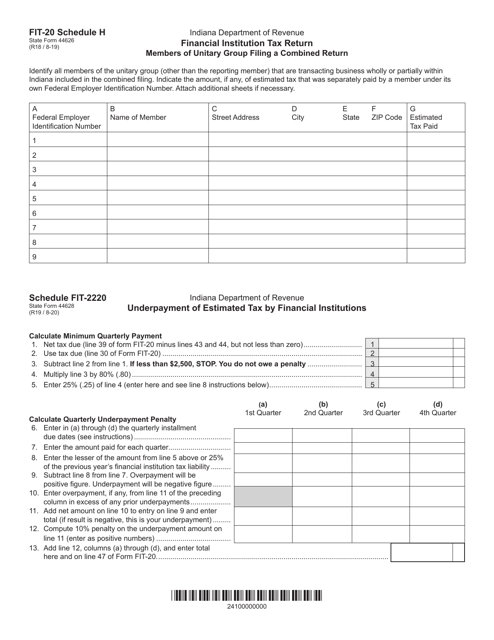

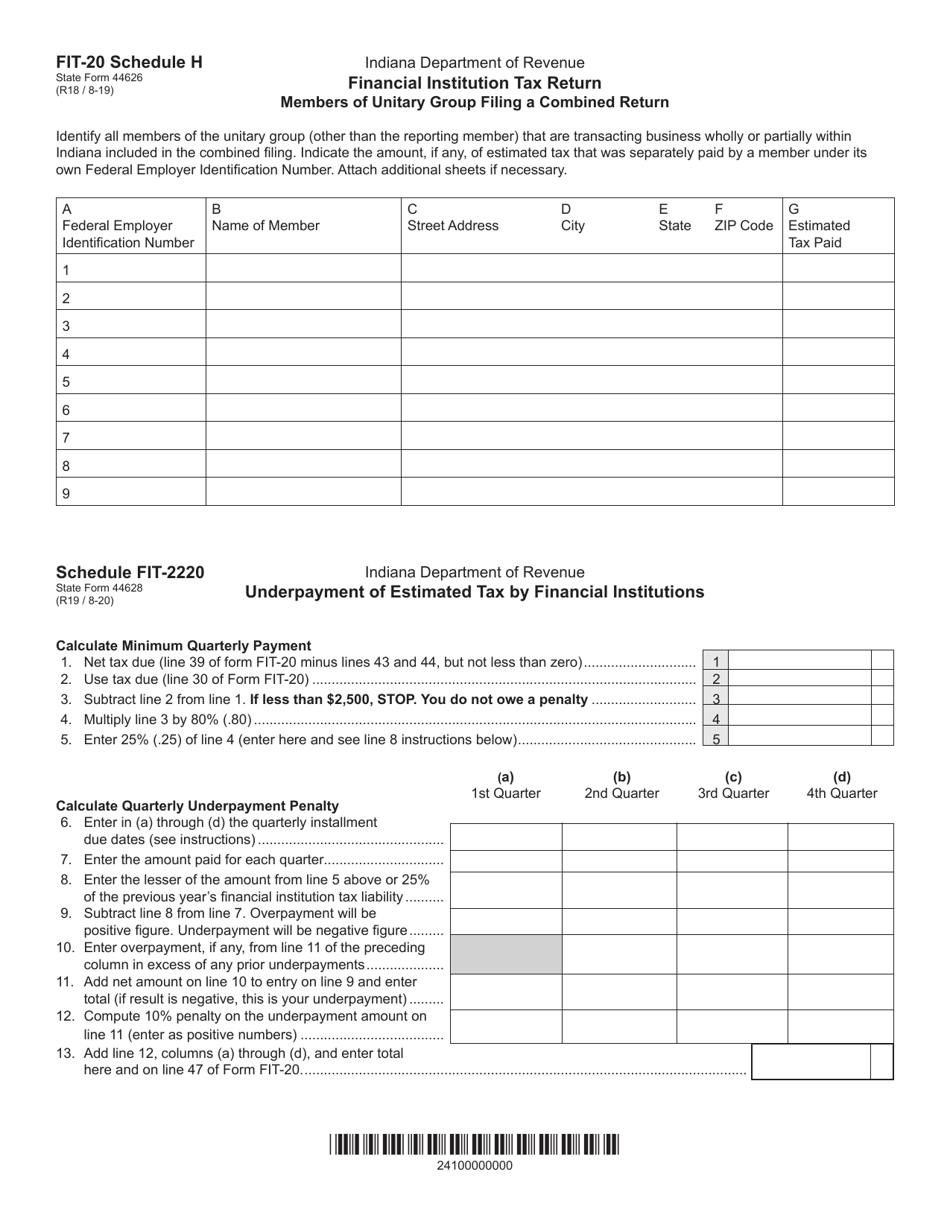

Form FIT-20 (State Form 44626; State Form 44628) Schedule FIT-2220, H Members of Unitary Group Filing a Combined Return; Underpayment of Estimated Tax by Financial Institutions - Illinois

What Is Form FIT-20 (State Form 44626; State Form 44628) Schedule FIT-2220, H?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT-20?

A: Form FIT-20 is a tax form used in the state of Illinois.

Q: What are State Form 44626 and State Form 44628?

A: State Form 44626 and State Form 44628 are form numbers used for specific sections of Form FIT-20.

Q: What is Schedule FIT-2220?

A: Schedule FIT-2220 is a schedule used by members of a unitary group filing a combined return.

Q: Who is required to file Schedule FIT-2220?

A: Members of a unitary group filing a combined return are required to file Schedule FIT-2220.

Q: What does Schedule FIT-2220 calculate?

A: Schedule FIT-2220 calculates the underpayment of estimated tax by financial institutions in Illinois.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-20 (State Form 44626; State Form 44628) Schedule FIT-2220, H by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.