This version of the form is not currently in use and is provided for reference only. Download this version of

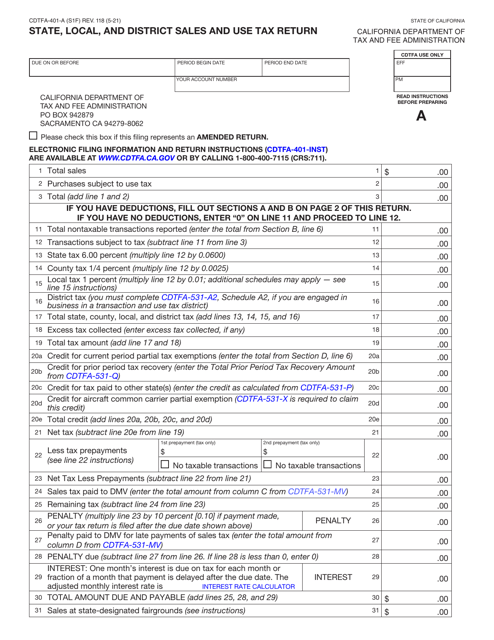

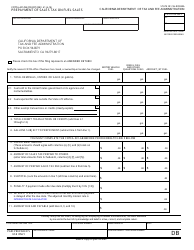

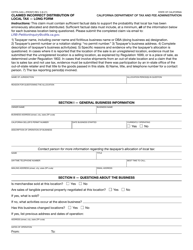

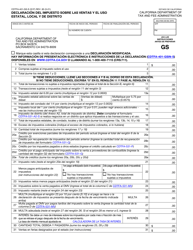

Form CDTFA-401-A

for the current year.

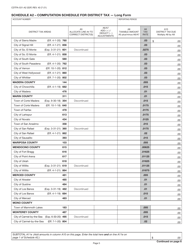

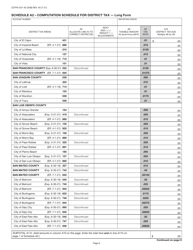

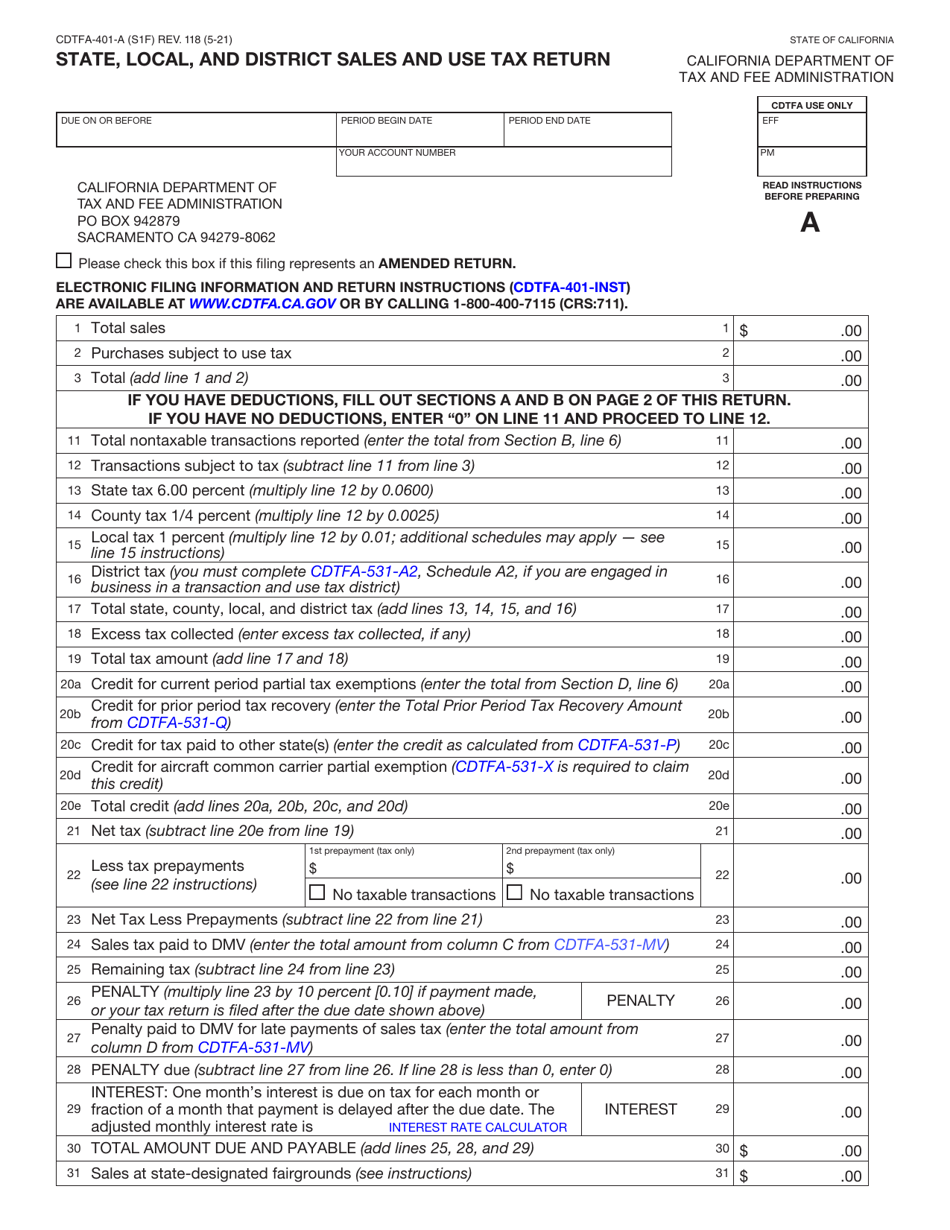

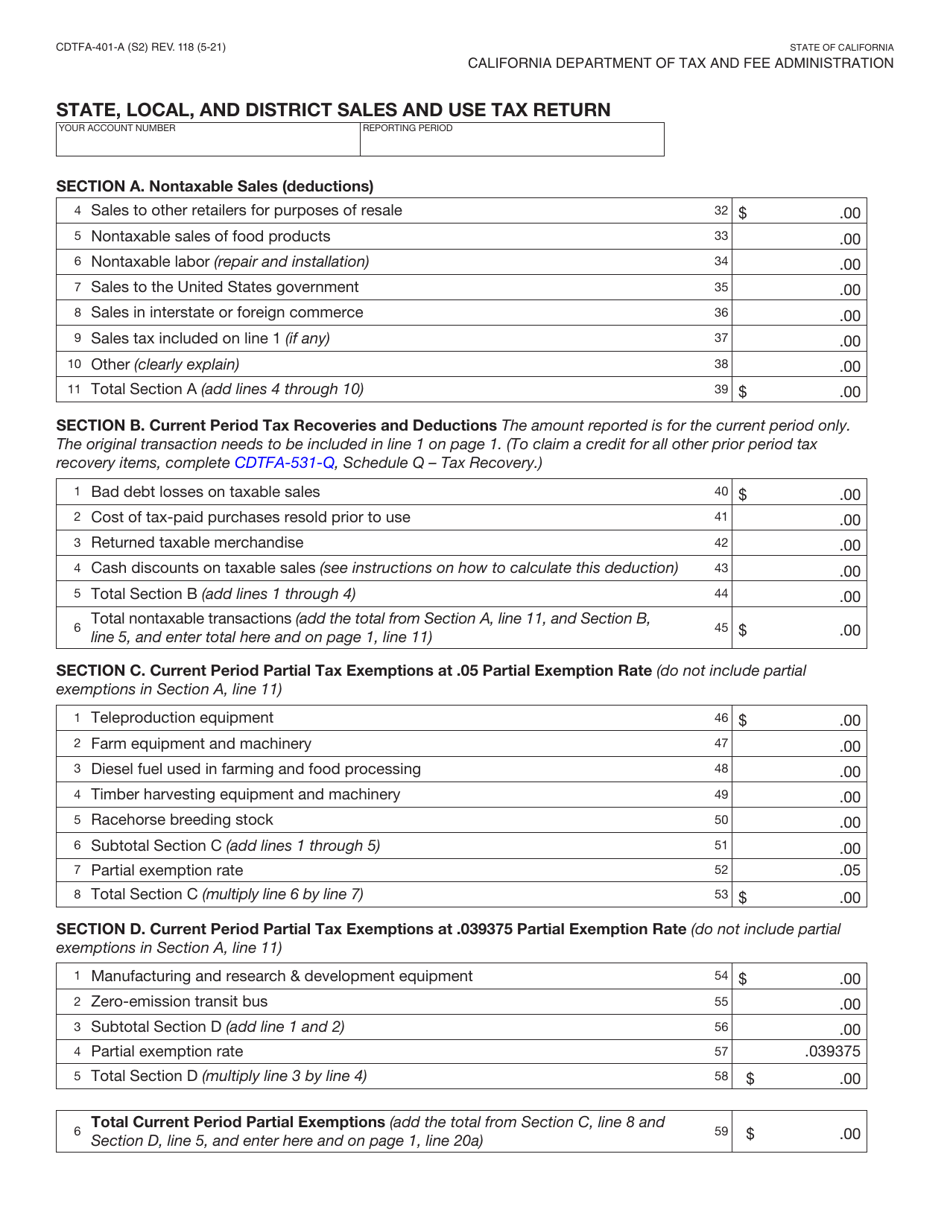

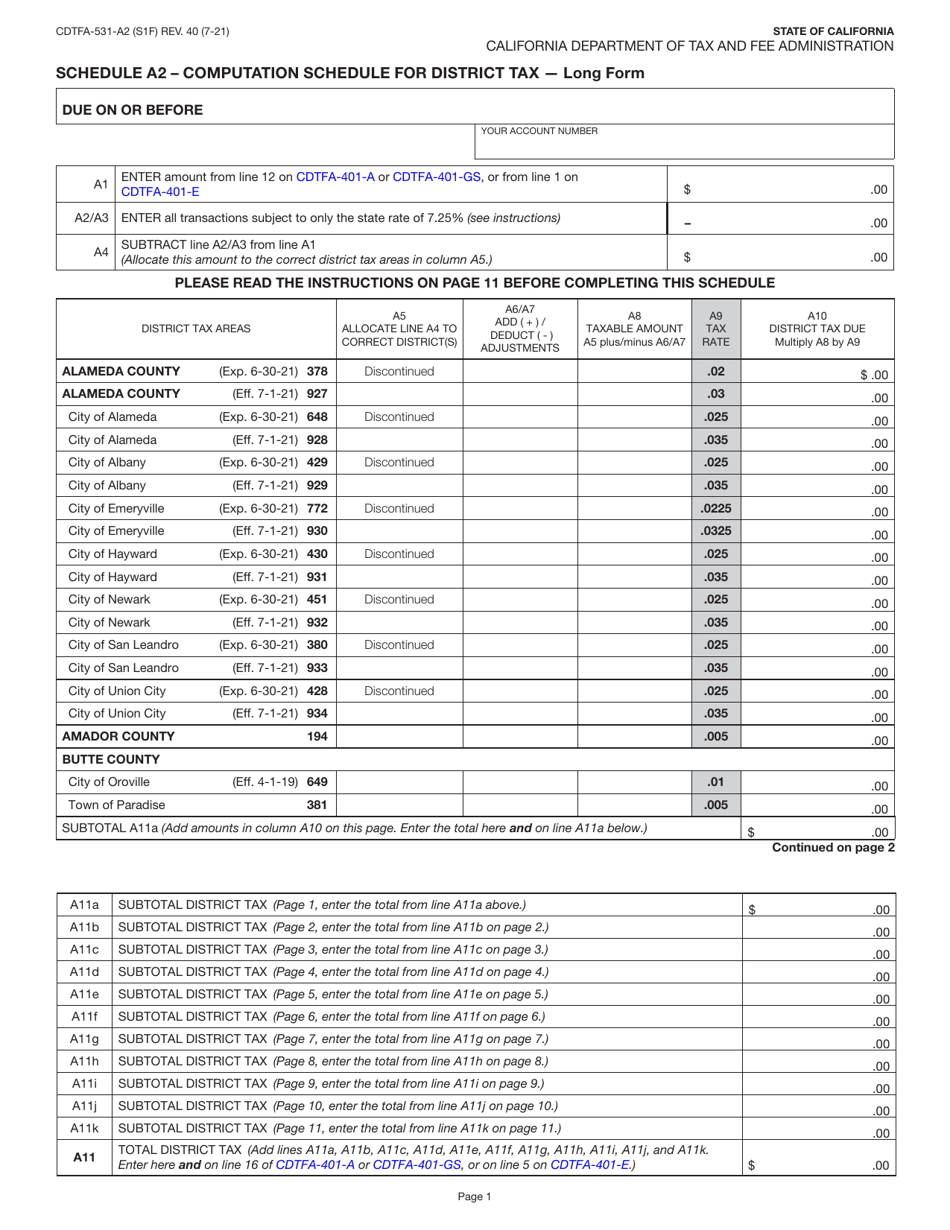

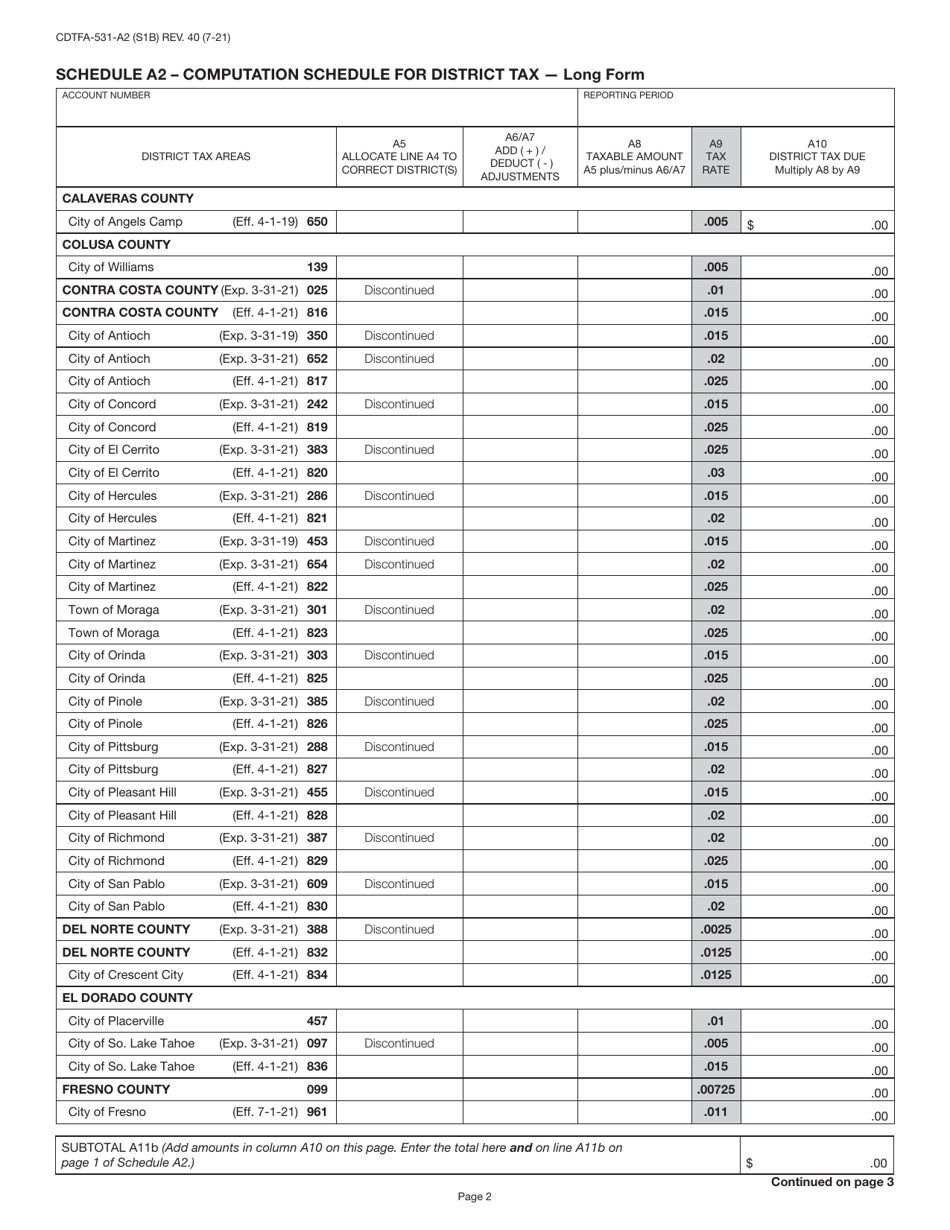

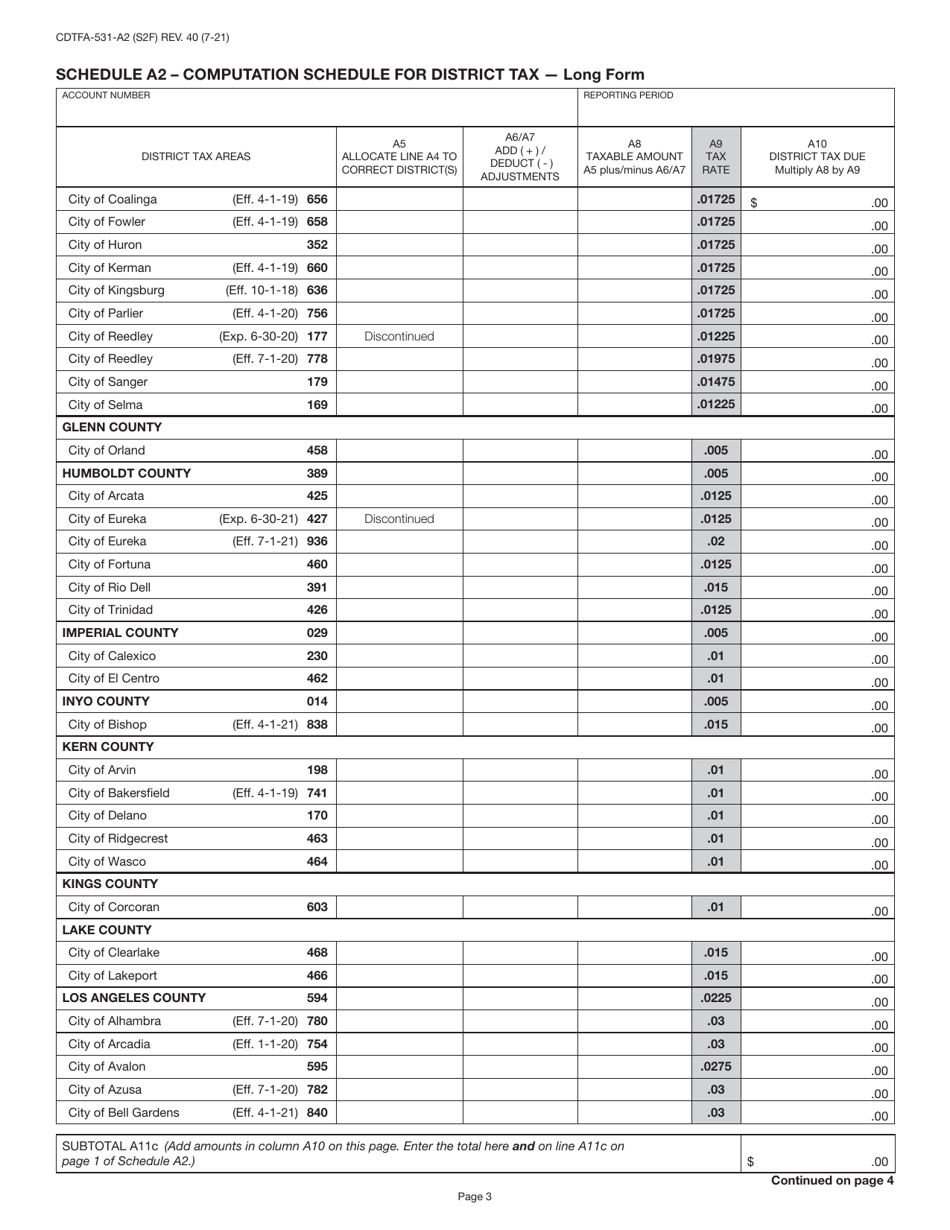

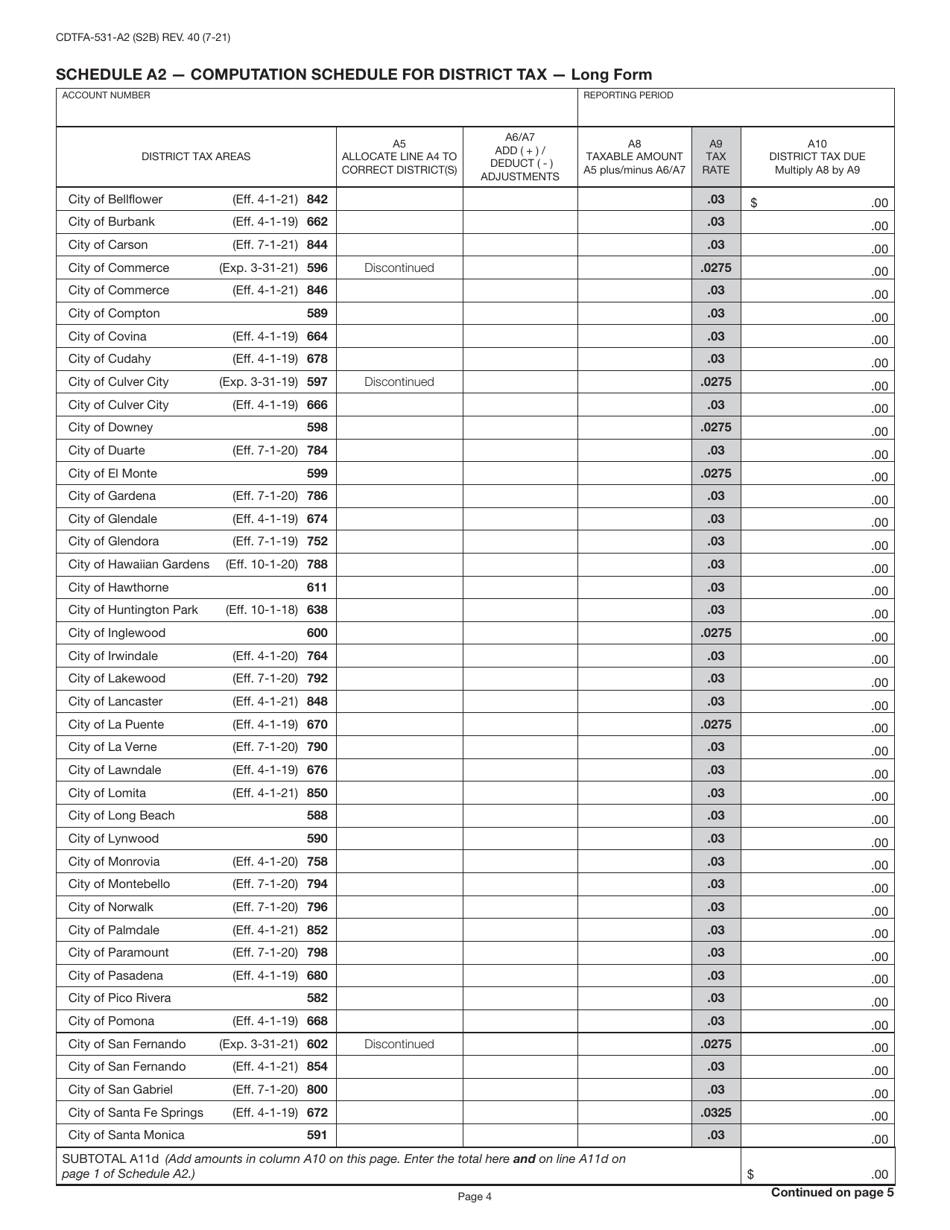

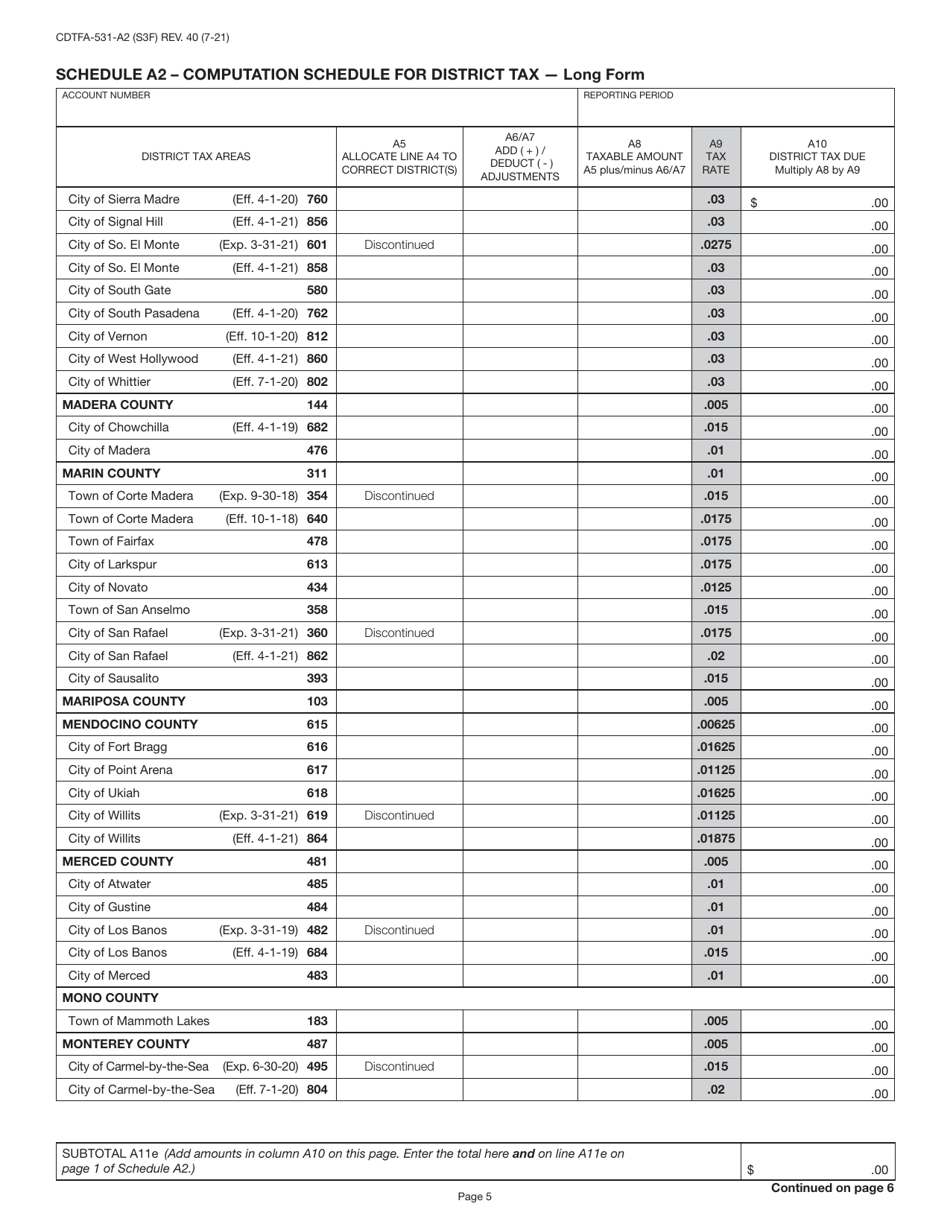

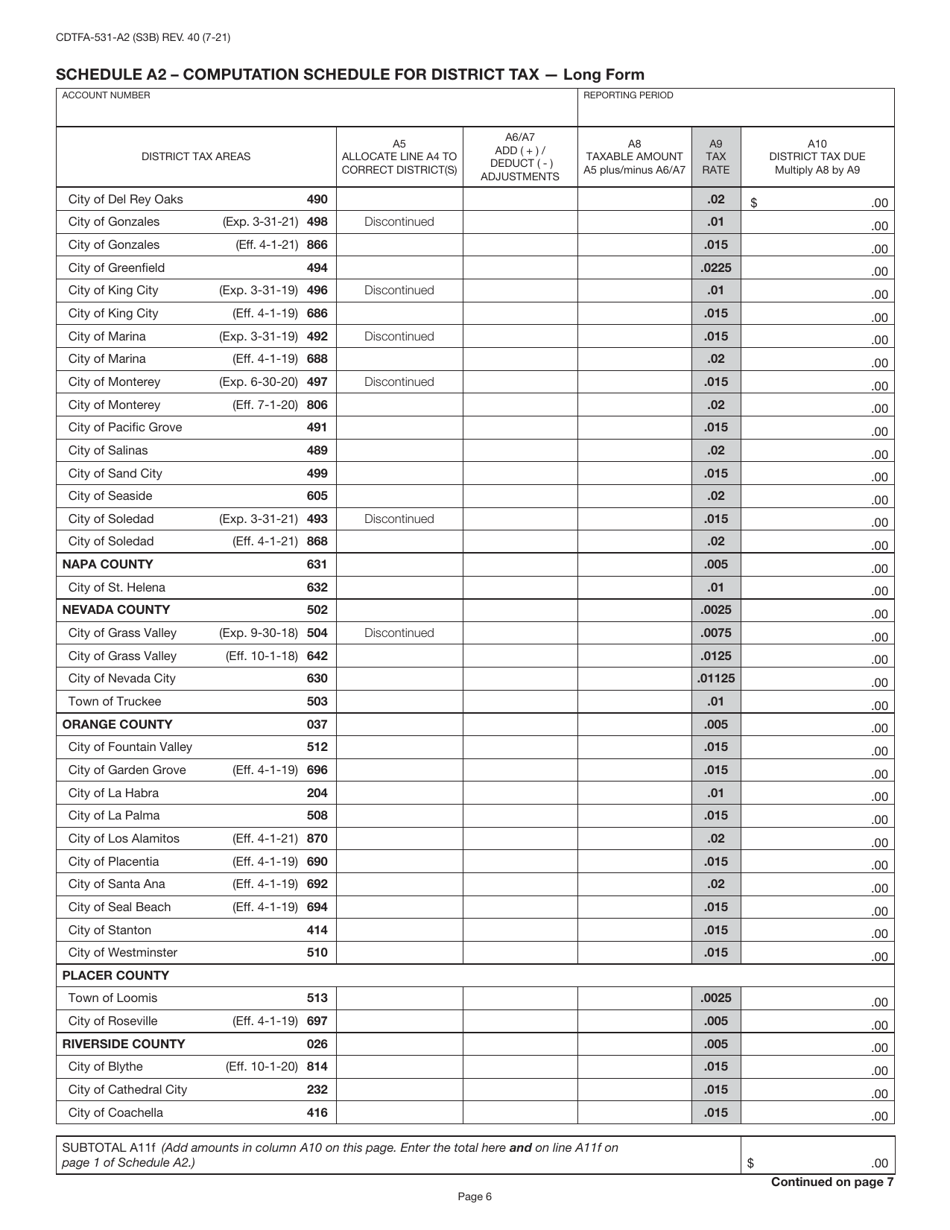

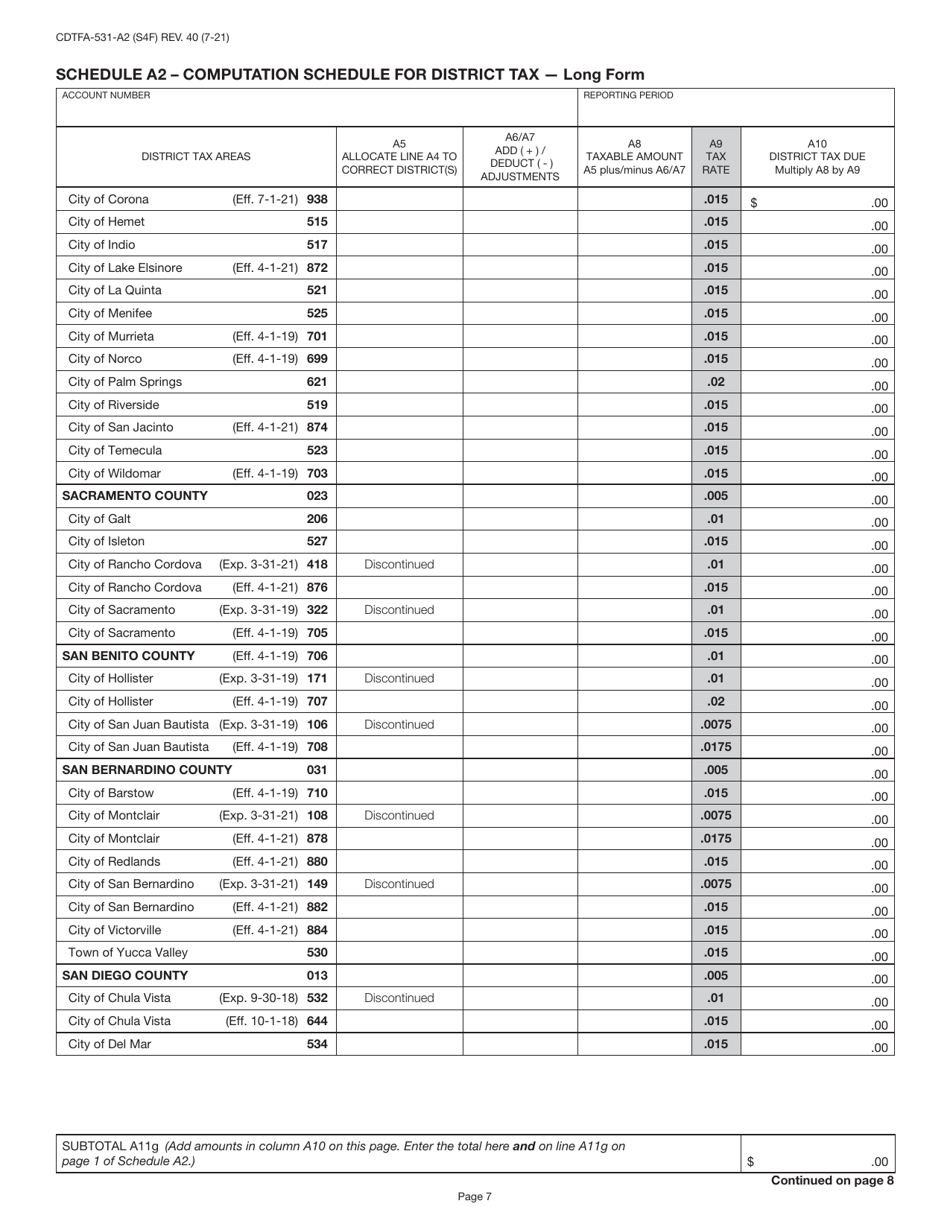

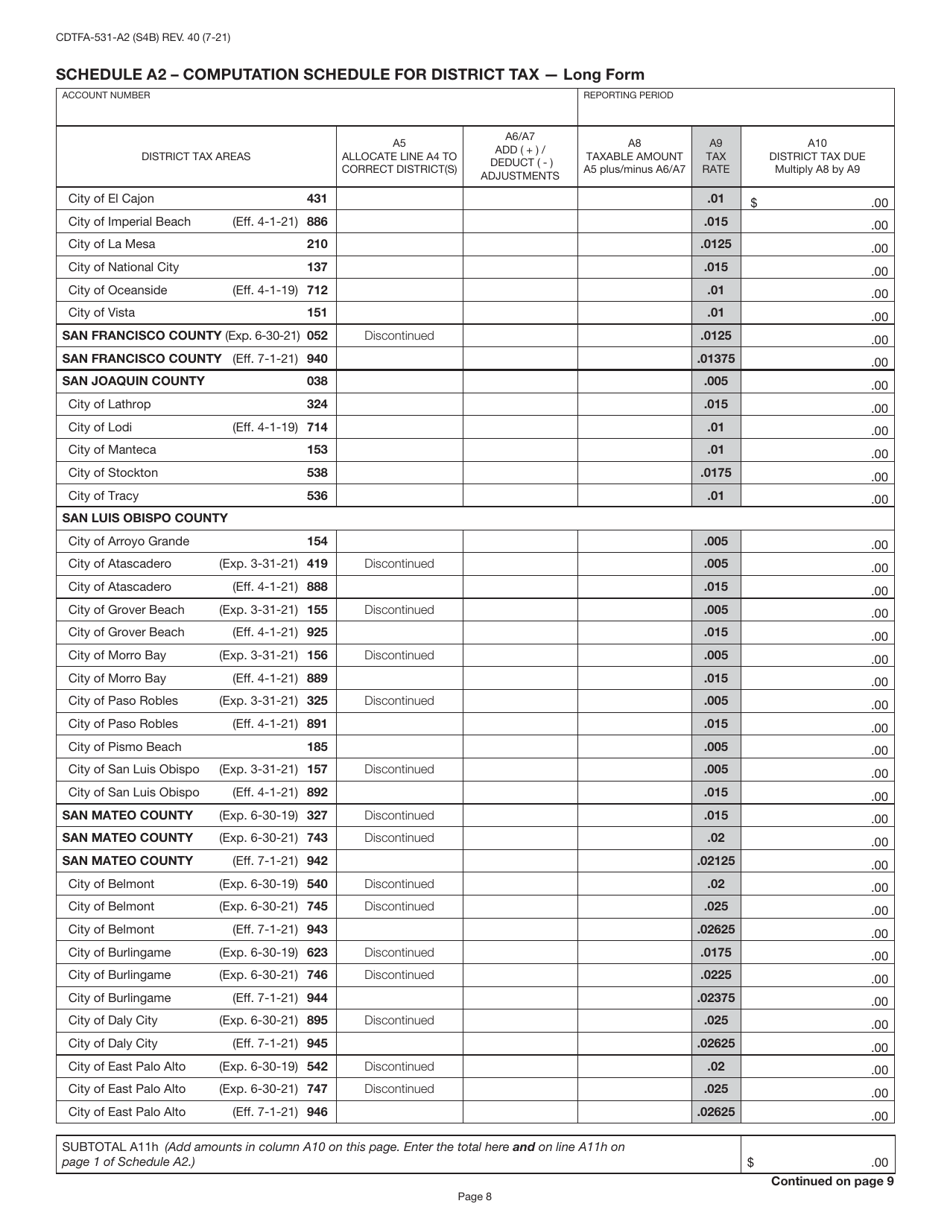

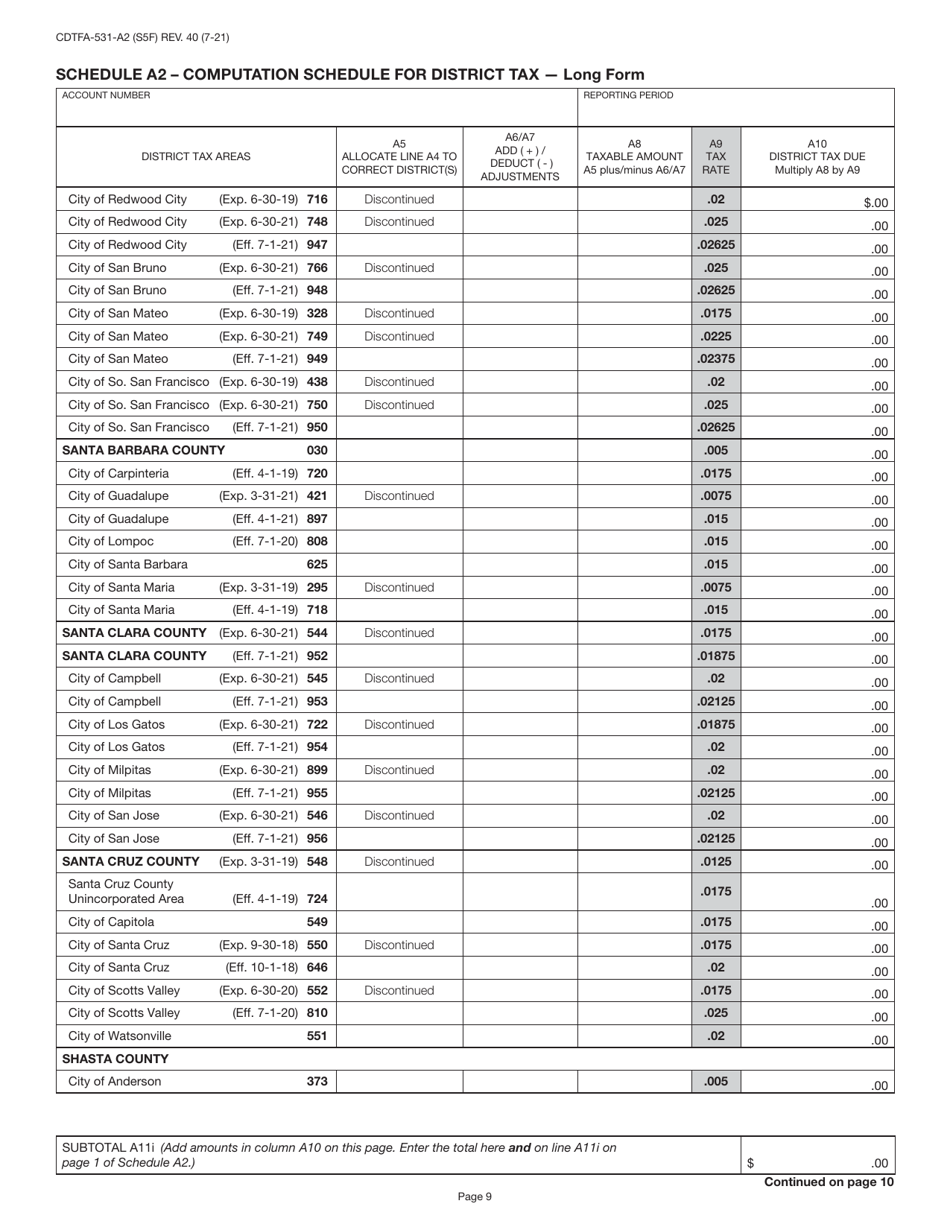

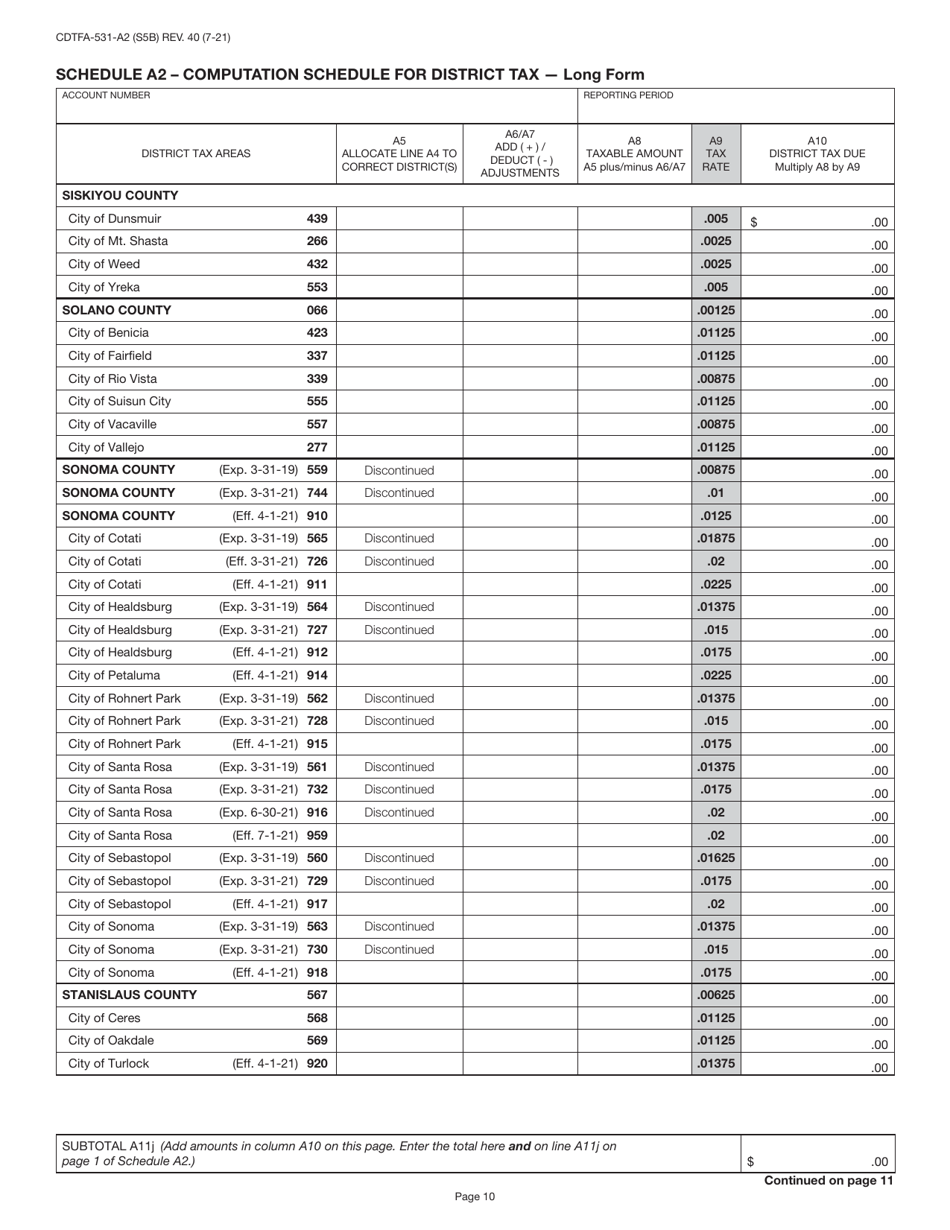

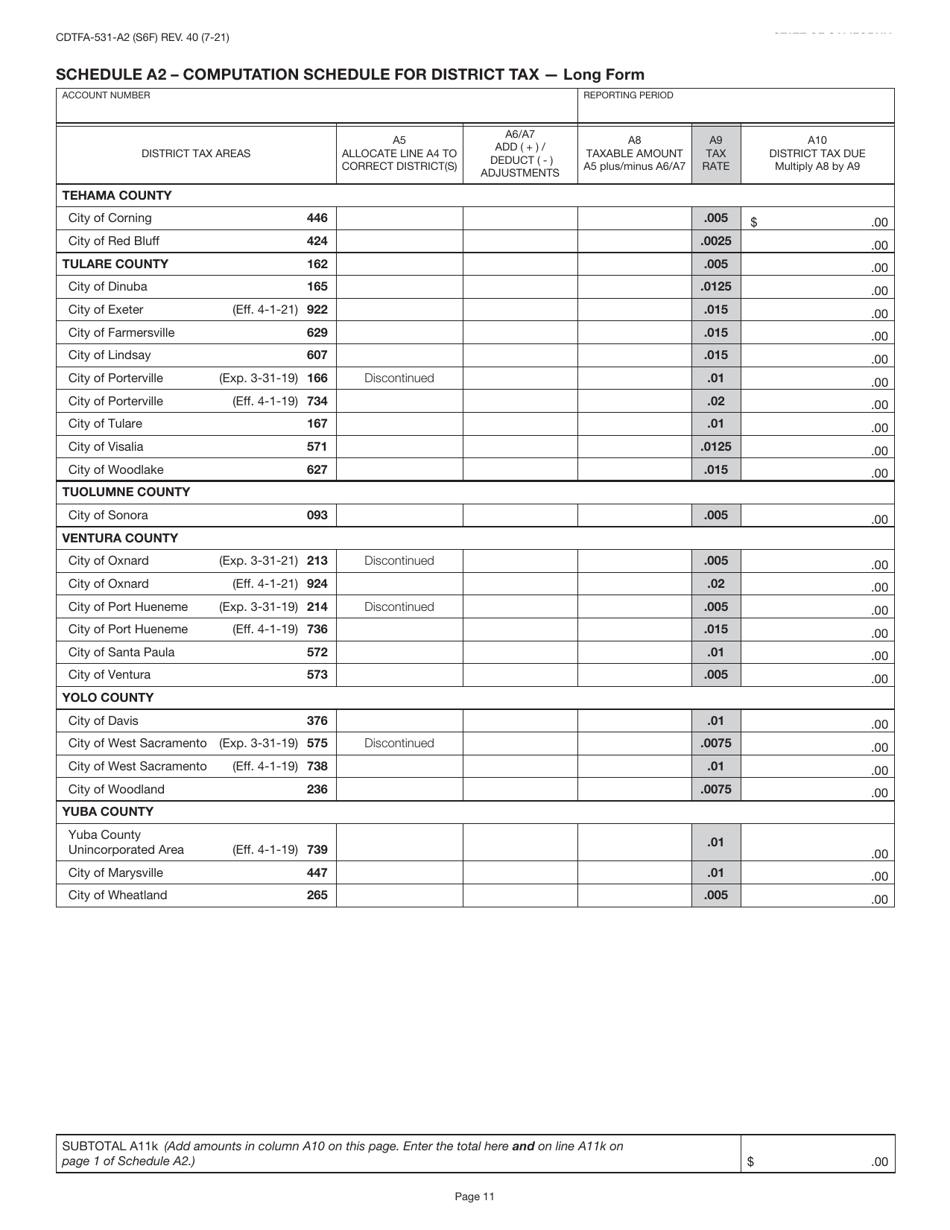

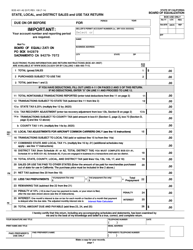

Form CDTFA-401-A State, Local, and District Sales and Use Tax Return - California

What Is Form CDTFA-401-A?

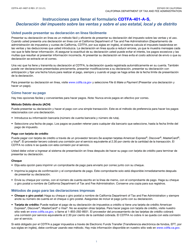

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form CDTFA-401-A?

A: The Form CDTFA-401-A is the State, Local, and District Sales and Use Tax Return for California.

Q: What is the purpose of Form CDTFA-401-A?

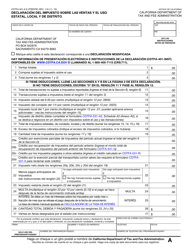

A: Form CDTFA-401-A is used to report and remit sales and use taxes collected in California.

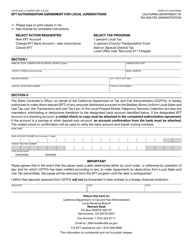

Q: Who is required to file Form CDTFA-401-A?

A: Businesses that are registered for sales and use tax in California are required to file Form CDTFA-401-A.

Q: How often do I need to file Form CDTFA-401-A?

A: The filing frequency for Form CDTFA-401-A depends on the amount of sales and use tax liability. It can be filed monthly, quarterly, or annually.

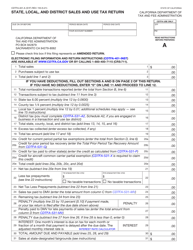

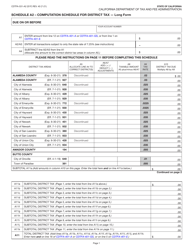

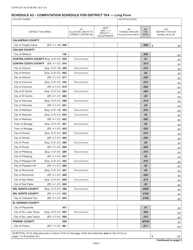

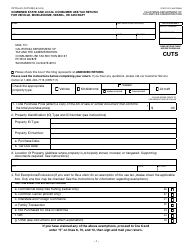

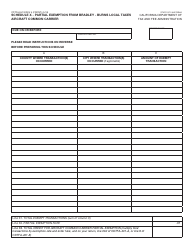

Q: What information is required on Form CDTFA-401-A?

A: Form CDTFA-401-A requires information about your business, sales and use tax liability, and deductions or credits.

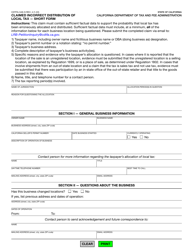

Q: Are there any penalties for late filing or non-filing of Form CDTFA-401-A?

A: Yes, there are penalties for late filing or non-filing of Form CDTFA-401-A, including interest charges and possible legal action.

Q: When is Form CDTFA-401-A due?

A: The due date for Form CDTFA-401-A depends on the filing frequency. It is typically due by the end of the month following the reporting period.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.