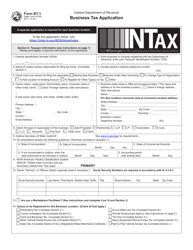

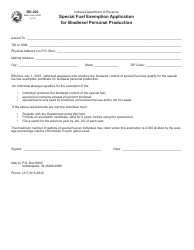

This version of the form is not currently in use and is provided for reference only. Download this version of

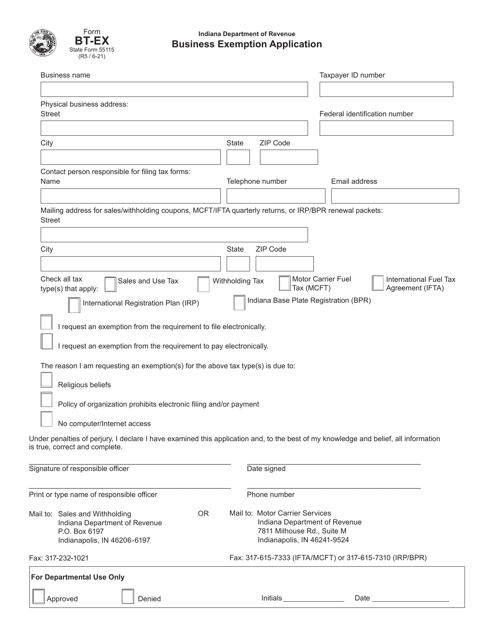

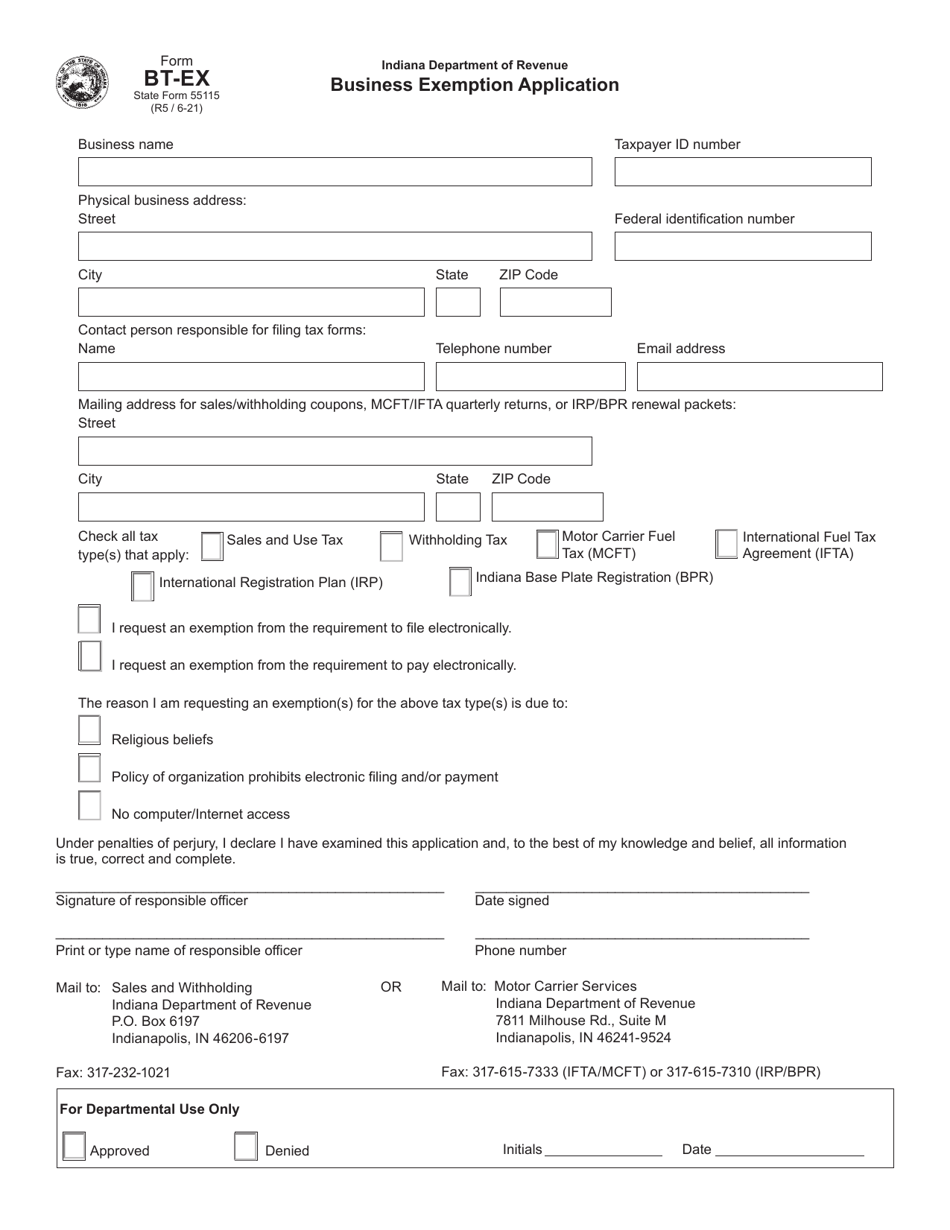

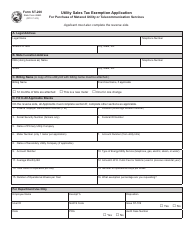

Form BT-EX (State Form 55115)

for the current year.

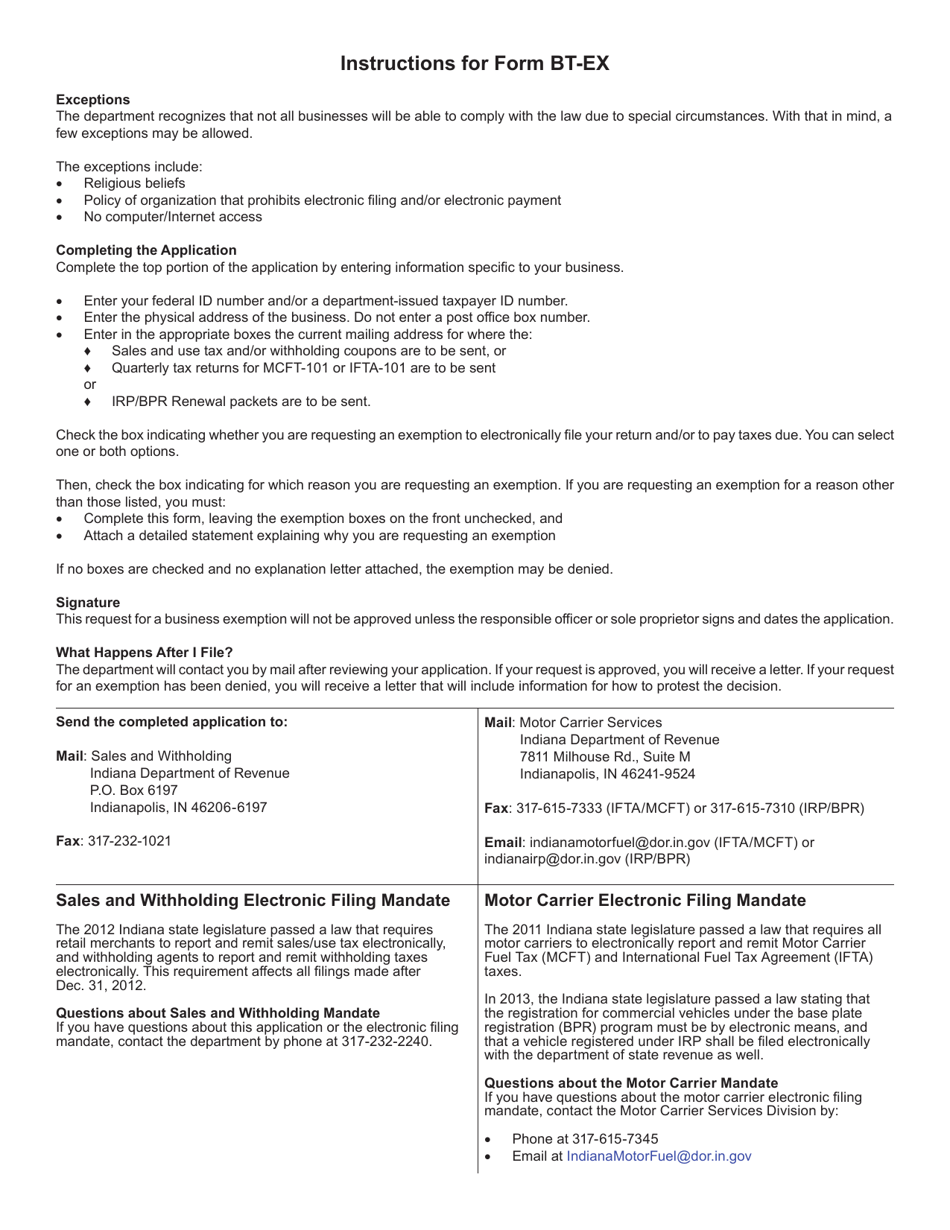

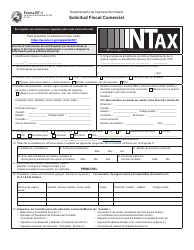

Form BT-EX (State Form 55115) Business Exemption Application - Indiana

What Is Form BT-EX (State Form 55115)?

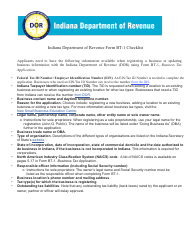

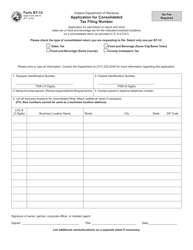

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

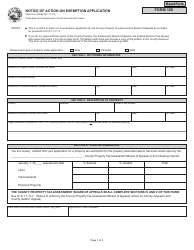

Q: What is Form BT-EX?

A: Form BT-EX is the Business Exemption Application used in the state of Indiana.

Q: Who should fill out Form BT-EX?

A: Form BT-EX should be filled out by businesses in Indiana seeking exemption from certain taxes.

Q: What is the purpose of Form BT-EX?

A: The purpose of Form BT-EX is to apply for exemptions from specific taxes for eligible businesses in Indiana.

Q: Which taxes can be exempted through Form BT-EX?

A: Form BT-EX can be used to seek exemption from state and local sales and use taxes.

Q: Are there any fees associated with submitting Form BT-EX?

A: No, there are no fees associated with submitting Form BT-EX.

Q: What supporting documentation is required with Form BT-EX?

A: The specific supporting documentation required with Form BT-EX will depend on the type of exemption being sought. It is recommended to review the instructions provided with the form for more details.

Q: Is Form BT-EX only applicable to businesses in Indiana?

A: Yes, Form BT-EX is specifically for businesses located in Indiana.

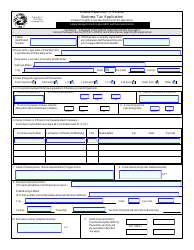

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-EX (State Form 55115) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.