpose of Form MF-27 is to provide a bond that guarantees the payment of taxes on motor vehicle fuel and special fuel distributions in Kansas.

Q: How much is the bond amount for Form MF-27?

A: The bond amount for Form MF-27 is determined by the Kansas Department of Revenue, based on the distributor's estimated fuel tax liability.

Q: What happens if I don't file Form MF-27?

A: Failure to file Form MF-27 can result in penalties and fines imposed by the Kansas Department of Revenue.

Q: When should Form MF-27 be filed?

A: Form MF-27 should be filed prior to the commencement of motor vehicle fuel and special fuel distribution in Kansas.

Q: Are there any other requirements for motor vehicle fuel and special fuel distributors in Kansas?

A: Yes, in addition to filing Form MF-27, distributors may also be required to obtain other licenses and permits from the Kansas Department of Revenue.

Q: Can I use Form MF-27 for other states?

A: No, Form MF-27 is specific to the state of Kansas and cannot be used for other states.

Q: What is the penalty for providing false information on Form MF-27?

A: Providing false information on Form MF-27 may result in criminal prosecution and additional penalties.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-27 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.