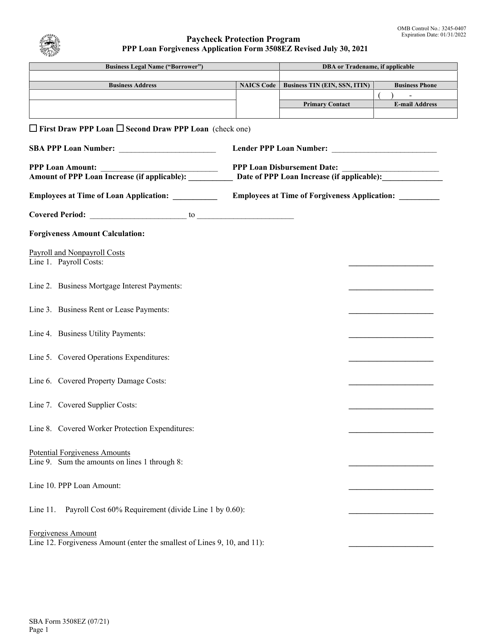

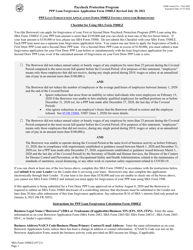

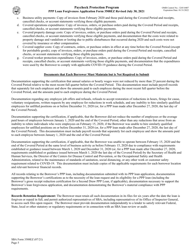

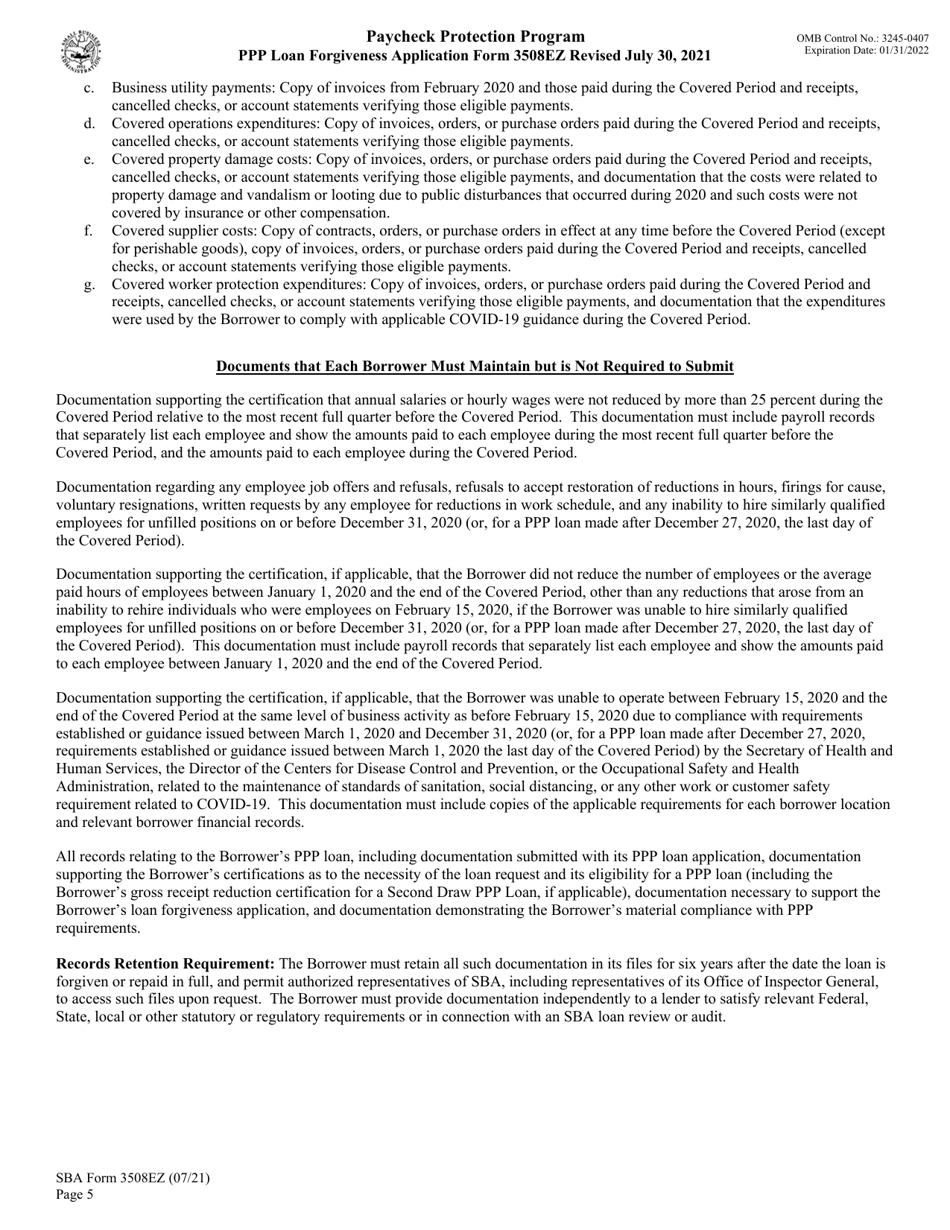

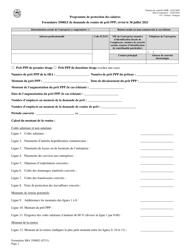

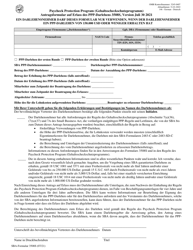

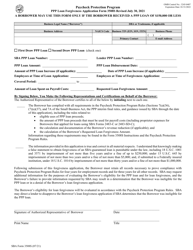

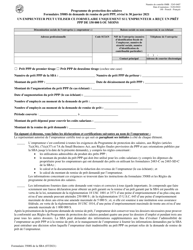

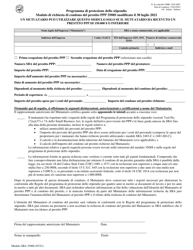

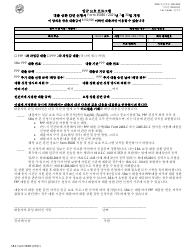

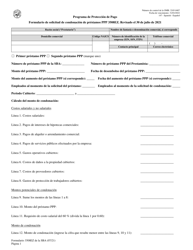

SBA Form 3508EZ PPP Ez Loan Forgiveness Application

What Is SBA Form 3508EZ?

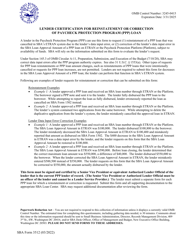

This is a legal form that was released by the U.S. Small Business Administration on July 30, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 3508EZ?

A: SBA Form 3508EZ is the PPP EZ Loan Forgiveness Application.

Q: What is the purpose of SBA Form 3508EZ?

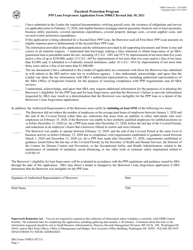

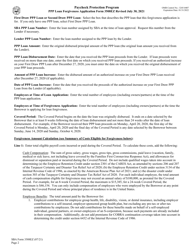

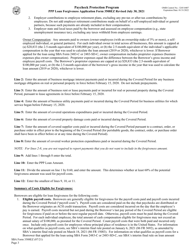

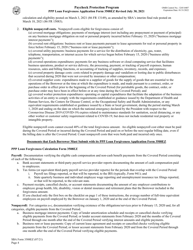

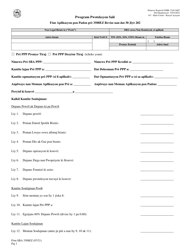

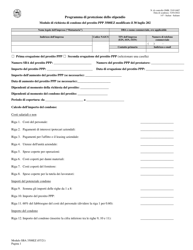

A: The purpose of SBA Form 3508EZ is to apply for loan forgiveness under the Paycheck Protection Program (PPP).

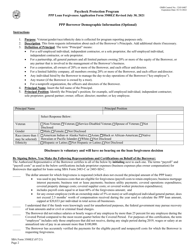

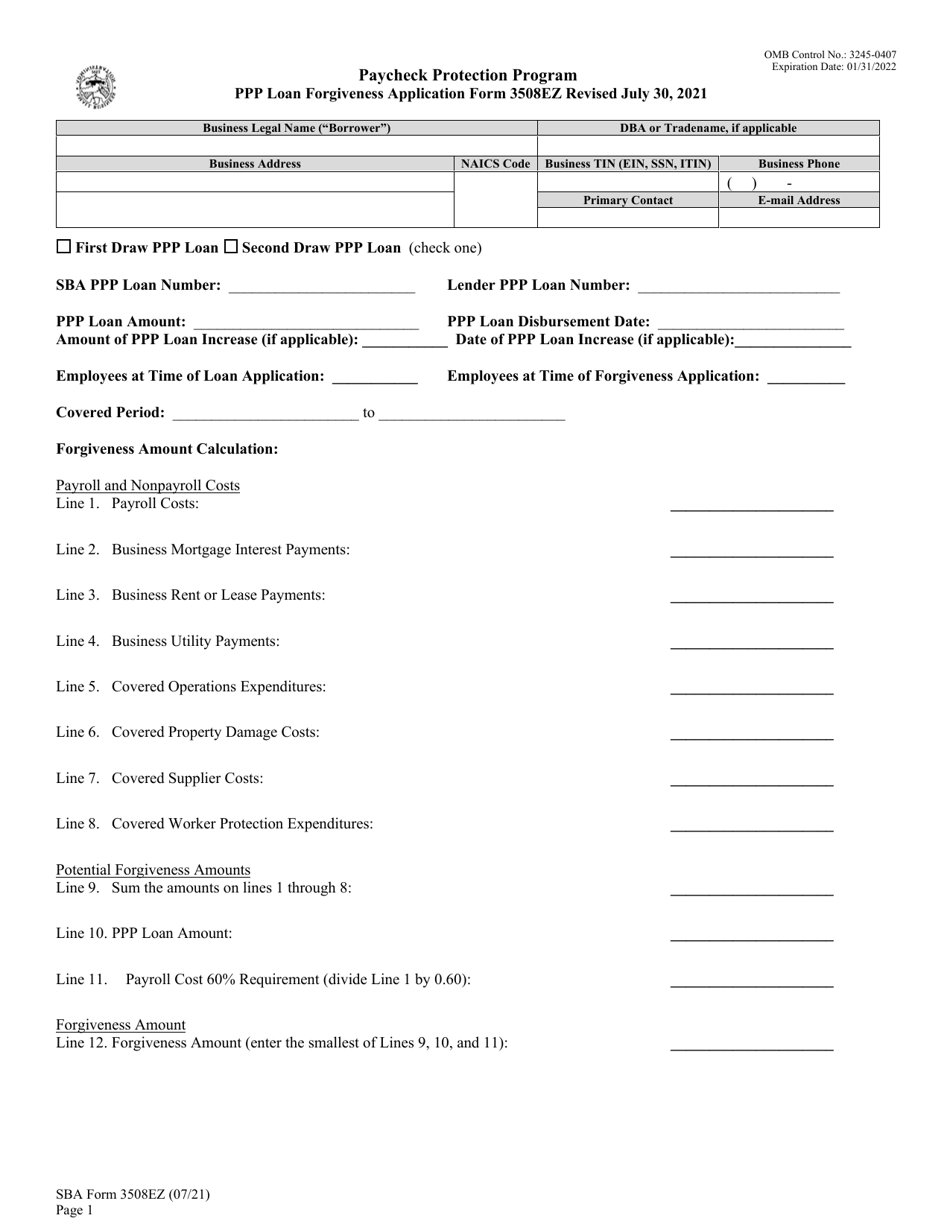

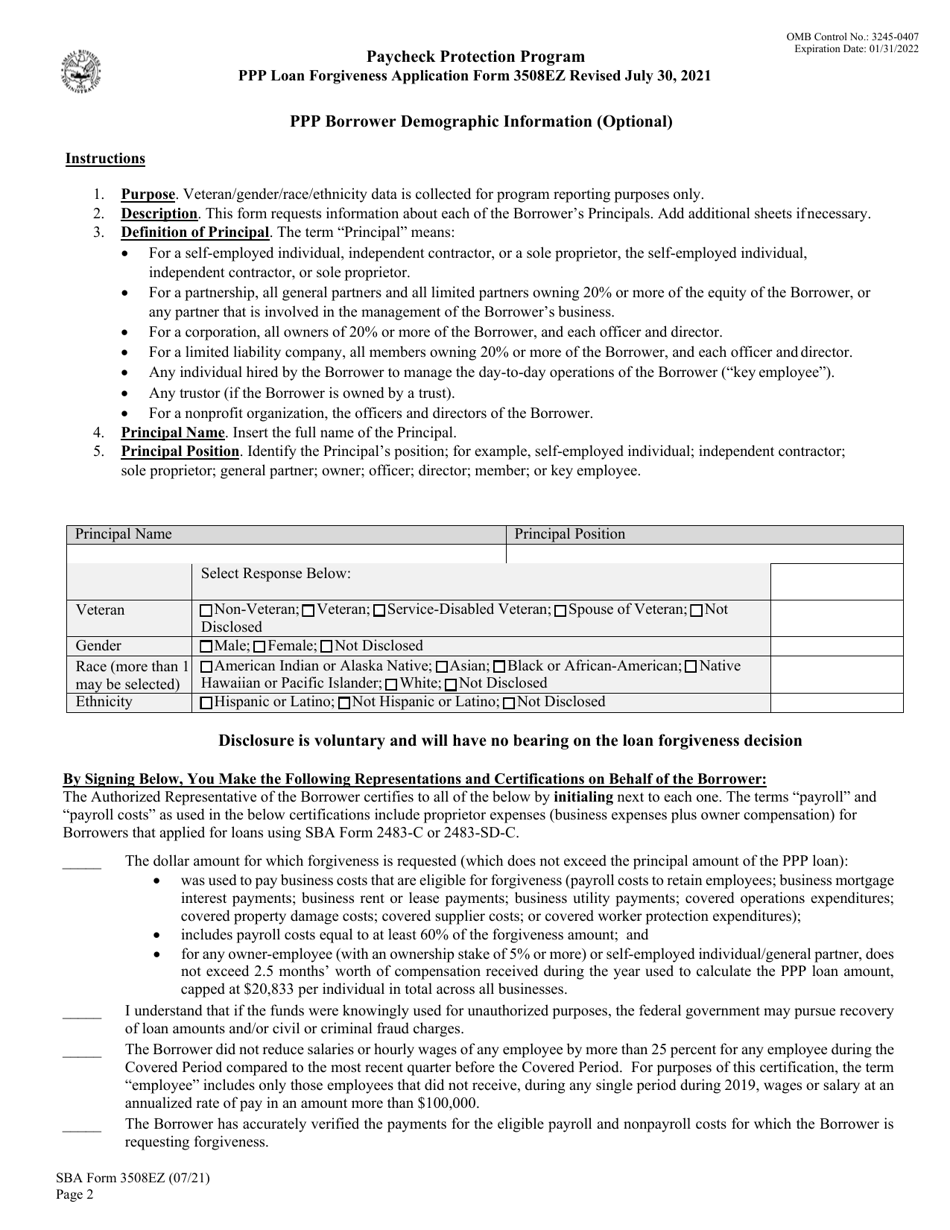

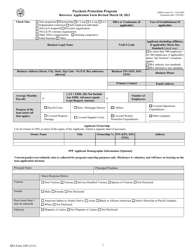

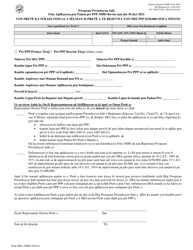

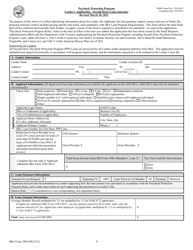

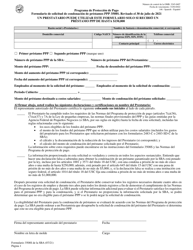

Q: Who is eligible to use SBA Form 3508EZ?

A: Borrowers who meet certain criteria, such as having no employees or experiencing a reduction in business activity, may be eligible to use SBA Form 3508EZ.

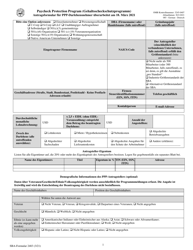

Q: What are the requirements for using SBA Form 3508EZ?

A: To use SBA Form 3508EZ, borrowers must meet specific criteria related to the forgiveness process, such as not having any salary or wage reductions for employees.

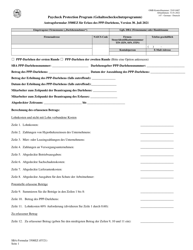

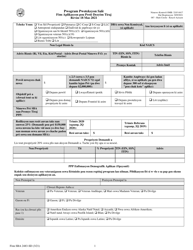

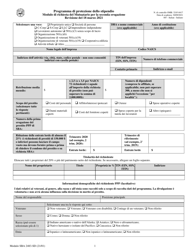

Q: What information is required in SBA Form 3508EZ?

A: SBA Form 3508EZ requires borrowers to provide information about their payroll and non-payroll costs, as well as details about any reductions in employee numbers or wages.

Q: When should I submit SBA Form 3508EZ?

A: Borrowers should submit SBA Form 3508EZ to their lender when they are ready to apply for loan forgiveness.

Q: Is SBA Form 3508EZ mandatory?

A: No, SBA Form 3508EZ is not mandatory. Borrowers can also choose to use the regular SBA Form 3508 for loan forgiveness.

Q: What should I do if I cannot use SBA Form 3508EZ?

A: If you do not meet the criteria for using SBA Form 3508EZ, you may still be able to use the regular SBA Form 3508 for loan forgiveness.

Q: Can I get assistance in filling out SBA Form 3508EZ?

A: Yes, you can seek assistance from your lender or a professional advisor to help you fill out SBA Form 3508EZ.

Form Details:

- Released on July 30, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 3508EZ by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.