This version of the form is not currently in use and is provided for reference only. Download this version of

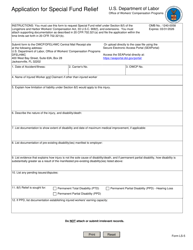

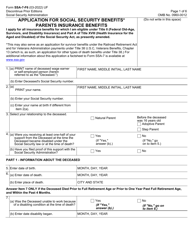

Form LS-271

for the current year.

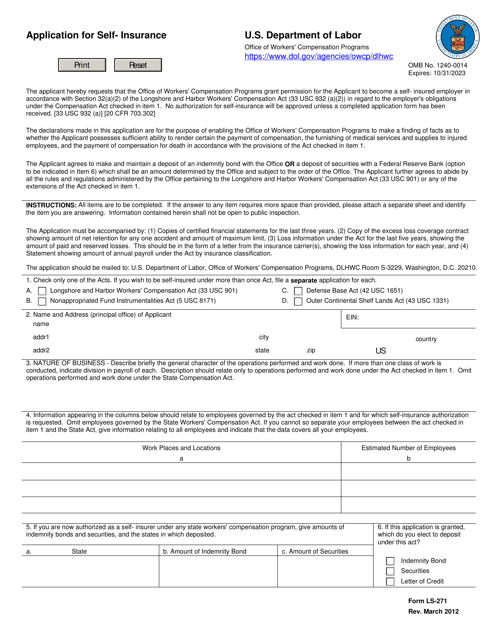

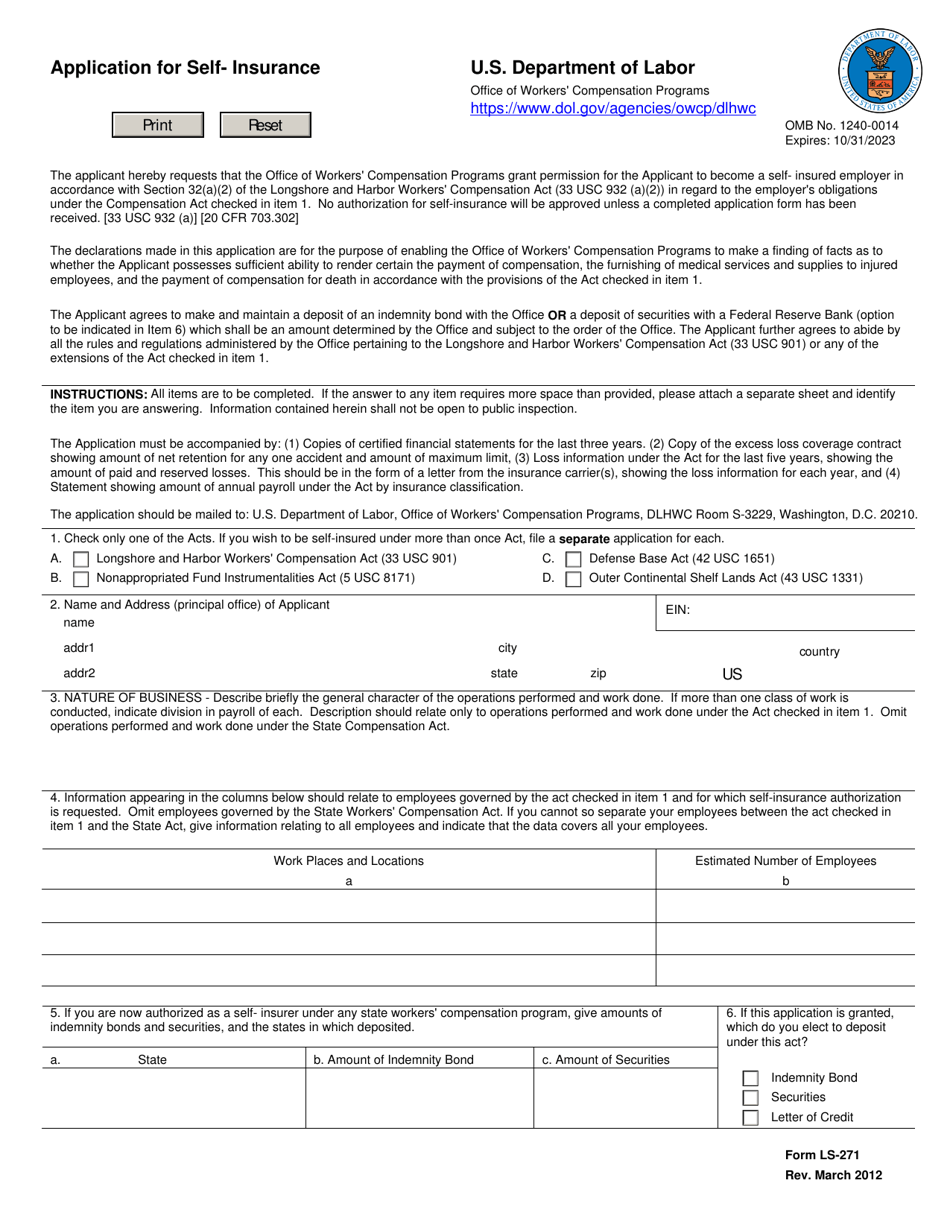

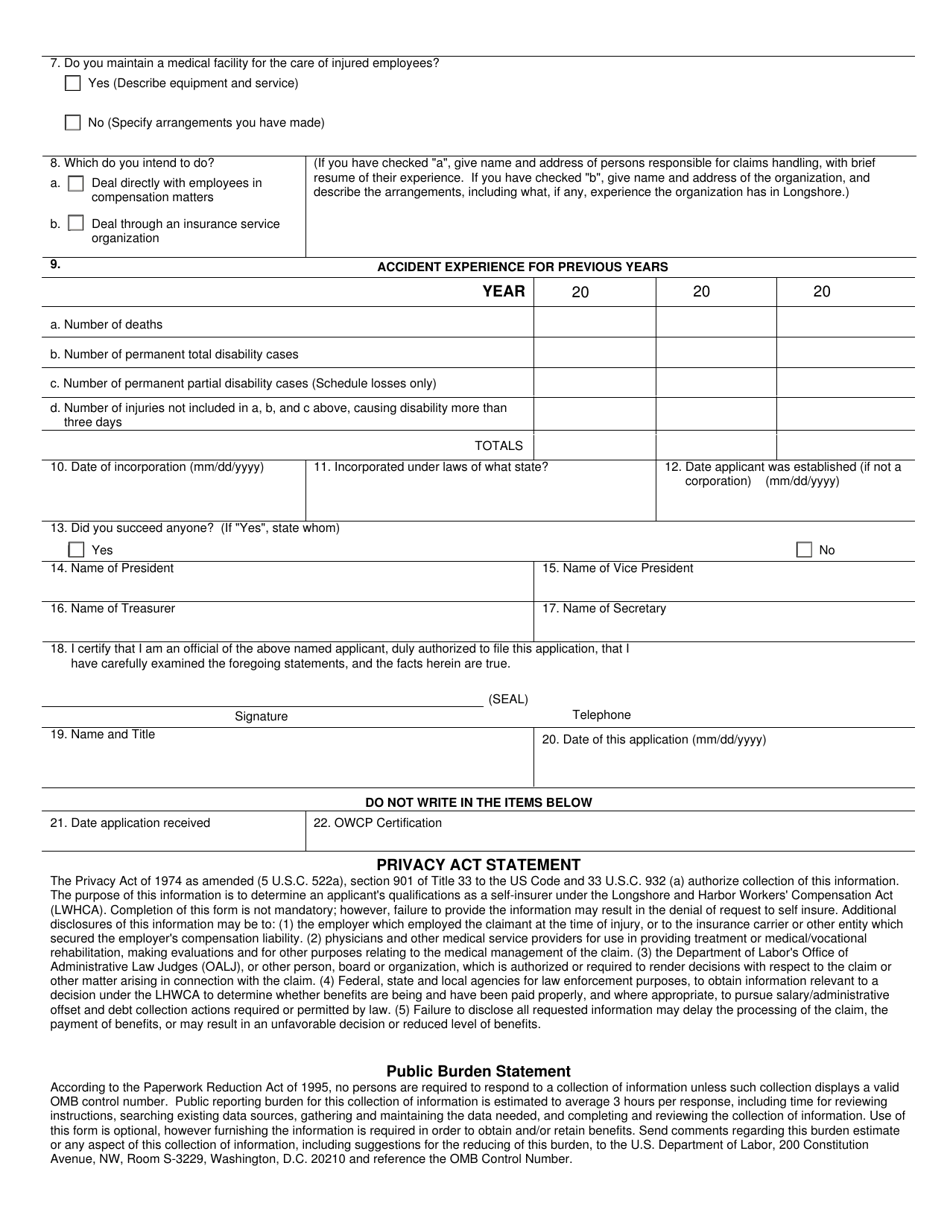

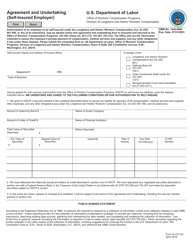

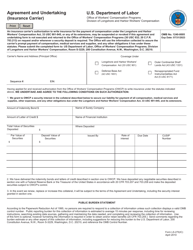

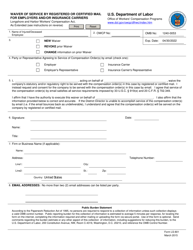

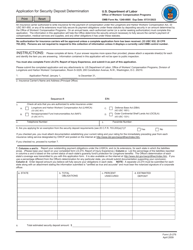

Form LS-271 Application for Self-insurance

What Is Form LS-271?

This is a legal form that was released by the U.S. Department of Labor - Office of Workers' Compensation Programs on March 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS-271?

A: Form LS-271 is an application for self-insurance.

Q: Who needs to fill out Form LS-271?

A: Businesses or organizations that want to self-insure their liabilities need to fill out Form LS-271.

Q: What is self-insurance?

A: Self-insurance is a risk management strategy where a business or organization chooses to bear the financial responsibility for potential losses rather than purchasing insurance.

Q: Why would a business choose self-insurance?

A: A business may choose self-insurance to have more control over their insurance costs, to customize coverage to fit their specific needs, or to save money in the long run.

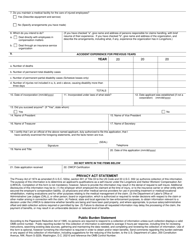

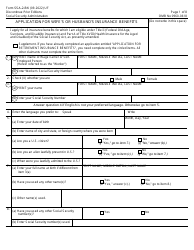

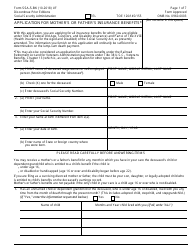

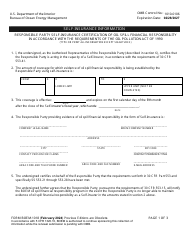

Q: What information is required on Form LS-271?

A: Form LS-271 requires detailed information about the business or organization, its financial stability, previous claims history, and proposed self-insurance plan.

Q: Are there any fees associated with submitting Form LS-271?

A: There may be fees associated with submitting Form LS-271, depending on the state and its regulations. It is best to check with the relevant agency for specific fee requirements.

Q: What is the deadline for filing Form LS-271?

A: The deadline for filing Form LS-271 varies by state. Businesses should consult the state agency or department for the specific deadline.

Q: Can a business be denied self-insurance?

A: Yes, a business can be denied self-insurance if it does not meet the eligibility criteria or if the state agency determines that self-insurance is not suitable for the business.

Q: What are the responsibilities of a self-insured business?

A: A self-insured business is responsible for managing its own claims, covering the costs of any losses or liabilities, and maintaining a sufficient level of financial reserves to meet its obligations.

Form Details:

- Released on March 1, 2012;

- The latest available edition released by the U.S. Department of Labor - Office of Workers' Compensation Programs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LS-271 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Office of Workers' Compensation Programs.