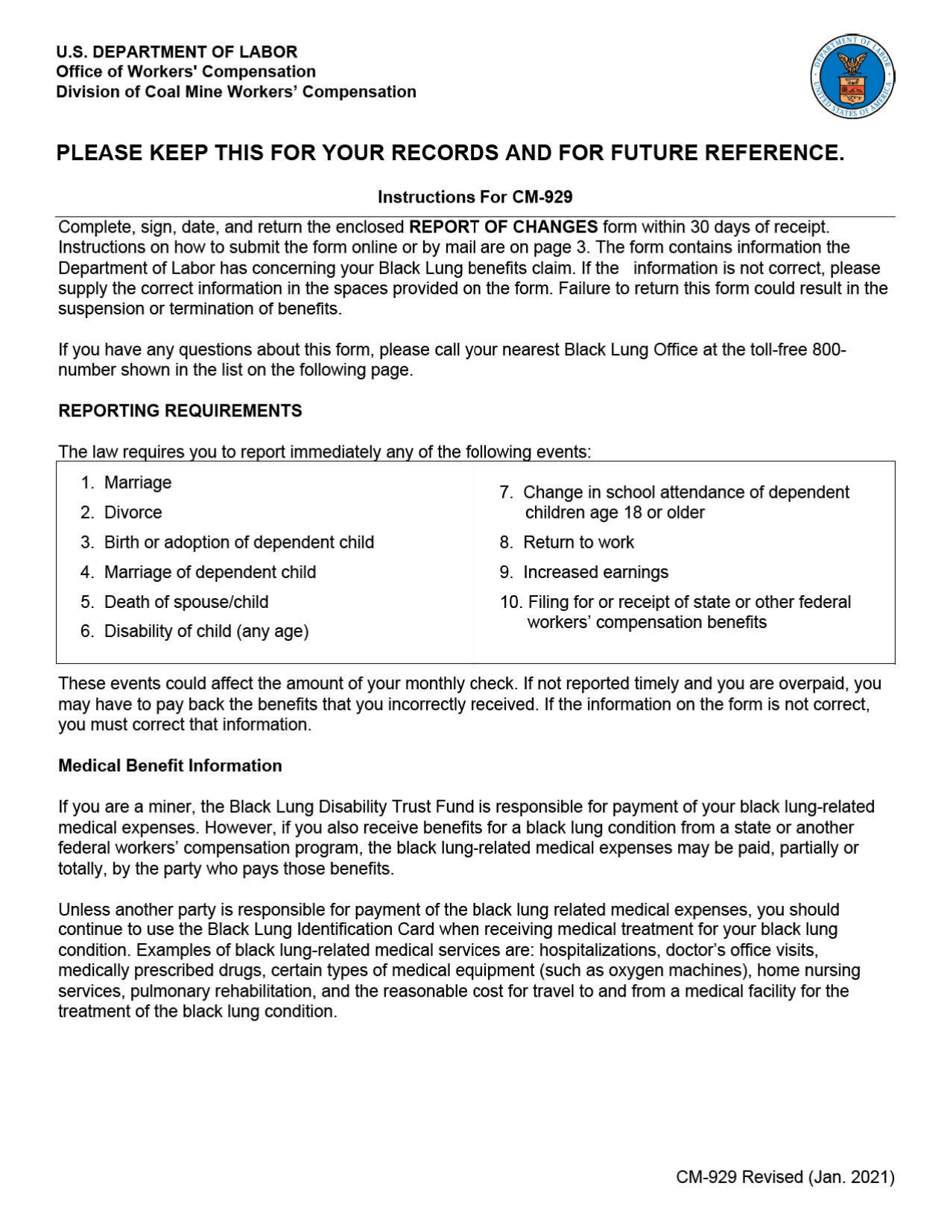

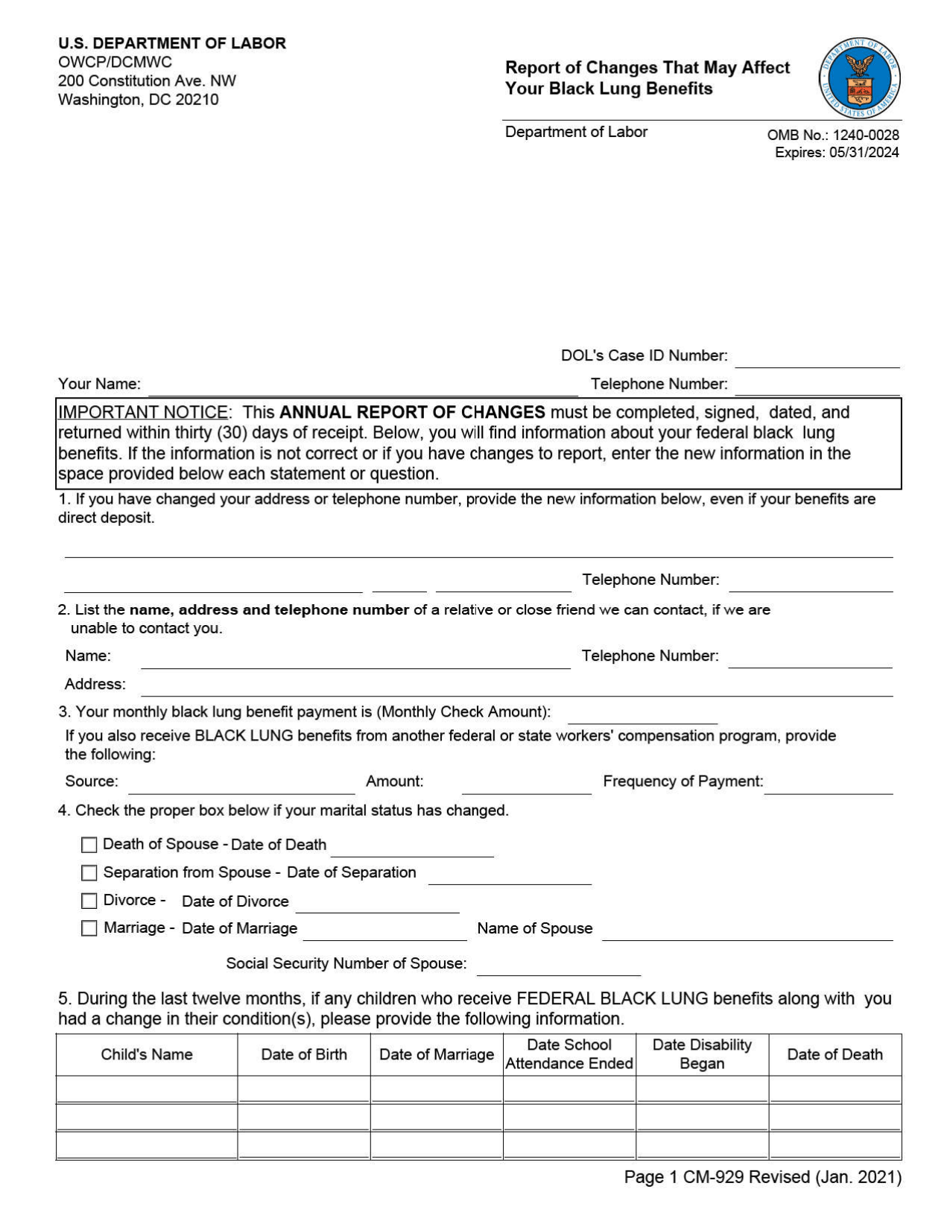

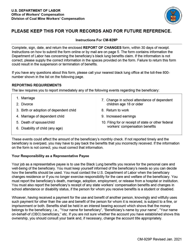

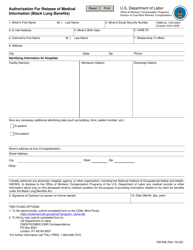

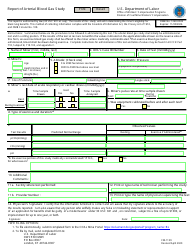

Form CM-929 Report of Changes That May Affect Your Black Lung Benefits

What Is Form CM-929?

This is a legal form that was released by the U.S. Department of Labor - Division of Coal Mine Workers' Compensation on January 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

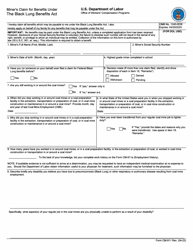

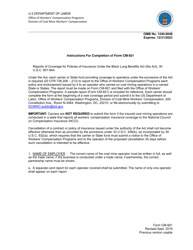

Q: What is Form CM-929?

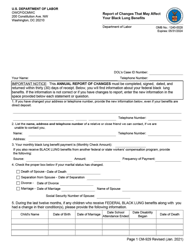

A: Form CM-929 is a report that individuals receiving black lung benefits must complete to inform the Black Lung Benefits Program of any changes that may affect their eligibility or benefit amount.

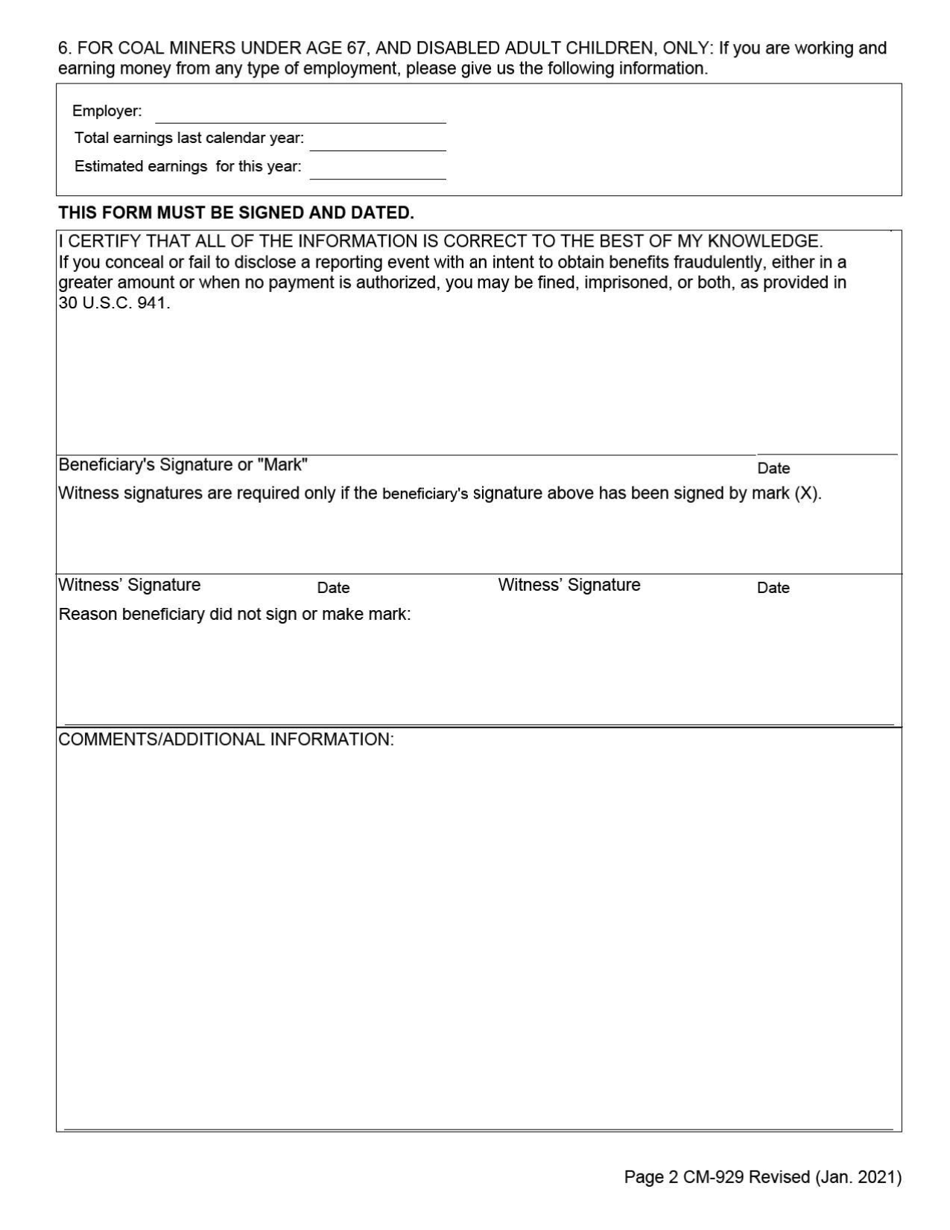

Q: Who needs to fill out Form CM-929?

A: Anyone who is receiving black lung benefits and experiences changes in their employment, income, or dependents must fill out Form CM-929.

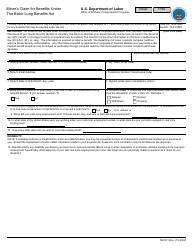

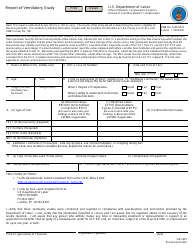

Q: What changes should be reported on Form CM-929?

A: Changes that should be reported on Form CM-929 include changes in employment, income, dependents, address, or medical condition.

Q: When should I submit Form CM-929?

A: Form CM-929 should be submitted within 30 days of the change that affects your black lung benefits.

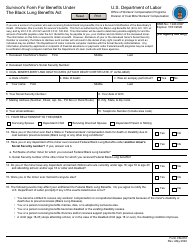

Q: What happens if I don't submit Form CM-929?

A: If you fail to submit Form CM-929 within 30 days of the change, it may result in a delay or reduction of your black lung benefits.

Q: Are there any penalties for not submitting Form CM-929?

A: There may not be any penalties for not submitting Form CM-929, but it is important to comply with the reporting requirements to ensure accurate and timely payment of your black lung benefits.

Form Details:

- Released on January 1, 2021;

- The latest available edition released by the U.S. Department of Labor - Division of Coal Mine Workers' Compensation;

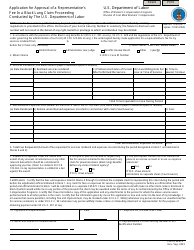

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CM-929 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Division of Coal Mine Workers' Compensation.