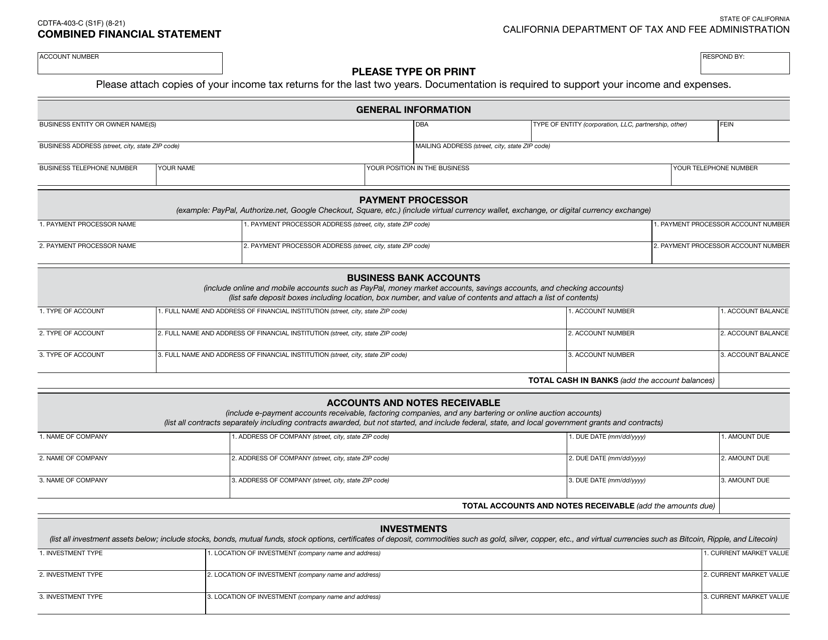

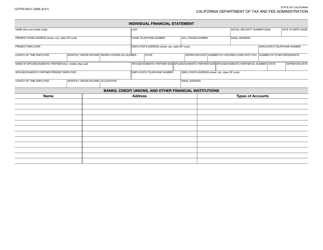

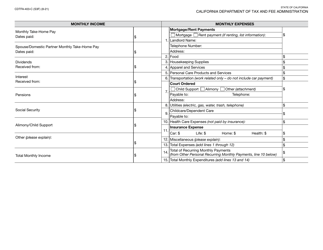

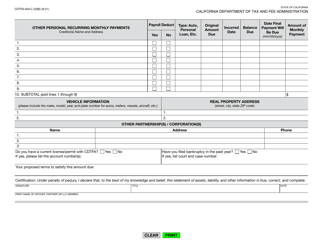

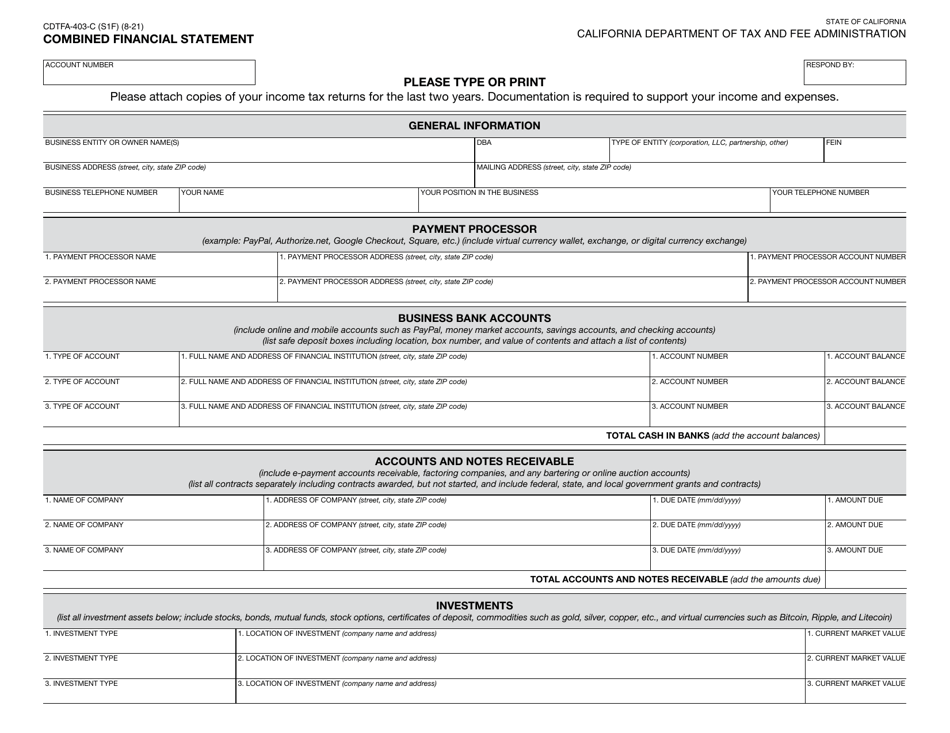

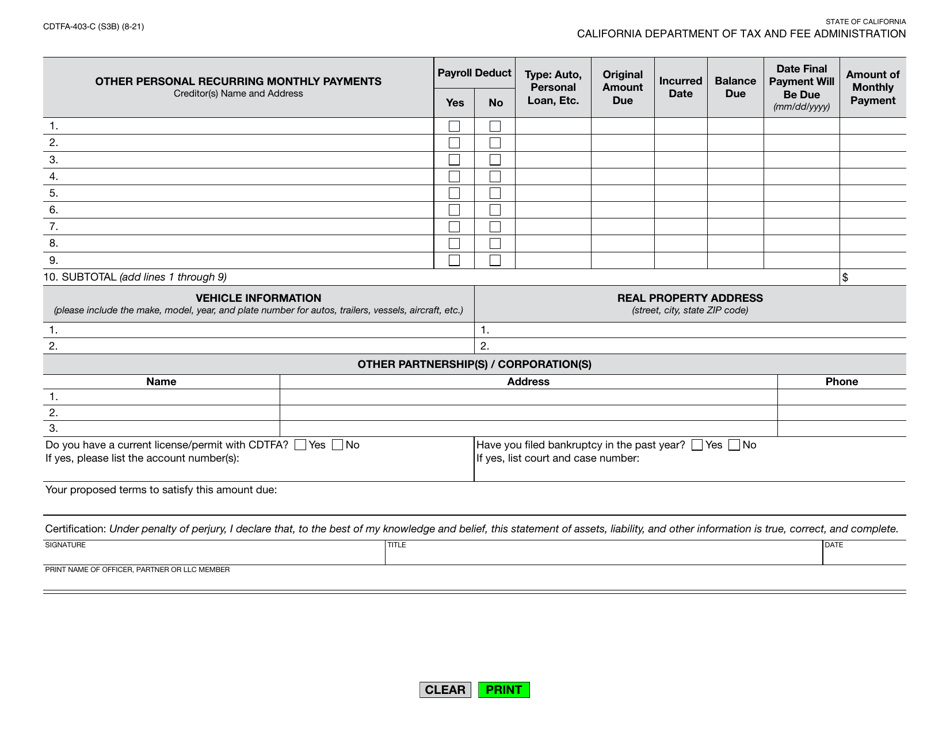

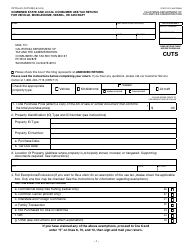

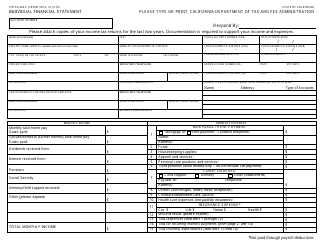

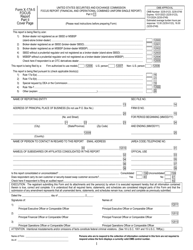

Form CDTFA-403-C Combined Financial Statement - California

What Is Form CDTFA-403-C?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-403-C?

A: Form CDTFA-403-C is the Combined Financial Statement for California.

Q: Who needs to file Form CDTFA-403-C?

A: Businesses in California that have sales tax permits and meet certain criteria may be required to file Form CDTFA-403-C.

Q: What is the purpose of Form CDTFA-403-C?

A: The purpose of Form CDTFA-403-C is to report the financial information of a business to the California Department of Tax and Fee Administration.

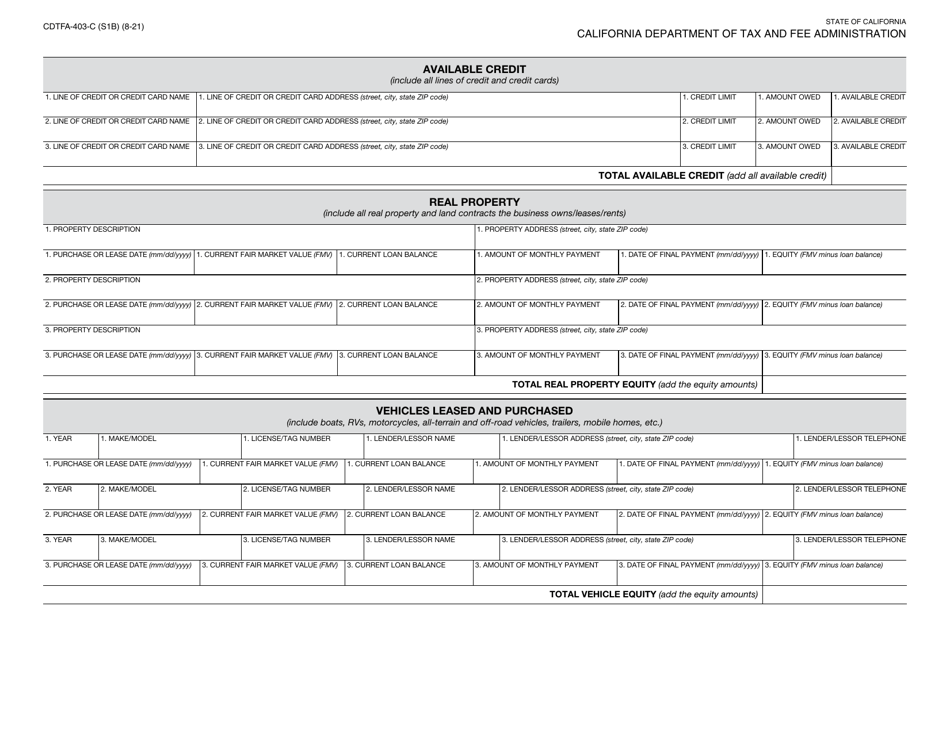

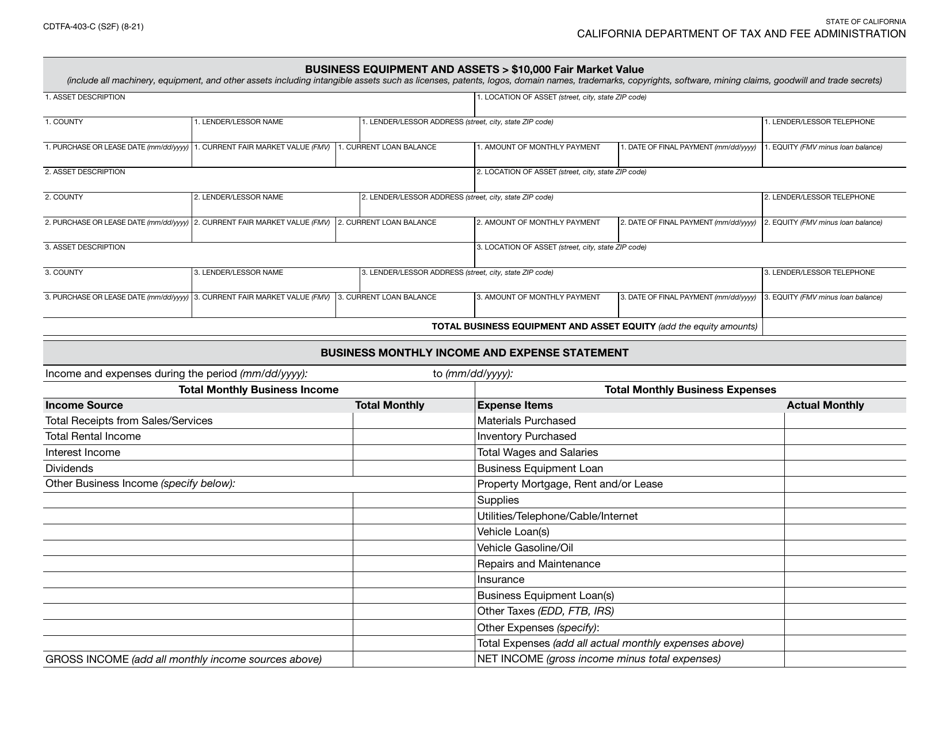

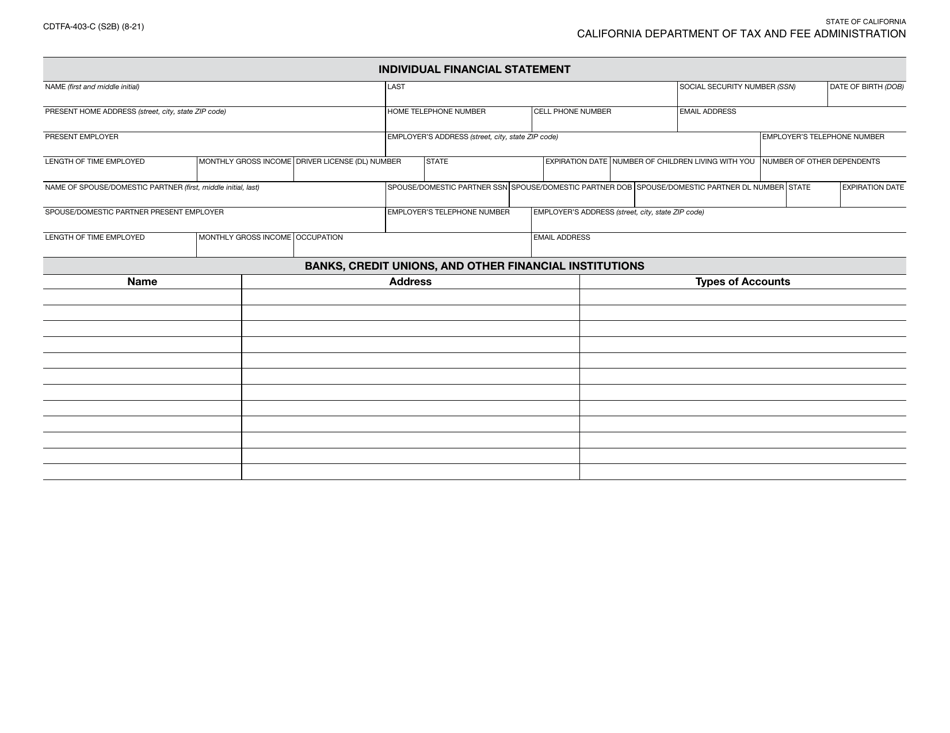

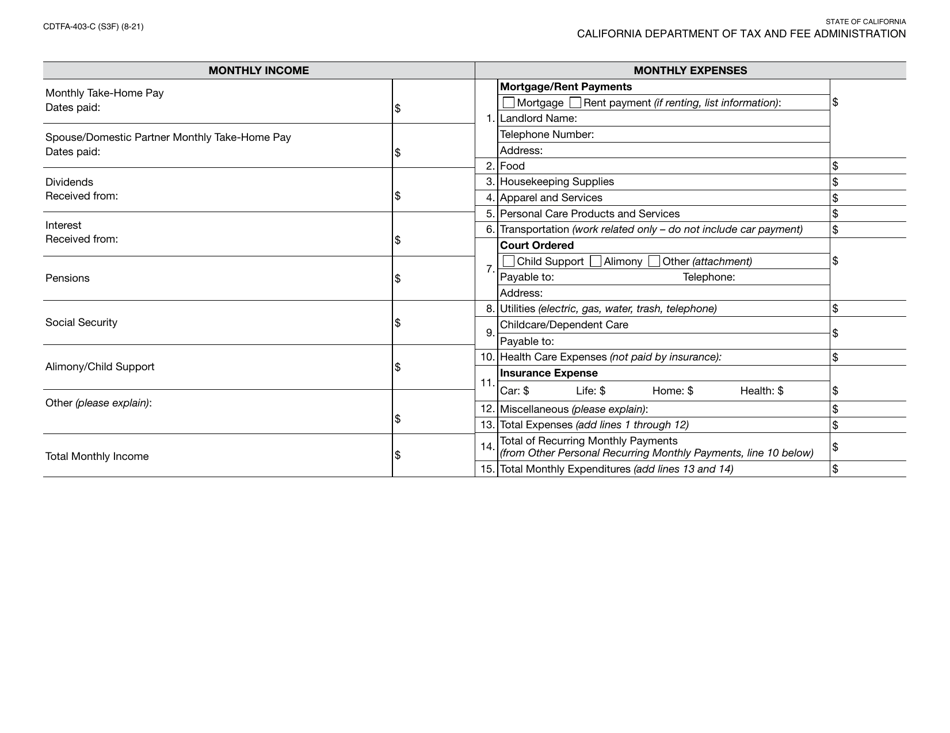

Q: What information is required on Form CDTFA-403-C?

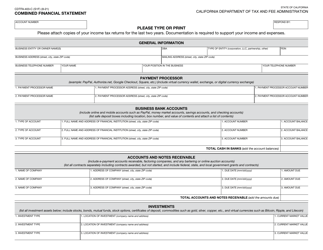

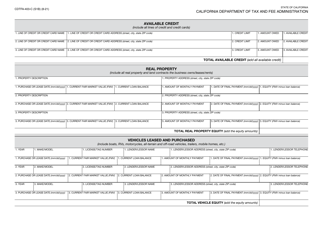

A: Form CDTFA-403-C requires businesses to provide their financial statements, including income, expenses, assets, and liabilities.

Q: When is Form CDTFA-403-C due?

A: Form CDTFA-403-C is due on the 25th day of the month following the end of the reporting period.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-403-C by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.